Ping An Insurance

Ping An Insurance known also as Ping An of China (simplified Chinese: 中国平安; traditional Chinese: 中國平安; pinyin: Zhōngguó Píng Ān), full name Ping An Insurance (Group) Company of China, Ltd. is a Chinese holding conglomerate whose subsidiaries provide insurance, banking, asset management, financial, healthcare services. The company was founded in 1988 and is headquartered in Shenzhen. "Ping An" literally means "safe and well".

| |

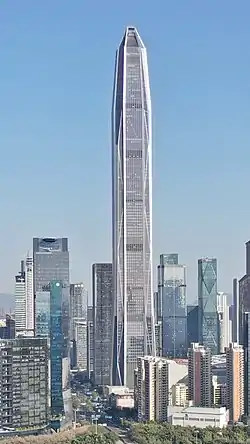

Headquarters at Ping An International Finance Centre | |

Native name | 中國平安保險 |

|---|---|

| Type | Public |

| Industry | Financial Services |

| Founded | 1988 |

| Founder | Ma Mingzhe |

| Headquarters | , China |

Area served | Worldwide |

Key people | Ma Mingzhe (Chairman), Xie Yonglin (President & Co-CEO), Tan Sin Yin (Co-CEO) |

| Services |

|

| Revenue | |

| Total assets | |

| Total equity | |

| Owners |

|

Number of employees | Approx. 344,223 [1] |

| Website | https://group.pingan.com |

| Footnotes / references in a consolidated basis[2] | |

In 2023, Ping An ranked 16th on the Forbes Global 2000 list and 23rd on the Fortune Global 500 list.[3] Ping An ranked 30th among the World’s top 500 Most Valuable Brands and fifth among global financial enterprises in the Global 500 2022 Report by Brand Finance.[4]

The company is considered to be the world's largest insurer, with US$121.7 billion net premiums written in 2020.[5] Its market capitalization was US$136 billion in March 2021, making it the largest insurer in the Asia-Pacific region.[6]

Ping An Insurance is one of the top 50 companies in the Shanghai Stock Exchange. It is also a constituent stock of Hang Seng Index, an index of the top 50 companies in the Hong Kong Stock Exchange. Ping An Insurance was also included in the pan-China stock indices CSI 300 Index,[7] FTSE China A50 Index [8] and Hang Seng China 50 Index.[9]

Ping An is a signatory of the United Nations-supported Principles for Responsible Investment (PRI), and was the first asset owner in mainland China to join.[10]

Business

Ping An Insurance Group started off in 1988 as a property and casualty insurance company, later diversifying into insurance, banking, asset management, financial services and healthcare services.[11]

Ping An has licenses to offer financial services, including insurance, banking, trusts, securities, futures and financial leasing.[12]

Since the mid-1990s, Ping An has been subsequently taken investments from overseas firms such as Morgan Stanley and Goldman Sachs in 1994. In 2002 HSBC took a large equity interest in Ping An.[13] In early 2008, Ping An agreed to take a 50% share in Fortis Investments, a subsidiary of Fortis,[14] which had taken over ABN AMRO Asset Management as a result of the split up of ABN AMRO in late 2007; the deal was canceled in October 2008. [15]

In June 2009, Ping An became a strategic investor in Shenzhen Development Bank, [16] (now part of Ping An Bank).

In 2012, the company created Ping An Ventures, a $150M VC fund which invested in over 100 companies, such as Didi Chuxing, HYCOR Biomedical, Meituan, Oscar Health, Payoneer, Taulia, and others.[17][18] In 2014, together with SBT Venture Capital Ping An led a $27M funding round for eToro.[19]

In 2016, Ping An Healthcare and Technology (Ping An Good Doctor) completed a Series A funding round of a total of US$500 million, making its valuation hit US$3 billion. Ping An also bought a 48% stake in Chinese car website Autohome Inc. from Telstra Corp. for $1.6 billion.[20]

In February 2018, three technology subsidiaries of Ping An completed private placement financing, which received positive responses particularly from international institutional investors. They were Ping An Healthcare and Technology Company Limited, Ping An Medical and Healthcare Management Co., Ltd and OneConnect Financial Technology Co., LTD.[21]

In May 2018, Ping An Good Doctor was listed on the Hong Kong Stock Exchange.[22]

In June 2019, Ping An One Connect Bank officially commenced operation after receiving a virtual banking license from the Hong Kong Monetary Authority in May 2019. In December 2019, OneConnect Financial Technology was listed on the New York Stock Exchange.[23]

In October 2020, Lufax, one of China's leading online wealth management platform, listed on the New York Stock Exchange.[24]

In May 2021, Ping An released the Ping An Zhen Yi Nian healthcare brand. The product line was mainly targeted at supporting urban elderly care communities, and integrates corporate finance, medical care and health technology. [25]

In July 2021, Ping An and Shionogi signed agreements to launch joint ventures in Shanghai and Hong Kong. Ping An-Shionogi is a Healthcare as a Service (HaaS) enterprise, an integrated medical and healthcare platform for public health and patients. The joint venture is a collaboration between the Ping An and Shionogi on drug research, development, production and sales. [26]

In October 2021, Ping An Bank rolled out services under the Cross-boundary Wealth Management Connect pilot scheme. [27]

In January 2022, Ping An Life (a subsidary of Ping An) received approval from the CBIRC for its investment in New Founder Group.[28]

In March 2022, Ping An Life launched a home-based elderly care service as part of their "insurance + home-based elderly care" product ecosystem. [29]

In July 2022, OneConnect (Ping An’s fintech subsidiary) listed on the main board of the Hong Kong Stock Exchange by way of introduction and dual-primary listing. [30]

In Ferburary 2023, Ping An Bank Hong Kong Branch was granted an insurance agency license by the Hong Kong Insurance Authority. [31]

Technology-Powered Business Transformation

Ping An invests 1% of its revenues into R&D (which itself consists of 10% of its annual profits), specifically, on new technologies of AI, Blockchain and Cloud Computing for ten years to transform its financial services and support the building of its five ecosystems: financial services, healthcare, auto services, real estate services, and smart city services.[32]

More than 598 million users are connected to at least one of those ecosystems.[33]

Over the years, Ping An has successfully launched fintech and healthtech businesses such as Lufax Holding,[34] OneConnect, Ping An Good Doctor (1833.HK), and Ping An HealthKonnect.[35]

Ping An's AskBob Doctor has ranked first in one of the three tasks in MEDIQA 2021, an AI healthcare questionand- answer contest hosted by the Association for Computational Linguistics. In 2021, AskBob Doctor scored an average 92.4 points while the six endocrinologists human team scored 89.5 points in an International Human-Machine Competition on Diabetes Management.[36]

In August 2022, Ping An launched an earth observation optical remote sensing satellite, PinAn-3 which also called Taijing-1 01.[37]

Ownership

Ping An is a publicly listed company.[38]

As of 30 June 2023, Charoen Pokphand Group is the single shareholder in Ping An, holding a 6.12% stake. The Shenzhen government, via Shenzhen Investment Holdings, owns a 5.29% stake as the second largest shareholder.[39]

Ping An has the classification of a civilian-run enterprise. Richard McGregor, author of The Party: The Secret World of China's Communist Rulers,[40] said that "the true ownership of large chunks of its shares remains unclear" and that the ownership of Ping An is a "murky structure".[41] In October 2012, The New York Times reported that relatives and associates of Chinese Premier Wen Jiabao controlled stakes in Ping An worth at least US$2.2 billion in 2007.[42]

HSBC acquired 48.22% of H shares by means of different HSBC subsidiaries[43] (H shares accounted for 34.83% of the share capital as at 31 December 2009,[43] which was later increased to 41.88% in 2015[44]). HSBC holds 16.80% of total shares of Ping An, making it the biggest shareholder as of 31 December 2009.[43]

Markets

Since 24 June 2004 Ping An has been listed on the Stock Exchange of Hong Kong (subsidiary of Hong Kong Exchanges and Clearing) as SEHK: 2318. Since 1 March 2007, it has a listing on the Shanghai Stock Exchange as SSE: 601318. Since 19 June 2023, its yuan-denominated shares has a listing on the Stock Exchange of Hong Kong as SEHK: 82318.

Ping An replaced Anhui Expressway in the Hang Seng China Enterprises Index (HSCEI) in 2004.[45]

The Hang Seng Index Services Company announced on 11 May 2007, that Ping An would join as Hang Seng Index Constituent Stock effective on 4 June 2007.[46]

Operations

Ping An has operations across all of the People's Republic of China, and in Hong Kong and Macau through Ping An Insurance Overseas. Lufax, OneConnect and Ping An Good Doctor have now expanded overseas. OneConnect served 100+ customers in 20 countries and regions mainly in Southeast Asia.[47]

ESG

The financial group is the first Chinese asset owner to have signed Climate Action 100+ and the United Nations’ Principle of Responsible Investment (UNPRI). PRI chief Reynolds called Ping An's decision "a milestone on China's road toward the full embrace of ESG".[48]

Ping An has invested more than USD$140 billion in clean energy and affordable healthcare. It has extended credit lines of more than USD$8.5 billion towards companies with green initiatives, with a balance of loans at the end of 2019 exceeding USD$3.4 billion. It was the first Chinese company to join UN Principles for Sustainable Insurance.[49]

It was the first insurance company from mainland China to be selected for the 2019 Dow Jones Sustainability Emerging Markets Index (DJSI).[50]

Ping An was named ESG Investor of the Year for Insurers, China at The Triple A Sustainable Investing Awards for Institutional Investor, ETF, and Asset Servicing Providers by The Asset Magazine.[51]

Ping An Insurance (Group) Co. of China Ltd. target to achieve operational carbon neutrality in 2030. And promised to support China's goal of achieving carbon neutrality by 2060, on the 52nd annual Earth Day.[52] Ping An Insurance Group published its green finance strategy in their 2020 Climate Risk Management Report.[53]

In April 2022, Ping An Life became the first insurance company in China to issue an ESG bond index under collaboration with the ChinaBond Pricing Center Co., Ltd. The index series strove for sustainable investment returns through diversified product innovation.[54]

In May 2022, Ping An Bank, together with China UnionPay and the Shanghai Environment and Energy Exchange, launched a personal carbon account platform called Low Carbon Home, which calculates users’ personal carbon emission reductions. This is the first carbon account in China to cover UnionPay credit cards and debit cards, and it advocates a green and low-carbon lifestyle for consumers. [55]

In July 2022, Ping An shown to support the floods in Henan by launching contingency measures after the unrivalled rainstorm hit Central China's Henan province.[56]

In 2022, The China Enterprise Reform and Development Society released the first China-focused ESG disclosure standard which collaborated with Ping An and dozens of other companies in China. Ping An drafted the standard by incorporating the insurer’s in-house CN-ESG evaluation system framework to provide a standardised scientific approach for corporate ESG information disclosure. [57]

A global leading ESG rating firm, Sustainalytics, rated Ping An as low ESG risk and score of 18.3. This was the best score among 290 Mainland China's insurance companies.[58]

Ping An was also recognized in The S&P Global Sustainability Yearbook 2022, the world’s most comprehensive publication of its kind, for its commitment to progress in sustainability by scoring within the top 15% of the insurance industry and achieving an S&P Global ESG Score within 30% of the industry’s top-performing company.[59]

In 2022, Ping An improved the company’s ESG governance structure and set up a Sustainable Development Committee to coordinate the management of core issues, including green finance, green operations and rural revitalization.[60]

In February 2023, Ping An was rated A- in the climate change category by CDP for its transparency and execution in addressing climate change. CDP, an internationally renowned non-profit organization, scored the report with data submitted by nearly 15,000 companies in 2022.[61] In the same month, Ping An Property & Casualty Insurance (Ping An P&C) launched its first ocean carbon sink index insurance policy in the city of Dalian, which provides carbon sink risk protection of RMB400,000 for a 8,867 square meters area of kelp, shellfish and algae.[62]

In June 2023, Ping An Bank disbursed the first installment (RMB13 million) of a loan to Baotou Iron and Steel Group Co., Ltd. under a RMB180 million financing agreement for a pilot carbon capture project, the first to encompass the whole supply chain of China’s steel industry.[63]

See also

Notes

- "Ping An Insurance (Group) Co. of China Ltd". The Wall Street Journal. Retrieved 19 September 2023.

- "2018 Audited Results" (PDF). Ping An Insurance. Hong Kong Stock Exchange. 12 March 2021. Archived (PDF) from the original on 21 October 2016. Retrieved 9 April 2021.

- "The Global 2000". Forbes.

- "Global 500 2023" (PDF). Brand Finance.

- "The world's largest insurers".

- "Largest insurance companies worldwide as of July 2019, by market capitalization".

- "CSI 300" (PDF). China Securities Index.

- "FTSE China Indexes". FTSE Russell.

- "Hang Seng China 50 Index".

- "PRI welcomes first asset owner signatory in China". UN Principles for Responsible Investment.

- "Ping An ups the digital stakes in China and beyond". AsiaMoney. 26 September 2018. Archived from the original on 2019-08-01. Retrieved 2019-12-07.

- "China's Ping An Insurance aims to join Alibaba, Tencent ranks as tech behemoth".

- "China's Ping An overtakes BlackRock to become HSBC's biggest shareholder". www.internationalinvestment.net. 2018-11-07. Retrieved 2020-04-07.

- The Ping An-Fortis Deal: Who Really Wins? Archived 2011-07-21 at the Wayback Machine, Caijing Magazine, 3 April 2008

- "China's Ping An to take $2.3 bln loss on Fortis". Reuters. 2008-10-05.

- "Ping An to invest in Shenzhen Development Bank". Bloomberg. 2009-06-15.

- "China's Ping An Ventures to raise up to $1.3 bln for healthcare investments: source". Reuters. 2018-02-07. Retrieved 2023-08-20.

- Irrera, Anna; Hirschauge, Orr (2014-11-20). "Chinese, Russian Lenders to Back Israel's eToro". Wall Street Journal. ISSN 0099-9660. Retrieved 2023-08-20.

- "eToro Confirms $27 Million Funding Round with Ping An Ventures and SBT Venture Capital". Financial and Business News. 2014-12-10. Retrieved 2023-08-20.

- "pingan to buy autohome from telstra for 1.6billio". Bloomberg News.

- "Three Technology Subsidiaries under Ping An Group Receive Financing from International Investors". Bloomberg.com. 2 February 2018.

- {{|title=Good Doctor trades briskly on debut, but ends flat after raising US$1.1b in biggest IPO this year|date=4 May 2018|url=https://www.scmp.com/business/companies/article/2144638/ping-good-doctor-jumps-much-7pc-trading-debut-after-raising-us11b}}

- "pingan's oneconnect flat in debut after $312 millionipo", Bloomberg.com, 13 December 2019

- "Chinese Lender Lufax Raises $2.36 Billion in IPO. Why It's a Broken Deal".

- "Ping An launches elderly care brand Ping An Zhen Yi Nia". Coverager.

- "Insight Weekly: Bank mergers of equals return; energy tops S&P 500; green bond sales to rise". S&P.

- "Ping An Bank unveils cross-border wealth offering in Greater Bay Area". Private Banker International.

- "China:Ping An clinches go-ahead for investment in troubled business arm of Peking University". 22 Feb 2022.

- "Ping An Business Case Studies: Breaking the Mold by Breaking Into Elderly Care in China". 22 Feb 2022.

- "OneConnect debuts on HKEX in dual primary listing". China Business Law Journal.

- "Ping An Bank Hong Kong branch granted insurance agency license". Insurance Asia.

- "China insurance giant Ping An plans tech R&D investment at $15bn". 8 Nov 2018.

- "Ping An Reports Steady YoY Growth of 4.9% in Operating Profit Attributable to Shareholders of the Parent Company in 2020" (Press release). 3 Feb 2021.

- "Chinese Lender Lufax Raises $2.36 Billion in IPO. Why It's a Broken Deal". Barron's.

- "Three Technology Subsidiaries under Ping An Group Receive Financing from International Investors". Bloomberg.

- "Ping An's AskBob beats six doctors by 2.9 points in diabetes competition". 3 Nov 2021.

- Willard, Jack (23 Aug 2022). "Ping An launches PingAn-3 satellite to support development of inclusive finance". Reinsurancene.ws.

- Chen, Shu-Ching Jean. "Chinese Giant Ping An Looks Beyond Insurance To A Fintech Future". Forbes. Shu-Ching Jean Chen.

- "Ping An results 30 June 2023" (PDF). HKEX.

- McGregor, Richard (2010). The Party: The Secret World of China's Communist Rulers. New York, 2012: Allen Lane.

{{cite book}}: CS1 maint: location (link) - McGregor, p. 204 Archived 2017-02-20 at the Wayback Machine-205.

- David Barboza, "Billions in Hidden Riches for Family of Chinese Leader" Archived 2017-05-19 at the Wayback Machine, The New York Times, 25 October 2012. Retrieved 27 October 2012.

- "2009 Annual Report" (PDF). Ping An Insurance. archive of Hong Kong Stock Exchange. 27 April 2010. Archived (PDF) from the original on 21 October 2016. Retrieved 20 October 2016.

- "2015 Annual Report" (PDF). Ping An Insurance. Hong Kong Stock Exchange. 29 March 2016. Archived (PDF) from the original on 21 October 2016. Retrieved 20 October 2016.

- "BEA Securities Hong Kong weekly report 14 August 2004" (PDF). BEA Securities.

- "Ping An Insurance Becomes Constituent Stock of Hang Seng Index". Ping An.

- {{|title=OneConnect to Announce Fourth Quarter and Full Year 2021 Financial Results|date=15 Feb 2022|url=https://finance.yahoo.com/news/oneconnect-announce-fourth-quarter-full-140000954.html}}

- "China awakens to the power of responsible investing".

- "China:Ping An is 1st Chinese company to join UN Principles for Sustainable Insurance".

- "Ping An named to Dow Jones Sustainability Index".

- "Ping An Named Insurance Company of the Year, ESG, China by The Asset" (Press release).

- "Ping An to achieve operational carbon neutrality in 2030".

- "Ping An releases climate risk management report for 2020".

- "LIC's IPO size slashed; Ping An Life's ESG bond index; QBE exits Ireland". S&P.

- "Ping An Bank launches personal carbon accounts". The Asset.

- "Chinese insurers move swiftly to handle rising claims after floods in Henan".

- "Chins issues first China-focused ESG disclosure standard based on pingan framework". 16 May 2022.

- "Ping An Receives Best ESG Score Among Mainland China's Insurance Companies: Here's What Investors Need To Know". 20 July 2022.

- "The Sustainability Yearbook - 2022 Rankings".

- "The Global Convergence of Standards for Climate-related Disclosure: Chinese companies' 2022 CDP disclosure report April 2023" (PDF). CDP.

- "Climate Change 2022". CDP.

- "Ping An obtains top ESG rating". Insurance Business Asia.

- "Climate finance: China's Ping An Bank lends US$25 million to Inner Mongolia steel maker to capture carbon emissions". South China Morning Post.

External links

- Business data for Ping An Insurance:

- News website about Ping An systems upgrade Archived 2010-12-15 at the Wayback Machine