This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 26,645 times.

In markets, day-traded stocks are purchased and sold over the course of a single day. Instead of holding onto their stocks for months as the financial markets rise and fall, day traders purchase stocks, hope their value rises, and sell them off at the end of a day.[1] To start day trading, choose an amount of money to invest and select a trading platform. If you’re new to stock markets in general, it may benefit you to work with a broker that can handle the large number of per-day trades that day traders tend to make. Day trading can net you large profits but is also labor intensive; most day traders find that they need to keep a constant eye on the markets.

Steps

Budgeting and Making an Investment

-

1Select a realistic amount of money to invest. If you’re a first-time day trader, pick an amount that will make profits without emptying your bank account, and be aware that you could lose everything you invest in a few months. Plan to invest at least $25,000 USD and not more than $40,000 USD unless you’re planning to dedicate hours every day to day trading.[2]

- Some investors choose to quit their jobs and operate as professional day traders. If this is your first time day trading, though, plan for it to supplement your already-existing income.

-

2Invest at least $25,000 USD to qualify as a pattern day trader. Most day traders are pattern day traders—this just means that you’re making 4 or more trades during every 1 business week. If you have less than the minimum amount of money required to qualify as a pattern day trader, the company may not permit you to make any trades.[3]

- Or, if you're working with a broker and invest less than the minimum amount, your broker may be blocked from making your trades by the stock companies.

- If your investment amount dips below $25,000 USD, you’ll need to reinvest more money to reach the minimum investment amount.

Advertisement -

3Purchase stocks with Computershare to invest in many companies. Computershare is used by nearly all listed companies to administer stock purchases and sales. The site allows you to buy stocks direct, without going through a broker. You’ll be charged $5–20 USD for setting up the account and you’ll also be charged transaction fees (for buying and selling shares) that range from $0.03–0.020 USD.[4]

- You’ll need to give Computershare access to a credit card or bank account in order to complete transactions.

- Make your account and begin trading online at: https://www-us.computershare.com/Investor/#DirectStock/Index.

-

4Trade stocks through company websites to manage fewer investments. A small number of major companies allow you to purchase stock directly from them without a broker or third-party stock-trading website. These companies include giants like Pfizer, General Electric, and Kellogg’s. Create a free stock-trading account through each of these companies’ websites.[5]

- For example, trade Home Depot stock online at: http://ir.homedepot.com/shareholder-services/direct-stock-purchase-plan.

- Other companies that allow direct stock purchasing and selling include Coca Cola, Exxon Mobile, and Johnson & Johnson.[6]

-

5Purchase stocks and pay the required transaction fees. Whether you’re using Computershare to invest in stocks, commodities, or forex (foreign exchange currency market); or purchasing stocks straight from a company website, you’ll need to observe the posted limits for minimum purchasing and investment fees.[7]

- Most companies will not let you invest less than a set minimum amount of money in their stocks and may also require a minimum investment-fee payment. Depending on the company you’re purchasing stock from, the minimum stock purchase amount can range anywhere from $25–2,500 USD.

- Investment fees vary based on whether you choose to make a one-time investment or recurring investments in a company’s stock.

- Once you sell a stock, your profits will be added back to your bank account or credit-card balance. Should you lose money, the amount you lost will be subtracted from your overall balance.

- Trading-cost information should be available to you either on the Computershare webpage for each individual company or on a company’s direct-trade webpage.

Trading through a Broker

-

1Evaluate various brokers to select one that works for you. If you’re new to stocks and markets, you may be better off not making your own trades. If you choose to trade through a broker, you’ll be telling a broker what trades to make, how much to trade, and exactly when to make them. Many different brokerages can help you.[8]

- Research various companies before making a choice. For a good website for comparing brokers, check out: http://www.stockbrokers.com.

- A good brokerage in the U.S. is Interactive Brokers at https://www.interactivebrokers.com/en/home.php. A good brokerage if you're trading abroad is Suretrader at ttps://www.suretrader.com/.

- Both of the above brokerages attract good reviews. Barron's Magazine rated Interactive Brokers as the best online U.S. brokerage in 2018.[9]

-

2Analyze the financial practices of various brokerages to compare them. Any brokerage agency’s financial information should be available on its website. Each brokerage firm is unique in its price structure, the platforms it uses, the buying opportunities it offers, and the initial deposit (minimum required payment) it requires. In comparing brokers, focus on the fees they charge per trade or per stock.[10]

- The fee per trade should be considerably less than $10 USD, considering how many trades you'll be making. If the fee is too high, find another broker.

- Look online to determine the minimum required account-deposit. For most reputable brokers, it's between $500 and $5,000 USD.

- If you live outside of the U.S. or the U.K., confirm that a brokerage will serve people from your country before you sign up.

-

3Contact a brokerage firm with questions about their business practices. If you’re unsure about a decent-looking brokerage’s minimum account-deposit amount or aren’t sure how fast a brokerage will make the trades that you’ve requested, contact the firm and ask them directly. Most brokerage firms will have a phone number or email account posted on their website. For example, you could call the broker office and ask questions:[11]

- To confirm that they have a low commission rate. Some brokers will charge you an arm and a leg.

- To ensure that they can make trades quickly. In the world of day trading, a delay of half an hour—or even 15 minutes—can lose you a lot of money.

- To make sure that the firm will offer you helpful trading resources, charting tools, and other helpful research tools.

-

4Open an online account with the brokerage of your choice. Since you’ll be doing the majority of your stock (or other market) trading online, make your account online as well. You’ll be asked to select the type of account you’d like to open and to provide your permanent residential address, Social Security Number, and the name and address of your employer.[12]

- For example, if you decide to use Charles Schwab & Co. as your brokerage firm, create an account at https://www.schwab.com/public/schwab/active_trader.

Strategizing Your Trades

-

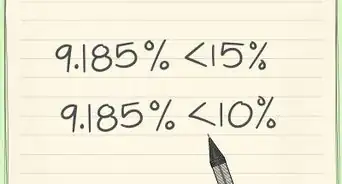

1Invest no more than 1–2% of your account on each trade. You’re probably going to lose money at first until you get the hang of day trading. If you begin by investing 5%, 10%, or 15% of your total account balance on a single trade, you’ll quickly exhaust the money you set aside to invest.[13]

- So, for example, if you have a total of $30,000 USD that you’ve set aside for training, only invest $300–$600 on any individual trade.

-

2Wait 15–20 minutes after every trade to see how the market moves. Novice day traders buy and sell stocks much too quickly and lose profits by doing so. If you’re a beginner, avoid trading off stocks that you’ve had for less than 20 minutes. Let the market shift a little before you buy or sell. Then, follow general stock trading logic: try to buy low and sell high.[14]

- Most markets are volatile in the first 2–3 hours during which they’re open, settle down during the middle of the day, and become more unpredictable as closing time nears.

-

3Utilize the “scalping” strategy to make quick, small profits. Scalping is one of the most popular day-trading strategies, especially among new traders. When using this strategy, sell your stock (or other market) shares as soon as they turn a profit. For example, if you bought 10 shares of a stock at $1 per share and 20 minutes later they increase to $1.05 a share, unload your stocks for a profit of $0.50.[15]

- While stock-trading strategies can get very complex—and risky—it’s best for beginners to stick with relatively simple, tried-and-true methods to turn a profit.

- Experimenting with a number of different day-trading strategies will allow you to capitalize on trends you see among different stocks and markets.

-

4Try the “momentum” strategy if you want to stick with 1–2 stocks. The “momentum” strategy involves following the news and picking 1–2 stocks to invest in that are likely to do well in that day’s trading cycle. So, if a business news source reports that tech stocks are likely to perform well on a day you’re day trading, buy up 10–20 shares of stock in well-known tech companies and watch the market.[16]

- When 1 or more of the stocks in which you invested rise by 20–30% (not uncommon for stocks with a significant daily increase), sell the stocks at the high point.

Diversifying Markets and Improving Your Trades

-

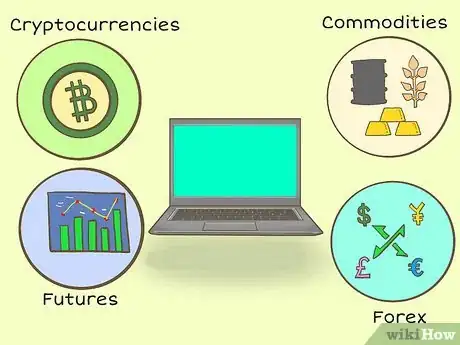

1Select multiple trading markets to invest in. Stocks are a common, popular, and frequently lucrative type of market for day traders to invest in. However, they’re not the only option. Diversifying the types of markets that you invest in will allow you to make more money than you would if you only invested in a single type of market. Commonly day-traded markets other than stocks include:[17]

- Cryptocurrencies like Bitcoin and Ethereum

- Commodities like oil, food, natural gas, and minerals

- The future prices of these commodities (known as “futures”)

- Forex: the foreign exchange currency market

-

2Learn about the markets you’re day trading in. Day trading requires some quick decisions, and these are hard to make if you’re unfamiliar with, for example, market closing times and holidays. To avoid potentially losing a large amount of money quickly, do some basic research to learn about various markets.[18]

- Before you start day trading, watch the markets you’re planning to invest in, and note how the markets respond to news events, political changes, and international news.

- For example, the stocks market may tend to do poorly when an international market suffers, while the forex market may improve.

-

3Follow specific stocks to note idiosyncrasies and market trends. Keeping an eye on 3–4 specific stocks—ones you’d like to invest in someday—over a week-long period will allow you to learn when the stocks rise and fall during the day. You’ll also pick up on larger market trends and quickly learn when to buy and sell for profit.[19]

- Also try reading stock analyses in business papers or websites to read analyses of why stocks perform in a certain way.

- This strategy applies in all markets, not just the stock market. Pick 1–2 specific cryptocurrencies or commodities and track them over a week to give yourself an idea of how they perform over a longer period of time.

-

4Pick a successful trader to learn from as a mentor. As you meet other day traders, you’ll have the opportunity to ask experienced investors for help and advice. Working with a mentor will tremendously improve your chances of becoming profitable. Many established traders make themselves available to offer tutoring and education.[20]

- Good mentors are often millionaire traders themselves, which means that they're exactly who you want teaching you.

- Learn from the mistakes that your mentor has made throughout their trading career, and you'll be less likely to make those same mistakes yourself.

-

5Analyze your trades to improve your trading plan. Every day trader needs some time to learn the ropes and hone their skills. If you find yourself losing money, try a different broker, different investing strategy, or different type of trading market. For example, if you’re losing money in stocks and forex, try investing more in cryptocurrencies and commodities.

- Remember your mistakes and use what you learn to make better trades in the future. You can even write down any mistakes in order to avoid making them again.

References

- ↑ https://www.investopedia.com/articles/trading/06/daytradingretail.asp

- ↑ https://www.investopedia.com/articles/active-trading/051415/10-steps-becoming-day-trader.asp

- ↑ https://vantagepointtrading.com/how-much-capital-do-i-need-to-start-day-trading-stocks/

- ↑ https://www.moneycrashers.com/buy-stocks-without-broker/

- ↑ https://www.forbes.com/sites/moneybuilder/2012/06/20/how-to-invest-using-direct-stock-purchase-plans/#4f2781912715

- ↑ https://www.moneycrashers.com/buy-stocks-without-broker/

- ↑ https://www.moneycrashers.com/buy-stocks-without-broker/

- ↑ https://www.nerdwallet.com/blog/investing/free-stock-trading/

- ↑ https://www.barrons.com/articles/interactive-brokers-takes-top-spot-in-online-broker-ranking-1521854071

- ↑ https://www.forbes.com/sites/karlkaufman/2018/02/18/how-to-trade-stocks-for-free/#7a0028129680

- ↑ https://www.benzinga.com/money/how-to-begin-day-trading

- ↑ https://www.nerdwallet.com/blog/investing/free-stock-trading/

- ↑ https://www.benzinga.com/money/how-to-begin-day-trading

- ↑ https://www.investopedia.com/articles/trading/06/daytradingretail.asp

- ↑ https://www.daytrading.com/strategies

- ↑ https://www.daytrading.com/strategies

- ↑ https://www.daytrading.com/

- ↑ https://www.investopedia.com/articles/active-trading/051415/10-steps-becoming-day-trader.asp

- ↑ https://www.investopedia.com/articles/trading/06/daytradingretail.asp

- ↑ https://tickertape.tdameritrade.com/trading/finding-trading-mentor-15711

About This Article

To start day trading, you need invest at least $25,000 USD to qualify as a pattern day trader. When you have the money to start trading, select multiple trading markets to invest in, such as stocks, cryptocurrencies, and commodities, so that you can diversify and possibly make more money. You should plan to invest no more than 1 to 2 % of your account on each trade so you don’t exhaust all of your money. If you’re new to stocks, it’s probably a good idea to trade with a broker until you get the hang of things. If you’d rather make trades on your own, you can purchase stocks through the Computershare website or buy a company’s stock directly from their website if they offer the option. For more information, including how to use the scalping strategy when day trading to make quick, small profits, scroll down!