Yield curve control

Yield curve control (YCC) is a monetary policy action whereby a central bank purchases variable amounts of government bonds or other financial assets in order to target interest rates at a certain level.[1] It generally means buying bonds at a slower rate than would occur under a Quantitative Easing policy. It affects long term interest rates, whereas QE is more impactful on shorter term interest rates. Where QE focuses on quantities of bonds, YCC is concerned with the price. [2] It can be thought of as a more effective form of QE: In QE the central bank buys bonds, but does not have a target for what interest rate those purchases will bring. In YCC, the central bank intentionally buys enough bonds to reach a certain interest rate target.

| Public finance |

|---|

|

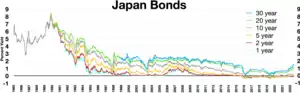

Zero interest-rate policy started in 1995

Negative interest rate policy started in 2014

Two examples of yield curve control can be found in the United States after World War II,[3] where bonds were purchased to keep interest rates low to allow cheaper government funding of the war effort,[4] and in Japan, early 21st century,[5] where bonds were purchased to keep long term interest rates at 0%, in an effort to stimulate the economy.[6]

See also

References

- "Yield Curve Control". Investopedia.

- "What is Yield Curve Control". Brookings.edu. 5 June 2020.

- "Yield Curve Control in the United States, 1942 to 1951". Federal Reserve Bank of Chicago.

- "The Treasury-Fed Accord, March 1951". Federal Reserve Bank of St. Louis.

- Kihara, Leika (20 December 2022). "BOJ jolts markets in surprise change to yield curve policy". Reuters.

- "Yield Curve Control". Investopedia.