There are two commonly used measures of national income and output in economics, these include gross domestic product (GDP) and gross national product (GNP). These measures are focused on counting the total amount of goods and services produced within some "boundary" where the boundary is defined by either geography or citizenship.

Since GDP measures income and output, it can be used to compare two countries. The country with higher GDP is often regarded as wealthier, but, when using GDP to compare countries, it is important to remember to adjust for population.

GDP

GDP limits its focus to the value of goods or services in an actual geographic boundary of a country, where GNP is focused on the value of goods or services specifically attributable to citizens or nationality, regardless of where the production takes place. Over time GDP has become the standard metric used in national income reporting and most national income reporting and country comparisons are conducted using GDP.

GDP can be evaluated by using an output approach, income approach, or expenditure approach.

Output Approach

The output approach focuses on finding the total output of a nation by directly finding the total value of all goods and services a nation produces. Because of the complication of the multiple stages in the production of a good or service, only the final value of a good or service is included in the total output. This avoids an issue referred to as double counting, where the total value of a good is included several times in national output, by counting it repeatedly in several stages of production.

For example, in meat production, the value of the good from the farm may be $10, then $30 from the butchers, and then $60 from the supermarket. The value that should be included in final national output should be $60, not the sum of all those numbers, $90.

Formula: GDP (gross domestic product) at market price = value of output in an economy in the particular year - intermediate consumption at factor cost = GDP at market price - depreciation + NFIA (net factor income from abroad) - net indirect taxes.

Income Approach

The income approach equates the total output of a nation to the total factor income received by residents or citizens of the nation. The main types of factor income are:

- Employee compensation (cost of fringe benefits, including unemployment, health, and retirement benefits);

- Interest received net of interest paid;

- Rental income (mainly for the use of real estate) net of expenses of landlords;

- Royalties paid for the use of intellectual property and extractable natural resources.

All remaining value added generated by firms is called the residual or profit or business cash flow.

Formula: GDI (gross domestic income, which should equate to gross domestic product) = Compensation of employees + Net interest + Rental & royalty income + Business cash flow

Expenditure Approach

The expenditure approach is basically an output accounting method. It focuses on finding the total output of a nation by finding the total amount of money spent. This is acceptable, because like income, the total value of all goods is equal to the total amount of money spent on goods. The basic formula for domestic output takes all the different areas in which money is spent within the region, and then combines them to find the total output .

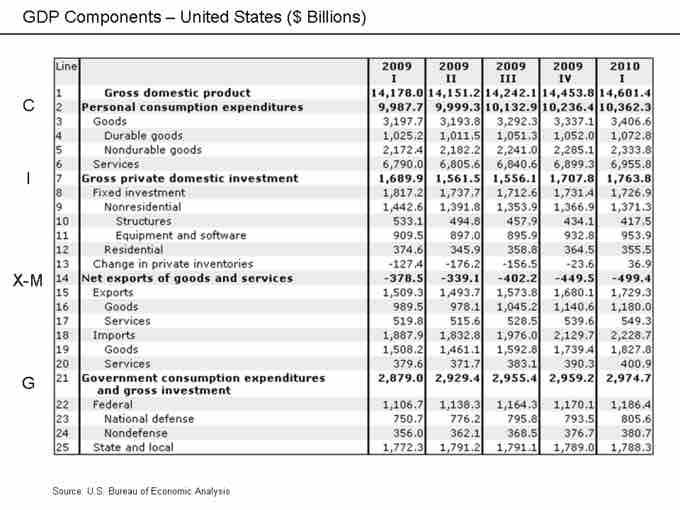

U.S. GDP Components

The components of GDP include consumption, investment, government spending, and net exports (exports minus imports).

Formula: Y = C + I + G + (X - M) ; where: C = household consumption expenditures / personal consumption expenditures, I = gross private domestic investment, G = government consumption and gross investment expenditures, X = gross exports of goods and services, and M = gross imports of goods and services.