This is “Empirical Evidence of a Money-Inflation Link”, section 25.1 from the book Finance, Banking, and Money (v. 1.0).

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. You may also download a PDF copy of this book (8 MB) or just this chapter (341 KB), suitable for printing or most e-readers, or a .zip file containing this book's HTML files (for use in a web browser offline).

25.1 Empirical Evidence of a Money-Inflation Link

Learning Objectives

- What is the strongest evidence for the reduced-form model that links money supply growth to inflation?

- What does the AS-AD model, a structural model, say about money supply growth and the price level?

Milton Friedman claimed that “inflation is always and everywhere a monetary phenomenon.”A Monetary History of the United States, 1867–1960. We know this isn’t entirely true because, as we saw in Chapter 23 "Aggregate Supply and Demand, the Growth Diamond, and Financial Shocks", negative aggregate supply shocks and increases in aggregate demand due to fiscal stimulus can also cause the price level to increase. Large, sustained increases in the price level, however, are indeed caused by increases in the money supply and only by increases in the money supply. The evidence for this is overwhelming: all periods of hyperinflation from the American and French Revolutions to the German hyperinflation following World War I, to more recent episodes in Latin America and Zimbabwe, have been accompanied by high rates of money supply (MS) growth. Moreover, the MS increases in some circumstances were exogenous, so those episodes were natural experiments that give us confidence that the reduced-form model correctly considers money supply as the causal agent and that reverse causation or omitted variables are unlikely.

Stop and Think Box

During the American Civil War, the Confederate States of America (CSA, or the South) issued more than $1 billion of fiat paper currency similar to today’s Federal Reserve notes, far more than the economy could support at the prewar price level. Confederate dollars fell in value from 82.7 cents in specie in 1862 to 29.0 cents in 1863, to 1.7 cents in 1865, a level of currency depreciation (inflation) that some economists think was simply too high to be accounted for by Confederate money supply growth alone. What other factors may have been at play? (Hint: Over the course of the war, the Union [the North] imposed a blockade of southern trade that increased in efficiency during the course of the war, especially as major Confederate seaports like New Orleans and Norfolk fell under northern control.)

A negative supply shock, the almost complete cutoff of foreign trade, could well have hit poor Johnny Reb (the South) as well. That would have decreased output and driven prices higher, prices already raised to lofty heights by continual emissions of too much money.

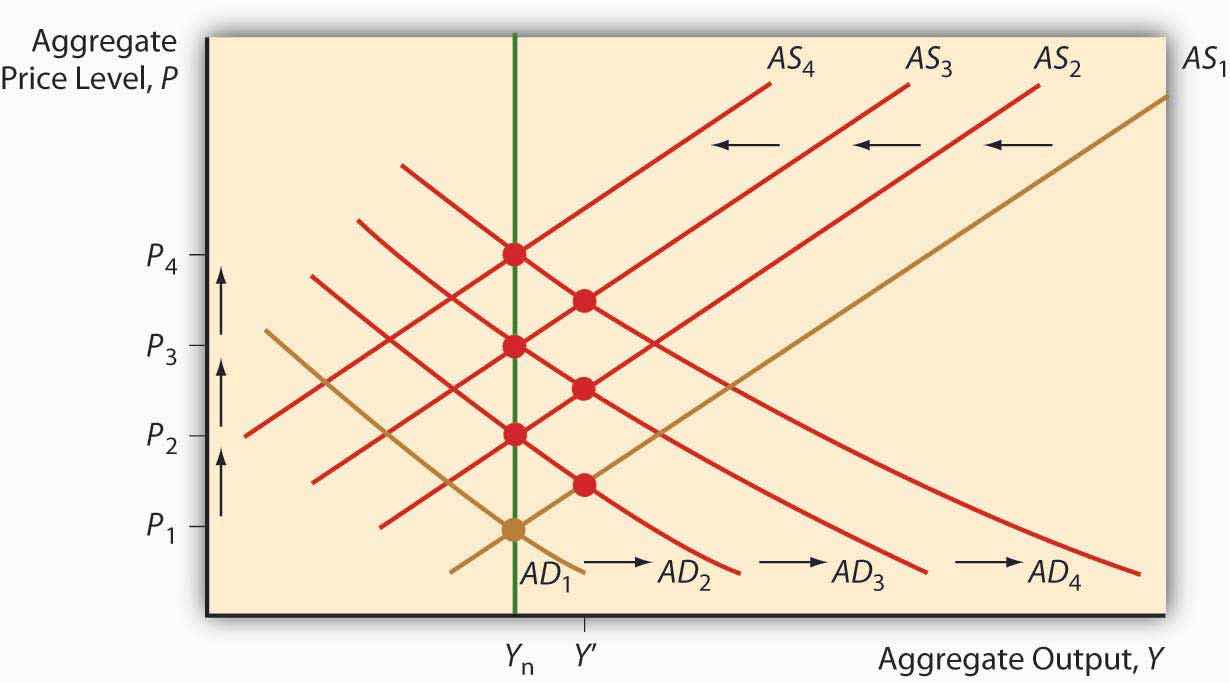

Economists also have a structural model showing a causal link between money supply growth and inflation at their disposal, the AS-AD model. Recall that an increase in MS causes the AD curve to shift right. That, in turn, causes the short-term AS curve to shift left, leading to a return to Ynrl but higher prices. If the MS grows and grows, prices will go up and up, as in Figure 25.1 "Inflation as a response to a continually increasing money supply".

Figure 25.1 Inflation as a response to a continually increasing money supply

Nothing else, it turns out, can keep prices rising, rising, ever rising like that because other variables are bounded. An increase in government expenditure G will also cause AD to shift right and AS to shift left, leaving the economy with the same output but higher prices in the long run (whatever that is). But if G stops growing, as it must, then P* stops rising and inflation (the change in P*) goes to zero. Ditto with tax cuts, which can’t fall below zero (or even get close to it). So fiscal policy alone can’t create a sustained rise in prices. (Or a sustained decrease either.)

Negative supply shocks are also one-off events, not the stuff of sustained increases in prices. An oil embargo or a wage push will cause the price level to increase (and output to fall, ouch!) and negative shocks may even follow each other in rapid succession. But once the AS curve is done shifting, that’s it—P* stays put. Moreover, if Y* falls below Ynrl, in the long run (again, whatever that is), increased unemployment and other slack in the economy will cause AS to shift back to the right, restoring both output and the former price level!

So, again, Friedman was right: inflation, in the sense of continual increases in prices, is always a monetary phenomenon and only a monetary phenomenon.This is not to say, however, that negative demand shocks might not contribute to a general monetary inflation.

Stop and Think Box

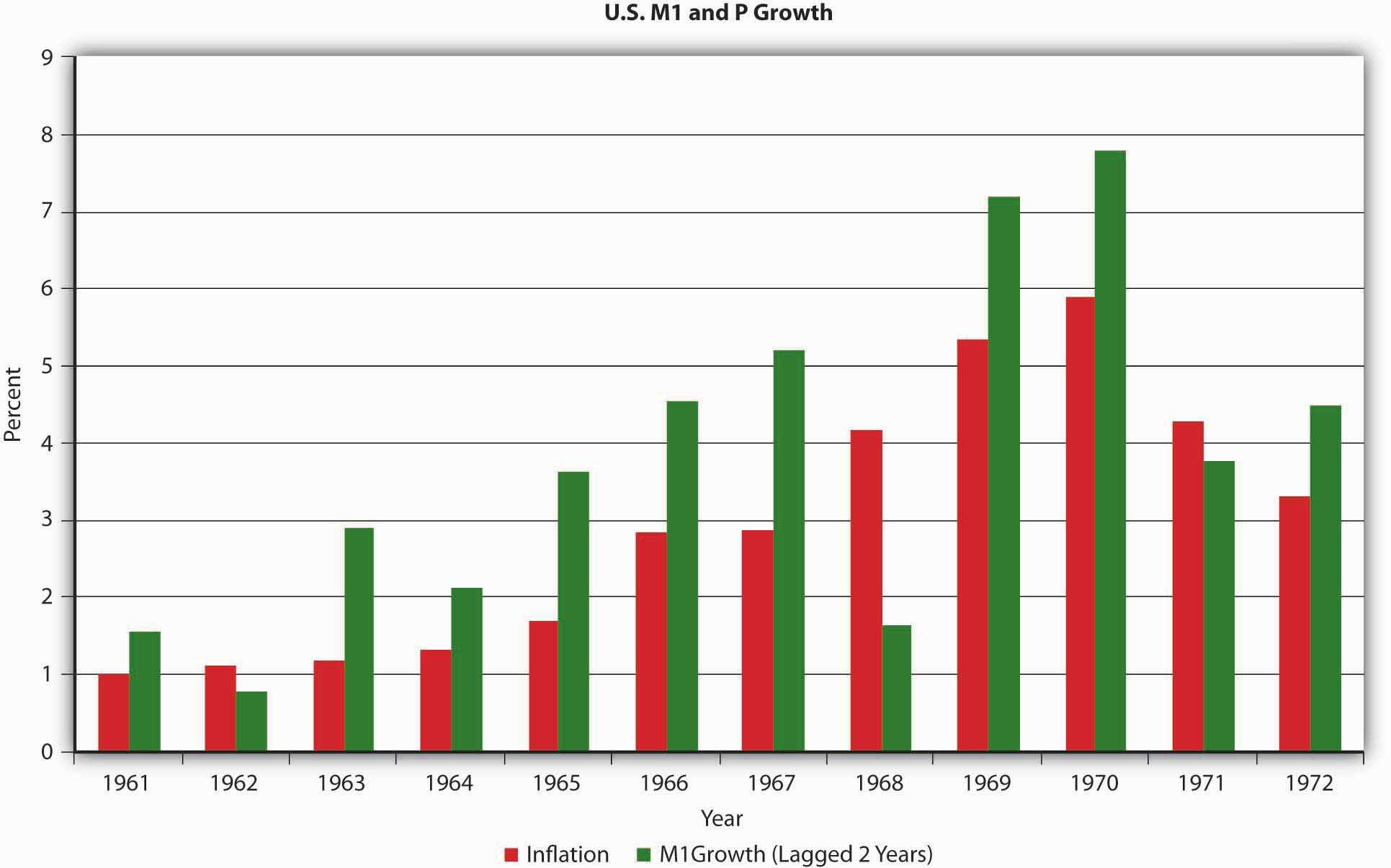

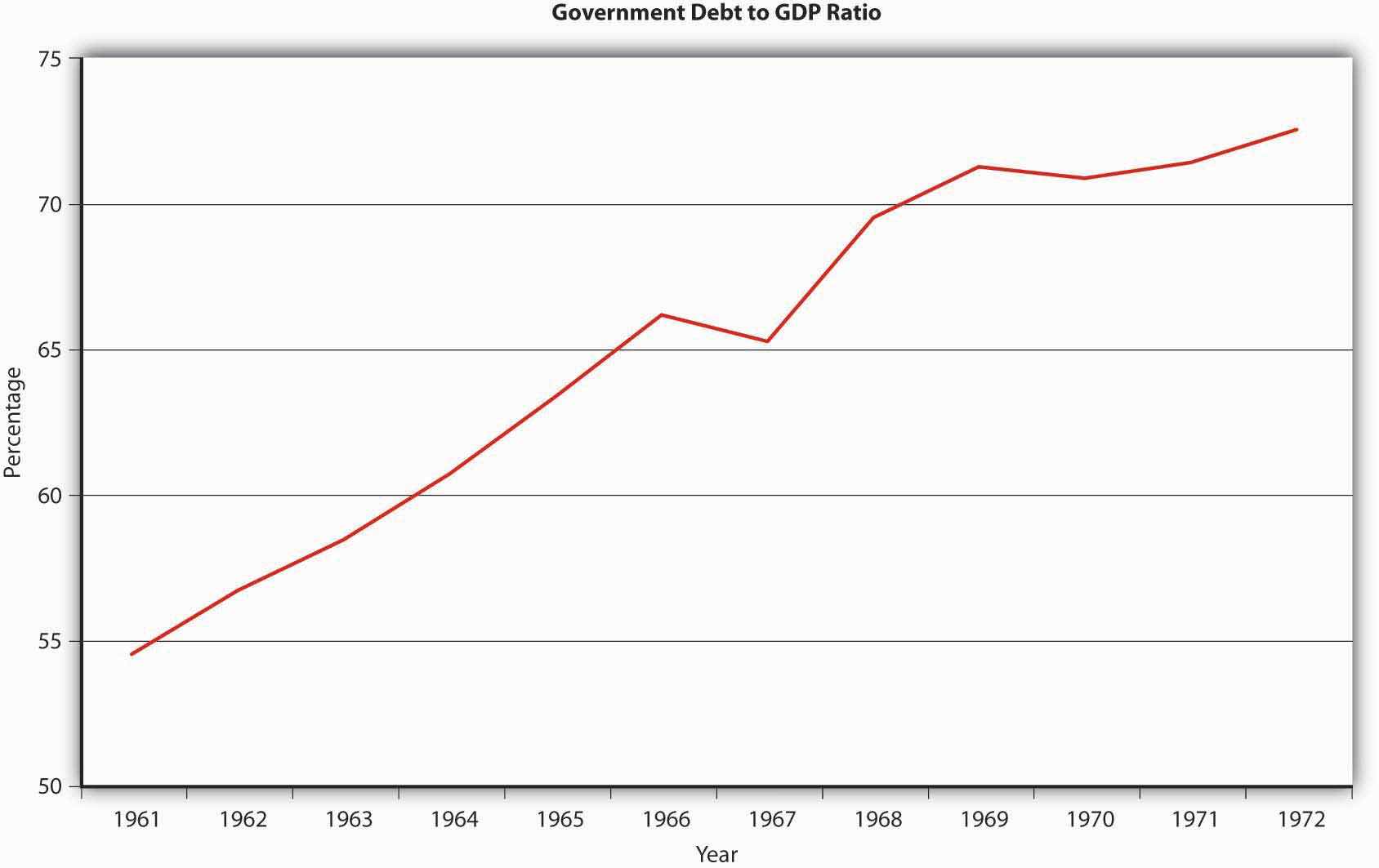

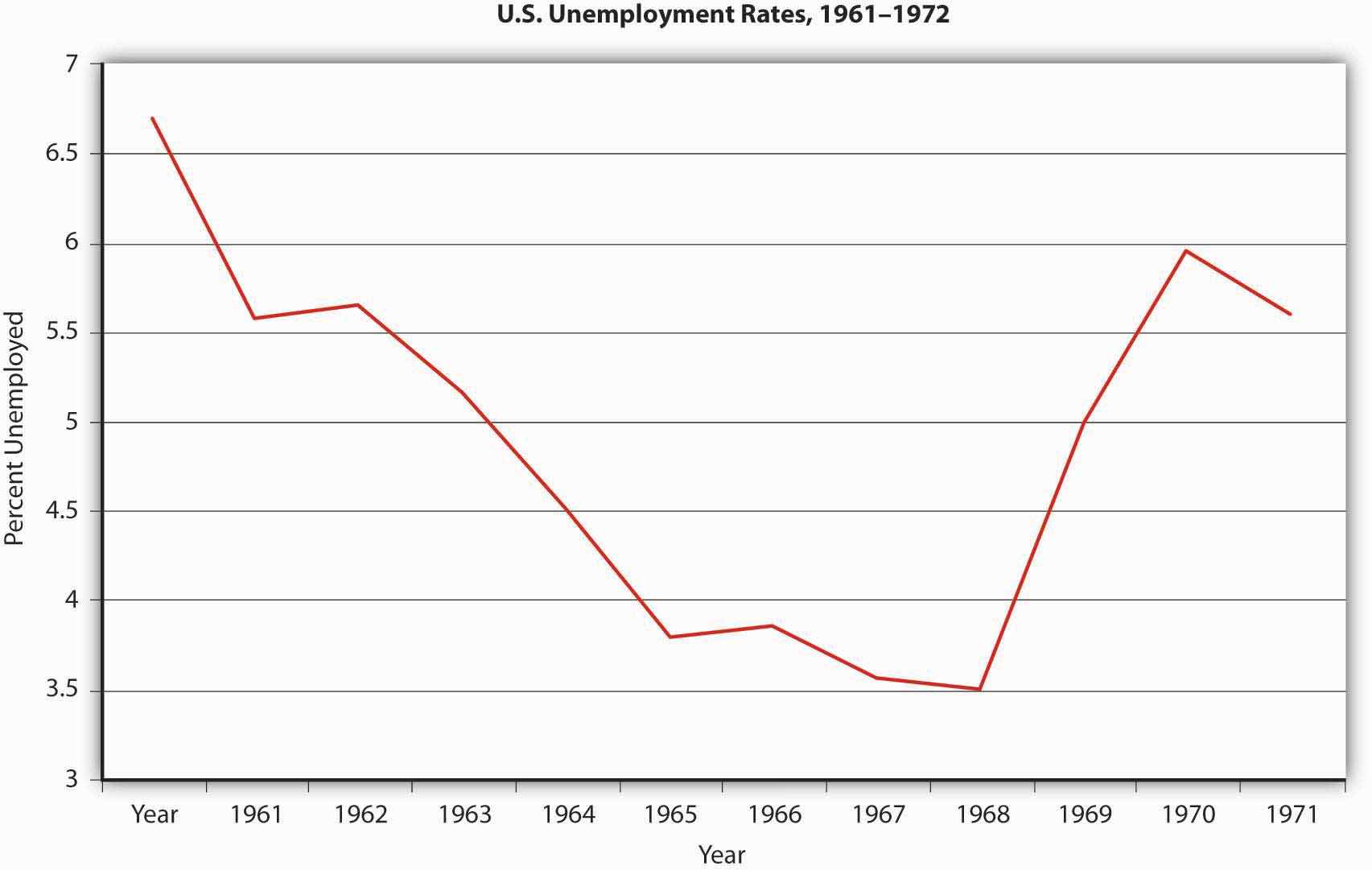

Figure 25.2 "U.S. M1 and P growth" compares inflation with M1 growth laggedThe time it takes for a policy to change on a variable, a cause to create an observable effect. two years. What does the data tell you? Now look at Figure 25.3 "Government debt-to-GDP ratio" and Figure 25.4 "U.S. unemployment rates, 1961–1972". What caused M1 to grow during the 1960s?

Figure 25.2 U.S. M1 and P growth

Figure 25.3 Government debt-to-GDP ratio

Figure 25.4 U.S. unemployment rates, 1961–1972

The data clearly show that M1 was growing over the period and likely causing inflation with a two-year lag. M1 grew partly because federal deficits increased faster than the economy, increasing the debt-to-GDP ratio, leading to debt monetization on the part of the Fed. Also, unemployment rates fell considerably below the natural rate of unemployment, suggesting that demand-pull inflation was taking place as well.

Key Takeaways

- Throughout history, exogenous increases in MS have led to increases in P*. Every hyperinflation has been preceded by rapid increases in money supply growth.

- The AS-AD model shows that money supply growth is the only thing that can lead to inflation, that is, sustained increases in the price level.

- This happens because monetary stimulus in the short term shifts the AD curve to the right, increasing prices but also rendering Y* > Ynrl.

- Unemployment drops, driving up wages, which shifts the AS curve to the left, Y* back to Ynrl, and P* yet higher.

- Unlike other variables, the MS can continue to grow, initiating round after round of this dynamic.

- Other variables are bounded and produce only one-off changes in P*.

- A negative supply shock or wage push, for instance, increases the price level once, but then price increases stop.

- Similarly, increases in government expenditures can cause P* to rise by shifting AD to the right, but unlike increases in the MS, government expenditures can increase only so far politically and practically (to 100 percent of GDP).