This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 16 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 27,348 times.

A title to property could have many potential problems, but the two most common are liens placed on the property and potential boundary disputes. To find these problems, you should have a title report created by a title insurance company. To release a lien, you must pay the underlying debt, and in order to settle a boundary dispute, you should discuss potential options with your neighbor.

Steps

Studying a Title Report

-

1Contact a title insurance company. Title insurance companies can provide “title reports,” which are created by scanning the files at the Recorder of Deeds office to find information about the piece of property.[1] As part of the title report, the company creates a chain of title, tracing back the ownership of the land as far back as possible. You can find title insurance companies in the following ways:

- Check in your phone book under “Title Insurance.” There should be a list of companies.

- Search online. You can do a general search for “title insurance company” and “your state” or “your city.”

- Ask your realtor for suggestions. Realtors will know of reputable title insurance companies.

-

2Purchase a title report. The title report typically costs $75-100 and is included in the closing costs.[2] Check your purchase and sale agreement to see whether the seller or buyer is responsible for paying the cost.

- You might want to clear up title before even entering into a purchase and sale agreement. In that situation, you would be responsible for the cost of the title report.

Advertisement -

3Identify problems in the title. The title report can reveal unknown problems with the ownership of the land. For example, someone might have put a lien on the property. A lien is a public notice that the property owner owes someone money, and it can prevent the property from being transferred.[3] Common title problems include:[4]

- Unpaid taxes. A lien can be placed on your property for unpaid federal taxes or unpaid property taxes.

- Court judgments. Sometimes liens can be placed on a piece of property when the property owner loses a lawsuit but doesn’t pay the court judgment.

- Mechanic’s liens. People who perform work on the property can file a lien if they don’t get paid.

- Encroachments. There could be boundary disputes involving the property.

- Unknown easements. An easement is a right to use someone’s property for a certain purpose. For example, sometimes a neighbor will have an easement to use their neighbor’s driveway to reach a parcel of land. A title report can reveal easements that have been recorded on the property’s deed.

-

4Buy title insurance. Title insurance can protect buyers from problems with the title. It is often included in the closing costs.[5] If you are sued because of a lien or because someone else claims title to the property, then the insurer will defend you in the lawsuit and pay out money to you up to the policy limit.

Removing Liens

-

1Contact the lienholder. You can’t transfer your property until you get the liens released. You should begin by contacting whoever has a lien on your property.[6] Call them up and explain that you want to settle the debt.

- Ask the title company what you should do if you can’t contact the lienholder. Some lienholders might have disappeared, or they might be gone for a limited amount of time.

-

2Pay off your debts. You won’t be able to release the lien without the lienholder’s permission, so you need to come to an agreement about the debt that you owe. If you have the money to pay off the debt, then you should do so.[7]

-

3Make sure a “satisfaction” or “release” is filed. In order to get the lien released, the lienholder must file a “satisfaction” or a “release.”[10] If he or she forgets, then the lien will remain on the title even if you paid off the debt.

- Ideally, you can get the paperwork for filing a satisfaction or release and give it to the lienholder at the same time that you pay off the lien.

- You can generally get the appropriate form from the Recorder of Deeds office. However, if the lien is a “judgment” lien, then you should get a “satisfaction” form from the court clerk.

-

4Wait until escrow to pay off certain debts. You have the option of waiting until the closing to pay off certain liens. For example, the escrow agent could pay off the IRS lien on the date of closing by using proceeds from the sale to pay off the debt.[11]

- Nevertheless, you might not want purchasers of your home to know that you have liens on the property. In that situation, you should contact the IRS ahead of time to discuss paying off your debt and removing the lien.

Resolving Boundary Disputes

-

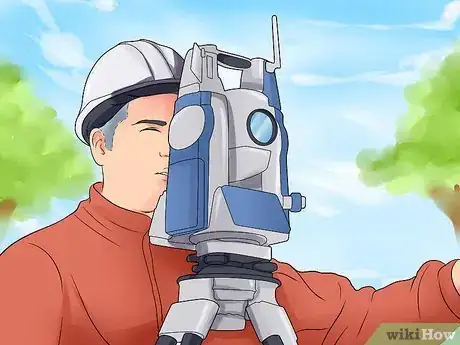

1Have a survey performed. If you identify a boundary dispute or think that there might be a boundary dispute, then you should have a survey performed.[12] You can find surveyors in the following manner:

- Check your phonebook. Look under “Land Survey” or “Surveyor.”

- Contact a surveyor’s association for a referral. For example, the California Land Surveyors Association maintains a website you can use to find surveyors.[13] There are other state or national associations you can find online.

-

2Discuss different options with your neighbor. If the survey comes back with problems, then you will need to resolve them with your neighbor. For example, you might be using part of your neighbor’s land, or they could be using part of yours. Alternately, the survey might not resolve where the property line should be.

- One option could be to come up with a boundary with your neighbor. For example, you could build a fence and agree that the fence will represent your new boundary line. You then transfer by quitclaim deed the land on the other side of the fence to your neighbor.[14]

- Sometimes you might have to bring a “quiet title” action where you can’t establish the boundary line or if your neighbor is using your property without your permission.

-

3Transfer land by quitclaim deed. If you decide to resolve the boundary dispute by quit claim deed, then you should draft the deed. Many state bar associations publish blank quit claim deeds you could use. You should check online by searching for “your state” and “blank quit claim deed.”

- Your deed should identify whoever is transferring the property as the “grantor” and who is receiving the property as the “grantee.”

- You should include a statement that the grantor is quitting their claim to the property and transferring title to the grantee for a certain amount of money: “Adam Smith (‘Grantor’), an adult resident of Grant County, hereby releases and quits his claims to Jane Jones (‘Grantee’), an adult resident of Grant County, in consideration of $100.”

- Include a description of the parcel of property you are transferring. Your survey should identify the land that is in dispute.

- If you are granting property to your neighbor, then you should sign the deed in front of a notary public.

- See Get a Quit Claim Deed for more information.

Bringing an Action to Quiet Title

-

1Decide whether to file for quiet title. You should bring an action to quiet title when there is a gap in the chain of title—someone unknown owned the property at some point. Gaps like these can be a problem, because you don’t know if the property was legally transferred.

- You should also bring an action to quiet title if someone is trying to claim an “easement by prescription.” This happens when someone just starts using your property without permission. For example, they could start using your driveway to reach their home. If they use your property long enough, they can get legal rights to continue using it.[15] A quiet title action can cut off any easement.

-

2Talk with an attorney. You would benefit from talking with a qualified attorney, who can advise you whether to bring a quiet title action. The attorney could also bring the quiet title action for you if you don’t have the time to bring it yourself.

- You can find a qualified attorney by contacting your local or state bar association and asking for a referral.[16]

- When you have the name of an attorney, call him or her and ask to schedule a consultation. Also check how much the attorney charges.

-

3Get a quiet title form. Your court might have created printed, “fill in the blank” forms you can use to file for quiet title.[17] You should check with the court clerk.

- Go to the county courthouse where the property is located. If the property is in two different counties, then you can go to either courthouse.

-

4Draft your own petition. Your courthouse might not have a form to use. In this situation, you need to draft your own petition, which is not too difficult. Begin by opening a blank word processing document and set the font to Times New Roman or Arial 14 point.

- At the top of the page, insert the court’s name: e.g., “Court of Common Pleas of Philadelphia County.”[18] Put the court’s name in bold, all caps. Center between the left- and right-hand margins.

- Insert the names of the parties beneath the court’s name. You are the “plaintiff” and whoever might claim an interest in your property is the “defendant.” If there is a gap in your chain of title, then name “John Does 1-100” as defendants. By doing so, you join unknown people as defendants to the lawsuit.

- Type “Case Number” and then leave a blank line to write in the case number, which you will get when you file your quiet title petition. Put the case number to the right of your name.

- Beneath the names of the parties, insert the title: “Action to Quiet Title” or something similar.

- See File a Quiet Title for more information about what should be in your petition.

-

5File the petition. Once you have completed the petition, you should make several copies. You need to file the original with the court clerk.[19] Depending on your court, you may also have to file copies with the court.

- You probably have to pay a filing fee. Ask the clerk ahead of time for the amount and acceptable methods of payment. Don’t assume the court accepts cash, checks, etc. Each court is different.

- If you can’t afford the filing fee, ask for a fee waiver form.

-

6Serve notice. You have to give any named defendant notice that you have filed a quiet title action so that they can come into court and challenge it. You should serve notice on any named defendant.[20]

- Generally, you can serve notice by having someone hand deliver a copy of the petition to each defendant. The person must be 18 or older and not part of the lawsuit. Typically, you can hire a private process server or pay the sheriff to make delivery. Check with the clerk.

- You may also have to publish notice in the newspaper, since you are trying to resolve the rights that unknown defendants might have in the property. The clerk should tell you whether this is a requirement.

-

7Go to trial. If no one objects, then you can ask the judge for a Decree to Quiet Title.[21] However, if someone does object, then they should draft and file a response to your petition. You will be sent a copy. The judge will hear testimony from you and the defendants, and you should find helpful documents to show the judge:

- Your copy of the deed.

- Photographs showing how the land is currently being used.

- Communications between you and the neighbor. In particular, find communications (such as emails) where you protest the use of your land without permission.

References

- ↑ http://www.findwell.com/blog/selling-a-home/clearing-up-title-issues-before-you-sell-home/

- ↑ http://www.finweb.com/real-estate/how-much-do-title-search-companies-typically-cost.html#axzz4DSSvo5yV

- ↑ http://www.nolo.com/legal-encyclopedia/what-property-lien.html

- ↑ http://www.findwell.com/blog/selling-a-home/clearing-up-title-issues-before-you-sell-home/

- ↑ http://www.finweb.com/real-estate/how-much-do-title-search-companies-typically-cost.html#axzz4DSSvo5yV

- ↑ http://www.findwell.com/blog/selling-a-home/clearing-up-title-issues-before-you-sell-home/

- ↑ http://wealthpilgrim.com/how-to-remove-a-lien/

- ↑ https://www.washingtonpost.com/news/where-we-live/wp/2016/06/20/these-common-title-problems-can-snag-your-home-closing/

- ↑ http://wealthpilgrim.com/how-to-remove-a-lien/

- ↑ https://www.washingtonpost.com/news/where-we-live/wp/2016/06/20/these-common-title-problems-can-snag-your-home-closing/

- ↑ http://www.findwell.com/blog/selling-a-home/clearing-up-title-issues-before-you-sell-home/

- ↑ http://www.realestatelawyers.com/resources/real-estate/title-boundary/common-problems-property-titles-resolutions

- ↑ https://www.californiasurveyors.org/findasurv.asp

- ↑ http://realestate.findlaw.com/neighbors/boundary-disputes.html

- ↑ http://realestate.findlaw.com/land-use-laws/prescriptive-easements.html

- ↑ http://apps.americanbar.org/legalservices/findlegalhelp/home.cfm

- ↑ https://www.courts.phila.gov/pdf/forms/fraudulent-conveyance-quiet-title-packet.pdf

- ↑ https://www.courts.phila.gov/pdf/forms/fraudulent-conveyance-quiet-title-packet.pdf

- ↑ http://thehardinlawfirm.com/2014/05/26/filing-action-quiet-title-arkansas/

- ↑ https://www.courts.phila.gov/pdf/forms/fraudulent-conveyance-quiet-title-packet.pdf

- ↑ http://thehardinlawfirm.com/2014/05/26/filing-action-quiet-title-arkansas/