X

This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

This article has been viewed 110,698 times.

If you want to find out how well your company can generate profit from its fixed costs, you need to measure the operating leverage. Keep reading for the formula you need to use to calculate this ratio!

Steps

Part 1

Part 1 of 2:

Calculating Operating Leverage

-

1Calculate contribution margin. The contribution margin is total sales less variable expenses. Variable expenses are those costs that increase with each incremental sale. Cost of goods sold, sales commissions and delivery expenses are examples of variable expenses. Subtract these expenses from total sales to calculate the contribution margin.[1]

- For example, suppose Company ABC had $100,000 in total sales in December, 2015. Variable expenses were: cost of goods sold - $30,000; sales commissions – 20,000; delivery expenses - $10,000.

- The contribution margin is .

-

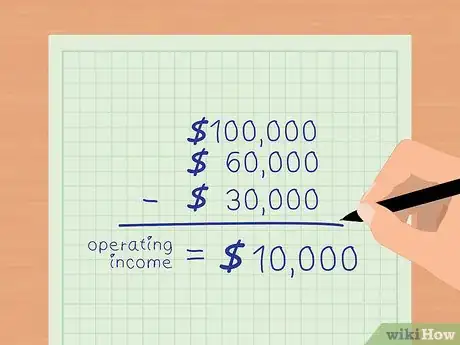

2Calculate operating income. Operating income is the total sales less all operating expenses except interest and taxes. If you have already deducted your variable expenses from total sales, now subtract fixed expenses to calculate the operating income. Fixed expenses include advertising, insurance, rent, utilities and payroll wages.

- Suppose Company ABC’s fixed expenses were: advertising - $2,000; insurance - $5,000; rent - $3,000; utilities - $2,000; wages - $18,000.

- Total fixed expenses are $30,000.

- Operating income is total sales less variable and fixed expenses.

- For Company ABC, the total sales were $100,000. The variable expenses are $60,000 and fixed costs are $30,000.

- Operating income = .

Advertisement -

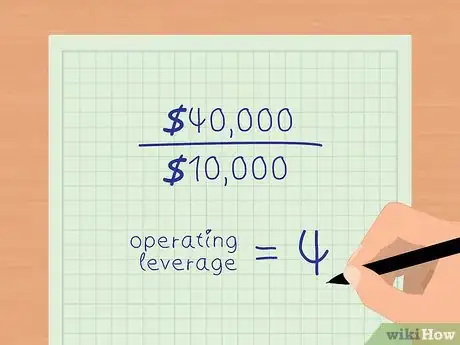

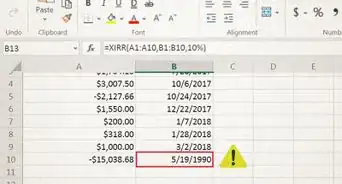

3Calculate operating leverage. Divide the contribution margin by the operating income. Company ABC’s contribution margin is $40,000. Its operating income is $10,000.[2] .

- Operating leverage = contribution margin / operating income.

- Company ABC’s operating leverage is 4.

Advertisement

Part 2

Part 2 of 2:

Analyzing Operating Leverage

-

1Evaluate profitability using operating leverage. Operating leverage tells you how fast your operating income grows in relation to your sales. In the example above, Company ABC’s operating leverage is 4. This means that the operating income grows four times as fast as sales. However, this number changes depending on the ratio of fixed to variable costs.[3]

- The higher your fixed expenses are as a percentage of total expenses, the higher your operating leverage is going to be.

- Higher operating leverage means that your net income grows at a faster rate.

-

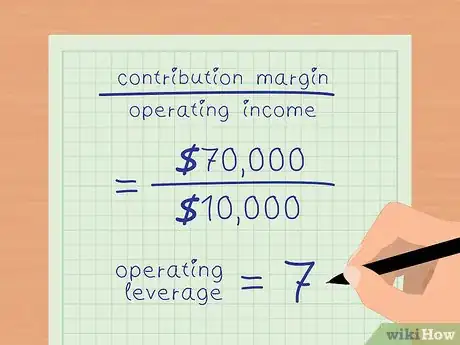

2Analyze the impact of higher fixed expenses and lower variable expenses. Company XYZ has the same sales and operating margin as Company ABC (sales = $100,000; operating margin = $10,000). However, its variable expenses are $30,000 and its fixed expenses are $60,000.[4]

- The contribution margin is .

- The operating income is .

- Operating leverage = contribution margin / operating income.

- .

- Company XYZ’s operating income grows 7 times as fast as its sales.

-

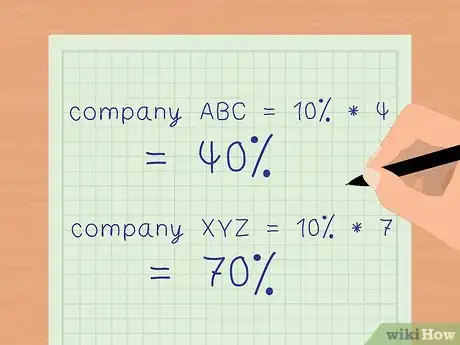

3Predict the impact on profit margin of growth in sales. Use the operating leverage to calculate how much your profit margin will increase with an increase in sales. Multiply the operating leverage by the percent increase in sales. This the percentage by which you can expect your profit margin to rise.[5]

- Suppose the two companies in the above examples each had a 10 percent increase in sales.

- For company ABC with an operating leverage of 4, net profit margin should increase by 40 percent with a 10 percent increase in sales .

- For company XYZ with an operating leverage of 7, net profit margin should increase by 70 percent with a 10 percent increase in sales .

- Therefore, you can use the operating leverage to quickly calculate the impact of changes in sales on your operating income without having to prepare detailed financial statements.

-

4Evaluate a company’s risk profile. High operating leverage means that companies can substantially increase their profits with small increases in sales. However, it also means that they have a lot of money tied up in fixed costs, such a machinery, real estate and wages. If the economy takes a downturn and they experience a decrease in sales, they don’t have much opportunity to reduce expenses to preserve their profit margin.[6]

- Investors should be cautious when investing in companies with high operating leverage.

-

5Apply operating leverage with care. Operating leverage can misrepresent a company’s capacity to increase its profit margin. For example, a company with an operating leverage of 7 should be able to increase its profit margin seven times as fast as its sales. But in reality, in order to increase sales, the company may need to add labor or expand into a larger space. These measures would increase fixed costs, and the company wouldn’t see the growth in profit margin predicted by the degree of operating leverage.[7]

Advertisement

References

- ↑ http://www.accountingtools.com/contribution-margin-ratio

- ↑ http://www.accountingdetails.com/operating_leverage.htm

- ↑ http://www.accountingdetails.com/operating_leverage.htm

- ↑ http://www.accountingdetails.com/operating_leverage.htm

- ↑ http://www.accountingdetails.com/operating_leverage.htm

- ↑ http://www.investopedia.com/articles/stocks/06/opleverage.asp

- ↑ http://www.investopedia.com/articles/stocks/06/opleverage.asp

About This Article

Advertisement