Chapter 6

Bond Valuation

By Boundless

The cost of money is the opportunity cost of holding money instead of investing it, depending on the rate of interest.

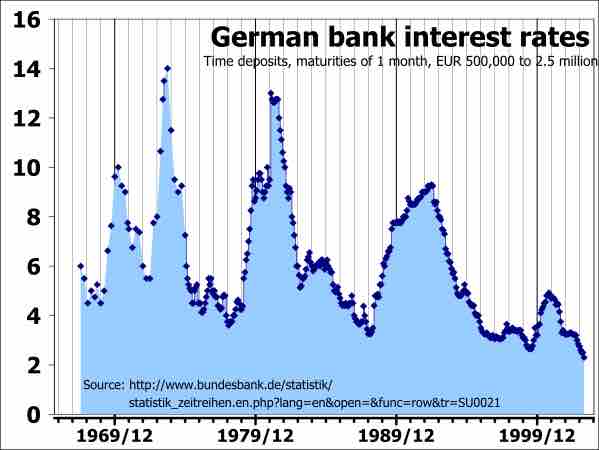

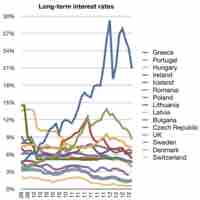

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender.

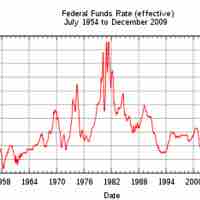

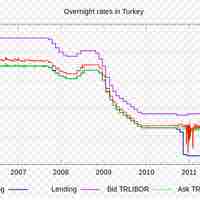

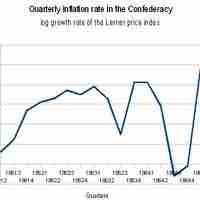

Market interest rates are mostly driven by inflationary expectations, alternative investments, risk of investment, and liquidity preference.

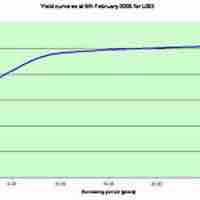

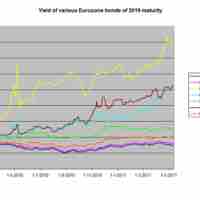

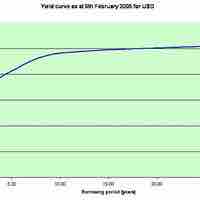

Term structure of interest rates describes how rates change over time.

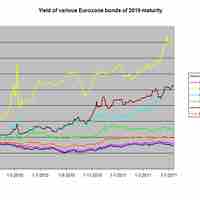

A yield curve shows the relation between interest rate levels (or cost of borrowing) and the time to maturity.

Yield curves on bonds and government provided securities are correlative, and are useful in projected future rates.

Taylor explained the rule of determining interest rates using three variables: inflation rate, GDP growth, and the real interest rate.

Par value is the amount of money a holder will get back once a bond matures; a bond can be sold at par, at premium, or discount.

The coupon rate is the amount of interest that the bondholder will receive per payment, expressed as a percentage of the par value.

Maturity date refers to the final payment date of a loan or other financial instrument.

A callable bond allows the issuer to redeem the bond before the maturity date; this is likely to happen when interest rates go down.

A sinking fund is a method by which an organization sets aside money to retire debts.

Other important features of bonds include the yield, market price and putability of a bond.

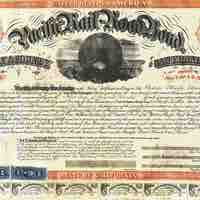

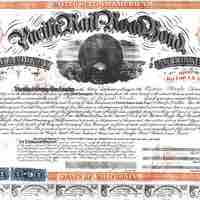

A bond is an instrument of indebtedness of the bond issuer to the holders.

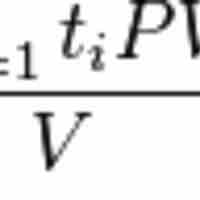

Duration is the weighted average of the times until fixed cash flows of a financial asset are received.

A bond indenture is a legal contract issued to lenders that defines commitments and responsibilities of the seller and the buyer.

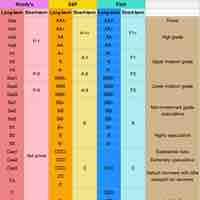

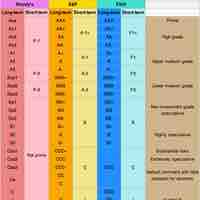

Bond credit rating agencies assess and report the credit worthiness of a corporation's or government's debt issues.

Bonds have some advantages over stocks, including relatively low volatility, high liquidity, legal protection, and a variety of term structures.

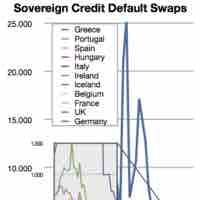

Bonds are subject to risks such as the interest rate risk, prepayment risk, credit risk, reinvestment risk, and liquidity risk.

A government bond is a bond issued by a national government denominated in the country's domestic currency.

A zero-coupon bond is a bond with no coupon payments, bought at a price lower than its face value, with the face value repaid at the time of maturity.

Floating rate bonds are bonds that have a variable coupon equal to a money market reference rate (e.g., LIBOR), plus a quoted spread.

Other bonds include register vs. bearer bonds, convertible bonds, exchangeable bonds, asset-backed securities, and foreign currency bonds.

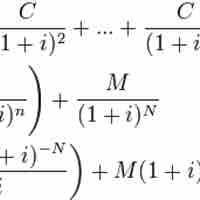

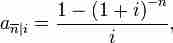

The value of a bond is obtained by discounting the bond's expected cash flows to the present using an appropriate discount rate.

Par value is stated value or face value, with a typical bond making a repayment of par value at maturity.

Yield to maturity is the discount rate at which the sum of all future cash flows from the bond are equal to the price of the bond.

An inflation premium is the part of prevailing interest rates that results from lenders compensating for expected inflation.

Nominal rate refers to the rate before adjustment for inflation; the real rate is the nominal rate minus inflation: r = R - i or, 1+r = (1+r)(1+E(r)).

"Time to maturity" refers to the length of time before the par value of a bond must be returned to the bondholder.

The yield to maturity is the discount rate that returns the bond's market price: YTM = [(Face value/Bond price)1/Time period]-1.

Payment frequency can be annual, semi annual, quarterly, or monthly; the more frequently a bond makes coupon payments, the higher the bond price.

Refunding occurs when an entity that has issued callable bonds calls those debt securities to issue new debt at a lower coupon rate.

Price risk is the risk that the market price of a bond will fall, usually due to a rise in the market interest rate.

Reinvestment risk is the risk that a bond is repaid early, and an investor has to find a new place to invest with the risk of lower returns.

Price risk is positively correlated to changes in interest rates, while reinvestment risk is inversely correlated.

Default risk is the risk that a bond issuer will default on any type of debt by failing to make payments which it is obligated to make.

The credit rating is a financial indicator assigned by credit rating agencies; bond ratings below BBB-/Baa are considered junk bonds.

There is no guarantee of how much money will remain to repay bondholders in a bankruptcy, therefore, the value of the bond is uncertain.