This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 17 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 93,488 times.

Learn more...

Some of the world's most famous franchises are fast food restaurants—McDonald's, Burger King, Taco Bell, Dunkin Donuts, and Kentucky Fried Chicken, just to name a few. To open your own franchise, you need to apply and be accepted by the “franchisor,” who must decide whether to let you license use of its trademarks and business methods. After arranging financing, you can sign the franchise agreement and then begin the necessary training.

Steps

Researching Fast Food Franchises

-

1Identify fast food franchises. There are many fast food franchises. Some are nationally known while others are newer and less known. You should consider your interests and then research what is available.

- You can find franchising opportunities by going to your library and checking out a “franchise opportunities handbook,” if one is available.[1]

- Also visit http://www.franchising.org to research franchise opportunities. You can search by state.

- A franchise exposition might be held nearby. Try to attend one, since you can compare multiple franchises and get answers to any questions you might have.

-

2Consider whether you have the money to open the franchise. Franchises can be incredibly expensive. For example, McDonald's requires that you have $750,000 in cash, which you can't borrow. Kentucky Fried Chicken also requires that you have $750,000 in liquid capital. You can find the requirements by researching the franchise online.

- Also pay attention to estimates of total start-up costs. Kentucky Fried Chicken estimates that total startup costs will be $1,262,800-2,543,000.

- Less known franchises will generally have lower start-up costs and requirements. For example, the Earl of Sandwich franchise has an estimated total investment of $331,600-485,200. It also requires a cash investment of $200,000.[2]

Advertisement -

3Talk to current and former franchisees. You want to do as much up-front research as possible. Opening a franchise is a huge financial (and emotional) commitment. You don't want there to be any surprises. To that end, you should contact current and former franchisees and ask them questions. For example, you could ask the following:

- Have they faced any problems with the franchisor or with the business plan? If so, how did the franchisor address those problems?

- Did the franchisee have the necessary experience and skills? Were training programs adequate?

- How would they describe the relationship with the franchisor?

- If the franchisee left the business, were they pushed out by the franchisor? Why did they leave?

- Did the franchisor allow former franchisees to fix any problems? How much time were they given?

- Did the franchisor help the franchisee sell their business?

-

4Check if complaints have been filed. You don't want to invest money and time in a franchise if it has a poor reputation or a history of mismanagement. You should do some research in the following places:

- Better Business Bureau. Visit the BBB for the city where the franchisor has its headquarters. Look to see if any complaints have been lodged.[3]

- Your state's franchise agency, which is usually part of your state's Attorney General's office. They collect complaints related to franchises.

-

5Assess your abilities honestly. Starting a new business is exciting. However, you could be setting yourself up to fail if you don't have the necessary skills. You should honestly self-assess. Consider the following:[4]

- Do you have the skills to manage a business? If you don't, do you have the drive to learn those skills?

- Can you survive financially if the franchise is not immediately successful? It might take you a year to break even.

- Do you have strong enough credit to get a business loan?

- How much time can you commit to the franchise?

Applying to a Franchise

-

1Submit an application. Once you have identified a franchise you are interested in, you should contact it. You can generally contact franchises online or by phone. Look on the franchisor's website. You may have to complete an application before going any further. The application will ask for detailed personal information, such as the following:[5] [Image:Open a Fast Food Franchise Business Step 5.jpg|center]]

- information on prior businesses that you've owned

- whether you've been involved in lawsuits

- location preferences for the franchise

- educational background

- detailed employment history

- personal financial statements, including assets, liabilities, net worth, and sources of income

-

2Analyze the Franchise Disclosure Document. By law, every franchisor must give you a lengthy document called a Franchise Disclosure Document (FDD) at least 14 days before you sign a contract. You should try to get it as soon as possible. The FDD contains important information that you must closely analyze before deciding to go ahead with the application. The following are some of its more important contents:[6]

- History of the company and the executives' business experience. If you've never heard of the franchisor, then make sure the executives have sufficient business experience.

- Litigation history—whether they franchisor or its management team have been sued. The FDD should also document whether the franchisor has sued its franchisees. Pay attention to multiple lawsuits involving fraud or misrepresentation.

- Initial fees and other start-up costs.

- Restrictions on a franchisee's ability to buy from certain suppliers. The franchisor might require that you buy only from certain vendors.

- Your obligations as the franchisee.

- Potential franchisor help with financing, training, and advertising. Also check whether you are obligated to pay for training and how much you must contribute to advertising.

- Audited financial statements. You should get statements for the past three years.

-

3Seek the help of professionals. You probably can't understand most of the FDD by yourself. Accordingly, you should get help. You should hire a lawyer to review contracts and legal information and an accountant to analyze the financial information.

- You can get a referral to a franchise lawyer by contacting your local or state bar association. Make sure your lawyer specializes in franchises and not only business law.

- You can get a referral to an accountant by asking another business owner or contacting your state's Society of Certified Professional Accountants.

-

4Attend a “discovery day” at corporate headquarters. Many franchisors offer discovery days, where you can attend corporate headquarters and tour the facilities. You also can ask management questions. You should try to attend the discovery day.

- Not every franchise will have a discovery day. Some now have virtual tours and seminars you can watch online.

- Don't leave discovery day without a business card. You will probably have plenty of questions and there should be someone you can contact.

- Some franchisors won't give you a copy of their FDD until you attend the discovery day.

-

5Sign the franchise agreement. After the franchisor approves your application, they will send you a franchise agreement to sign. Go over it with your lawyer.[7] If you and your lawyer don't understand terms of the agreement, then ask the franchisor for clarification.

- After signing the agreement, make sure that you keep a copy. You will need to follow your obligations under the franchise agreement. If you don't, then the franchisor could terminate your business.

Financing Your Franchise

-

1Make sure you have the necessary down payment. Down payment requirements vary depending on the fast food franchise. You will probably have to provide documentation that you have the necessary amount. You should gather bank statements.

-

2Ask about franchisor financing. Some franchisors will offer to finance their franchises.[8] Alternately, they may have developed relationships with banks which will extend a loan so that you can buy a franchise. You should ask about franchisor financing if it isn't mentioned in the FDD.

- There are some advantages to franchisor financing. For example, the process is usually simplified.

- However, the franchisor might only be willing to fund part of the amount necessary to start the business.[9]

-

3Consider an SBA loan. The Small Business Administration is a U.S. government agency that will guarantee loans. About 10% of their loans are for franchises.[10] To qualify for an SBA loan, you must meet stringent requirements, such as having excellent credit (usually a score over 700).

- You can ask about an SBA loan by visiting a bank.

-

4Apply for a conventional loan instead. Banks might also lend even if you don't qualify for an SBA loan. However, the interest rate and terms will be less favorable than what you could get with an SBA loan. You should gather the following financial information to show a bank:[11]

- personal financial statement

- personal tax returns for the past three years

- verification of your down payment

- a business plan

-

5Consider other financing options. Make sure that you consider all sources of potential funding. For example, you might obtain the money in one of the following ways:

- Take out a Home Equity Line of Credit (HELOC). You might be able to get a second mortgage or HELOC on your home. If the business fails, however, you can lose your house.

- Use money in a retirement account. Instead of taking an early withdrawal, you set up a C corporation and roll over your retirement fund into it. This corporation then owns the franchise.[12] Think carefully before doing this because you could lose your retirement savings.

- Find other investors. Other people might be willing to go into business with you. You can pool your resources.

-

6Pay up front fees to the franchisor. Franchisors charge required fees, so you need to pay that money soon after signing the franchise agreement. The fee amount will depend on the franchise, but you should have known the amount before signing the franchise agreement.

- Dunkin Donuts, for example, will require $40,000-90,000 in franchise fees.[13]

Preparing to Open the Franchise

-

1Find a location to open. Your franchise plan probably has requirements for where you can be located. Ideally, your franchisor will help you find a location, and they may have established relationships with commercial real estate owners. However, the amount of franchisor help available will vary.[14]

- If you have to look on your own, then pay attention to whether any commercial building projects are slated nearby. For example, if a new mall is being built, then foot traffic might be diverted from your business. You can check with the city's land use office to find out if any new building projects are planned.

- Pay attention to building requirements listed in your franchise agreement. For example, McDonald's requires that the ideal site be at least 50,000 square feet.[15] You should have your franchisor sign off on any building before you lease it.

-

2Purchase equipment. You don't get the equipment for free. Instead, you will need to purchase the necessary equipment. Your franchisor should tell you what equipment to purchase and set up so that you can run your business.

-

3Attend trainings. The franchisor should offer trainings so that you can hit the ground running. The trainings will differ depending on the fast food franchise. McDonald's, for example, offers the following training:[16]

- 9-18 months at a nearby restaurant

- seminars, one-on-one training sessions, and conferences

- operator training classes

- a week-long course conducted at the Oak Brook, Illinois headquarters

-

4Obtain proper permits and licenses. Generally, you will need to get permits and licenses from your state as well as from your municipality. One advantage of hiring a lawyer is that they can handle this paperwork for you.

- Your franchisor should also help you navigate the requirements for your location.[17]

- Fast food businesses are closely monitored by the government. You must meet minimum health and safety requirements and you can expect to be visited by inspectors after you open.

-

5Hire staff. Your franchisor may have particular applications that you must use when recruiting staff. They may also be able to provide you with help recruiting staff. Always check with your franchisor.

- Pay attention to staff with prior fast food experience, particularly experience with the same franchise.

- Remember the importance of asking for and checking references. If someone left a previous job working at a fast food restaurant, then they might have been fired.

Opening Your Business

-

1Think about a soft opening. With a soft opening, you open the business in order to work out the kinks before your grand opening, which will be heavily advertised.[18] At the end of the soft opening, you and your team can assess how well you did and address weaknesses.

- You should still prepare for a soft opening so that there are no major glitches.[19] Make sure employees know how to operate the cash register and how to make change properly. You only get one chance to make a first impression.

-

2Plan a grand opening. The grand opening should be heavily advertised, and your franchisor should provide marketing support and guidelines for a grand opening. There may even be a corporate team that will swoop in and help you.[20]

- Plan to use banners, balloons, signs, and ribbons that suggest a “grand opening” theme.

- Also think about giving away door prizes or offering certain items for free. This can build excitement and good will.

- If possible, invite the mayor and city council members to attend. They can help you cut the ribbon as you open your new business.

-

3Advertise the opening. Choose a date when you know people won't be busy. For example, don't pick the Fourth of July as your opening, since many people are not visiting fast food restaurants on that day. You should try to reach people using many different methods of advertising:[21]

- TV and radio ads

- print media ads

- social networking posts

-

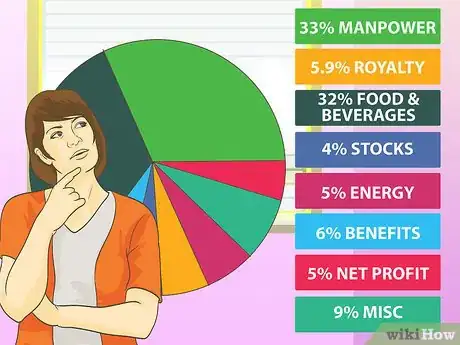

4Continue to meet your franchise obligations. As a franchisee, you don't have total control of your business. Instead, you must meet all of the obligations spelled out in your franchise agreement. For example, you will probably have to do the following at a minimum:

- Contribute to national and regional advertising. Typically, you must contribute a certain percentage of your sales to pay for advertising.

- Pay royalties for the use of the franchisor's trademarks. For example, Dunkin Donuts requires an ongoing royalty of 5.9%.[22]

Community Q&A

-

QuestionI have no experience with fast food but my passion is to open a fast food restaurant. How can I get started?

Community AnswerOpening a business is hard, especially when you don't have experience in the particular service you want to offer. A good step may be to work in a fast food restaurant or find an internship with a manager of a fast food restaurant. This will give you an inside look into how these businesses are run. You can also hire someone with knowledge to act as a consultant.

Community AnswerOpening a business is hard, especially when you don't have experience in the particular service you want to offer. A good step may be to work in a fast food restaurant or find an internship with a manager of a fast food restaurant. This will give you an inside look into how these businesses are run. You can also hire someone with knowledge to act as a consultant.

References

- ↑ https://www.ftc.gov/system/files/documents/plain-language/pdf-0127_buying-a-franchise.pdf

- ↑ http://www.franchising.com/earlofsandwich/

- ↑ https://www.ftc.gov/system/files/documents/plain-language/pdf-0127_buying-a-franchise.pdf

- ↑ https://www.ftc.gov/system/files/documents/plain-language/pdf-0127_buying-a-franchise.pdf

- ↑ http://www.franchising.com/howtofranchiseguide/the_franchise_application.html

- ↑ https://www.entrepreneur.com/article/222438

- ↑ https://www.thebalance.com/franchise-agreement-vs-franchise-disclosure-document-1350607

- ↑ http://guides.wsj.com/small-business/franchising/how-to-finance-a-franchise-purchase/

- ↑ https://www.fundera.com/resources/franchise-financing

- ↑ http://guides.wsj.com/small-business/franchising/how-to-finance-a-franchise-purchase/

- ↑ http://guides.wsj.com/small-business/franchising/how-to-finance-a-franchise-purchase/

- ↑ http://guides.wsj.com/small-business/franchising/how-to-finance-a-franchise-purchase/

- ↑ https://www.entrepreneur.com/franchises/dunkindonuts/282304

- ↑ https://www.entrepreneur.com/article/218184

- ↑ http://corporate.mcdonalds.com/mcd/franchising/real_estate/site_criteria.html

- ↑ http://corporate.mcdonalds.com/mcd/franchising/us_franchising/why_mcdonalds/world_class_training.html#preparing-for-ownership

- ↑ http://www.fastcasual.com/blogs/how-license-permit-knowledge-can-save-your-restaurant/

- ↑ http://www.franchising.com/howtofranchiseguide/how_to_stage_a_grand_opening_for_your_new_franchise.html

- ↑ https://www.entrepreneur.com/article/223303

- ↑ http://www.franchising.com/howtofranchiseguide/how_to_stage_a_grand_opening_for_your_new_franchise.html

- ↑ http://www.franchising.com/howtofranchiseguide/how_to_stage_a_grand_opening_for_your_new_franchise.html

- ↑ https://www.entrepreneur.com/franchises/dunkindonuts/282304