This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

There are 10 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 261,721 times.

The Net Asset Value (NAV) is the calculation that determines the value of a share in a fund of multiple securities, such as a mutual fund, hedge fund, or exchange-traded fund (ETF). While stock prices change constantly when markets are open, the NAV of a fund is calculated at the end of business each day, to reflect the price changes in the investments owned by the fund. This NAV calculation makes it easy for investors to track the value of their shares in a fund, and the NAV of a share in a fund generally establishes its selling price.

Steps

Calculating NAV

-

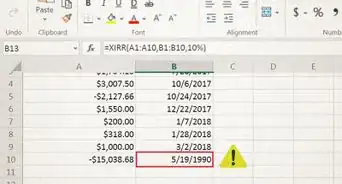

1Choose the valuation date. The net asset value (NAV) of a mutual fund, hedge fund, or ETF changes every day the stock market is open, as the value of the fund's investments fluctuate. For your net asset value calculation to be valuable, you must use fund data for the calculation on a date that is relevant to your needs. Choose a specific date and ensure all the values you use to calculate your fund net asset value come from this date.

-

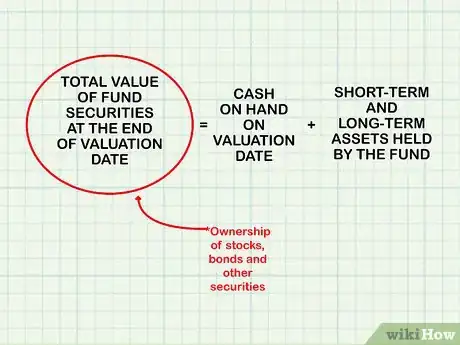

2Calculate the total value of the fund’s securities at the end of the valuation date. The fund’s securities are its ownership of stocks, bonds, and other securities. As these securities’ values are posted daily, you can learn the value of your fund’s investment in each kind of security at the end of the valuation date.[1]

- This total should include value of any cash on hand on the valuation date, as well as any short term or long term assets held by the fund.

Advertisement -

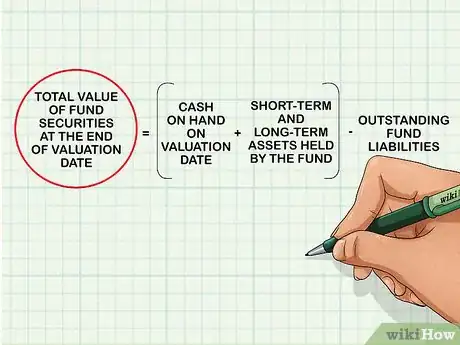

3Subtract outstanding fund liabilities. In addition to investments, the fund likely has several outstanding liabilities. These are amounts the fund has borrowed to make additional investments, in the hopes that the fund can earn interest on its investments at a higher rate than it pays on its outstanding loans. Subtract the amount of these debts from the total value of the securities you calculated.

- The fund's prospectus will list each of its assets and liabilities. Download the prospectus online or call for it by phone. Most newspapers will have daily stock listings showing the closing price of any publicly traded stock.

-

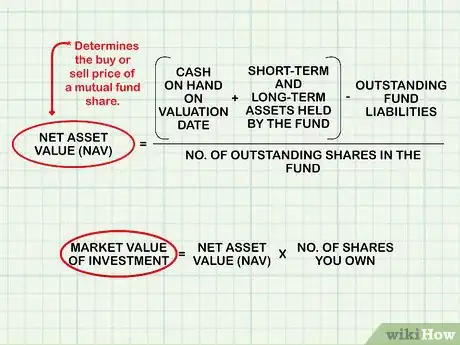

4Divide by the number of outstanding shares in the fund. The result of this calculation is the net asset value, or the value of one share’s portion of the assets owned by the fund.[2] If you own multiple shares in the fund, you can multiply the NAV by the number of shares you own to learn the market value of your investment. The NAV generally determines the buy or sell price of a mutual fund share, so you should expect to be able to sell back your shares for relatively close to the NAV.

- For mutual funds, NAV per share is calculated every day. It is based on the closing prices of the securities in the fund.[3]

- Buy and sell orders for mutual funds are processed based on the NAV for the date. Since the NAV is calculated at the close of business, investors must wait until the next business day to make the trade at that price.[4]

Evaluating Long-Term Fund Performance with NAV and Total Return

-

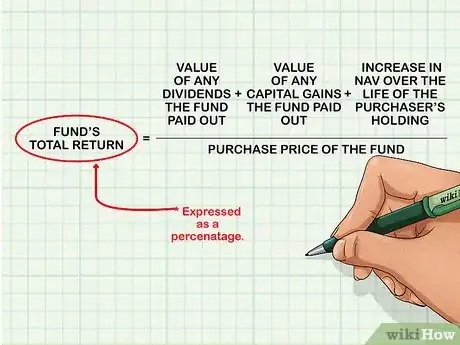

1Calculate your fund's total return. The total return on a fund is the sum of the value of any dividends the fund paid out, the value of any capital gains the fund paid out, and any increase in NAV over the life of the purchaser's holding, divided by the purchase price of the fund. The total return is expressed as a percentage, to illustrate what percent of the purchase price holders have received in cash distributions and fund appreciation during the fund life.

- Mutual funds are required by law to distribute capital gains (positive cash flow from the purchase and sale of stock with mutual funds) to fund shareholders. This is different than a share of stock, where the holder receives capital gains as an increase to share price, not a direct pay out. For this reason, the NAV of a fund isn't enough on its own to evaluate long-term performance of a fund.

-

2Evaluate your fund's total return rate. You should analyze your total return rate to determine whether or not you are earning enough income off of your fund investment. Most funds are fairly diverse, and mutual funds should over-perform the stock market. While the stock market does fluctuate constantly, you should evaluate your fund's performance against the market's to ensure you are getting a reasonable return.

- From 1926 to the present, the annualized return for the S&P 500 has been about 10 percent. The annualized return from Sept 2005 to Sept 2015 for S&P 500 has been about 7%.[5] Note that returns can vary depending upon holding period, and that returns of individual stocks can vary significantly. You should compare your total return rate to the return rate on the stock market for the period you are assessing, while considering your overall acceptable return rate.

-

3Evaluate your fund's net asset value. The net asset value is a good indicator of whether or not your investment in the fund is retaining its value. If you purchased a share of a mutual fund for $50, receive investment income on the fund of $5 each year, and maintain a net asset value of $50 each year, you will essentially be earning 10% interest on your investment, which is a much higher rate than a savings account. By following the NAV of your fund shares, you can monitor whether or not your base investment is retaining its value, in addition to bringing in income.

- Most investment strategists caution against using the NAV to value your investment in the same way you might value an investment in stock using the daily stock price. Because mutual funds pay out all of their income and capital gains to shareholders, (besides the management fees charged to operate the fund), successful mutual funds don’t have to increase their NAV over time. They instead need to maintain NAV while providing interest payments to shareholders.

-

4Adjust your fund investments. After assessing the NAV and total return performance of your fund investment, you may consider whether or not to adjust your investments. While mutual funds are considered some of the most secure and diverse investments in stocks, some funds focus on specific market areas, like tech or healthcare. If you feel your specific fund isn't providing the returns you are seeking, and you think you can get those returns elsewhere, adjust your investments accordingly.

Understanding Other Applications of Net Asset Value

-

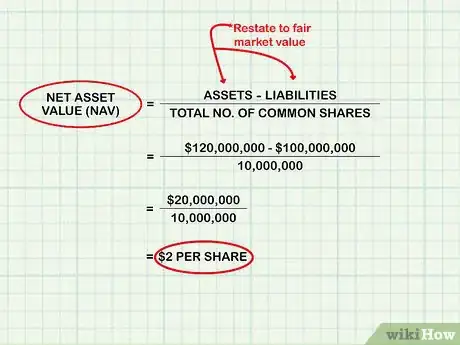

1Determine the economic value of a company. This is known as the asset-based approach for valuing a company. This calculation looks at the total assets of a company minus its liabilities. This approach is often used when a business is no longer operating and is preparing for liquidation.[6]

- Choose your valuation date and use the balance sheet as of that date.

- If necessary, restate assets and liabilities to fair market value. This means restating the value of the company’s assets and liabilities for what they could be bought or sold in the current market. This might apply to assets such as inventory, capital equipment and property and liabilities such as litigation or warranty accruals.

- Include any unrecorded assets and liabilities that are not reflected on the balance sheet but may still impact the company’s value. For instance, any pending litigation that might result in the company needing to make a payment within the next operating cycle.[7] Include the estimated amount the company may lose.

- Subtract liabilities from assets, and divide by the total number of common shares to get the NAV per share or the company.

- For example, suppose a company had $120 million in assets and $100 million in liabilities and 10 million common shares. Assets minus liabilities equal $20 million. Net asset value per share equals $20 million /10 million = $2 per share.

-

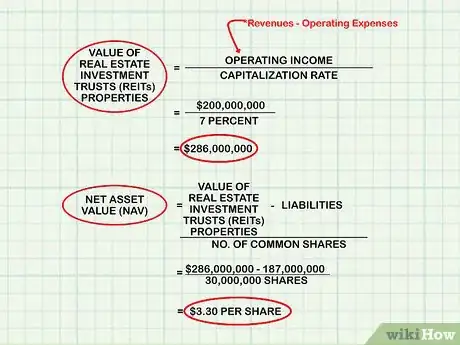

2Evaluate the performance of real estate investment trusts (REITs). REITs are corporations that own income-producing real estate properties or mortgages and allow investors to purchase shares of stock. For all of the properties in the trust, you can calculate the book value, or the value of the property less accumulated depreciation. However, calculating the net asset value better reflects the market value of shares in the REIT.[8] [9] [10]

- Begin with an appraisal of the REIT’s properties. One method is to divide the operating income of the properties (revenues minus operating expenses) by the capitalization rate (which is the expected rate of return on a property based on its income).[11]

- For example, if the total operating income of an REIT is $200 million and the average capitalization rate is 7 percent, the value of the properties would be $286 million ($200 million / 7 percent = $286 million).

- Once you have the value of the properties, deduct the liabilities, such as the mortgage debt still owed to get the NAV. For example, suppose the total mortgage debt and other liabilities in the above example equals $187 million. The NAV equals $286 million - $187 million = $99 million.

- Divide the NAV by the number of common shares. Suppose there are 30 million shares. The NAV per share would be $99 million / 30 million = $3.30 per share.

- The quoted prices per share for the REIT should theoretically be close to the NAV per share.

-

3Assess the performance of variable universal life insurance policies. Variable universal life insurance policies are similar to mutual funds. They are life insurance policies that gain cash value through investments in several separate accounts. The securities can change value with fluctuations in the market. Since they are sold as units of ownership to policyholders, you can evaluate the value of the policy by calculating the NAV per unit.[12]

- The process to calculate the investment value of a variable insurance policy is similar to the process used for mutual funds.

References

- ↑ http://www.investopedia.com/ask/answers/04/032604.asp

- ↑ http://www.investopedia.com/terms/n/nav.asp

- ↑ http://www.investopedia.com/terms/n/nav.asp

- ↑ http://www.investopedia.com/terms/n/nav.asp

- ↑ http://www.moneychimp.com/features/market_cagr.htm

- ↑ http://www.investopedia.com/terms/a/asset-based-approach.asp

- ↑ https://money-zine.com/definitions/investing-dictionary/litigation-claims-and-assessments/

- ↑ https://www.reit.com/investing/reit-basics/what-reit

- ↑ http://www.investopedia.com/articles/04/030304.asp

About This Article

To calculate your net asset value, choose a valuation date as the numbers can vary daily. Then, calculate the total value of the fund’s securities at the end of the valuation date minus any outstanding fund liabilities. Finally, divide by the number of outstanding shares in the fund to arrive at the net asset value, or the value of one share’s portion. If you own multiple shares, multiply the net asset value by the number of shares owned to learn the market value of your investment. To learn how to evaluate long-term fund performance, keep reading!