Chapter 19

Financial Management

By Boundless

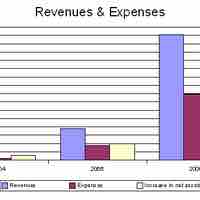

Finance involves the evaluation, disclosure, and management of economic activity and is crucial to the successful operation of firms and markets.

Financial managers ensure the financial health of an organization through investment activities and long-term financing strategies.

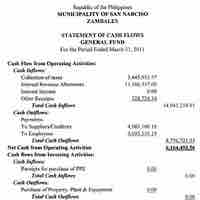

Operating cash flow refers to the daily cash inflows and outflows generated from business revenues earned, excluding certain costs.

Capital costs are incurred for the purchase of land, buildings, construction of assets, and equipment, etc., used during business operations.

Funds typically originate from company sales and earning revenue; other cash sources include the sale of non-current assets and company stock.

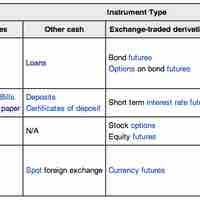

Business operations can require the use of credit, or the transfer of money or property on promise of repayment, to meet operating needs.

Inventory management is primarily about specifying the quantity and placement of stocked goods.

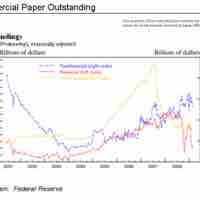

Commercial paper is a money-market security issued (sold) by large corporations to get money to meet short term debt obligations.

Factoring makes it possible for a business to readily convert a substantial portion of its accounts receivable into cash.

Credit cards allow users to pay for goods and services based on the promise to pay for them later and the immediate provision of cash by the card provider.

A commercial bank lends money, accepts time deposits, and provides transactional, savings, and money market accounts.

Trade credit is the largest use of capital for a majority of B2B sellers; Accounts Payable is money owed by a firm to its suppliers.

Asking friends and families to invest is one way that start-ups are funded.

A secured loan is a loan in which the borrower pledges an asset (e.g. a car or property) as collateral, while an unsecured loan is not secured by an asset.

Short-term loans offer individuals and businesses borrowing options to meet financial obligations.

Financial leverage is a technique used to multiply gains and losses by obtaining funds through debt instead of equity.

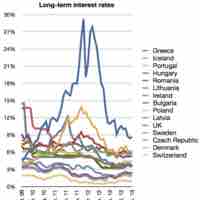

Debt is a way for firms to access capital for operations or investment with various terms and agreements for future repayment .

Companies can use equity financing to raise money and/or increase shareholder liquidity (through an IPO).

Three common examples of long term loans are government debt, mortgages, and debentures (bonds).

A corporate bond is issued by a corporation seeking to raise money in order to expand its business.