Risk Adjusting for the Time Horizon

When evaluating the riskiness of an investment, not only will investors or companies need to evaluate their preferences and risk tolerance, but it is also necessary to take into account the time horizon of the investment. A longer time horizon will generally require a higher return, due to an increased risk in price volatility and increased uncertainty relating to possible outcomes. In terms of long term debt investments, such as long term corporate or government bonds, a longer time horizon gives rise to uncertainties in the potential operations of the debtor entity as well as unforeseen movements in the market as a whole. In other words, default risk increases as the time horizon lengthens. However, when considering stock investments, having a longer time horizon can be considered safer in some respects. Since stock investments have more time to overcome potential downturns in value, having a longer time horizon can justify more aggressive investing. For example, an individual investor with a time horizon of less than five years should not be invested in stocks. However, those with time horizons over five years should consider stocks because of their growth potential. Put simply, as time horizon lengthens a higher percentages of stocks should be added to a portfolio.

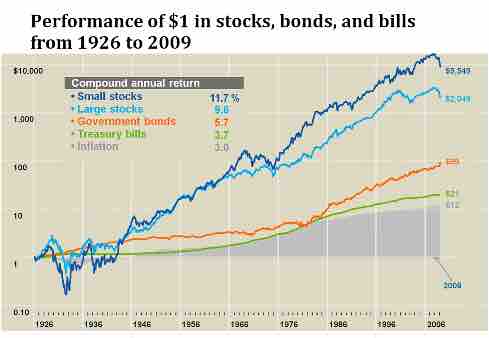

Performance of Stocks, Bonds and Bills

This graph gives an illustration of investing a dollar in different asset classes in the market from 1926 to the end of 2007.

For an individual, diversifying investments in different time horizons is also important. By staying in the market through different market cycles, individuals can reduce the risk of receiving a lower return than expected–especially with investments that fluctuate significantly over the short term.

Real Options Consideration

When there are multiple possible outcomes, management of a firm may choose to undertake real options analysis in order to factor in the various possibilities. A real option itself is the right, but not the obligation, to undertake certain business initiatives, such as deferring, abandoning, expanding, staging, or contracting a capital investment project. When uncertainty exists as to when and how business or other conditions will eventuate, flexibility as to the timing of the relevant project is valuable and constitutes optionality. Some examples include Inflation or deferment options, where management has flexibility as to when to start a project. For example, in natural resource exploration a firm can delay mining a deposit until market conditions are favorable. Also, an option to abandon, where management may have the option to cease a project during its life, and, possibly, to realize its salvage value. Here, when the present value of the remaining cash flows falls below this salvage value, the asset may be sold. Finally, sequencing options, where management can observe outcomes from a part of a project and resolve some of the uncertainty relating to the venture overall. Once resolved, management has the option to proceed or not with the development of the other projects.