Section 1

Ratio Analysis and Statement Evaluation

By Boundless

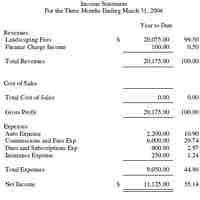

Companies prepare three financial statements according to GAAP rules: the income statement, the balance sheet, and the cash flow statement.

Profitability ratios are used to assess a business's ability to generate earnings.

Liquidity ratios measure how quickly assets can be turned into cash in order to pay the company's short-term obligations.

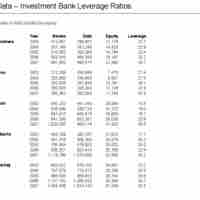

Debt ratios provide information about a company's long-term financial health.

Most financial ratios have no universal benchmarks, so meaningful analysis involves comparisons with competitors and industry averages.

Valuation ratios describe the value of shares to shareholders, and include the EPS ratio, the P/E ratio, and the dividend yield ratio.

Activity ratios provide useful insights regarding an organization's ability to leverage existing assets efficiently.

Most of the ratios discussed can be calculated using information found in the three main financial statements.