2022 stock market decline

The 2022 stock market decline was an economic event involving a decline in stock markets globally. The decline was the worst for American stock indices since 2008, ending three-years of gains.[1]

In February 2022, the Russian invasion of Ukraine caused a sell-off across many financial markets throughout the world.

The stock market decline has had a serious negative impact on economies throughout the world. In the United States, the S&P 500 stock market index peaked in January and began a gradual decline. In September, the S&P 500 would experience its largest drop since March 2020.

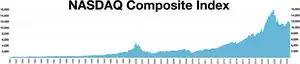

In the United States, the stock market decline was associated with a bear market which is considered to have begun on January 3, 2022, and to have ended on October 22, 2022; within months, the Dow Jones Industrial Average, the Nasdaq Composite, and the S&P 500 entered the bull market in November 2022, May 2023, and June 2023 respectively.[2] In Japan, the Nikkei 225 reached its highest level since 1990, in May 2023.[3]

Causes

The global financial instability in 2022 is a holdover from the COVID-19 pandemic, as investors attempted to determine the long-term effects of the pandemic on the global economy.[4] Global indices began to decline after January 2022. However, the Russian invasion of Ukraine escalated the decline as fears of energy disruption became apparent.[5]

Global markets were also impacted by fears of economic recession. On June 13, 2022, the MSCI ACWI index, which tracks stock prices from both emerging and developed markets, officially slipped into a bear market, falling 21% from a mid-November peak.[6]

Effects

Effects on the United States

The S&P 500 index peaked at 4,796 on its January 3 close and had since been on a downward trend for several months. In response to the inflation surge, the Federal Reserve rapidly raised interest rates which further led to a decline in investor confidence. Markets favor low interest rate environments because they are conducive to future growth: when interest rates are low, companies can increase spending, which leads to increased stock prices. As the United States gross domestic product shrank in the first quarter of 2022, fears of an economic recession contributed to the decline in equity prices.[7] The gross domestic product (GDP) decreased at an annual rate of 1.6 percent in the first quarter of 2022, according to the "third" estimate released by the Bureau of Economic Analysis.[8] By June 16, 2022, the S&P had fallen 23.55% from 4,796 to 3,666, though its currently unknown if the index will plunge below the level. The DJIA fell 18.78% since its January 4 high, while the Nasdaq Composite fell 33.70% from its November 19 high.[9][10]

On September 13, 2022, the S&P 500 experienced its largest single-day drop since June 2020.[11]

According to Morningstar, Inc., environmental, social, and corporate governance (ESG) investment funds in the United States saw capital inflows of $3.1 billion in 2022 while non-ESG investment funds saw capital outflows of $370 billion.[12]

Effects on China

Concerns over the economic effects of China's Zero-COVID strategy and its regulatory crackdown on companies like Ant Group have led to a decline in Chinese stock prices. In June 2022, the Alibaba Group's (NYSE: BABA) share price declined from a peak of over US$300 in mid-2020 to below US$100.[13]

Effects on emerging markets

Emerging markets were hit by the worst sell-off in decades. The JPMorgan EMBI Global Diversified delivered returns of -15% in 2022. During the same period, ETFs that provide exposure to emerging markets such as VWO, IEMG, and EEM are all down more than 15% since the start of 2022.[14]

Effects on cryptocurrency

As part of the global decline in most risky assets, the price of Bitcoin fell 59% during the same time period, and it declined 72% from its November 8th all-time high. The price of cryptocurrencies like the aforementioned Bitcoin and Ethereum plunged in June 2022 (the former of which suffered another decline) as investors moved their money out of risky assets.[15]

References

- Jesse Pound; Samantha Subin (December 30, 2022). "Stocks fall to end Wall Street's worst year since 2008, S&P 500 finishes 2022 down nearly 20%". CNBC.

- "The S&P 500 is in a bull market. Here's what that means and how long the bull might run". The Associated Press. June 8, 2023.

- "Japan's Nikkei hits 33-year high on weak yen, US optimism". Al Jazeera. May 29, 2023.

- Vega, Nicolas (2022-06-14). "Stocks have officially entered bear market territory—here's what that means and what you should do". CNBC. Retrieved 2022-06-29.

- Toews, Phillip (March 14, 2022). "Opinion: Ukraine War Likely Has Triggered Lasting Bear Market". Barrons. Retrieved 2022-06-29.

- Maki, Sydney (2022-06-13). "Global Stocks Dive Into Bear Market as Risk Appetite Evaporates". Bloomberg. Retrieved 2022-07-04.

- Simonetti, Isabella (2022-06-30). "After Worst Start in 50 Years, Some See More Pain Ahead for Stock Market". The New York Times. Retrieved 2022-06-30.

- "Gross Domestic Product (Third Estimate), GDP by Industry, and Corporate Profits (Revised), First Quarter 2022 | U.S. Bureau of Economic Analysis (BEA)". www.bea.gov. Retrieved 2022-07-03.

- Schnipper, Scott (2022-06-13). "The S&P 500 is now in an official bear market, according to S&P Dow Jones Indices". CNBC. Retrieved 2022-06-23.

- Gura, David (2022-06-13). "Stocks sink, sending the S&P 500 to a bear market". NPR. Retrieved 2022-06-23.

- Rennison, Joe (September 13, 2022). "Markets Plunge as Inflation Data Undercuts Wall Street's Optimism". The New York Times. Retrieved September 13, 2022.

- Shifflett, Shane (March 7, 2023). "Sustainable Funds Dodged Outflows in 2022 Market Rout". The Wall Street Journal. News Corp. Retrieved April 27, 2023.

- Calhoun, George. "Alibaba Update: It's Down 75%. Is It Still A Value Play?". Forbes. Retrieved 2022-06-23.

- Jonathan, Wheatley (28 May 2022). "Emerging Markets hit by worst sell-off in decades". Financial Times. Retrieved 2022-06-30.

- Vigna, Corrie Driebusch and Paul (2022-06-18). "The Crypto Party Is Over". Wall Street Journal. ISSN 0099-9660. Retrieved 2022-06-23.