This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 7 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 94% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 108,300 times.

A DRIP is a "dividend reinvestment program" that enables stockholders to automatically reinvest dividends paid by the company into the purchase of more shares of stock.[1] The program also allows investors to purchase fractional shares of stock in the event that the dividends received aren't large enough to purchase entire shares. The advantage of DRIPs to investors is that they bypass brokerage commissions with the additional share purchases and offer accelerated portfolio growth as income is reinvested in the stock instead of being paid out as cash.

Steps

Identifying the Stocks You Want to Purchase

-

1Find companies that offer DRIPs. Before you can decide on which companies you want to invest in, you'll first have to locate companies that offer DRIPs. You can do that with a simple Google search or checking out sites that are known to maintain a list of companies that allow shareholders to enter a DRIP program.[2]

-

2Select the stock or stocks you want to buy. Remember, you're investing in a company. Be sure to pick a great company that has a proven track record of performance over the years and has the potential for continued growth.

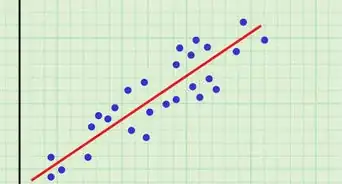

- Look at the chart of the company's stock price. It should show a distinct, upward trend over the long-term. Remember that DRIPS are long-term investments even more so than standard stocks. That's because you can buy stocks at the price you want when you want. However, you buy DRIPs based on a schedule. You could get unlucky enough that your DRIP shares are frequently purchased when the stock price is near a high. That's why you should approach DRIP investing with the a time frame of building wealth over years or, better yet, decades.

- Look for a company that has a history of increasing its dividends. Remember, you're going to be buying new shares of stock with the dividends. Wouldn't it be great if those dividends increase over time so that you can buy even more shares?

- Look for a company that has a history of revenue growth over the years. Although not every single year is expected to be better than the previous one, the general trend should show that the company's revenue grows over time.

- Look for a company that's in a business you understand. If you're in pharmaceuticals, pick a pharmaceutical company. If you're in manufacturing, pick a manufacturing company. The advice of the great investor Peter Lynch still stands: buy what you know.[3]

Advertisement -

3Ensure you have a balanced portfolio. You don't want all your eggs in one basket. If all of your DRIP stocks are from the same industry, and that industry experiences a recession, then your portfolio value could plummet. Be sure that you're properly diversified with stocks from different sectors.

Buying DRIPs

-

1Purchase company stock. Before you can even enroll in the DRIP program for a company, you must already be a shareholder. In most cases, you only need to own one share of stock. You can buy that share of stock with your favorite online brokerage.

- Be sure that you purchase the share of stock in your own name, or the name you plan on using to enroll in the DRIP program.

- You might also be able to purchase shares of stock directly from the company with no commission. Contact the company's investor relations department for more information on that.

- You can also use the "buddy system" to get your first share of stock. For example, if you know somebody who owns stock in Walgreen's, you can use the company's transfer agent to transfer one of his or shares into your own name.

-

2Invest in DRIPs through your online brokerage account. Many of the major online brokerages allow you to do almost any type of investing, including DRIP investing. Just login to your brokerage account and use the search bar to search for "DRIPs". The search results should give you some articles and tutorials about how to enroll in DRIPs online.

-

3Enroll in a DRIP program through a transfer agent. All of the companies that offer DRIPs use a transfer agent to administer the program. You'll need to get in touch with the transfer agent that handles DRIPs for the stock you want to purchase.

- An easy way to find the the transfer agent is to go to the "Investor Relations" or "Investors" section of the company website. For example, the "Investors" page of Abbott Laboratories has a "Dividend Reinvestment" link.[4] . If you click that link, you'll be taken to a page that gives you information about the company's DRIP program.[5] . You'll also see a link to computershare, the transfer agent responsible for administering the DRIP for Abbott Laboratories.[6] Contact computerShare for more information about enrolling in that DRIP.

- You can alternatively just Google the company name plus the word "DRIP" to find the transfer agent. If you Google "Abbott Laboratories DRIP", you'll find the Computershare link right at the top.[7]

-

4Pay attention to fees. There are some fees associated with DRIP programs. You don't want excessive fees taking a bite out of your return on investment. You'll find that most of the fees are minimal, but check them out before you enroll just to be safe.

- The fees should be listed on the transfer agent's website. If not, give them a call and ask about the fee structure.

-

5Set up an automatic investment schedule. Once you've purchased the initial shares, plan to invest a little each month through an automatic withdrawal from your savings or checking account. That's how you'll maximize the growth of your account.

- Keep in mind that the automatic reinvestment schedule varies from company to company. Some companies will reinvest dividends every week. Others pay dividends twice a month. Still others pay quarterly. Contact the company so that you know when the dividends will be reinvested.

-

6Prepare for taxes. Even though your dividend income is reinvested, it's still considered income for tax purposes. Be ready to pay taxes on what you've earned.

- At the beginning of the calendar year, you'll receive a 1099 form from each company that you're investing in. That form will provide you with the amount of income that you need to report.

Warnings

- Beware of foreign companies that offer DRIPs. You may have to pay foreign taxes. In most cases, however, you will be reimbursed for this when you file your tax returns.⧼thumbs_response⧽

- Keep good records of dividend reinvestments and additional cash purchases. You will need to determine the "cost basis" of your shares (for tax purposes) when you decide to sell them. This is the average cost of those shares when you purchased them.⧼thumbs_response⧽

References

- ↑ http://www.investopedia.com/ask/answers/04/021304.asp

- ↑ https://www.directinvesting.com/search/no_fees_list.cfm

- ↑ http://www.telegraph.co.uk/finance/personalfinance/investing/10651578/How-to-invest-like...top-stock-picker-Peter-Lynch.html

- ↑ http://www.abbott.com/investors.html

- ↑ http://www.abbottinvestor.com/phoenix.zhtml?c=94004&p=irol-divreinvstprog

- ↑ https://www-us.computershare.com/investor/3x/plans/planslist.asp?bhjs=1&fla=0&planid=368&state=eStateDisplayPlanSummary

- ↑ https://www.google.com/#q=abbott+laboratories+drip

-Step-3.webp)