The statement of cash flows and the income statement are both financial documents that are essential to have and understand when analyzing the financial state of a firm. When trying to determine the profitability and solvency of a business, it is important to analyze both of these statements. They both, in some form, depict funds that are flowing into and out of a company. However, while the income statement focuses on profitability, the statement of cash flows focuses on solvency.

The Income Statement

The income statement reports the profitability of a company over a stated period of time. It indicates how revenue brought in from business activities is transformed into net income, through the deduction of various expenses. Income statements should help investors and creditors determine the past financial performance of the enterprise, predict future performance, and assess the capability of generating future cash flows through report of the income and expenses. However, information of an income statement has several limitations. For example, items that might be relavent but cannot be reliably measured, such as brand recognition, are not reported. Also, some values depend on judgements and estimations, such as depreciation expense. Most importantly, revenues and expenses are reported on an accrual basis and may not accurately reflect the actual amount of cash flowing in and out of the business, respectively.

The Statement of Cash Flows

This situation is the reason behind the importance of the cash flow statement. The statement of cash flows shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing, and financing activities. The statement captures both the current operating results and the accompanying changes in the balance sheet. The cash flow statement has been adopted as a standard financial statement because it eliminates allocations, which might be derived from different accounting methods, such as various timeframes for depreciating fixed assets. It is intended to:

- provide information on a firm's liquidity and solvency and its ability to change cash flows in future circumstances,

- provide additional information for evaluating changes in assets, liabilities and equity,

- improve the comparability of different firms' operating performance by eliminating the effects of different accounting methods, and

- indicate the amount, timing and probability of future cash flows.

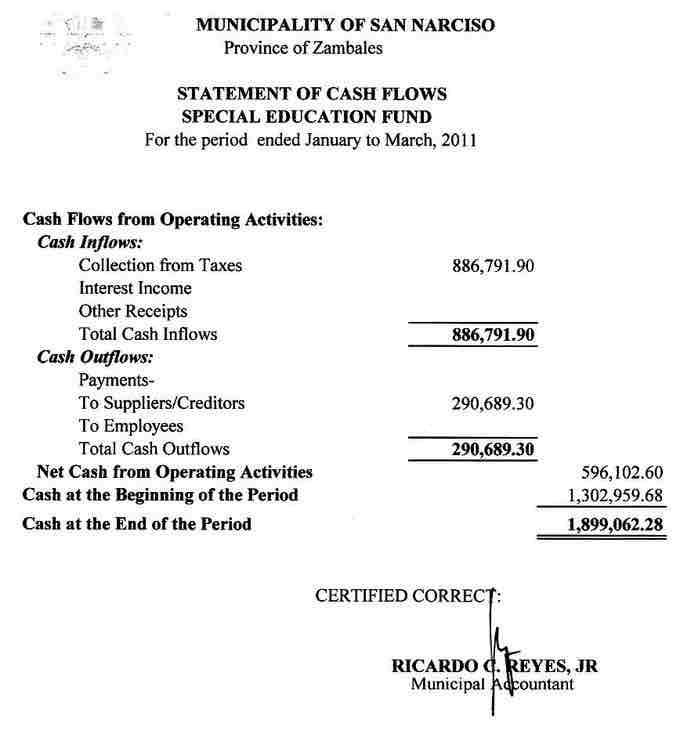

Statement of Cash Flows

This is an example of a cash flow statement reflecting cash flows for the Municipality of San Narciso in the Philippines.