This article was co-authored by Marcus Raiyat. Marcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 144 testimonials and 93% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 1,854,606 times.

Trading foreign exchange on the currency market, also called trading forex, can be a thrilling hobby and a great source of income. To put it into perspective, the securities market trades about $22.4 billion per day; the forex market trades about $5 trillion per day. You can trade forex online in multiple ways.

Steps

Learning Forex Trading Basics

-

1Understand basic forex terminology.

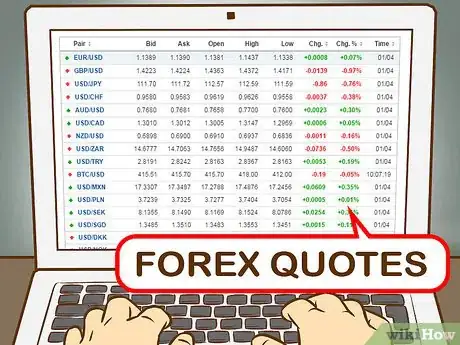

- The type of currency you are spending or getting rid of, is the base currency. The currency that you are purchasing is called quote currency. In forex trading, you sell one currency to purchase another.

- The exchange rate tells you how much you have to spend in quote currency to purchase base currency.

- A long position means that you want to buy the base currency and sell the quote currency. In our example above, you would want to sell U.S. dollars to purchase British pounds.

- A short position means that you want to buy quote currency and sell the base currency. In other words, you would sell British pounds and purchase U.S. dollars.

- The bid price is the price at which your broker is willing to buy base currency in exchange for quote currency. The bid is the best price at which you are willing to sell your quote currency on the market.

- The ask price, or the offer price is the price at which your broker will sell base currency in exchange for quote currency. The ask price is the best available price at which you are willing to buy from the market.

- A spread is the difference between the bid price and the asking price. [1]

-

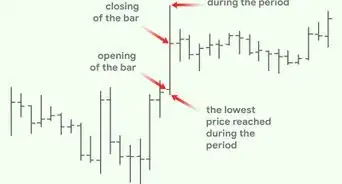

2Read a forex quote. You'll see two numbers on a forex quote: the bid price on the left and the asking price on the right.Advertisement

-

3Decide what currency you want to buy and sell.

- Make predictions about the economy. If you believe that the U.S. economy will continue to weaken, which is bad for the U.S. dollar, then you probably want to sell dollars in exchange for a currency from a country where the economy is strong.

- Look at a country's trading position. If a country has many goods that are in demand, then the country will likely export many goods to make money. This trading advantage will boost the country's economy, thus boosting the value of its currency.

- Consider politics. If a country is having an election, then the country's currency will appreciate if the winner of the election has a fiscally responsible agenda. Also, if the government of a country loosens regulations for economic growth, the currency is likely to increase in value.

- Read economic reports. Reports on a country's GDP, for instance, or reports about other economic factors like employment and inflation will have an effect on the value of the country's currency. [2]

- It's important to consider hedging out currency risk as well as looking at the potential gain you can make in a different international market due to changes in currency exchange rates.

-

4Learn how to calculate profits.

- A pip measures the change in value between two currencies. Usually, one pip equals 0.0001 of a change in value. For example, if your EUR/USD trade moves from 1.546 to 1.547, your currency value has increased by ten pips.

- Multiply the number of pips that your account has changed by the exchange rate. This calculation will tell you how much your account has increased or decreased in value. [3]

Opening an Online Forex Brokerage Account

-

1Research different brokerages. Take these factors into consideration when choosing your brokerage:

- Look for someone who has been in the industry for ten years or more. Experience indicates that the company knows what it's doing and knows how to take care of clients.

- Check to see that the brokerage is regulated by a major oversight body. If your broker voluntarily submits to government oversight, then you can feel reassured about your broker's honesty and transparency. Some oversight bodies include:

- United States: National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC)

- United Kingdom: Financial Conduct Authority (FCA)

- Australia: Australian Securities and Investment Commission (ASIC)

- Switzerland: Swiss Federal Banking Commission (SFBC)

- Germany: Bundesanstalt für Finanzdienstleistungsaufsicht (BaFIN)

- France: Autorité des Marchés Financiers (AMF)

- See how many products the broker offers. If the broker also trades securities and commodities, for instance, then you know that the broker has a bigger client base and a wider business reach.

- Read reviews but be careful. Sometimes unscrupulous brokers will go into review sites and write reviews to boost their own reputations. Reviews can give you a flavor for a broker, but you should always take them with a grain of salt.

- Visit the broker's website. It should look professional, and links should be active. If the website says something like "Coming Soon!" or otherwise looks unprofessional, then steer clear of that broker.

- Check on transaction costs for each trade. You should also check to see how much your bank will charge to wire money into your forex account.

- Focus on the essentials. You need good customer support, easy transactions, and transparency. You should also gravitate toward brokers who have a good reputation.[4]

-

2Request information about opening an account. You can open a personal account or you can choose a managed account. With a personal account, you can execute your own trades. With a managed account, your broker will execute trades for you.

-

3Fill out the appropriate paperwork. You can ask for the paperwork by mail or download it, usually in the form of a PDF file. Make sure to check the costs of transferring cash from your bank account into your brokerage account. The fees will cut into your profits.

-

4Activate your account. Usually, the broker will send you an email containing a link to activate your account. Click the link and follow the instructions to get started with trading. [5]

Starting Trading

-

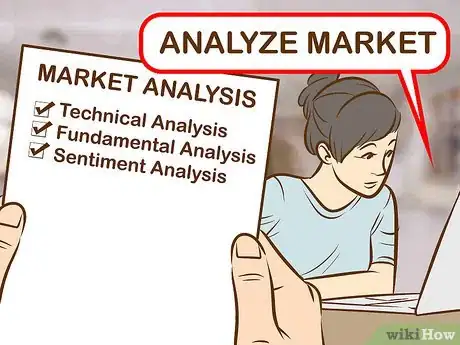

1Analyze the market. You can try several different methods:

- Technical analysis: Technical analysis involves reviewing charts or historical data to predict how the currency will move based on past events. You can usually obtain charts from your broker or use a popular platform like Metatrader 4.

- Fundamental analysis: This type of analysis involves looking at a country's economic fundamentals and using this information to influence your trading decisions.

- Sentiment analysis: This kind of analysis is largely subjective. Essentially you try to analyze the mood of the market to figure out if it's "bearish" or "bullish." While you can't always put your finger on market sentiment, you can often make a good guess that can influence your trades.

-

2Determine your margin. Depending on your broker's policies, you can invest a little bit of money but still, make big trades.

- For example, if you want to trade 100,000 units at a margin of one percent, your broker will require you to put $1,000 cash in an account as security.

- Your gains and losses will either add to the account or deduct from its value. For this reason, a good general rule is to invest only two percent of your cash in a particular currency pair.

-

3Place your order. You can place different kinds of orders:

- Market orders: With a market order, you instruct your broker to execute your buy/sell at the current market rate.

- Limit orders: These orders instruct your broker to execute a trade at a specific price. For instance, you can buy currency when it reaches a certain price or sells currency if it lowers to a particular price.

- Stop orders: A stop order is a choice to buy currency above the current market price (in anticipation that its value will increase) or to sell currency below the current market price to cut your losses. [6]

-

4Watch your profit and loss. Above all, don't get emotional. The forex market is volatile, and you will see a lot of ups and downs. What matters is to continue doing your research and sticking with your strategy. Eventually, you will see profits.

Community Q&A

-

QuestionWhat do we usually trade here specifically?

DonaganTop AnswererHere we're talking about using one national currency to purchase a second national currency and trying to do so at an advantageous exchange rate so that later one can re-sell the second currency at a profit.

DonaganTop AnswererHere we're talking about using one national currency to purchase a second national currency and trying to do so at an advantageous exchange rate so that later one can re-sell the second currency at a profit. -

QuestionCan I trade without brokers?

Community AnswerNo. The brokers are the ones with the pricing, and execute the trades. However, you can get free demo accounts to practice and learn platforms.

Community AnswerNo. The brokers are the ones with the pricing, and execute the trades. However, you can get free demo accounts to practice and learn platforms. -

QuestionIs Forex trading safe?

DonaganTop AnswererNot unless you really know what you're doing. For most people, Forex trading would amount to gambling. If you can find an experienced trader to take you under his wing, you might be able to learn enough to succeed. There is big money to be made in Forex, but you could easily lose your whole stake, too.

DonaganTop AnswererNot unless you really know what you're doing. For most people, Forex trading would amount to gambling. If you can find an experienced trader to take you under his wing, you might be able to learn enough to succeed. There is big money to be made in Forex, but you could easily lose your whole stake, too.

Warnings

- Ninety percent of day traders are unsuccessful. If you want to learn common pitfalls which will cause you to make bad trades, consult a trusted money manager.⧼thumbs_response⧽

- Check to make sure that your broker has a physical address. If a broker doesn't offer an address, then you should look for someone else to avoid being scammed.⧼thumbs_response⧽

Things You'll Need

- Brokerage account

- Cash to invest.

References

- ↑ http://www.babypips.com/school/how-you-make-money-in-forex.html

- ↑ http://www.investopedia.com/articles/forex/11/economic-factors-affecting-forex.asp

- ↑ http://www.babypips.com/school/pips-and-pipettes.html

- ↑ http://www.100forexbrokers.com/how-to-choose-forex-broker

- ↑ http://www.babypips.com/school/opening-a-forex-trading-account.html

- ↑ http://forex.tradingcharts.com/learn_forex/6._Mechanics_of_Forex_Trading.html

About This Article

To trade forex, choose a brokerage that is regulated by a major oversight body like National Futures Association (NFA) or Financial Conduct Authority (FCA) and open an account. Read and analyze international economic reports, then choose a currency you feel is economically sound to trade with, like the US dollar or Euro. Start placing orders through your broker based on your research findings, then watch your account to monitor your profits and losses. To learn how to analyze the market and set your trade margins, keep reading!