This article was co-authored by Jill Newman, CPA and by wikiHow staff writer, Hunter Rising. Jill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

This article has been viewed 764,800 times.

If you have a mix of full-time and part-time employees, the full-time equivalent (FTE) lets you represents the full-time hours that all of the employees in your business work. FTEs are important for checking HR metrics and determining tax statuses for your business, but luckily they’re pretty easy to calculate on your own. Keep reading to find out everything you need to know about calculating FTEs and how to use them.

Things You Should Know

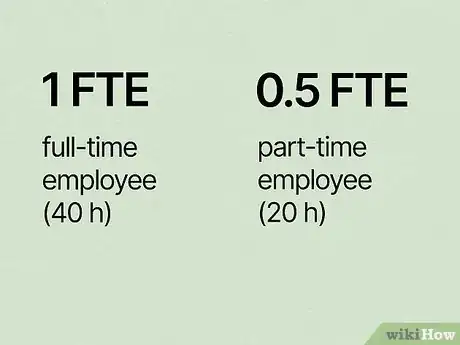

- FTE is the full-time equivalent hours that all the employees in your business represent. Each full-time employee counts as 1 FTE.

- Add the hours worked by part-time employees to the hours worked by full-timers to get the total hours.

- Divide the total hours worked by the number of full-time hours for the given time period to find the FTE.

Steps

Example FTE Calculation

-

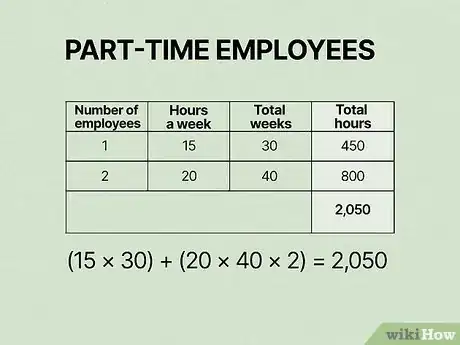

1Determine the hours worked by part-time employees. Make a list or pull the accounting records for all of the employees that work fewer than 30 hours a week. Add the hours for all the employees together.[2]

- Example: You have 3 part-time employees for the year. One works 15 hours a week for 30 weeks, and the other 2 work 20 hours for 40 weeks each.

- The first employee works: 15 hours x 30 weeks = 450 hours.

- The second and third employee work: 20 hours x 40 weeks x 2 employees = 1,600 hours.

- Add the hours together: 450 hours for 30 weeks + 1,600 hours for 40 weeks = 2,050 part-time hours for the year.

-

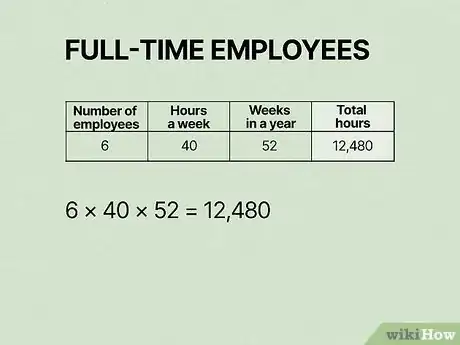

2Total the hours that full-time employees worked. Full-time employees usually work 40 hours each week for over 120 days a year, but it also includes anyone who works more than 30 hours weekly. Add all of the hours from full-time workers together to use for your calculation.[3]

- Example: You have 6 full-time employees working 40 hours a week. 40 hours x 6 employees = 240 weekly hours.

- Multiply the hours by 52 (weeks in a year) to determine full-time annual hours: 52 weeks x 240 hours = 12,480 annual full-time hours.

- If your business has a 32- or 35-hour workweek, then multiply the number of employees by that amount instead of 40.

-

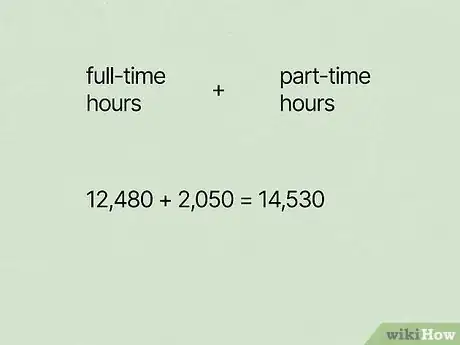

3Add the full-time hours to the part-time hours. The result you get is the total hours worked by all the employees in your business.[4]

- Example: 12,480 full-time hours + 2,050 part-time hours = 14,530 total hours.

-

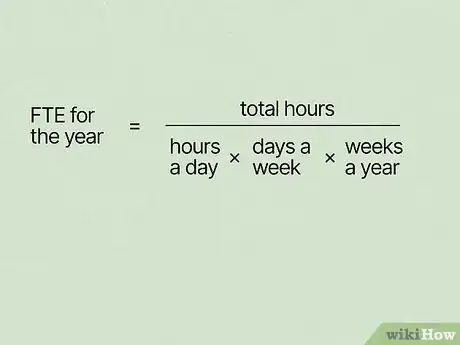

4Divide the total hours by the full-time hours. To calculate FTE for the year, divide the total hours by 2,080 (8 hours a day x 5 days a week x 52 weeks a year). The result is the total full-time equivalent employees you have.[5]

- Example: 14,530 total hours ÷ 2,080 full-time hours = 6.98 FTEs.

- Holiday hours and other paid leave are already accounted for as part of the hours worked so you don’t need to make any special calculations.

How do you use FTE calculations?

-

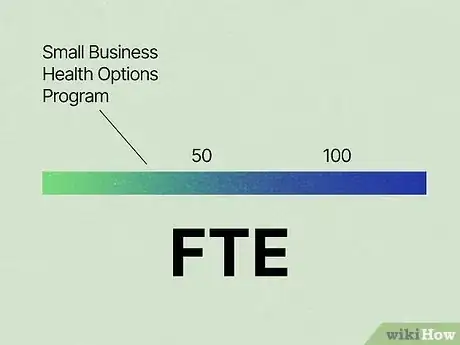

1Use FTEs to check eligibility for tax and health insurance policies. Some health insurance policies through the Affordable Care Act are only available to businesses that have certain FTEs. For example, the Small Business Health Options Program (SHOP) requires you to have fewer than 50 FTEs to qualify. If you have more than 50 FTEs, then your business must offer 12 weeks of family and medical leave as well as more comprehensive health insurance plans.[6]

-

2Compare employee FTEs to determine their efficiency. Look at the FTEs for individual employees at your business. Since each full-time employee counts as 1 FTE, they should each get a similar amount of work done during the day. If there are full-time employees getting less work done than others, then they aren’t working as effectively and can use improvement.[7]

- Example: If a full-time employee and part-time employee are getting the same amount of work done, then the full-time employee is only working with an efficiency of 0.5 FTE. The full-time employee either needs additional tasks to fill their time or to be talked to about their performance.

-

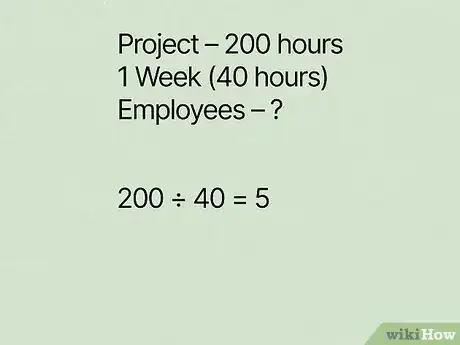

3Check FTEs to see how many employees you need for a project. If you have an estimate for how long a work project will take, divide the estimated hours by the hours in a workweek. The result is the number of full-time equivalent employees you’ll need to complete the project.[8]

- Example: If a project requires 200 hours to complete, divide 200 by 40 hours in a workweek. 200 project hours ÷ 40 workweek hours = 5 FTEs. You’ll need 5 full-time employees working for a full workweek to complete your project.

Expert Q&A

-

QuestionShould I include PTO in an FTE calculation?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Financial Advisor A company will have to decide if it wants to use the standard 2080 annual hours in a job (which includes holiday and PTO time), or if it is more useful to use actual hours working on the job. This will depend on what the analysis will be used for

A company will have to decide if it wants to use the standard 2080 annual hours in a job (which includes holiday and PTO time), or if it is more useful to use actual hours working on the job. This will depend on what the analysis will be used for -

QuestionHow do I calculate FTE?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Financial Advisor An FTE is the hours worked by one employee on a full-time basis. This is used to convert the hours worked by several part-time employees into the hours worked by full-time employees. On an annual basis, an FTE is considered to be 2,080 hours, which is calculated as: 8 hours per day x 5 work days per week x 52 weeks per year = 2,080 hours per year When a business employs a significant number of part-time staff, it can be useful to convert their hours worked into full time equivalents, to see how many full-time staff they equate to. The FTE concept is used in a number of measurements.

An FTE is the hours worked by one employee on a full-time basis. This is used to convert the hours worked by several part-time employees into the hours worked by full-time employees. On an annual basis, an FTE is considered to be 2,080 hours, which is calculated as: 8 hours per day x 5 work days per week x 52 weeks per year = 2,080 hours per year When a business employs a significant number of part-time staff, it can be useful to convert their hours worked into full time equivalents, to see how many full-time staff they equate to. The FTE concept is used in a number of measurements.

References

- ↑ https://support.adp.com/adp_payroll/content/hybrid/ACA/SharedResponsibilityReference.pdf

- ↑ https://support.adp.com/adp_payroll/content/hybrid/ACA/SharedResponsibilityReference.pdf

- ↑ https://support.adp.com/adp_payroll/content/hybrid/ACA/SharedResponsibilityReference.pdf

- ↑ https://www.irs.gov/newsroom/small-business-health-care-tax-credit-questions-and-answers-determining-ftes-and-average-annual-wages

- ↑ https://usnh.edu/banner/cheat-sheets/active/CalcFTECompHourlyEmp.pdf

- ↑ https://www.carboncollective.co/sustainable-investing/how-to-calculate-ftes

- ↑ https://www.hrmetricsservice.org/wp-content/uploads/2013/07/HR-Metrics-Interpretation-Guide-v7.1.pdf

- ↑ https://www.saviom.com/blog/fte-vs-hours-what-should-you-use-and-when/

About This Article

To calculate FTE, identify the total number of hours worked by part-time employees during a particular time period. Then, calculate the total number of hours worked by full-time employees for that same time period. Add the hours worked by full-time and part-time employees together, then divide that number by the total hours worked by full-time employees to determine the FTE for that particular period. To learn about FTE calculators and using professional calculations, read on!