Why Measure Cash Flows?

When it comes to financial reporting activities, the statement of cash flows is a useful tool when it comes to understanding a business's liquidity and available short-term cash and cash equivalent assets. In layman's terms, the statement of cash flows identifies what resources a business can use relatively quickly. Understanding cash flows is useful because it

- provides accurate information regarding an organization's liquidity,

- projects future cash flow expectations in terms of quantity and timing,

- acts as a point of operating performance comparison between organizations,

- and highlights key changes in asset and operational valuations.

How to Determine Cash Flows

When understanding how an organization creates a statement of cash flows, it's important to know there are two established methods: the direct method and the indirect method.

The Direct Method

As the name implies, the direct method of reporting cash flows identifies clear circumstances of cash inflow or outflow. It is a simpler, more straight forward approach to cash flows, where each line item is a tangible form of cash credit or debit. Some common items on a direct cash flow report include:

- Cash flows from operating activities, such as payments received from customers, payments paid to suppliers and taxes.

- Cash flows from financing activities, such as dividends paid.

- Cash flows from investing activities, such as the purchase of new equipment and the sale of assets.

It's important to note that the direct method requires additional documents to take into account indirect cash flow implications for an organization. As a result, the direct method is less often used simply because the additional requirements limit the advantage of simplicity when filing using this format.

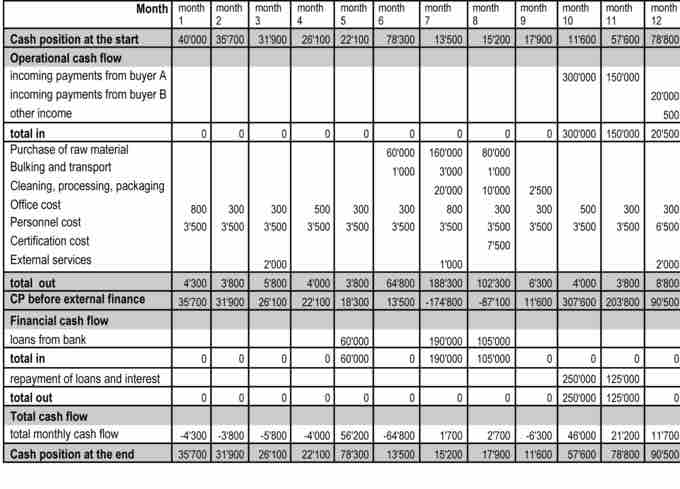

Simple Direct Cash Flow Statement

This is a simple direct monthly cash flow statement from a small business. It's worth noting that there are no investing activities in this example.

The Indirect Method

The indirect method is quite a bit more involved than the direct method, as it incorporates valuation changes in non-cash assets as well. The structure of the indirect method is also somewhat different, as it starts with the overall net income amount for the reporting period, where operational, investing, and financial changes in valuations are then applied to this amount. The resulting balance is considered the net increase or decrease in overall cash and cash equivalents.

Let's take a look at some examples of indirect cash flow line items for context:

- Operating items in the indirect method include depreciation and amortization, accounts receivable, inventory, and operating gains and losses.

- Investment items in the indirect method include capital expenditures and investments (i.e. in securities, other businesses, tangible and intangible assets).

- Financial items in the indirect method include dividends, stock repurchases, and changes in overall debt.

When you apply each of these items to the net income of a given period, you will derive a net increase or decrease in overall cash flow as a result of investments, financing, and operations for an organization.