This article was co-authored by Hannah Cole. Hannah Cole is an Enrolled Agent and the Founder of Sunlight Tax. As an Artist and Tax Specialist with over 10 years of experience in freelance taxation, Hannah specializes in doing taxes for self-employed creative people and small businesses, setting up a business as a creative person, and personal finance issues in creative work. She has her Enrolled Agents license, which is a tax expertise and representation credential issued by the IRS. She has been hosted to speak about taxes for artists by institutions including the Harvard Ed Portal, the Boston Foundation, the New York Foundation for the Arts, RISD, and Cornell University. Hannah received her BA in Art History from Yale University, MFA in Painting from Boston University, and studied accounting at Brooklyn College.

This article has been viewed 1,791,007 times.

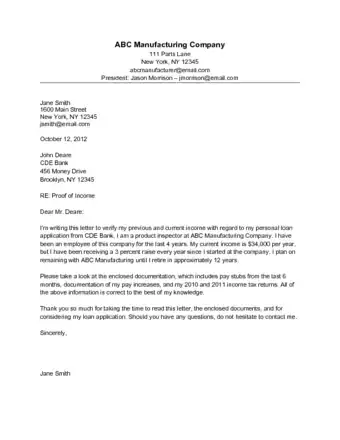

It is not unusual to be asked to verify your income when inquiring about a line of credit, a loan, a lease, or a rental agreement. This verification will usually come in the form of a letter, written by you, an employer, an accountant, or a social security caseworker. As the income verification letter will be used as an official documentation of your income, it is important that it contain specific information. If you need to write one yourself, here are the steps and what to include in your letter for proof of income.

Steps

Sample Proof of Income Letters

Writing Your Income Letter

-

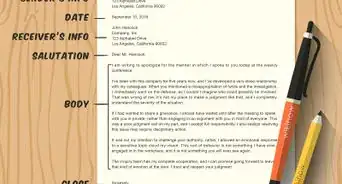

1Begin by listing your contact information at the top of the page. This should include the name, address, telephone number and email address of the entity responsible for preparing the verification of income, in this case you.

- If you are self-employed, you should include your business name and information.

- This information should be positioned at the top left of the page. Separate it from the next section by inserting one blank line below it.

-

2Explain the purpose of the letter in a few words. You should do this in memo format under the contact information. For example: "RE: income letter."

- This brief blurb about the subject of your letter will help your reader quickly understand that they need to continue reading, as the subject is important.

Advertisement -

3Begin the actual letter with a polite greeting followed by the proper name of the recipient. For example, you may say, "Dear Mr. Williams," or "To Ms. Mayer."

- If you are not sure who the letter should be officially addressed to, use the standard, "To Whom It May Concern."

- It's important to keep your greetings businesslike and official. This letter is not a casual one, so don't begin it with a casual tone.

-

4Introduce yourself and explain why you are submitting the income verification letter. For example, you may say, "My name is John Homebuyer. The purpose of this letter is to accompany my mortgage application, in order to substantiate my worthiness for loan approval."

- This quick summary is important to provide. This may be one of many such letters that your reader reads in a day. You need to tell them the point of your letter quickly and succinctly, so as not to waste their time.

-

5Provide details about your basic income. You should outline how much money you make, how you make your money, how long you have been making that much money, and how long you anticipate being able to maintain the same (or greater) income.

- For example, you may start this portion of the income letter by saying, "I am self-employed as a freelance photographer. I have been in this line of work for the past 12 years, and self-employed for the past 6 years.

- Do not embellish your income or give incorrect information in this section. The person you are writing to will probably independently verify that the information you are giving it true, so don't get caught lying. This could jeopardize the services you are requesting.

-

6Mention any additional income you have, in addition to your basic employment. This could include a variety of items such as annuities, pensions, government benefits, or gifts. Make clear how much and how often you receive this income.

- For instance, you can simply state "Additionally, I receive a monthly pension from ABC Technology of $500. This pension is a guaranteed income for the rest of my life."

- The person you are writing to may verify this income as well. Be sure that the information you are giving them is correct. Otherwise, it might cause a problem for the service you are requesting, such as a loan.

-

7Finish this section by summarizing your total income and suggesting how it will be sustained or increase in the future. The suggestions for how it will change should be based in fact, for instance trends over time in changes to your income. Do not simply state your hopes for future income.

- Here is an example of what this could look like: "My current employment income is approximately $45,000 annually, and my pension payment is $600 per month. As my business income has increased by an average of 5 percent each year, I can expect to be able to maintain this growth in the foreseeable future. As well, my pension payments are scheduled to continue for the next 15 years."

-

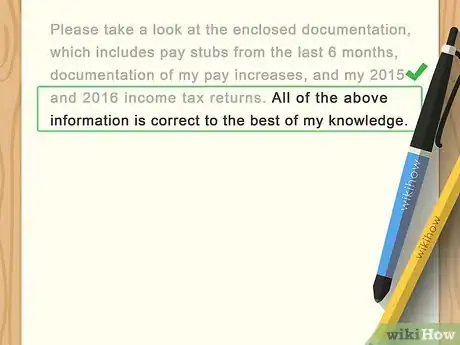

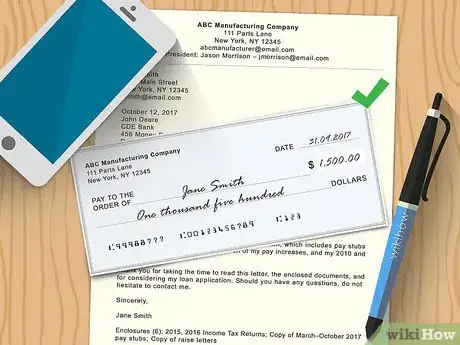

8Include a note at the end signaling that there is additional paperwork included with your letter. You can transition into this easily by simply requesting that the reader examine the enclosed documentation, which must support the claims you make in your letter.

- Including this note will help insure that the person receiving your letter will know that you have included supplementary documentation.

-

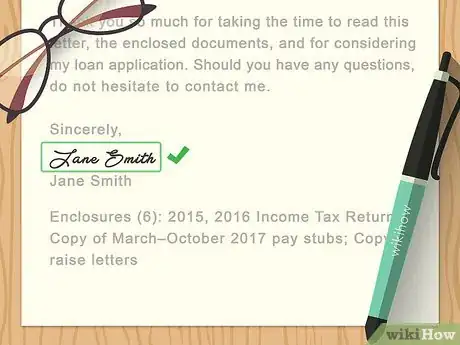

9Thank the reader for their time and consideration. Then close your letter with a formal closing salutation followed by your full name.

- "Sincerely" is a common formal closing salutation used in letters such as this.

- If you are planning on printing out the letter, you may want to leave two blank lines between your formal closing salutation and your name. This will give you room so that you can sign it by hand, right above your typed name.[1]

-

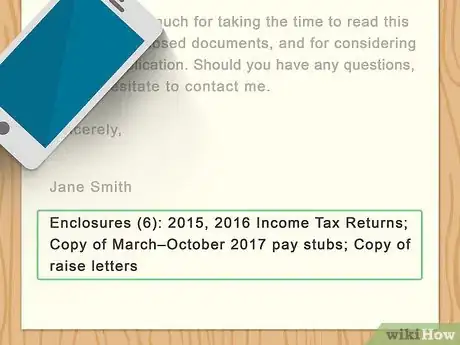

10Type "Enclosure" under your name. This will indicate the supporting documentation you included with the letter.

-

11Include a disclaimer such as, "all of the information above is true to the best of my knowledge."[2] This is optional but shows that you are taking the seriousness of this letter and your request for funding earnestly.

-

12Sign the letter by hand, if you are sending a printed copy. If you are sending this letter electronically you will not be able to sign it by hand.

- Remember, you left two blank lines between your closing salutation and your typed name if you planned on printing your letter. Then, once printed, this is where you insert your signature.

Including Supplementary Documentation of Income

-

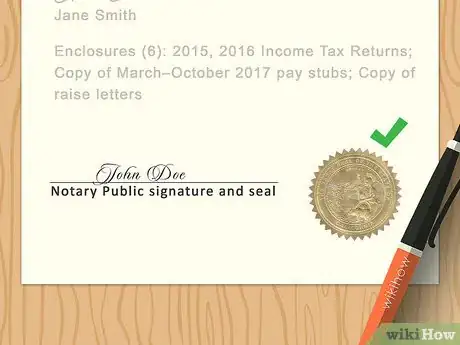

1Have your income letter notarized by an official notary public. This will help ensure it is recognized as an official document by the institution you are submitting it to.

- You can find your closest notary public by searching online. There is even an official database of notary publics across the US.[3] However, it is usually a good bet that there is one available at your local banking or governmental institution.

- Notary publics will probably charge you a small fee for their services. This is, after all, their business.

-

2Enclose copies of check stubs as income documentation. As there are many different forms of income, there are also different types of documentation you may need to include. Check stubs are a good way to prove the steadiness of your current income.

- In the modern era, with electronic payrolls, you may not actually get check stubs. Direct deposit records should work well as income documentation if you do not have actual check stubs.

-

3Enclose copies of tax returns as income documentation. Tax returns are a good way to document your income over time.

- Tax records may be helpful if you have changed jobs recently, as they can show that you have consistently made an income, despite changes in employment.

- If you are self-employed, you may need to submit a variety of documents as your verification of income, including bank statements, tax forms and a financial statement from your accountant.

-

4Provide documentation for other types of income. This may include social security income, pensions, or retirements.[4]

Community Q&A

-

QuestionHow do I write out an agreement for employment in exchange for rent?

Community AnswerThats a legal document, so there are most likely templates online, and be sure to check your local and state landlord-tenant laws, as well.

Community AnswerThats a legal document, so there are most likely templates online, and be sure to check your local and state landlord-tenant laws, as well.

References

- ↑ http://www.dailywritingtips.com/how-to-format-a-us-business-letter/

- ↑ http://www.usattorneylegalservices.com/proof-of-income.html

- ↑ https://os.dc.gov/service/search-notary-public

- ↑ http://www.dfas.mil/retiredmilitary/manage/payverification.html

- ↑ http://www.ssa.gov/ssi/ssi-resources.htm

- ↑ http://www.usattorneylegalservices.com/proof-of-income.html

About This Article

If you need to write a letter to provide proof of income, make sure to include details about your basic income, like how much you make and how you earn it. For example, you can say “I’m a self-employed freelance photographer. I have been in this line of work for 12 years, and self-employed for the past 6 years.” In addition to your main income, tell the recipient about any extra money you make and summarize your total income. To further prove your income, enclose copies of paychecks and tax returns and mention their inclusion at the end of the letter. Before signing your name, proofread your letter for mistakes and make it sound professional by using formal salutations, like “Sincerely.” For more help, like how to add a disclosure to your letter, scroll down.