An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. Changes in interest rate levels signal the status of the economy. As a vital tool of monetary policy, interest rates are kept at target levels - taking into account variables like investment, inflation, and unemployment - for the purpose of promoting economic growth and stability. In the U.S., the Federal Reserve (often referred to as 'The Fed') implements monetary policies largely by targeting the federal funds rate. This is the rate that banks charge each other for overnight loans of federal funds, which are the reserves held by banks at the Fed.

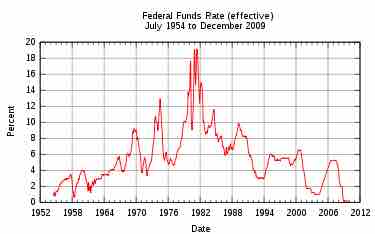

Federal fund rates

The effective federal funds rate in the U.S. charted over more than half a century.

Monetary policies are referred to as either expansionary or contractionary. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. An expansionary policy increases the total supply of money in the economy more rapidly than usual. Contractionary policy is intended to slow inflation in hopes of avoiding the resulting distortions and deterioration of asset values. Contractionary policy increases interest rate levels by expanding the money supply more slowly than usual or even shrinking it. Most central banks around the world assume and expect that lowering interest rates (expansionary monetary policies) would produce the effect of increasing investments and consumptions. However, lowering interest rates can sometimes lead to the creation of massive economic bubbles, when a large amount of investments are poured into the real estate market and stock market.

Crowding Out

Crowding out is a phenomenon occurring when expansionary fiscal policy causes interest rates to rise, thereby reducing investment spending. That means increase in government spending crowds out investment spending. This change in fiscal policy shifts equilibrium in the goods market. A fiscal expansion increases equilibrium income. If interest rates are unchanged, an increase in the level of aggregate demand will follow. This increase in demand must be met by rise in output.

With this increase in equilibrium income, the quantity of money demanded is higher. Because there is an excessive demand for real balances, the interest rate rises. Firms planned spending declines at higher interest rates, thus the aggregate demand falls. The adjustment of interest rates and their impact on aggregate demand dampen the expansionary effect of the increased government spending.