Chapter 11

Capital Budgeting

By Boundless

Capital budgeting is the planning process used to determine which of an organization's long term investments are worth pursuing.

The main goals of capital budgeting are not only to control resources and provide visibility, but also to rank projects and raise funds.

Capital budgeting requires a thorough understanding of cash flow and accounting principles, particularly as they pertain to valuing processes and investments.

Several methods are commonly used to rank investment proposals, including NPV, IRR, PI, payback period, and ARR.

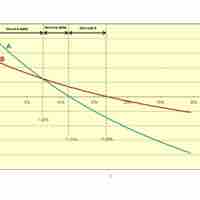

NPV and PI assume reinvestment at the discount rate, while IRR assumes reinvestment at the internal rate of return.

Long-term financing is generally for assets and projects and short term financing is typically for continuing operations.

The payback method is a method of evaluating a project by measuring the time it will take to recover the initial investment.

To calculate a more exact payback period: Payback Period = Amount to be initially invested / Estimated Annual Net Cash Inflow.

The payback method is more effective at accurately projecting payback periods when it is discounted to incorporate the time value of money.

Payback period as a tool of analysis is easy to apply and easy to understand, yet effective in measuring investment risk.

Payback period analysis ignores the time value of money and the value of cash flows in future periods.

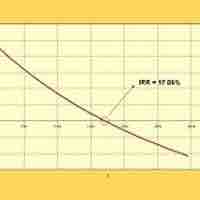

IRR is a rate of return used in capital budgeting to measure and compare the profitability of investments; the higher IRR, the more desirable the project.

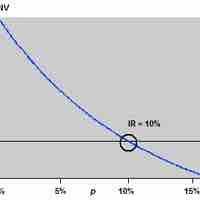

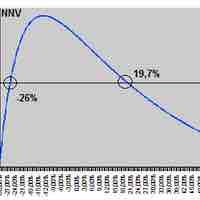

Given a collection of pairs (time, cash flow), a rate of return for which the net present value is zero is an internal rate of return.

The IRR method is easily understood, it recognizes the time value of money, and compared to the NPV method is an indicator of efficiency.

IRR can't be used for exclusive projects or those of different durations; IRR may overstate the rate of return.

When cash flows of a project change sign more than once, there will be multiple IRRs; in these cases NPV is the preferred measure.

The MIRR is a financial measure of an investment's attractiveness; it is used to rank alternative investments of equal size.

Net Present Value (NPV) is the sum of the present values of the cash inflows and outflows.

The NPV is found by summing the present values of each individual cash flow.

A positive NPV means the investment makes sense financially, while the opposite is true for a negative NPV.

NPV is easy to use, easily comparable, and customizable.

NPV is hard to estimate accurately, does not fully account for opportunity cost, and does not give a complete picture of an investment's gain or loss.

The NPV Profile graphs the relationship between NPV and discount rates.

Cash flow factors are the operational, financial, or investment activities which cause cash to enter or leave the organization.

A replacement project is an undertaking in which the company eliminates a project at the end of its life and substitutes another investment.

Sunk costs are retrospective costs that cannot be recovered, and are therefore irrelevant to future investment decisions in the project which incurs them.

Opportunity cost refers to the value lost when a choice is made between two mutually exclusive options.

An externality is an effect of an economic action, the cost or benefit of which is shouldered by someone outside the transaction.

The tax rate is the amount of tax expressed as a percentage.

Depreciation is the process by which an asset is used up, and its cost is allocated over a period of time.

Section 179 of the IRS code allows some pieces of property to be expensed entirely when they are purchased, rather than depreciated.