This is “Monetary Policy Targets and Goals”, chapter 17 from the book Finance, Banking, and Money (v. 1.0).

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. You may also download a PDF copy of this book (8 MB) or just this chapter (248 KB), suitable for printing or most e-readers, or a .zip file containing this book's HTML files (for use in a web browser offline).

Chapter 17 Monetary Policy Targets and Goals

Chapter Objectives

By the end of this chapter, students should be able to:

- Explain why the Fed was generally so ineffective before the late 1980s.

- Explain why macroeconomic volatility declined from the late 1980s until 2008.

- List the trade-offs that central banks face and describe how they confront them.

- Define monetary targeting and explain why it succeeded in some countries and failed in others.

- Define inflation targeting and explain its importance.

- Provide and use the Taylor Rule and explain its importance.

17.1 A Short History of Fed Blunders

Learning Objectives

- Why was the Fed generally so ineffective before the late 1980s?

- Why has macroeconomic volatility declined since the late 1980s?

The long and salutary reign of Greenspan the Great (1987–2006)http://wohlstetter.typepad.com/letterfromthecapitol/2006/02/greenspan_the_g.html and the auspicious beginning of the rule of Bernanke the Bald (2006–present)http://www.princeton.edu/pr/pictures/a-f/bernanke/bernanke-03-high.jpg temporarily provided the Fed with something it has rarely enjoyed in its nearly century-long existence, the halo of success and widespread approbation. While it would be an exaggeration to call Federal Reserve Board members the Keystone Kops of monetary policy, the Fed’s history, a taste of which we’ve already indulged ourselves with in Chapter 11 "The Economics of Financial Regulation", is more sour than sweet. Central banks are, after all, the last bastions of central planning in otherwise free market economies. And central planning, as the Communists and the Austrian economists who critiqued them discovered, is darn difficult.http://www.mises.org/etexts/austrian.asp

This is not a history textbook, but the past can often shed light on the present. History warns us to beware of claims of infallibility. In this case, however, it also provides us with a clear reason to be optimistic. Between 1985 or so and 2007, the U.S. macroeconomy, particularly output, was much less volatile than previously. That was a happy development for the Fed because, as noted in Chapter 13 "Central Bank Form and Function", central banks are generally charged with stabilizing the macroeconomy, among other things. The Fed in particular owes its genesis to the desire of Americans to be shielded from financial panics and economic crises.

The Fed itself took credit for almost 60 percent of the reduction in volatility. (Is anyone surprised by this? Don’t we all embrace responsibility for good outcomes, but eschew it when things turn ugly?) Skeptics point to other causes for the Great Calm, including dumb luck; less volatile oil prices (the 1970s were a difficult time in this regard);http://www.imf.org/external/pubs/ft/fandd/2001/12/davis.htm less volatile total factor productivity growth;http://en.wikipedia.org/wiki/Total_factor_productivity and improvements in management, especially just-in-time inventory techniques, which has helped to reduce the inventory gluts of yore.http://en.wikipedia.org/wiki/Just-in-time_(business) Those factors all played roles, but it also appears that the Fed’s monetary policies actually improved. Before Paul Volcker (1979–1987), the Fed engaged in pro-cyclical monetary policies. Since then, it has tried to engage in anti-cyclical policies. And that, as poet Robert Frost wrote in “The Road Not Taken,” has made all the difference.http://www.bartleby.com/119/1.html

For reasons that are still not clearly understood, economies have a tendency to cycle through periods of boom and bust, of expansion and contraction. The Fed used to exacerbate this cycle by making the highs of the business cycle higher and the lows lower than they would otherwise have been. Yes, that ran directly counter to one of its major missions. Debates rage whether it was simply ineffective or if it purposely made mistakes. It was probably a mixture of both that changed over time. In any event, we needn’t “go there” because a simple narrative will suffice.

The Fed was conceived in peace but born in war. As William SilberIn the interest of full disclosure, Silber is a colleague, but also the co-author of a competing, and storied, money and banking textbooks. points out in his book When Washington Shut Down Wall Street, the Federal Reserve was rushed into operation to help the U.S. financial system, which had been terribly shocked, economically as well as politically, by the outbreak of the Great War (1914–1918) in Europe.http://www.pbs.org/greatwar/ At first, the Fed influenced the monetary base (MB) through its rediscounts—it literally discounted again business commercial paper already discounted by commercial banks. A wholesaler would take a bill owed by one of its customers, say, a department store like Wanamaker’s, to its bank. The bank might give $9,950 for a $10,000 bill due in sixty days. If, say, thirty days later the bank needed to boost its reserves, it would take the bill to the Fed, which would rediscount it by giving the bank, say, $9,975 in cash for it. The Fed would then collect the $10,000 when it fell due. In the context of World War I, this policy was inflationary, leading to double-digit price increases in 1919 and 1920. The Fed responded by raising the discount rate from 4.75 to 7 percent, setting off a sharp recession.

The postwar recession hurt the Fed’s revenues because the volume of rediscounts shrank precipitously. It responded by investing in securities and, in so doing, accidentally stumbled upon open market operations. The Fed fed the speculative asset bubble of the late 1920s, then sat on its hands while the economy crashed and burned in the early 1930s. Here’s another tidbit: it also exacerbated the so-called Roosevelt Recession of 1937–1938 by playing with fire, by raising the reserve requirement, a new policy placed in its hands by FDR and his New Dealers in the Banking Act of 1935.

During World War II, the Fed became the Treasury’s lapdog. Okay, that is an exaggeration, but not much of one. The Treasury said thou shalt purchase our bonds to keep the prices up (and yields down) and the Fed did, basically monetizing the national debt. In short, the Fed wasn’t very independent in this period. Increases in demand, coupled with quantity rationing, kept the lid on inflation during the titanic conflict against Fascism, but after the war the floodgates of inflation opened. Over the course of just three years, 1946, 1947, and 1948, the price level jumped some 30 percent. There was no net change in prices in 1949 and 1950, but the start of the Korean War sent prices up another almost 8 percent in 1951, and the Fed finally got some backbone and stopped pegging interest rates. As our analysis of central bank independence in Chapter 13 "Central Bank Form and Function" suggests, inflation dropped big time, to 2.19 percent in 1952, and to less than 1 percent in 1953 and 1954. In 1955, prices actually dropped slightly, on average.

This is not to say, however, that the Fed was a fully competent central bank because it continued to exacerbate the business cycle instead of ameliorating it. Basically, wealth would increase (decrease), driving interest rates (as we learned in Chapter 5 "The Economics of Interest-Rate Fluctuations") up (down), inducing the Fed to buy (sell) bonds, thereby increasing (decreasing) MB and thus the money supply (MS). So when the economy was naturally expanding, the Fed stoked its fires and when it was contracting, the Fed put its foot on its head. Worse, if interest rates rose (bond prices declined) due to an increase in inflation (think Fisher Equation), the Fed would also buy bonds to support their prices, thereby increasing the MS and causing yet further inflation. This, as much as oil price hikes, caused the Great Inflation of the 1970s. Throughout the crises of the 1970s and 1980s, the Fed toyed around with various targets (M1, M2, fed funds rate), but none of it mattered much because its pro-cyclical bias remained.

Stop and Think Box

Another blunder made by the Fed was Reg Q, which capped the interest rates that banks could pay on deposits. When the Great Inflation began in the late 1960s, nominal interest rates rose (think Fisher Equation) above those set by the Fed. What horror directly resulted? What Fed goal was thereby impeded?

Shortages known as credit crunches resulted. Whenever p* > preg, shortages result because the quantity demanded exceeds the quantity supplied by the market. Banks couldn’t make loans because they couldn’t attract the deposits they needed to fund them. That created much the same effect as high interest rates—entrepreneurs couldn’t obtain financing for good business ideas, so they wallowed, decreasing economic activity. In response, banks engaged in the loophole mining discussed in Chapter 8 "Financial Structure, Transaction Costs, and Asymmetric Information".

By the late 1980s, the Fed, under Alan Greenspan, finally began to engage in anti-cyclical policies, to “lean into the wind” by raising the federal funds rate before inflation became a problem and by lowering the federal funds rate at the first sign of recession. Since the implementation of this crucial insight, the natural swings of the macroeconomy have been much more docile than hitherto, until the crisis of 2007–2008, that is. The United States experienced two recessions (July 1990–March 1991 and March 2001–November 2001)http://www.nber.org/cycles.html but they were so-called soft landings, that is, short and shallow. Expansions have been longer than usual and not so intense. Again, some of this might be due to dumb luck (no major wars, low real oil prices [until summer 2008 that is]) and better technology, but there is little doubt the Fed played an important role in the stabilization.

Of course, past performance is no guarantee of future performance. (Just look at the New York Knicks.) As the crisis of 2007–2008 approached, the Fed resembled a fawn trapped in the headlights of an oncoming eighteen-wheeler, too afraid to continue on its path of raising interest rates and equally frightened of reversing course. The result was an economy that looked like road kill. Being a central banker is a bit like being Goldilocks. It’s important to get monetary policy just right, lest we wake up staring down the gullets of three hungry bears. (I don’t mean Stephen Colbert’s bearshttp://www.youtube.com/watch?v=KsTVK9Cv9U8 here, but rather bear markets.)

Key Takeaways

- The Fed was generally ineffective before the late 1980s because it engaged in pro-cyclical monetary policies, expanding the MS and lowering interest rates during expansions and constricting the MS and raising interest rates during recessions, the exact opposite of what it should have done.

- The Fed was also ineffective because it did not know about open market operations (OMO) at first, because it did not realize the damage its toying with rr could cause after New Dealers gave it control of reserve requirements, and because it gave up its independence to the Treasury during World War II.

- Also, in the 1970s, it targeted monetary aggregates, although its main policy tool was an interest rate.

- The Fed’s switch from pro-cyclical to anti-cyclical monetary policy, where it leans into the wind rather than running with it, played an important role in decreased macroeconomic volatility, although it perhaps cannot take all of the credit because changes in technology, particularly inventory control, and other lucky events conspired to help improve macro stability over the same period.

- Future events will reveal if central banking has truly and permanently improved.

17.2 Central Bank Goal Trade-offs

Learning Objective

- What trade-offs do central banks face and how do they confront them?

Central banks worldwide often find themselves between a rock and a hard place. The rock is price stability (inflation control) and the hard place is economic growth and employment. Although in the long run the two goals are perfectly compatible, in the short run, they sometimes are not. In those instances, the central bank has a difficult decision to make. Should it raise interest rates or slow or even stop MS growth to stave off inflation, or should it decrease interest rates or speed up MS growth to induce companies and consumers to borrow, thereby stoking employment and growth? In some places, like the European Union, the central bank is instructed by its charter to stop inflation. “The primary objective of the European System of Central Banks,” the Maastricht Treaty clearly states, “shall be to maintain price stability. Without prejudice to the objective of price stability, the ESCB shall support the general economic policies in the Community” including high employment and economic growth. The Fed’s charter, by contrast, gives the Fed a dual mandate to ensure price stability and maximum employment. Little wonder that the Fed has not held the line on inflation as well as the European Central Bank (ECB), but unemployment rates in the United States are generally well below those of most European nations. (There are additional reasons for that difference that are not germane to the discussion here.)

Stop and Think Box

When central banks act as a lender of last resort (LLR) to restore stability to the financial system, they create a time inconsistency problemWhenever somebody’s preferences change over time to such an extent that what is preferred at one time becomes inconsistent with what is preferred at another time.. Can you identify what it is? (Hint: It involves moral hazard.)

It is believed that if a central bank or other lender of last resort, like the International Monetary Fund, steps in too often, it creates a moral hazard problem because businesses, including banks, take on extra risks safe in the knowledge that if the system gets in trouble, prompt and effective aid will be forthcoming. This is time inconsistent because, by stopping one panic or crisis, the central bank plants the seeds for the next.

Do note that almost nobody wants 100 percent employment, when everyone who wants a job has one. A little unemployment, called frictional unemployment, is a good thing because it allows the labor market to function more smoothly. So-called structural unemployment, when workers’ skills do not match job requirements, is not such a good thing, but is probably inevitable in a dynamic economy saddled with a weak educational system. (As structural unemployment increased in the United States, education improved somewhat, but not enough to ensure that all new jobs the economy created could be filled with domestic laborers.) So the Fed shoots for what is called the natural rate of unemployment. Nobody is quite sure what that rate is, but it is thought to be around 5 percent, give or take.

Key Takeaways

- The main trade-off that central banks face is a short-term one between inflation, which calls for tighter policy (higher interest rates, slower money growth), and employment and output, which call for looser policy (lower interest rates, faster money growth).

- Some central banks confront trade-offs by explicitly stating that one goal, usually price stability (controlling inflation), is of paramount concern.

- Others, including the Fed, confront the trade-off on an ad hoc, case-by-case basis.

17.3 Central Bank Targets

Learning Objectives

- What is monetary targeting and why did it succeed in some countries and fail in others?

- What is inflation targeting and why is it important?

Once a central bank has decided whether it wants to hold the line (no change [Δ]), tighten (increase i, decrease or slow the growth of MS), or ease (lower i, increase MS), it has to figure out how best to do so. Quite a gulf exists between the central bank’s goals (low inflation, high employment) and its tools or instruments (OMO, discount loans, changing rr). So it sometimes creates a target between the two, some intermediate goal that it shoots for with its tools, with the expectation that hitting the target’s bull’s-eye would lead to goal satisfaction:

TOOLS→TARGET→GOALIn the past, many central banks targeted monetary aggregates like M1 or M2. Some, like Germany’s Bundesbank and Switzerland’s central bank, did so successfully. Others, like the Fed, the Bank of Japan, and the Bank of England, failed miserably. Their failure is partly explained by what economists call the time inconsistency problem, the inability over time to follow a good plan consistently. (Weight-loss diets suffer from the time inconsistency problem, too, and every form of procrastination is essentially time inconsistent.) Basically, like a wayward dieter or a lazy student (rare animals to be sure), they overshot their targets time and time again, preferring pleasure now at the cost of pain later.

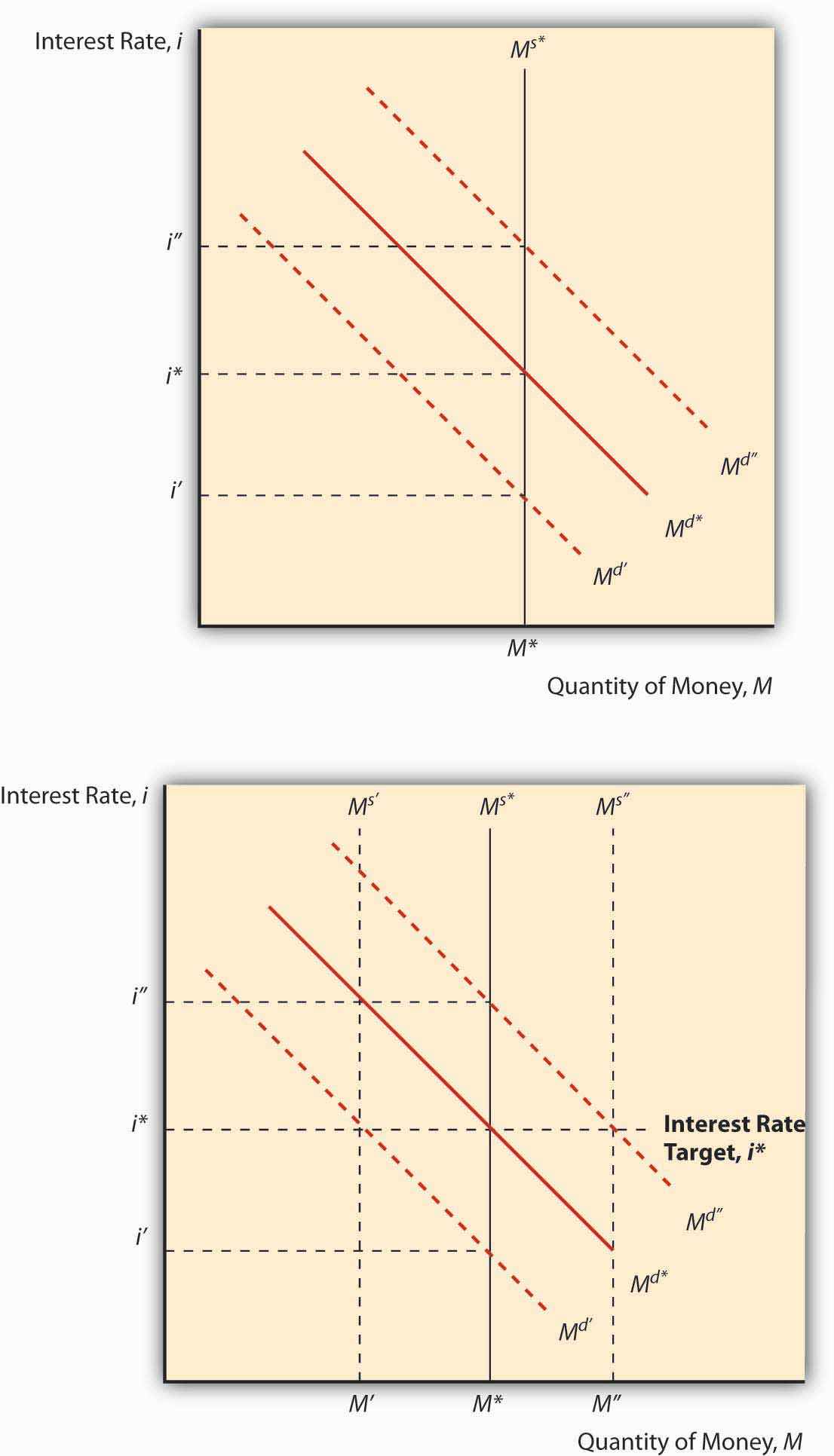

Another major problem was that monetary targets did not always equate to the central banks’ goals in any clear way. Long lags between policy implementation and real-world effects made it difficult to know to what degree a policy was working—or not. Worse, the importance of specific aggregates as a determinant of interest rates and the price level waxed and waned over time in ways that proved difficult to predict. Finally, many central banks experienced a disjoint between their tools or operating instruments, which were often interest rates like the federal funds, and their monetary targets. It turns out that one can’t control both an interest rate and a monetary aggregate at the same time. To see why, study Figure 17.1. Note that if the central bank leaves the supply of money fixed, changes in the demand for money will make the interest rate jiggle up and down. It can only keep i fixed by changing the money supply. Because open market operations are the easiest way to conduct monetary policy, most central banks, as we’ve seen, eventually changed reserves to maintain an interest rate target. With the monetary supply moving round and round, up and down, it became difficult to hit monetary targets.

Figure 17.1

Central banks can control i or MS, but not both.

In response to all this, several leading central banks, beginning with New Zealand in 1990, have adopted explicit inflation targets. The result everywhere has been more or less the same: lower employment and output in the short run as inflation expectations are wrung out of the economy, followed by an extended period of prosperity and high employment. As long as it remains somewhat flexible, inflation targeting frees central bankers to do whatever it takes to keep prices in check, to use all available information and not just monetary statistics. Inflation targeting makes them more accountable because the public can easily monitor their success or failure. (New Zealand took this concept a step further, enacting legislation that tied the central banker’s job to keeping inflation within the target range.)

Stop and Think Box

What do you think of New Zealand’s law that allows the legislature to oust a central banker who allows too much inflation?

Well, it makes the central bank less independent. Of course, independence is valuable to the public only as a means of keeping inflation in check. The policy is only as good as the legislature. If it uses the punishment only to oust incompetent or corrupt central bankers, it should be salutary. If it ousts good central bankers caught in a tough situation (for example, an oil supply shock or war), the law may serve only to keep good people from taking the job. If the central banker’s salary is very high, the law might also induce him or her to try to distort the official inflation figures on which his or her job depends.

The Fed has not yet adopted explicit inflation targeting, though a debate currently rages about whether it should. And under Ben Bernanke, it moved to what some have called inflation targeting-lite, with a new policy of communicating with the public more frequently about its forecasts, which now run to three years instead of the traditional two.“The Federal Reserve: Letting Light In,” The Economist (17 November 2007), 88–89. As noted above, the Fed is not very transparent, and that has the effect of roiling the financial markets when expectations about its monetary policy turn out to be incorrect. It also induces people to waste a lot of time engaging in “Fed watching,” looking for clues about monetary policy. Reporters actually used to comment on the thickness of Greenspan’s briefcase when he went into Federal Open Market Committee (FOMC) meetings. No joke!http://www.amazon.com/Inside-Greenspans-Briefcase-Investment-Strategies/dp/007138913X;http://www.amazon.com/Inside-Greenspans-Briefcase-Investment-Strategies/dp/007138913X

Why doesn’t the Fed, which is charged with maintaining financial market and price stability, adopt explicit targets? It may be that it does not want to be held accountable for its performance. It probably wants to protect its independence, but for its private interest (power) rather than for the public interest (low inflation). It may also be that the Fed has found the holy grail of monetary policy, a flexible rule that helps it to determine the appropriate federal funds target.

Key Takeaways

- Monetary targeting entails setting and attempting to meet growth rates of monetary aggregates such as M1 or M2.

- It succeeded in countries like Germany and Switzerland, where the central bank was committed to keeping inflation in check.

- In other countries, like the United States and the United Kingdom, where price stability was not the paramount goal of the central bank, the time inconsistency problem eroded the effectiveness of the targets.

- In short, like a dieter who can’t resist that extra helping at dinner and two desserts, the central banks could not stick to a good long-term plan day to day.

- Also, the connection between increases in particular aggregates and the price level broke down, but it took a long time for central bankers to realize it because the lag between policy implementation and real-world outcome was often many months and sometimes years.

- Inflation targeting entails keeping increases in the price level within a predetermined range, e.g., 1 and 2 percent per year.

- Countries whose central banks embraced inflation targeting often suffered a recession and high unemployment at first, but in the long run were able to achieve both price level stability and economic expansion and high employment.

- Inflation targeting makes use of all available information, not just monetary aggregates, and increases the accountability of central banks and bankers. That reduces their independence but not at the expense of higher inflation because inflation targeting, in a sense, is a substitute for independence.

17.4 The Taylor Rule

Learning Objective

- What is the Taylor Rule and why is it important?

Many observers suspect that the Fed under Greenspan and Bernanke has followed the so-called Taylor Rule, named after the Stanford University economist, John Taylor, who developed it. The ruleIn this context, a monetary policy rule, an equation that tells central bankers what interest rate policies they should put in place given employment, output, inflation, and perhaps other macroeconomic variables. states that

fft = π + ff*r + ½(π gap) + ½(Y gap)where

fft = federal funds target

π = inflation

ff*r = the real equilibrium fed funds rate

π gap = inflation gap (π – π target)

Y gap = output gap (actual output [e.g. GDP] − output potential)

So if the inflation target was 2 percent, actual inflation was 3 percent, output was at its potential, and the real federal funds rate was 2 percent, the Taylor Rule suggests that the fed funds target should be

fft = π + ff*r + ½(π gap) + ½(Y gap) fft = 3 + 2 + ½(1) + ½(0) fft = 5.5If the economy began running a percentage point below its potential, the Taylor Rule would suggest easing monetary policy by lowering the fed funds target to 5 percent:

fft = 3 + 2 + ½(1) + ½(−1) fft = 3 + 2 + .5 + −.5 = 5If inflation started to heat up to 4 percent, the Fed should respond by raising the fed funds target to 6.5:

fft = 4 + 2 + ½(2) + ½(−1) = 6.5Practice calculating the fed funds target on your own in Exercise 1.

Exercise

-

Use the Taylor Rule—fft = π + ff*r + ½(π gap) + ½(Y gap)—to determine what the federal funds target should be if:

Inflation Equilibrium Real Fed Funds Rate Inflation Target Output Output Potential Answer: Fed Funds Target 0 2 1 3 3 1.5 1 2 1 3 3 3 2 2 1 3 3 4.5 3 2 1 3 3 6 1 2 1 2 3 2.5 1 2 1 1 3 2 1 2 1 4 3 3.5 1 2 1 5 3 4 1 2 1 6 3 4.5 7 2 1 7 3 14

Notice that as actual inflation exceeds the target, the Taylor Rule suggests raising the fed funds rate (tightening monetary policy). Notice too that as output falls relative to its potential, the rule suggests decreasing the fed funds rate (easier monetary policy). As output exceeds its potential, however, the rule suggests putting on the brakes by raising rates. Finally, if inflation and output are both screaming, the rule requires that the fed funds target soar quite high indeed, as it did in the early 1980s. In short, the Taylor Rule is countercyclical and accounts for two important Federal Reserve goals: price stability and employment/output.

The Taylor Rule nicely explains U.S. macroeconomic history since 1960. In the early 1960s, the two were matched: inflation was low, and growth was strong. In the latter part of the 1960s, the 1970s, and the early 1980s, actual ff* was generally well below what the Taylor Rule said it should be. In that period, inflation was so high we refer to the period as the Great Inflation. In the latter part of the 1980s, ff* was higher than what the Taylor Rule suggested. That was a period of weak growth but decreasing inflation. Finally, since 1990 or so, the Taylor Rule and ff* have again been very closely matched. Like the early 1960s, that period has been one of low inflation and high growth.

Stop and Think Box

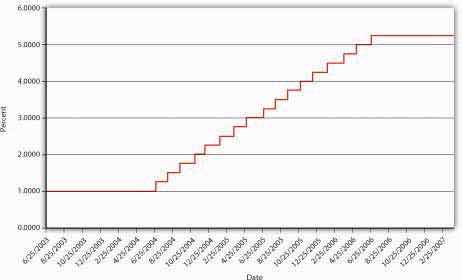

Examine Figure 17.2 "The Fed’s feds fund target, 2003–2007" carefully. Assuming the Fed uses the Taylor Rule, what happened to inflation and output from mid-2003 until mid-2006. Then what happened?

Figure 17.2 The Fed’s feds fund target, 2003–2007

Assuming that the Fed’s inflation target, the real equilibrium federal funds rate, and the economy’s output potential were unchanged in this period (not bad assumptions), increases in actual inflation and increases in actual output would induce the Fed, via the Taylor Rule, to increase its feds fund target. Both were at play but were moderating by the end of 2006, freezing the funds target at 5.25 percent, as shown in Figure 17.3 "Inflation and per capita gross domestic product (GDP), 2003–2006".

Figure 17.3 Inflation and per capita gross domestic product (GDP), 2003–2006

None of this means, however, that the Fed will continue to use the Taylor Rule, if indeed it does so. Nor does it mean that the Taylor Rule will provide the right policy prescriptions in the future. Richard Fisher and W. Michael Cox, the president and chief economist of the Dallas Fed, respectively, believe that globalization makes it increasingly important for the Fed and other central banks to look at world inflation and output levels in order to get domestic monetary policy right.See Richard W. Fisher and W. Michael Cox, “The New Inflation Equation,” Wall Street Journal, April 6, 2007, A11.

Stop and Think Box

Foreign exchange rates can also flummox central bankers and their policies. Specifically, increasing (decreasing) interest rates will, ceteris paribus, cause a currency to appreciate (depreciate) in world currency markets. Why is that important?

The value of a currency directly affects foreign trade. When a currency is strong relative to other currencies (when each unit of it can purchase many units of foreign currencies), imports will be stimulated because foreign goods will be cheap. Exports will be hurt, however, because domestic goods will look expensive to foreigners, who will have to give up many units of their local currency. Countries with economies heavily dependent on foreign trade must be extremely careful about the value of their currencies; almost every country is becoming more dependent on foreign trade, making exchange rate policy an increasingly important one for central banks worldwide to consider.

Key Takeaways

- The Taylor Rule is a simple equation—fft = π + ff*r + ½( π gap) + ½(Y gap)—that allows central bankers to determine what their overnight interbank lending rate target ought to be given actual inflation, an inflation target, actual output, the economy’s potential output, and an estimate of the equilibrium real fed funds rate.

- When the Fed has maintained the fed funds rate near that prescribed by the Taylor Rule, the economy has thrived; when it has not, the economy has been plagued by inflation (when the fed funds rate was set below the Taylor rate) or low output (when the fed funds rate was set above the Taylor rate).

17.5 Suggested Reading

Blinder, Alan. Central Banking in Theory and Practice. Cambridge, MA: MIT Press, 1999.

Silber, William. When Washington Shut Down Wall Street: The Great Financial Crisis of 1914 and the Origins of America’s Monetary Supremacy. Princeton, NJ: Princeton University Press, 2007.

Taylor, John B. Monetary Policy Rules. Chicago, IL: University of Chicago Press, 2001.