Stadium subsidy

A stadium subsidy is a type of government subsidy given to professional sports franchises to help finance the construction or renovation of a sports venue. Stadium subsidies can come in the form of tax-free municipal bonds, cash payments, long-term tax exemptions, infrastructure improvements, and operating cost subsidies. Funding for stadium subsidies can come from all levels of government and remains controversial among legislators and citizens.

When surveyed, 86% of economists favored eliminating public subsidies for professional sports franchises.[1][2][3] According to economists, state and local subsidies to build stadiums for professional sports teams are unlikely to result in economic benefits that exceed the costs to taxpayers.[4][5][6] Stadium subsidies have distributional effects, primarily benefitting wealthy owners, players and other staff of sports franchises while imposing costs on the public.[7] Stadium subsidies are widely criticized for using taxpayer funds to benefit franchise owners, who are often billionaires, to the detriment of public schools and infrastructure.[8][9][10][11][12]

Background

In the United States

Prior to the 1950s, stadium subsidies were essentially unheard of, with funding for professional sports stadiums coming from private sources. In 1951, MLB commissioner Ford Frick decided that league teams were bringing large amounts of revenue to their host cities from which owners weren't able to profit. He announced that cities would need to start supporting their teams by building and maintaining venues through public subsidy.[13] Most new or renovated professional sports stadiums are financed at least partly through stadium subsidies. While Frick may have been a catalyst, this change has been primarily caused by the increase in bargaining power of professional sports teams at the expense of their host cities.

Many studies suggest that there are a number of direct and indirect economic benefits associated with hosting a professional sports team, although each city experiences this to a different degree.[14][15] Even so, a 2017 survey found that "83% of economists polled believed that a subsidy's cost to the public outweighed the economic benefits".[16][17] The economics behind issuing billions of dollars to professional athletic organizations are still unclear, but cities have clearly showed that they are willing to assume the bets, as both the number of subsidies issued and the amount of money issued per subsidy have increased.[18][19][20]

27 of the 30 stadiums built between 1953 and 1970 received more than $450 million in total public funding for construction.[21] During this period, publicly funding a stadium grew in popularity as an effective incentive to attract professional sports teams to up and coming cities. Famous examples include the Brooklyn Dodgers leaving New York in exchange for 300 acres in Chavez Ravine and the New York Giants moving to San Francisco for what would eventually become Candlestick Park.[22]

Over time, a market for subsidies has come into existence. Sports teams have realized their ability to relocate at lower and lower costs to their private contributors. Because local governments feel that keeping their sports teams around is critical to the success of their cities, they comply and grant teams subsidies. This creates a market for subsidies, where professional athletic organizations can shop between cities to see which municipality will provide them with the most resources. Teams in the NFL have a major incentive to keep their stadium up to date, as the NFL allows teams to bid to host the Super Bowl and takes recent and planned renovations into account.[23][24] Many NFL teams in recent years have asked for subsidies for the construction of entirely new stadiums, like the Atlanta Falcons, who were subsequently awarded the contract for Super Bowl LIII.[25]

In Europe

Public subsidies for major league sports stadiums and arenas are far less common in Europe than in the United States. The relationship between the local clubs and the cities that host them is typically much stronger than in the United States, with the team being more intrinsic to the cities' identity. Cities would be significantly more upset at the departure of their beloved local teams, and viable alternative cities already have their own clubs to whom their residents are loyal. As a result, the leagues in Europe have significantly less bargaining power, and that the stadiums are largely privately funded instead. They will not threaten to relocate to another city if not provided with a subsidy, or at the very least the threat would not be credible.[26] It is also worth noting that the NFL, the league in the United States whose stadiums have the highest percentage of public financing of the four major leagues, does not have an equivalent in Europe; American football is relatively unpopular in Europe when compared to association football.

Other factors to consider regarding the differences in the use of public subsidies for stadiums in North America and in Europe are both the differences in how the leagues are organized in their respective continents as well as the internal geographical differences between the United States and European countries. In North America, franchises operate inside of a closed league, in which the leagues have a fixed, maximum number of teams (e.g., 32 teams at maximum) for the sake of scheduling. This monopolistic structure, coupled with the large geographic size of both the United States and Canada, has resulted in a considerable imbalance between the number of teams in the four main North American sports leagues and the number of eligible major cities and/or metropolitan areas in the United States and Canada who desire and/or can sustain such teams. This disparity affords franchise owners significant bargaining power, as they have a considerable market of urban areas to which they could consider relocating their teams and request subsidies for new stadiums if their team's current host cities are unwilling or unable to do so. By contrast, European sports leagues generally use a league system and promotion and relegation, in which sports clubs from various cities can be promoted to higher leagues based on their performance in the completed season. This inclusive approach, coupled with the fact that most of the large cities in European countries would have their own clubs, deprives club owners in Europe of the effectiveness in the threats of relocating their clubs to other cities if their current city fails to provide subsidies for new stadiums.

Types of Subsidies

There are two primary ways that a city facilitates the construction of a stadium. The first, and most commonly used method, is a direct subsidy. This involves a city promising a certain amount of revenue to go towards the construction, maintenance, and renovation of a stadium. Other times, the city will give tax breaks to teams or stadium owners in lieu of a direct cash transfer.[27] Over a period of time, a reduction in the taxes paid against the stadium generally saves the organization building the stadium around the same amount as a subsidy would be worth.

In the US, annual subsidies provided by states for the construction of stadiums range into billions of dollars.[28][29] A 2005 study of all sports stadiums and facilities in use by the four major leagues from 1990 to 2001 calculated a total public subsidy of approximately $17 billion, or approx. $24 billion in 2018 dollars. The average annual subsidy during that period was $1.6 billion ($2.2 billion in 2018 dollars) for all 99 facilities included in the study, with an average of $16.2 million ($22.8 million in 2018 dollars) per facility annually.[20] A 2012 Bloomberg analysis estimates that tax exemptions annually cost the U.S. Treasury $146 million.[2]

| NBA | NFL | MLB | NHL |

| Cleveland Cavaliers[30] | Buffalo Bills[31][32] | Baltimore Orioles[33] | Boston Bruins[30] |

| Oklahoma City Thunder[30] | Miami Dolphins[34] | Boston Red Sox[33] | Buffalo Sabres[35] |

| Golden State Warriors[36] | New England Patriots[37] | New York Yankees[38] | Detroit Red Wings[39] |

| Atlanta Hawks[40] | New York Jets | Tampa Bay Rays[41][42] | Florida Panthers[43] |

| Indiana Pacers[30] | Baltimore Ravens[37] | Toronto Blue Jays[30] | Montreal Canadiens |

| Houston Rockets[44] | Cincinnati Bengals[37] | Chicago White Sox[45][46] | Ottawa Senators[47] |

| Utah Jazz[48] | Cleveland Browns[37] | Cleveland Indians[33] | Tampa Bay Lightning[49] |

| New York Knicks[30] | Pittsburgh Steelers[37][50][51] | Detroit Tigers[44] | Toronto Maple Leafs[41] |

| Brooklyn Nets[52] | Houston Texans[37] | Kansas City Royals[53] | Carolina Hurricanes[54] |

| Orlando Magic[44][55] | Indianapolis Colts[37] | Minnesota Twins[56][44] | Columbus Blue Jackets |

| Miami Heat[30] | Jacksonville Jaguars[57] | Houston Astros[33][44] | New Jersey Devils[44] |

| Boston Celtics[30] | Tennessee Titans[37] | Los Angeles Angels[33] | New York Islanders[38] |

| Denver Nuggets[30] | Denver Broncos[37] | Oakland Athletics[33] | New York Rangers[30] |

| Los Angeles Clippers[30] | Kansas City Chiefs[58] | Seattle Mariners[59] | Philadelphia Flyers[47] |

| Los Angeles Lakers[30] | Las Vegas Raiders[60] | Texas Rangers[33] | Pittsburgh Penguins[38] |

| Minnesota Timberwolves[56] | Los Angeles Chargers[60] | Atlanta Braves[61] | Washington Capitals[47] |

| Portland Trail Blazers[30] | Dallas Cowboys[37] | Miami Marlins[44] | Chicago Blackhawks[62] |

| Washington Wizards[30] | New York Giants | New York Mets[44] | Colorado Avalanche[30] |

| Dallas Mavericks[44] | Philadelphia Eagles[37] | Philadelphia Phillies[44] | Dallas Stars[44] |

| San Antonio Spurs[44] | Washington Football Team/Commanders[37] | Washington Nationals[44] | Minnesota Wild[56] |

| Detroit Pistons[39] | Chicago Bears[37] | Chicago Cubs[63] | Nashville Predators[64][65] |

| Toronto Raptors[30] | Detroit Lions[37] | Cincinnati Reds[44] | St. Louis Blues[66] |

| Philadelphia 76'ers[30] | Green Bay Packers[37] | Milwaukee Brewers[44] | Winnipeg Jets[67] |

| Milwaukee Bucks[68] | Minnesota Vikings[56][60] | Pittsburgh Pirates[51] | Anaheim Ducks[69] |

| Chicago Bulls | Atlanta Falcons[70] | St. Louis Cardinals[37] | Arizona Coyotes[44] |

| New Orleans Pelicans[30] | Carolina Panthers[71] | Arizona Diamondbacks[72] | Calgary Flames[73][74] |

| Sacramento Kings[30] | New Orleans Saints[57] | Colorado Rockies[33] | Edmonton Oilers[75] |

| Phoenix Suns[30] | Tampa Bay Buccaneers[37][76] | Los Angeles Dodgers[33] | Los Angeles Kings |

| Memphis Grizzlies[44] | Arizona Cardinals[77][78] | San Diego Padres[44] | San Jose Sharks[47] |

| Charlotte Hornets[44] | Los Angeles Rams[60] | San Francisco Giants[79] | Vancouver Canucks[47] |

| San Francisco 49ers[37] | Vegas Golden Knights[80][81] | ||

| Seattle Seahawks[37] |

Sources:[82][83][84][85][86][87][88][89][90][37][44][33][30][47]

Benefits

In granting stadium subsidies, governments claim that the new or improved stadiums will have positive externalities for the city. Proponents tout improvements to the local economy as the primary benefits. Economists who debate the issue have separated the effects on a local economy into direct and indirect effects. Direct benefits are those that exist as a result of the "rent, concessions, parking, advertising, suite rental, and other preferred seating rental", and direct expenses come from "wages and related expenses, utilities, repairs and maintenance, insurance," and the costs of building the facilities.[14] Generally, these benefits vary widely. The Baltimore Orioles, for example, estimate that each game they host brings $3 million in economic benefits to the city. Over the course of an entire baseball season, the Orioles will have 81 home games, a benefit of $243 million a season.[27] For NFL teams, there are only 8 home games a season; even so, over the lifetime of a stadium, between 20 and 30 years, the accumulated benefit is still substantial, which is the argument teams make to municipalities when they request the subsidy.

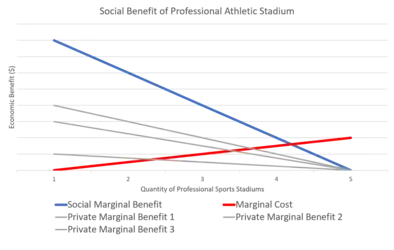

According to the diagram, a fictitious city would like to acquire four teams, since at that point the social marginal benefit of recruiting a team still exceeds the marginal cost.

Supporters further argue that the stadiums attract tourism and businesses that lead to further spending and job creation, representing indirect benefits. All of the increased spending causes a local multiplier effect that leads to more spending and job creation and eventually finances the subsidy through increased tax revenues from ticket and concessions sales, improved property values and more spending nearby the stadium.[91] In some cases, there has been an observed reduction in crime during a game, although the aggregate effect of professional sports on crime is disputable.[92][93] Additionally, there has recently been research that suggests that home games generate what is called a "sunny day benefit".[94] There is a measurable drop in local spending that occurs within a city on a rainy day, but with a professional sports team playing a game, spending increases significantly. Jordan Rappaport, an economist at the Federal Reserve Bank of Kansas City, estimates that this benefit is between $14 and $24 million a year, which can be compounded over the life of a stadium.[94]

Advocates for stadium subsidies also claim less quantifiable positive externalities, such as civic pride and fan identification, so that hosting a major sports team becomes something of a public good. Local sports fans enjoy the benefit even if they do not pay for it.[91][95] When a city conducts a calculation to assess what they are willing to pay for a subsidy, they use an economic model that attempts to quantify the various social benefits for each dollar invested. This is done through a social marginal benefit evaluation, which takes the sums of all of the private benefits that result from investing, intended or not. Economists consider all the economic effects of having a professional athletic team in a city, like the "sunny day" benefit, job creation, civic pride, increased tourism, decreases/increases in crime rates, etc. The social marginal cost is equal to the sum of the private marginal benefits. The marginal cost is known only by the government, who deliberates with franchises to decide how much bringing a team to their city will cost.

Criticisms

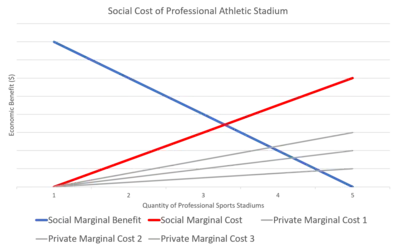

According to the diagram, a fictitious city would like to acquire three teams, since at that point the social marginal benefit of recruiting a team still exceeds the social marginal cost.

Many criticisms exist regarding the use of stadium subsidies. First, critics argue that new stadiums generate little to no new spending (consumption). Instead, what fans spend in and around the stadium are substitutes for what they would otherwise spend on different entertainment options. Thus, this argument contends, new stadiums do not cause economic growth or lead to increased aggregate income. In fact, this suggests that money being substituted towards concessions, tickets, and merchandise actively harms the economy surrounding a stadium.[96] For example, the Little Caesars Arena in Detroit, Michigan, was subsidized by a bond issue, diverting taxes paid by local businesses into stadium construction.[39] Annually, an estimated $15 million in taxpayer funds earmarked for public schools are used to subsidize the stadium.[97][98]

Another criticism of stadium subsidies is that much of the money the new stadiums bring in does not stay in the local economy. Instead of going to stadium employees and other sources that would benefit the local community, a lot of the money goes toward paying the organizations.[96] Those payments come from either the state or city government, where spending normally goes towards social welfare programs or salaries for government employees. It has been argued that the opportunity cost of a subsidy for a sports team is far greater than the benefit, since the billions of dollars that are spent on a stadium could be better spent on schools, firehouses, public transportation, or police departments.[20][1]

Critics also argue that the construction of new stadiums could cause citizens and businesses to leave a city because of eminent domain issues. If a city is forced to take land from its citizens to build a new stadium, those who have lost land could become angry enough to leave the city. If they are business owners, then they will likely take their businesses with them. These trade-offs are a part of the marginal cost calculation the city does. Much like the social marginal benefit calculation the city performed to find what benefits teams brought to the city, the social marginal cost calculation sums up all of the unintended negative effects from a particular spending plan.

A review of the empirical literature assessing the effects of subsidies for professional sports franchises and facilities reveals that most evidence goes against sports subsidies. Specifically, subsidies cannot be justified on the grounds of local economic development, income growth or job creation.[14][15][94][95]

References

- Kianka, Tim (March 6, 2013). "Subsidizing Billionaires: How Your Money is Being Used to Construct Professional Sports Stadiums". Jeffrey S. Moorad Center for the Study of Sports Law. Retrieved February 3, 2016.

- Kuriloff, Aaron; Preston, Darrell (September 5, 2012). "In Stadium Building Spree, U.S. Taxpayers Lose $4 Billion". bloomberg.com. Retrieved February 3, 2016.

- Wolla, Scott A. (May 2017). "The Economics of Subsidizing Sports Stadiums". research.stlouisfed.org.

- "Sports Stadiums". Clark Center Forum. 2017.

- Wolla, Scott A. (May 2017). "The Economics of Subsidizing Sports Stadiums". research.stlouisfed.org.

- "Do Economists Reach a Conclusion on Subsidies for Sports Franchises, Stadiums, and Mega-Events?". Econ Journal Watch. 2008.

- Noll, Roger G.; Zimbalist, Andrew (2011). Sports, Jobs, and Taxes: The Economic Impact of Sports Teams and Stadiums. Brookings Institution Press. ISBN 978-0-8157-2040-9.

- Morrison, Richard (September 6, 2019). "Welfare for Billionaires: Stadium Subsidies Are Pure Cronyism". Competetive Enterprise Institute. Retrieved October 21, 2021.

- "Taxpayer subsidies for stadiums of 26 billionaire team owners have totaled $9 billion since 1990, with most in last decade". The Gazette. February 2021. Retrieved October 21, 2021.

- Boehm, Eric (September 7, 2017). "Stop Subsidizing Football". Reason. Retrieved October 21, 2021.

- Dator, James (June 9, 2021). "Publicly funding stadiums for billionaires is a scam". SB Nation. Retrieved October 21, 2021.

- Weiner, Evan (December 4, 2013). "Bankruptcy Hasn't Stopped Detroit's Plan for Public Funding of New Sports Stadium". The Daily Beast.

- Fort, Rodney D. (2011). Sports Economics. Boston: Prentice Hall. pp. 408, 409. ISBN 9780136066026.

- Baade, Robert A.; Dye, Richard F. (April 1990). "The Impact of Stadium and Professional Sports on Metropolitan Area Development". Growth and Change. 21 (2): 1–14. doi:10.1111/j.1468-2257.1990.tb00513.x.

- Coates, Dennis (October 2007). "Stadiums and Arenas: Economic Development or Economic Redistribution?". Contemporary Economic Policy. 25 (4): 565–577. doi:10.1111/j.1465-7287.2007.00073.x. S2CID 153466370.

- Wolla, Scott (May 2017). "The Economics of Subsidizing Sports Stadiums". Page One Economics.

- "Sports Stadiums". IMG Forum. January 31, 2017.

- Brown, T.M. (May 23, 2017). "The Raiders Robbed Las Vegas In America's Worst Stadium Deal". Deadspin. Retrieved March 2, 2018.

- Kampis, Johnny. "Falcons' new home is just the latest of handouts to the NFL". Washington Examiner. Retrieved March 2, 2018.

- Long, Judith Grant (May 2005). "Full Count: The Real Cost of Public Funding for Major League Sports Facilities". Journal of Sports Economics. 6 (2): 119–143. doi:10.1177/1527002504264614. S2CID 154928281.

- Okner, B. (1974). "Subsidies of Stadiums and Arenas". In Noll, R. G. (ed.). Government and the Sports Business. Washington, DC: The Brookings Institution. pp. 325–348.

- Phelps, Zachary A. (2004). "Stadium Construction for Professional Sports: Reversing the Inequities Through Tax Incentives". Journal of Civil Rights and Economic Development. 18 (3).

- Swayne, Linda E. (2011). Encyclopedia of Sports Management and Marketing. SAGE. ISBN 9781412973823.

- "N.Y./N.J. Super Bowl in 2008 may not come to pass". USA Today. Retrieved March 2, 2018.

- "Super Bowl LIII - Mercedes Benz Stadium". Mercedes Benz Stadium. Retrieved March 3, 2018.

- John., Bale (1993). Sport, space, and the city. London: Routledge. ISBN 978-0415080989. OCLC 26160156.

- Noll, Andrew Zimbalist and Roger G. "Sports, Jobs, & Taxes: Are New Stadiums Worth the Cost?". Brookings. Retrieved March 3, 2018.

- Isidore, Chris (January 30, 2015). "NFL gets billions in subsidies from U.S. taxpayers". CNN. Retrieved February 2, 2016.

- Gillespie, Nick (December 6, 2013). "Football: A Waste of Taxpayers' Money". Time. Retrieved February 2, 2016.

- Long, Judith Grant (2013). Public/Private Partnerships for Major League Sports Facilities. pp. 144–145. ISBN 9780415806930.

- "Buffalo Bills, lease, Ralph Wilson Stadium, subsidies". December 21, 2012.

- "The Bills Blackmailed New York Taxpayers into Covering 84 Percent of Stadium Renovations". December 27, 2012.

- Long, Judith Grant (2013). Public/Private Partnerships for Major League Sports Facilities. p. 132. ISBN 9780415806930.

- Hanks, Douglas (July 24, 2018). "Miami Dolphins win last-minute boost to county subsidy package worth up to $58 million".

- Keith, Charlotte (October 29, 2014). "Sabres score big subsidies at HarborCenter".

- Davis, Scott (March 28, 2019). "Warriors President Rick Welts explains why their new $1.4 billion self-financed stadium was a one-of-a-kind situation other teams can't replicate". Business Insider.

- "NFL Stadium Funding Information: Stadiums Opened Since 1997" (PDF). Conventions Sports & Leisure International. December 2, 2011. Archived from the original (PDF) on December 22, 2012 – via CBS Minnesota.

- Boselovic, Len (September 9, 2016). "Sports stadiums a $3.7 billion drain on taxpayers". Pittsburgh Post-Gazette.

- Felton, Ryan (December 16, 2014). "News Hits: Schuette OKs school taxes for new Red Wings arena". metrotimes.com.

- "Atlanta Council approves car rental tax deal for Philips renovation". The Atlanta Journal-Constitution.

- Kuriloff, Aaron (November 6, 2012). "Stadiums Cost Taxpayers Extra $10 Billion, Harvard's Long Finds". bloomberg.com.

- "How much do the Tampa Bay Rays boost the local economy?". Tampa Bay Times.

- "Broward Commission gives $86 million to Florida Panthers". Sun Sentinel.

- Gold, Alexander K.; Drukker, Austin J.; Gayer, Ted (September 8, 2016). "Why the federal government should stop spending billions on private sports stadiums". Brookings Institution.

- "30 years later, taxpayers still on the hook for White Sox stadium". illinoispolicy.org. June 29, 2018.

- Kantor, Paul; Judd, Dennis R. (October 5, 2015). American Urban Politics in a Global Age. p. 223. ISBN 9781317350354.

- Long, Judith Grant (2013). Public/Private Partnerships for Major League Sports Facilities. pp. 149–150. ISBN 9780415806930.

- Falk, Aaron (June 15, 2016). "Utah Jazz: Salt Lake City RDA approves $22.7M tax break for Jazz arena renovation". Salt Lake City Tribune.

- "Hillsborough Co., Lightning agree to extension and funding plan through 2037". 10NEWS.

- "Team Sale Would Trigger Review of Public Stadium Funding". NFL. ESPN.com. July 16, 2008. Retrieved August 5, 2008.

- Barnes, Tom; Dvorchak, Robert (July 10, 1998). "Plan B Approved: Play ball!". Pittsburgh Post-Gazette. Retrieved April 5, 2008.

- Mathis-Lilley, Ben (October 2, 2014). "Russian Plutocrat Set to Make $1.6 Billion in Brooklyn Via Tax Money, Eminent Domain Seizure". Slate.

- "Report: The Kansas City Royals Are Using Taxpayer Money Meant for Stadium Repairs to Pay for Other Stuff". July 31, 2012.

- "Wake Approves 'Tourism Tax' Projects; Now Waits for City Input". August 20, 2019.

- Schlueb, Mark (July 24, 2007). "City Oks Venues: Big Hurdle Awaits: VOTE: Orlando approves the $1.1 billion project 6-1". Orlando Sentinel. Archived from the original on November 9, 2009. Retrieved January 8, 2020.

- "Minnesota to Send Nearly $500 Million to Billionaire Team Owners". The Heartland Institute.

- Easterbrook, Gregg (October 2013). "How the NFL Fleeces Taxpayers". The Atlantic.

- "Missourians subsidize KC stadiums to tune of $3 million per year. When will Kansans chip in?". Kansas City Star. May 19, 2019.

- "Breakdown: Safeco Field, a $180 Million Proposal and Seattle's Lodging Tax". July 31, 2018.

- "Tax breaks do figure into NFL stadium plan in Inglewood". Los Angeles Times. January 13, 2015.

- Boudway, Ira; Smith, Kate (April 27, 2016). "The Braves Play Taxpayers Better Than They Play Baseball". Bloomberg.com. Retrieved October 21, 2021.

- "Shedding more light on the United Center tax break". January 7, 2013.

- "Emanuel, Cubs Quick to Note No Tax Dollars Used in Wrigley Renovations".

- Rau, Nate. "Nashville Predators and Mayor David Briley reach decades-long Bridgestone Arena deal". The Tennessean.

- "Predators Are Not A Profitable Business Despite Public Subsidies, On-Ice Success". www.sportsbusinessdaily.com. April 30, 2012.

- Hartmann, Ray. "As the Blues score another fat public subsidy, the scorecard is clear: Taxpayers lose". Riverfront Times.

- Kives, Bartley (March 6, 2019). "City and province to provide Winnipeg pro sports with $16.6M this year". cbc.ca.

- Ryan, Sean (August 12, 2015). "Gov. Walker signs $250M Milwaukee Bucks arena financing plan".

- Jozsa, Frank P. (2003). American Sports Empire: How the Leagues Breed Success. Greenwood Publishing Group. p. 184. ISBN 9781567205596.

- deMause, Neil (September 29, 2017). "Why are Georgia taxpayers paying $700m for a new NFL stadium?". The Guardian – via www.theguardian.com.

- Ozanian, Mike. "Carolina Panthers Get Third-Richest Taxpayer Gift In NFL History". Forbes.

- "Arizona could join national compact forbidding taxpayer-funded sports facilities".

- "Opinion: This isn't just a game: Calgary cannot afford a new football stadium".

- "Why Calgary council drank the publicly subsidized Kool-aid on arenas - Macleans.ca".

- "A look back at how Edmonton's Rogers Place is being paid for".

- "Buccaneers, sports authority agree on $100 million Raymond James Stadium upgrade". Tampa Bay Times.

- Kuriloff, Aaron (October 24, 2015). "While Arizona Cardinals Soar, Legal Battle Puts Stadium Investors in Red Zone". The Wall Street Journal.

- Isidore, Chris (January 30, 2015). "NFL gets billions in subsidies from U.S. taxpayers". CNNMoney.

- "The Giants Are Asking San Francisco for Millions in Tax Breaks". May 31, 2016.

- Campo, Catherine (December 24, 2017). "Taxpayer money should be spent on public services — not stadiums, says Las Vegas Knights owner Bill Foley". CNBC.

- Notte, Jason. "This kind of stadium funding could only happen in Las Vegas". MarketWatch.

- "Here's how every NHL arena was funded". Flamesnation. September 13, 2017. Retrieved March 5, 2018.

- National Sports Law Institute at Marquette University Law School (June 12, 2012). "Major League Baseball" (PDF). Sports Facility Reports. 13. Archived from the original (PDF) on March 9, 2013. Retrieved March 5, 2018.

- Center, StubHub. "About StubHub Center | StubHub Center". www.stubhubcenter.com. Retrieved March 5, 2018.

- Snider, Rick. "Maryland and D.C. politicians might have helped Virginia land the Redskins' next stadium". Washington Post.

- "Arena Facts - Pepsi Center". Pepsi Center. Retrieved March 5, 2018.

- "Clippers owner Steve Ballmer announces '100 percent privately funded' arena". Sporting News. June 15, 2017. Retrieved March 5, 2018.

- "A Privately Financed Arena - NBA Style - An Experienced, Award-Winning Attorney Concentrating in the Areas of Real Estate & Sports Law". An Experienced, Award-Winning Attorney Concentrating in the Areas of Real Estate & Sports Law. April 2, 2015. Retrieved March 5, 2018.

- "Little Caesars Arena's funding mix not without critics". Detroit News. Retrieved March 5, 2018.

- "Shedding more light on the United Center tax break". Crain's Chicago Business. Retrieved March 5, 2018.

- Zimbalist, Andrew; Noll, Roger G (1997). "Sports, Jobs, & Taxes: Are New Stadiums Worth the Cost?". Brookings Institution. The Brookings Institution. Retrieved February 17, 2016.

- Copus, Ryan; Laqueur, Hannah (April 2019). "Entertainment as Crime Prevention: Evidence From Chicago Sports Games". Journal of Sports Economics. 20 (3): 344–370. doi:10.1177/1527002518762551. S2CID 220063109.

- White, Garland F.; Katz, Janet; Scarborough, Kathryn E. (January 1992). "The Impact of Professional Football Games Upon Violent Assaults on Women". Violence and Victims. 7 (2): 157–171. doi:10.1891/0886-6708.7.2.157. PMID 1419925. S2CID 40928657. ProQuest 208555240.

- Rappaport, Jordan; Wilkerson, Chad (2001). "What are the benefits of hosting a major league sports franchise?". Economic Review. 86 (1): 55–86. ProQuest 218422373.

- Owen, Jeffrey G. (2006). "The Intangible Benefits of Sports Teams" (PDF). Public Finance and Management. 6 (3): 321–345.

- Zaretsky, Adam M. (April 1, 2001). "Should Cities Pay for Sports Facilities?". The Regional Economist. Federal Reserve Bank of St. Louis. Retrieved February 2, 2016.

- Aguilar, Louis (November 5, 2015). "Red Wings arena cost at $627M, could go higher". The Detroit News.

- Felton, Ryan (October 10, 2014). "Lawmaker requests Michigan Attorney General's opinion on Detroit arena funding". metrotimes.com.