After you have read this section, you should be able to answer the following questions:

The first two articles we quoted from made it clear that the housing market was heavily affected by the financial crisis. More than that, it was where the crisis began—and so it is where we begin our story.

We start with the market for new homes, which are part of real gross domestic product (real GDP). (The buying and selling of existing homes is not counted in GDP.) New homes are supplied by construction firms and demanded by families wishing to live in a new home. New homes are also bought by speculators who purchase houses in the hope that they can resell them for a higher price in the future.

Toolkit: Section 16.6 "Supply and Demand"

Supply and demandA framework that explains and predicts the equilibrium price and equilibrium quantity of a good. is a framework we use to explain and predict the equilibrium price and quantity of a good. A point on the market supply curve shows the quantity that suppliers are willing to sell for a given price. A point on the market demand curve shows the quantity that demanders are willing to buy for a given price. The intersection of supply and demand determines the equilibrium price and quantity that will prevail in the market.

The toolkit contains a presentation of supply and demand that you can use for reference purposes in this and the following chapters.

The supply-and-demand framework applies to the case that economists call a competitive marketA market that satisfies two conditions: (1) there are many buyers and sellers, and (2) the goods the sellers produce are perfect substitutes.. A market is said to be competitive, or, more precisely, to exhibit perfect competition, under two conditions:

In a competitive market, buyers and sellers take the price as given; they think their actions have no effect on the price in the market.

The market demand for housing is shown in Figure 4.1 "The Market Demand for Houses". We call this the market demand curveThe number of units of a good or a service demanded at each price. because it reflects the choices of the many households in the economy. In macroeconomics, we typically look at markets at this level of aggregation and do not worry much about the individual decisions that underlie curves such as this one.

Figure 4.1 The Market Demand for Houses

The market demand curve shows the quantity of houses demanded at each price.

As the price of housing decreases, the quantity demanded increases. This is an example of the law of demand, which derives from two effects:

In the case of the market for housing, the first of these is more important. Most people own either zero houses or one house. As houses become cheaper, more people decide that they can afford a house, so the quantity demanded increases. A few people might decide to buy an additional house, but they would presumably be in the rich minority. For other goods, such as chocolate bars or shoeshines, the second effect is more important: as price decreases, people increase the quantity that they buy.

When we draw a demand curve, we are varying the price but holding everything else fixed. In particular, we hold fixed the level of income, the prices of other goods and services in the economy, and the tastes of households. If these other factors change, then the market demand curve will shift—that is, the quantity demanded will change at each price.

A leftward shift of the market demand curve for houses, as indicated in Figure 4.2 "A Shift in the Market Demand Curve", could be caused by many factors, including the following:

Figure 4.2 A Shift in the Market Demand Curve

If there is a decrease in demand for houses, then fewer houses are demanded at each price. The demand curve shifts leftward.

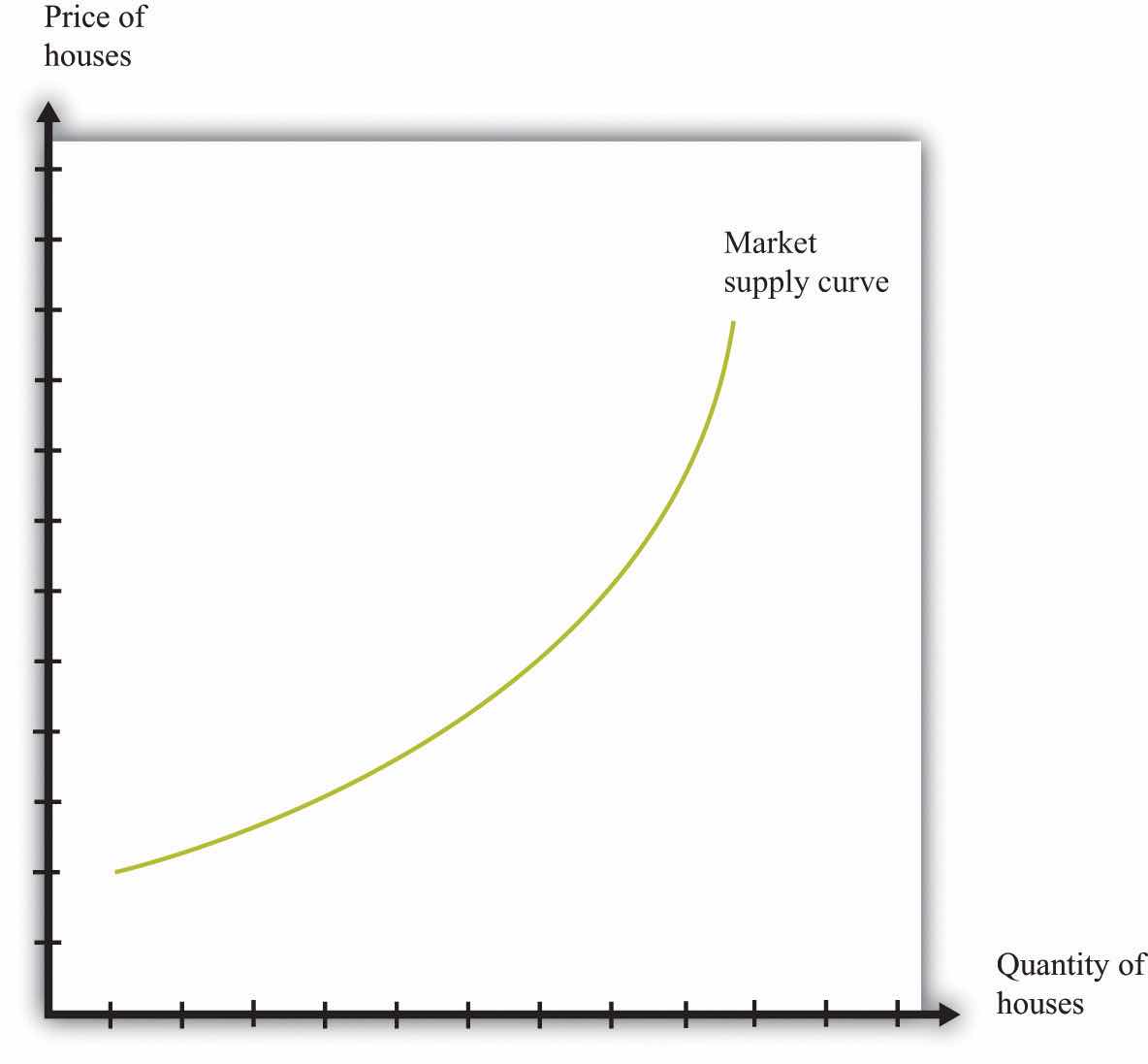

The counterpart to the market demand curve is the market supply curveThe number of units of a good or a service supplied at each price., which is obtained by adding together the individual supply curves in the economy. The supply curve slopes upward: as price increases, the quantity supplied to the market increases. As with demand, there are two underlying effects.

Figure 4.3 The Market Supply of Houses

The market supply curve shows the quantity of houses supplied at each price. It has a positive slope: as the price of houses increases, the number of houses supplied to the market increases as well.

When we draw a supply curve, we again vary the price but hold everything else fixed. A change in any other factor will cause the market supply curve to shift. A leftward shift of the market supply curve for houses, as indicated in Figure 4.4 "A Shift in Supply of Houses", could be caused by many factors, including the following:

Figure 4.4 A Shift in Supply of Houses

If there is a decrease in supply of houses, then fewer houses are supplied at each price. The supply curve shifts leftward.

We now put the market demand and market supply curves together to give us the supply-and-demand picture in Figure 4.5 "Market Equilibrium". The point where supply and demand meet is the equilibrium in the market. At this point, there is a perfect match between the amount that buyers want to buy and the amount that sellers want to sell.

Toolkit: Section 16.6 "Supply and Demand"

Equilibrium in a market refers to an equilibrium price and an equilibrium quantity and has the following features:

Figure 4.5 Market Equilibrium

In a competitive market, equilibrium price and quantity are determined by the intersection of the supply and demand curves.

We speak of equilibrium because there is a balancing of the forces of supply and demand in the market. At the equilibrium priceA price such that the quantity supplied equals the quantity demanded., suppliers of the good can sell as much as they wish, and demanders of the good can buy as much of the good as they wish. There are no disappointed buyers or sellers. Because the demand curve has a negative slope and the supply curve has a positive slope, supply and demand will cross once, and both equilibrium price and equilibrium quantityThe quantity supplied and demanded at the equilibrium price. will be positive.

Table 4.1 "Market Equilibrium: An Example" provides an example of market equilibrium. It gives market supply and market demand for four different prices. Equilibrium occurs at a price of $100,000 and a quantity of 50 new houses.

Table 4.1 Market Equilibrium: An Example

| Price ($) | Market Supply | Market Demand |

|---|---|---|

| 10,000 | 5 | 95 |

| 50,000 | 25 | 75 |

| 100,000 | 50 | 50 |

| 200,000 | 100 | 0 |

Economists typically believe that a perfectly competitive market is likely to reach equilibrium. The reasons for this belief are as follows:

Pictures like Figure 4.5 "Market Equilibrium" are useful to help understand how the market works. Keep in mind, however, that firms and households in the market do not need any of this information. This is one of the beauties of the market. All an individual firm or household needs to know is the prevailing market price. All the coordination occurs through the workings of the market.