What is the Discount Rate?

The discount rate has a few definitions, depending on the context. For the sake of this discussion, the discount rate is the percentage used in an net present value calculation to understand the overall cost of capital (or, from the perspective of some investors, the required return) on a given project. What this means is that there is a rate, calculated by the assumption of risk, which is used to normalize the interest rate on borrowed capital (for the borrower) and/or invested capital (for the lender.

In U.S. central banking, the interest rate that banks pay the federal reserve when using securities as collateral is also referred to as the discount rate, and in this case it will act as the benchmark for future interest rates issued.

Why Adjust for Risk?

The primary purpose of a discount rate, or an interest rate in general, is fairly simple. Capital today is worth more than capital tomorrow, due to the time value of money (i.e. the opportunity cost of foregone investments). As a result of this concept, the idea of interest rates is justified. All this means is that a borrower of capital will have to take into account the cost of that capital over a given time period, which will be calculated as an additional percentage of the overall principal borrowed being added to the principal itself on a period to period basis.

In this context, the interest rate is subjected to risk. A riskier investment will require a higher return (due to the basic premise of risk and return). After all, why invest in a riskier investment when safer investments exist unless that riskier investment offers a higher percentage of return? It is at this point that the logic behind adjusting discount rates becomes practical. All discount rates must take into account the overall risk being assumed in the investment, and adjust the rate of expected return to meet the implications of the overall risk over time. For banks, for example, the overall interest rate they would offer a risky entrepreneurial project isn't the same as the rate they would offer an established big business.

Risk-adjusted Net Present Value

A net present value calculation is a common and useful tool that takes the overall future projected costs and returns of a new venture or business project and grounds it in today's dollars. What this means is it calculates out the time value of money during the projected time period of the financing of the project in order to see if the returns over a given time period will exceed the costs in beginning the project. As an entrepreneur, this will tell you if/when you will reach profitability (using a variety of assumptions). It is calculated as follows:

Adjusting this for the risk-adjusted discount rate is a simple modification, where each future cash flow is multiplied by the estimated likelihood of its occurrence. In this situation, a higher degree of uncertainty (and thus risk) is built into each expected cash flow (called a discounted cash flow, or DCF). Through discounting each cash flow by the estimated probability of receiving that return, the overall riskiness of the NPV calculation is increased. With this increase in risk, the discount rate can now be risk-adjusted accordingly.

Common Risk-adjusted Discount Rates

It is important to note at this point that every calculation is different, and some start-ups will see low discount rates because investors believe strongly in what the start up is trying to accomplish. However, the discount rates typically applied to different types of companies show significant differences:

- Early start-ups: 40–60%

- More established start-ups: 30–50%

- Mature companies: 10–25%

All and all, investors must carefully consider the risk in a given investment, and adjust the discount rates accordingly. This ensures a proper assessment of the risk and return ratio for various differentiated investment projects.

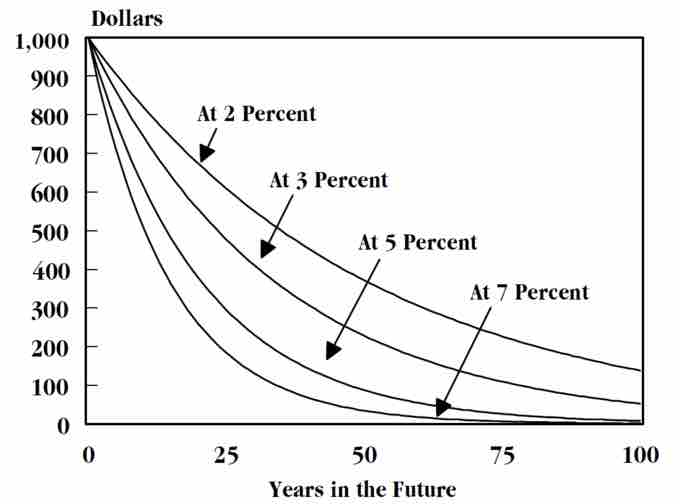

Discounting Curves

This chart illustrates the devaluation of capital over time as a result of various discount rates.