Carbon pricing in Canada

Carbon pricing in Canada is implemented either as a regulatory fee or tax levied on the carbon content of fuels at the Canadian provincial, territorial or federal level. Provinces and territories of Canada are allowed to create their own system of carbon pricing as long as they comply with the minimum requirements set by the federal government; individual provinces and territories thus may have a higher tax than the federally mandated one but not a lower one. Currently, all provinces and territories are subject to a carbon pricing mechanism, either by an in-province program or by one of two federal programs.[1] As of April 2023 the federal minimum tax is set at CA$65 per tonne of CO2 equivalent, set to increase to CA$170 in 2030.[2][3]

| Part of a series about |

| Environmental economics |

|---|

|

In the absence of a provincial system, or in provinces and territories whose carbon pricing system does not meet federal requirements, a regulatory fee is implemented by the federal Greenhouse Gas Pollution Pricing Act (GHGPPA), which passed in December 2018. In provinces where the fee is levied, 90% of the revenues are returned to tax-payers.[4] The carbon tax is levied because of a need to combat climate change, which resulted in Federal commitments to the Paris Agreement. According to NASA's Jet Propulsion Laboratory (JPL), the air today contains 400 ppm of CO2 while the CO2 level average over the past 400,000 years was between 200 ppm and 280 ppm.[5][6]

Saskatchewan never had a carbon pricing system and other provinces—Manitoba, Ontario, New Brunswick, and Alberta—have opted out of previous provincial carbon tax systems. Revenue from the federal GHGPPA, which came into effect in April 2019, is redistributed to the provinces, either through tax credits to individual residents or to businesses and organizations that are affected by the tax but are unable to pass on the cost by raising consumer prices.[7][4]

The introduction of the tax was met with political resistance, mainly by the Conservative Party of Canada which attempted to "make the carbon tax the single issue" of the 2019 federal election campaign.[8] This argument did not succeed, as the Canadian voting public supported parties that also supported the carbon tax, leading CBC News to declare Canada's carbon tax to be "the big election winner" and "the only landslide victor" in this election.[9] Similarly, legal challenges to the law failed on March 25, 2021 when the Supreme Court of Canada rejected the 2019 appeal of the provinces of Manitoba, Ontario, Alberta, and Saskatchewan, ruling in Reference re Greenhouse Gas Pollution Pricing Act that GHGPPA was constitutional.[10]

History

Alberta becomes first jurisdiction in North America to put price on carbon

In 2003 Alberta signaled its commitment to manage greenhouse gas emissions by passing the Climate Change and Emissions Management Act. One of the first actions taken under this legislation was to develop a mandatory reporting program for large emitters in Alberta.

In March 2007 Alberta passed Specified Gas Emitters Regulation. The first compliance cycle was from July 1 to December 31, 2007.[11]

Quebec implements first carbon tax

In June 2007, Quebec implemented the first carbon tax in Canada which was expected to generate $2 million annually.[12]

On December 11, 2008, ExxonMobil CEO Rex Tillerson said that a carbon tax is preferable to a cap-and-trade program which "inevitably introduces unnecessary cost and complexity". A carbon tax is "a more direct, more transparent and more effective approach". Tillerson added that he hoped that the revenues from a carbon tax would be used to lower other taxes so as to be revenue neutral.[13]

2008: Dion election proposal

An unpopular revenue-neutral carbon tax was proposed in 2008 during the Canadian federal election, by Stéphane Dion, then leader of the Liberal Party. It was Dion's main platform and it allegedly contributed to the defeat of the Liberal Party with its worst share of the popular vote in the country's history.[14][15][16]

The Conservative party, who won the 2008 election, had promised to implement a North American-wide cap-and-trade system for greenhouse gases.[17] During the 2008 Canadian federal election, the Conservative party promised to develop and implement greenhouse gas emissions trading by 2015, also known as cap and trade, that encourage a certain type of behaviour through economic incentives regarding the control of emissions and pollution.[18][17]

2014 Ecofiscal Commission

In 2014 public policy economists and superannuated politicians came together to begin discussions on what would become the Canada's Ecofiscal Commission. The Commission was established with the participation of Paul Martin, Jim Dinning, Preston Manning, and Jack Mintz on November 4, 2014,[19] and became the leading advocacy group in Canada for carbon pricing.[20] They published reports in 2015,[21] 2016,[22] and 2017.[23]

2015: Trudeau pledges to act if elected

In February 2015, Justin Trudeau announced that he would impose carbon pricing if elected. The proposed system would resemble the medicare model in which provinces would design systems suitable for their needs with the federal government setting national targets and enforcing principles.[24]

2016: Paris Agreement

The Paris Agreement (French: Accord de Paris)[25] is an agreement within the United Nations Framework Convention on Climate Change (UNFCCC), dealing with greenhouse-gas-emissions mitigation, adaptation, and finance, signed in 2016. The agreement's language was negotiated by representatives of 196 state parties at the 21st Conference of the Parties of the UNFCCC in Le Bourget, near Paris, France, and adopted by consensus on 12 December 2015.[26][27] Under the Paris Agreement, each country must determine, plan, and regularly report on the contribution that it undertakes to mitigate global warming.[28] No mechanism forces[29] a country to set a specific target by a specific date.[30]

A special report by The Guardian in partnership with Climate Action Tracker, compared pledges made by some 200 countries that participated in the 2015 United Nations round of talks on a "new climate deal" hosted in Paris.[31] The co-authors wrote an in-depth analysis of 14 key countries and blocs, including Canada. The article, which summarized the report, said that Canada climate targets were the "weakest ... of any major industrialised economy which experts say was a "direct result" of Stephen Harper government's hard line policies" and its "promotion" of the "vast reserves of tar sands in Alberta" that are highly polluting".[32]

By December 2016 the ten provinces and the Canadian government presented their "executive, mitigation and adaptation" strategies towards a clean economy.[33] The "extensive document"—"Pan-Canadian Framework on Clean Growth and Climate Change"—"lean[-ed] heavily on carbon pricing".[23]

In 2018, Canada passed the GHGPPA implementing a revenue-neutral carbon tax starting in 2019,[34][35] which applies only to provinces whose carbon pricing systems created for their jurisdictions, did not meet federal requirements.[35] Revenue from the carbon tax will be redistributed to the provinces.[35]

According to a report by the Canadian Chamber of Commerce (CCC) released on December 13, 2018, Canada's largest business group endorsed the carbon pricing introduced by the federal government[36] saying it offers flexibility and is the "most efficient way to cut emissions"[37] and "solidly backs carbon pricing."[38] According to a December 13 CTV News article, Stewart Elgie, from the Ottawa-based Environment Institute at the University of Ottawa, the CCC's "endorsement of the carbon tax as the most efficient emissions-cutting tool" and its support of "Canada's investments in clean technology at home and abroad", provides the Canadian economy with a "major opportunity...to market itself in a low-carbon future".[36]

In December 2018, the Senate Committee on Agriculture and Forestry submitted their report based on a year-long study on the "impacts of climate change and carbon pricing on agriculture, agri-food and forestry".[39] Although some witnesses raised concerns that Canada's international competitiveness could be diminished compared with producers "who do not bear these additional, carbon-related costs". The Committee noted that a "study of the effects of British Columbia's carbon tax — which launched in 2008 — suggested the province's international competitiveness was not diminished".[39]: 10 The report recommended that Environment and Climate Change Canada, formerly known as Environment Canada, or EC consider exemptions for agricultural activities under the GHGPPA, with "special attention to competitiveness for producers and food affordability for Canadians". The Committee recommended exempting fuels used for heating or transportation in farming activities.[39]: 10

2018: Canadian government enacts GHGPPA

The Parliament of Canada passed the Greenhouse Gas Pollution Pricing Act (GHGPPA)[40] in the fall of 2018 under Bill C-74.[41][42] The GHGPPA refers to charge or pricing instead of taxation. The charge which will rise to $50 per tonne of CO2 by 2022, begins at CA$20 in 2019[43] and increases by CA$10 per year until 2022. Through the GHGPPA, provinces have the flexibility to create their own solutions to deal with GHG emissions in their own jurisdictions. Through the GHGPPA all provinces are required to place a minimum price of CA$20 a tonne of GHG emissions by January 1, 2019.[44] The tax will be retroactive to January.[45] The tax has increased to CA$30 in 2020 and to CA$40 per tonne as of April 2021.[46]

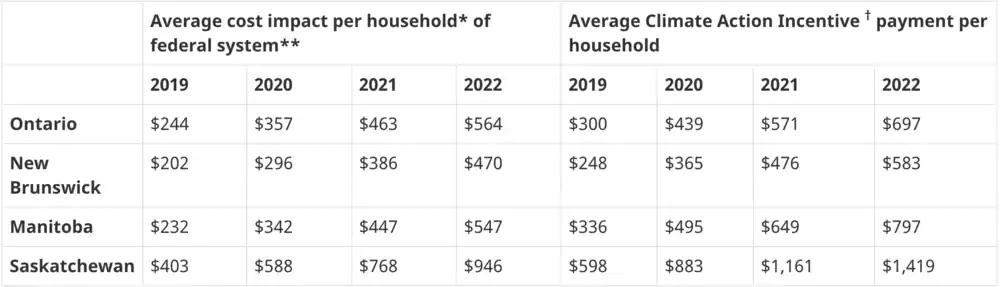

The federal government plans to send an annual rebate ranging from $300 to 600 adequate emissions pricing plans.[45] For example, if a family of 4 in Ontario pays CA$20 per month extra for gas, home heating and other costs, that same family will receive CA$307 in annual rebates. Compared to the CA$240 in costs, the GHGPPA should leave them CA$67 better off in 2019. The rebate benefit increases each year as the carbon price and the rebate both gradually rise.[47] Taxpayers had to request the Climate Action Incentive Payment (CAIP) rebate on their annual income tax return until filing their 2021 tax return, from which time eligibility for the rebate is automatic and the taxpayer sent a cheque or a direct deposit is made into their bank account.[48]

In her October 23, 2018 Power & Politics podcast, Vassy Kapelos interviewed Dominic LeBlanc, the Minister of Intergovernmental Affairs, Northern Affairs and Internal Trade, Saskatchewan Premier Scott Moe, and Ontario Minister of Environment Rod Phillips.[49]

Carbon pricing in Canada is forecast by Environment Canada to remove 50-60 MT of emissions from the air annually by 2022, which represents about 12% of all Canadian emissions. However, Canada needs to reduce emissions to 512 MT by 2030 to meet its Paris Climate Change accord. This would mean reducing annual emissions by about 200MT from the 2018 levels. In addition to carbon pricing, the government is pursuing a range of additional policies including improving fuel standards, energy efficiency, and closing coal plants.[50]

Forecast economic impact

A May 22, 2018 report by the Parliamentary Budget Officer (OFC) showed that carbon pricing would have at most a minor impact on the economy, with an increase in GDP in 2022 of about CA$2 billion, or 0.1% of GDP.[51]: 5

According to a 2018 report, British Columbia, which has had a carbon price since 2008, had the fastest growing economy in Canada.[52]

In their April 25, 2019 report, Canada's Parliamentary Budget Officer estimated that the federal government "will generate CA$2.63 billion in carbon pricing revenues in 2019-20."[53]: 1 The report said that the "vast majority of revenues (CA$2.43 billion) will be generated through the fuel charge; the balance, roughly CA$197 million, will be generated by output-based pricing."[53]: 1 According to the PBO report, there will be an estimated increase in carbon pricing revenues of CA$6.20 billion by 2023-24.—CA$5.77 billion from the fuel charge proceed and the rest from the OBPS[53]: 1 —a "trading system for large industry, known as the output-based pricing system (OBPS)".[53]: 16

"The federal government has stated that the carbon pricing system will be revenue neutral; any revenues generated under the system will be returned to the province or territory in which they are generated. Households will receive 90 per cent of the revenues raised. The remaining 10 per cent will go to support particularly affected sectors, including small businesses, schools, and hospitals. Based on this assumption, 80% of households will receive higher transfers than the amount paid in direct and indirect costs. The net benefits are broadly progressive by income group: lower-income households will receive larger net transfers than higher-income households."

— "Fiscal and Distributional Analysis of the Federal Carbon Pricing System". Parliamentary Budget Officer (OFC). April 25, 2019. p.3.

However, the Canadian Revenue Agency has declared that, as of June 3, 2019, the average payment to households was less than previously estimated. It amounted to CA$174 in New Brunswick, CA$203 in Ontario, CA$231 in Manitoba and CA$422 in Saskatchewan.[54]

2018: Constitutional challenges of GHGPPA

In 2019, the provinces of Manitoba, Ontario, Saskatchewan brought their case to the Supreme Court of Canada. On March 25, 2021, the justices rejected their appeal, ruling in Reference re Greenhouse Gas Pollution Pricing Act that the GHGPPA was constitutional.[10]

Carbon price in individual provinces and territories

By 2018, Quebec (2007), British Columbia (2008), Alberta, Ontario, Manitoba and Nova Scotia had carbon-pricing policies in place.[23] By 2017, Metro Vancouver was "exploring road fares and other fee-based mechanisms to address traffic congestion".[23] Ontario cancelled their cap and trade system in 2018. The outlines of a new climate plan for Ontario, which did not include any carbon pricing system, was unveiled in November 2018.[44]

Manitoba, Ontario, Saskatchewan, and New Brunswick refused to impose their own emissions pricing so the federal pricing came into effect on April 1. Residents of the four provinces pay more for gasoline and heating fuel. The "starting rate added 4.4 cents to the price of a litre of gas, about four cents to a cubic metre of natural gas". The price of propane, butane and aviation fuel will also increase. Residents will receive rebates on their income tax returns. Amounts will vary with each province.[57] In Saskatchewan for example, a family of four will receive $609 in 2019.[58]

British Columbia

The Government of British Columbia introduced a carbon tax in 2008.[59]

British Columbia was the first Canadian province to join the Western Climate Initiative (WCI), which was established in February 2007 by the governors of Arizona, California, New Mexico, Oregon, and Washington to reduce greenhouse gas emissions. The WCI became an international partnership when BC joined.[60] By 2011, BC's preference was for its existing carbon tax as opposed to the cap and trade proposed by the WCI.[61]

In 2013, Angel Gurría, then-Secretary-General of the Organisation for Economic Co-operation and Development (OECD), said that the "implementation of British Columbia's carbon tax is as near as we have to a textbook case, with wide coverage across sectors and a steady increase in the rate" over a period of five years.[62][63]

According to a November 2015 article in The Atlantic, after British Columbia's provincial government introduced a carbon tax in 2008, greenhouse emissions were reduced, "fossil fuel use in British Columbia [had fallen] by 16 percent, as compared to a 3 percent increase in the rest of Canada, and its economy ... outperformed the rest of the country." This proved that carbon tax benefits were "no longer theoretical" and that they did not hinder economic growth.[59]

Quebec

Quebec participates in an international emissions trading scheme with the US state of California.

In June 2007, Quebec implemented a carbon tax on energy distributors, producers, and refiners, the first Canadian province to do so. When announcing the new tax, Quebec Natural Resources Minister Claude Béchard said that industries would absorb the tax, which would total CA$200 million in revenue annually, instead of passing on the cost to consumers.[12] Of the 50 companies affected, the hardest hit would be oil companies, who would pay "about CA$69 million a year for gasoline, CA$36 million for diesel fuel, and CA$43 million for heating oil".[12] The tax would also affect natural gas distributors who would pay about CA$39 million and electricity distributor Hydro-Québec who would pay CA$4.5 million for its Sorel-Tracy, Quebec-based thermal energy plant.[12]

Saskatchewan

The Premier of Saskatchewan, Scott Moe, has spoken emphatically against the GHGPPA.[49] The Government of Saskatchewan released a report entitled "Prairie Resilience: A Made-in-Saskatchewan Climate Change Strategy" which he said in an October 23, 2018 interview with CBC's Vassy Kapelos, has been accepted by the federal government as meeting GHGPPA requirements.[64] The federal government assured residents of Saskatchewan that "all direct proceeds collected in Saskatchewan under the federal pollution pricing backstop system" would be paid "through direct payments to individuals and families and investments to reduce emissions, save money, and create jobs". For example, a family of four would "receive $609 in 2019".[58]

Alberta

In July 2007, Alberta enacted the Specified Gas Emitters Regulation, Alta. Reg. 139/2007,[65] (SGER). This tax[66][67] exacts a $15/tonne contribution by companies that emit more than 100,000 tonnes of greenhouse gas annually that do not reduce their CO2 emissions per barrel by 12 percent, or buy an offset.[68][69][70] In January 2016, the contribution required by large emitters increased to $20/tonne.[71] The tax fell heavily on oil companies and coal-fired electricity plants. It was intended to encourage companies to lower emissions while fostering new technology. The plan only covered the largest emitters, who produced 70% of Alberta's emissions.[70] Critics charged that the smallest energy producers are often the most casual about emissions and pollution.[70] The carbon tax is currently $20 per tonne.[72] Because Alberta's economy is dependent on oil extraction, the majority of Albertans opposed a nationwide carbon tax. Alberta also opposed a national cap and trade system. The local tax retains the proceeds within Alberta.[73]

On 23 November 2015, the Alberta government announced a carbon tax scheme similar to British Columbia's in that it would apply to the entire economy. All businesses and residents paid tax based upon equivalent emissions, including the burning of wood and biofuels. The tax came into force in 2017 at $20 per tonne.

On 4 June 2019 a carbon tax repeal bill was enacted.

In November 2015 Premier Rachel Notley and Alberta Environment Minister Shannon Phillips announced Alberta's carbon tax.[20]

In his Maclean's 2015 article, economist Trevor Tombe wrote that "[p]ricing carbon is one of the most sensible policy prescriptions to address greenhouse gas emissions".[20] Tombe listed the advantages and disadvantages. The carbon tax provides a "new source of revenue for the government".[20] The tax is a "far more efficient means of lowering greenhouse gas emissions than regulatory approaches."[20] As part of the process of researching and implementing the carbon tax, the Alberta government worked with a panel chaired by University of Alberta economist Andrew Leach to study a carbon tax based on "sensible, evidence-based policy advice", which Tombe described as "a model for other jurisdictions".[20] The price of the carbon tax began at CA$20 a tonne in 2017, rose to CA$30 a ton in 2018 and was tied to a 2% increase based on rising inflation, which Tombe considered to be "reasonable".[20] Tombe estimated the impact of the carbon tax on the 3 "most carbon-intensive consumer purchases". He estimated an increase in the price of gasoline of c. 6.7 cents per litre when the CA$30 a tonne tax came into effect. Natural gas prices would increase by about $1.50 /GJ.[20] "[L]ow to middle-income households" would "receive compensation".[20]

Premier Kenney joined like-minded premiers, including Doug Ford of Ontario, Scott Moe of Saskatchewan and Brian Pallister of Manitoba, in a lawsuit against the federal Liberal government on the carbon tax. The Court of Appeal of Alberta ruled against the federal government.[74] This decision was later overturned when the Supreme Court of Canada ruled that the federal carbon tax was constitutional.[75]

The first piece of legislation introduced by the newly-elected Premier of Alberta, Jason Kenney, was Bill 1: An Act to Repeal the Carbon Tax.[76] The bill repeals the provincial carbon tax, but it will be replaced by the federal carbon levy.[77]

Ontario

The Ontario Climate Change Mitigation and Low-Carbon Economy Act, 2016 passed by the government of Kathleen Wynne established a standard cap and trade system which integrates with the Western Climate Initiative (WCI) providing access to an "even greater market to buy and sell the most cost effective carbon credits."[78][79] Gary Goodwin called it the "best and most integrated solution to the problem of emissions."[78]

In September 2017, the Wynne government of Ontario joined the Western Climate Initiative (WCI), which was established in February 2007 by the governors of Arizona, California, New Mexico, Oregon, and Washington to reduce greenhouse gas emissions. *April 24, 2007: British Columbia joined with the five western states, turning the WCI into an international partnership[60] with the goal of developing a multi-sector, market-based program to reduce greenhouse gas emissions.and link its cap-and-trade system with Quebec's and California's in January 2018. This harmonized carbon market will be the second largest in the world, trailing only the EU Emissions Trading System (ETS) and will feature joint permit auctions. Because it allows for permit trading between jurisdictions, linked cap-and-trade systems achieve lower-cost mitigation actions across jurisdictions than an unlinked system.[60]

In October 2018, the newly-elected Progressive Conservative government under premier Doug Ford, cancelled the previous cap and trade system as he had promised in his electoral campaign.[80] In November, the Ontario government unveiled a climate plan which did "not include any kind of price on emissions".[81]

Gas station decals

_-_20290906_(cropped).jpg.webp)

In April 2019, the provincial government introduced the Federal Carbon Tax Transparency Act as part of its budget, which makes it mandatory for all gas stations (excluding those situated on Indian reserves) to display government-commissioned decals on their pumps informing customers of the claimed "cost" of the carbon tax—increasing gas prices by 4.4 cents per-litre, and increasing gas prices by up to 11 cents per-litre by 2022. The decals contain a URL for a page on the Ontario web site that explains its positions on the tax, but the decals do not mention the rebate programs. Gas stations may be inspected at "all reasonable times" for compliance with the Act, and owners may be fined CA$500 for their first violation, and CA$1,000 per-day if they persist. The fines increase to $5,000 and 10,000 for corporations.[82] The act became effective August 30, 2019.[83][84]

Federal Minister of Environment and Climate Change Catherine McKenna accused the Ford government of "wasting taxpayers' dollars on misleading stickers" which failed to acknowledge the rebate programs "or the cost of inaction on climate change".[82] The Act was criticized by the Ontario NDP, with MPP Peter Tabuns accusing Ford of "threatening private business owners with massive fines for failing to post Conservative Party advertisement[s]".[84][85] Fellow MPP Taras Natyshak issued a letter to the Chief Electoral Officer, alleging that the decals should be considered partisan campaign advertising under the Canada Elections Act due to the then-upcoming federal election. The government defended the decals and Act, considering it "transparency" that reminds Ontario residents of the "costs" of the Liberal carbon tax.[85][84] Green Party of Ontario leader Mike Schreiner accused Ford of "forcing businesses to be complicit in his anti-climate misinformation campaign", and invited gas stations to help him inform the public that "climate change will cost us more" with his own version of the decal.[86]

The Canadian Civil Liberties Association took the Ontario government to court over the mandatory stickers, arguing the messages were “a form of compelled political expression.” In September 2020, the Ontario Superior Court of Justice sided with CCLA, ruling that Ford's mandatory gas-pump decals attacking federal carbon-pricing measures are unconstitutional and violated business owners' freedom of expression.[87]

Northwest Territories

The Government of the Northwest Territories implemented a carbon price that took effect in September 2019.[88]

Output Based Pricing System (OBPS)

Most aspects of the federal government's Output Based Pricing System (OBPS) announced in December 2018, "which targets greenhouse gas emissions from large, industrial facilities", are similar to Alberta's Carbon Competitiveness Incentive Regulation (CCIR) which was also similar to Alberta's 2007 Specified Gas Emitters Regulation (SGER).[89] The three programs had a "price on carbon emissions" and a "system of allocations through which firms receive some number of emissions credits for free."[89] The OBPS rules apply to large facilities in Ontario, New Brunswick, Manitoba, Prince Edward Island, Saskatchewan, Yukon and Nunavut—the "provinces covered by the federal backstop policy."[89] The OBPS covers a "relatively small share of emissions in the provinces it affects."[89] Most emissions come from smaller emitters which "will be covered in large part by the carbon price". A University of Alberta professor of economics named Andrew Leach blogged that "Much of the coverage of this system has framed the OBPS as an exemption from emissions pricing for large emitters, but that hides the importance of the two, linked programs – the carbon price and the output-based allocation of credits."[89]

In the spring of 2018, the federal government had "proposed that all fossil fuel-burning generating stations be treated the same with the first 420 tonnes of greenhouse gases per gigawatt hour of electricity produced exempt from carbon taxes and everything above that subject to a charge."[90]

CBC reported in October 2018 that "natural gas stations face carbon taxes on emissions above 370 tonnes, oil on emissions above 550 tonnes and coal above 800 tonnes, a major concession to coal plants."[90][Notes 1]

Carbon tax and the 2019 federal election

In June 2018, John Ivison wrote in the National Post that the Conservative Party were attempting to make the carbon tax "the single issue" of the 2019 federal election campaign.[8] He argued that Andrew Scheer's leadership had interpreted Doug Ford's election as premier of Ontario as "an explicit rejection of the carbon tax".[8]

See also

Acts and Regulations for carbon pricing

| Legislation | Program | Act and regulation links |

|---|---|---|

| Alberta | ||

| British Columbia | ||

| Canada |

| |

| New Brunswick | ||

| Newfoundland and Labrador | ||

| Nova Scotia |

| |

| Ontario | ||

| Prince Edward Island | ||

| Quebec |

| |

| Saskatchewan |

Notes

- According to Robert Jones' CBC article, by 2016, the Irving Oil Refinery in Saint John, New Brunswick was the largest source of greenhouse gases in Atlantic Canada. Belledune Generating Station a 450 MW coal-fired electrical generating station owned and operated by provincial Crown corporation NB Power in Belledune, New Brunswick, was the second largest source.

References

- "Carbon Pricing in Canada (Updated 2020)". energyhub.org. September 24, 2020. Retrieved September 26, 2020.

- Canada, Department of Finance (October 23, 2018). "Backgrounder: Fuel Charge Rates in Listed Provinces and Territories". www.canada.ca.

- Canada, Environment and Climate Change (August 5, 2021). "Update to the Pan-Canadian Approach to Carbon Pollution Pricing 2023-2030". www.canada.ca.

- Nuccitelli, Dana (October 26, 2018). "Canada passed a carbon tax that will give most Canadians more money". The Guardian. Archived from the original on November 29, 2018. Retrieved January 1, 2019.

- Callery, Susan, ed. (nd). "Graphic: The relentless rise of carbon dioxide". Earth Science Communications Team. NASA's Jet Propulsion Laboratory, California Institute of Technology. Climate Change: Vital Signs of the Planet. Retrieved October 27, 2019.

- "Innovation Energy: Canada leads the way in carbon capture as more governments put a price on CO2". Financial Post, a division of Postmedia Network Inc. July 17, 2019.

- "Greenhouse Gas Pollution Pricing Act". Act No. SC 2018, c 12, s 186 of June 21, 2018. CANLII. Retrieved December 19, 2018.

- Ivison, John (June 18, 2018). "The carbon tax could be the ballot question in the 2019 federal election". National Post. Retrieved June 22, 2019.

- Bakx, Kyle (October 22, 2019). "The big election winner? The carbon tax". CBC News. Retrieved November 17, 2019.

- (Supreme Court of Canada March 25, 2021).Text

- "Annual Summary of Specified Gas Emitters Regulation: 2007-2008" (PDF). Government of Alberta.

- "Quebec to collect nation's 1st carbon tax". CBC. June 7, 2007. Archived from the original on April 14, 2018. Retrieved January 1, 2019.

- "Exxon supports carbon tax". Calgary Herald News. January 9, 2009. Archived from the original on January 22, 2009.

- Bryden, Joan (October 20, 2008). "Liberals cast themselves in leader's light". Toronto Star. Archived from the original on October 13, 2012. Retrieved January 1, 2019.

- Bilton, Chris (January 7, 2009). "Green shifting right?". Eye Weekly. Archived from the original on May 1, 2011.

- Reid, Scott (December 26, 2009). "The good, the (mostly) bad, and the faint signs of hope". The Globe and Mail. Archived from the original on March 8, 2009. Retrieved January 1, 2019.

- "Case of the Conservatives' carbon amnesia". The Globe and Mail. Archived from the original on June 18, 2018. Retrieved January 1, 2019.

- Stavins, Robert N. (November 2001). "Experience with Market-Based Environmental Policy Instruments" (PDF). Discussion Paper 01-58. Washington, D.C.: Resources for the Future. Archived from the original (PDF) on May 1, 2011. Retrieved May 20, 2010.

Market-based instruments are regulations that encourage behavior through market signals rather than through explicit directives regarding pollution control levels or methods

- "About Canada's Ecofiscal Commission". Canada's Ecofiscal Commission. n.d. Archived from the original on September 4, 2018. Retrieved August 5, 2018.

- Tombe, Trevor (November 23, 2015). "Here's what we know—and don't know—about Alberta's carbon tax". Macleans. Archived from the original on September 23, 2018. Retrieved August 5, 2018.

- "Ecofiscal Commission Annual Report 2015" (PDF). Archived (PDF) from the original on January 1, 2019. Retrieved January 1, 2019.

- "Ecofiscal Commission Annual Report 2016" (PDF). Archived (PDF) from the original on January 1, 2019. Retrieved January 1, 2019.

- "Ecofiscal Commission Annual Report 2017" (PDF). Archived (PDF) from the original on January 1, 2019. Retrieved January 1, 2019.

- McCarthy, Shawn (February 6, 2015). "Trudeau announces carbon-pricing plan if Liberals win election". The Globe and Mail. Archived from the original on November 12, 2018. Retrieved December 31, 2018.

- Also known as Paris climate accord or Paris climate agreement.

- Sutter, John D.; Berlinger, Joshua (12 December 2015). "Final draft of climate deal formally accepted in Paris". CNN. Cable News Network, Turner Broadcasting System, Inc. Archived from the original on 12 December 2015. Retrieved 12 December 2015.

- "Paris climate talks: France releases 'ambitious, balanced' draft agreement at COP21". ABC Australia. December 12, 2015.

- Article 3, Paris Agreement (2015)

- "Paris climate accord marks shift toward low-carbon economy". Globe and Mail. Toronto, Canada. 14 December 2015. Archived from the original on 13 December 2015. Retrieved 14 December 2015.

- Mark, Kinver (14 December 2015). "COP21: What does the Paris climate agreement mean for me?". BBC News. BBC. Archived from the original on 14 December 2015. Retrieved 14 December 2015.

- Caelainn Barr; Will Franklin; Troy Griggs; Karl Mathiesen; Matt Osborn; Adam Vaughan (October 16, 2015). "Which countries are doing the most to stop dangerous global warming?". The Guardian. Archived from the original on January 1, 2019. Retrieved December 20, 2018.Carbon dioxide equivalent CO2e emissions (MtCO2e)

- Goldenberg, Suzanne (October 16, 2015). "Compromised by weak target and dirty tar sands". The Guardian. Archived from the original on January 1, 2019. Retrieved December 20, 2018.

Vast reserves of tar sands oil in Alberta have meant Canada has maintained a hard line throughout the climate negotiations.

- "Pan-Canadian Framework on Clean Growth and Climate Change". London School of Economics (LSE). December 9, 2016. Retrieved August 5, 2018.

- Greenhouse Gas Pollution Pricing Act, in force since June 21, 2018 (page visited on October 26, 2018).

- Dana Nuccitelli, "Canada passed a carbon tax that will give most Canadians more money" Archived November 29, 2018, at the Wayback Machine, The Guardian, October 26, 2018 (page visited on October 26, 2018).

- Rabson, Mia (December 13, 2018). "Canada's largest business group 'very much in favour of' carbon pricing". CTV News via The Canadian Press (CP). Ottawa, Ontario. Archived from the original on December 17, 2018. Retrieved December 18, 2018.

- Rabson, Mia (December 17, 2018). "Carbon tax is the smartest way to target rising emissions: Canadian Chamber of Commerce". The Canadian Press. Archived from the original on December 17, 2018. Retrieved December 18, 2018.

- Chung, Emily (December 17, 2018). "Canadian Chamber of Commerce solidly backs carbon pricing: Businesses concerned about use of carbon pricing as 'political bargaining chip'". CBC News. Archived from the original on December 17, 2018. Retrieved December 18, 2018.

- Feast or Famine: Impacts of climate change and carbon pricing on agriculture, agri-food and forestry (PDF). Senate Committee on Agriculture and Forestry (Report). December 21, 2018. p. 77. Archived (PDF) from the original on January 1, 2019. Retrieved December 31, 2018.

- "First Reading". Bill C-74. March 27, 2018. Archived from the original on January 1, 2019. Retrieved December 19, 2018.

- "Second Reading". Bill C-74. May 28, 2018. Archived from the original on January 1, 2019. Retrieved December 19, 2018.

- "Third Reading". Bill C-74. June 21, 2018. Archived from the original on January 1, 2019. Retrieved December 19, 2018.

- Goodwin, Gary (July 6, 2018). "The pan-Canadian framework: Setting a price on carbon". Archived from the original on January 1, 2019. Retrieved December 18, 2018.

- "Ecojustice, Suzuki Foundation, want to back federal carbon pricing plan in court". City News via The Canadian Press. November 30, 2018. Archived from the original on January 1, 2019. Retrieved December 19, 2018.

- "Trudeau promises rebates from carbon tax in provinces without levy". Power & Politics. October 23, 2018. CBC. Retrieved December 19, 2018.

- "Canada's carbon price is set to increase by $10 on April 1". March 27, 2021.

- "Have you calculated your rebate?". Fair Path Forward.

- Nay, Isaac (July 14, 2022). "Eligible Ontarians can expect climate payment on Friday. Here's what you need to know". Toronto Star. Retrieved July 15, 2022.

- "Pollution and your pocketbook". Power & Politics. October 23, 2018. 44:04 minutes in. CBC News Network. Retrieved December 19, 2018.

- "Estimated impacts of the Federal Carbon Pollution Pricing System", Environment Canada, 2018, ISBN 978-0-660-26230-7, retrieved June 21, 2019

- "The Impact of a PanCanadian Carbon Pricing Levy on PBO's GDP Projection" (PDF), Parliamentary Budget Officer (PBO), Ottawa, Canada, p. 12, May 22, 2018, retrieved June 21, 2019

- "Alberta, B.C. lead provinces in GDP growth". The Globe and Mail. May 2, 2018. Retrieved June 21, 2019.

In 2017, Alberta experienced the "fastest expansion among the 10 provinces" with its GDP growing by 4.9 percent, representing a recovery after falling output in 2015 and 2016 when oil prices collapsed. In 2017, British Columbia posted its strongest pace of growth since 2008

- Fiscal and Distributional Analysis of the Federal Carbon Pricing System (PDF) (Report). Ottawa, Canada. April 25, 2019. p. 30. Retrieved October 27, 2019.

- "Canada's average carbon tax rebates are lower than the feds projected: data | Globalnews.ca". Global News.

- "Update to the Pan-Canadian Approach to Carbon Pollution Pricing 2023-2030". Environment and Climate Change Canada. August 5, 2021. Retrieved July 11, 2022.

- Tasker, John Paul (March 29, 2022). "Canada releases plan for a 40 per cent cut in carbon emissions by 2030". CBC News. Retrieved July 10, 2022.

- "Federal carbon tax kicks in for Ontario, Saskatchewan, Manitoba and New Brunswick". Global News. March 31, 2019. Retrieved May 23, 2019.

- "Government of Canada's response to Saskatchewan court decision". Government of Canada. May 3, 2019. Retrieved May 23, 2019.

- Halstead, Ted (November 16, 2015). "The Republican Solution for Climate Change; Republicans have the ability to offer a market-based solution to climate change, so why aren't they doing it?". The Atlantic. Washington, D.C. Archived from the original on August 25, 2018. Retrieved August 5, 2018.

- "B.C. joins Western Regional Climate Action Initiative". Office of the Premier. April 24, 2007. Archived from the original on April 25, 2017. Retrieved January 1, 2019.

- "Vancouver Sun 2011". Archived from the original on February 4, 2012. Retrieved January 1, 2019.

- Gurría, Angel (October 9, 2013). "The climate challenge: Achieving zero emissions". Organisation for Economic Co-operation and Development (OECD). Archived from the original on January 1, 2019. Retrieved December 31, 2018.

Since Sweden introduced its carbon tax in 1991, an additional nine OECD countries have followed suit. We have learned a lot from these experiences on how to introduce carbon taxes. For example, introducing the taxes incrementally over time can allow households and businesses to make smooth, efficient adjustments.

- Beaty, Ross; Lipsey, Richard; Elgie, Stewart (July 9, 2014). "The shocking truth about B.C.'s carbon tax: It works". The Globe and Mail. Toronto, Ontario. Archived from the original on December 11, 2015. Retrieved December 10, 2015.

- Prairie Resilience: A Made-in-Saskatchewan Climate Change Strategy (PDF) (Report). Government of Saskatchewan. 2017. Archived (PDF) from the original on January 1, 2019. Retrieved January 1, 2019.

- "Specified Gas Emitters Regulation, Alta Reg 139/2007". Retrieved December 11, 2013.

- "Alberta's carbon-tax windfall dilemma". The Globe and Mail. April 9, 2013. Archived from the original on September 4, 2015. Retrieved December 12, 2013.

- "The Tax Favored By Most Economists". Brookings. Archived from the original on September 2, 2013. Retrieved December 12, 2013.

- "To Spur Innovation, What Price to Put on Oil Sands Carbon? – Tyee Solutions Society". tyeesolutions.org. Archived from the original on November 15, 2012.

- "Carbon tax proposal a non-starter in Alberta". CBC News. January 8, 2008. Archived from the original on June 9, 2008. Retrieved August 19, 2010.

- "Go figure – a carbon tax crafted right here at home". The Calgary Herald. March 9, 2007. Archived from the original on May 11, 2011. Retrieved August 19, 2010.

- Wells, Victoria (June 25, 2015). "Alberta boosts carbon tax to $20 a tonne starting in 2016 as part of climate change plan". Financial Post. Archived from the original on September 20, 2016. Retrieved September 14, 2016.

- "Alberta Extends Climate Change Rules, Including $15 Tonne Carbon Levy". Huffpost Alberta. Archived from the original on December 8, 2015. Retrieved November 27, 2015.

- Simpson, Jeffery (January 22, 2010). "Many Albertans agree: A carbon tax was the best solution". The Globe and Mail. Archived from the original on April 22, 2010. Retrieved August 19, 2010.

- Abedi, Maham (February 25, 2020). "After losing in Alberta, carbon tax heads to Supreme Court — here's what to know". Global News. Retrieved April 29, 2021.

- Gilmore, Rachel (March 25, 2021). "Canada's carbon price is constitutional, Supreme Court rules". Global News. Retrieved April 29, 2021.

- "Bill Status Report for the 30th Legislature - 1st Session (2019)" (PDF), Legislative Assembly of Alberta, p. 2, June 20, 2019, retrieved June 20, 2019

- "Alberta makes it official: Bill passed and proclaimed to kill carbon tax". June 5, 2019. Retrieved July 25, 2019.

- Goodwin, Gary (July 20, 2018). "The pan-Canadian framework on climate change: Ontario v. Ottawa". Archived from the original on January 1, 2019. Retrieved December 18, 2018.

- [ ] July 20, 2018 Gary Goodwin

- "Ontario government passes legislation to cancel cap-and-trade". Global News. October 31, 2018. Retrieved September 24, 2020.

- "Eco, health groups and provinces seek status in carbon-tax court challenge". Windsor Star. November 30, 2018. Retrieved September 24, 2020.

- "Gas stations could be fined up to $10K if they don't display Ontario government carbon tax stickers". Global News. April 12, 2019. Retrieved August 14, 2019.

- "Ontario wants anti-carbon tax gas pump stickers displayed by Aug. 30". CTV News. Canadian Press. June 11, 2019. Retrieved August 14, 2019.

- "Steep fines coming for Ontario gas stations that don't display carbon tax warning signs". CTV News Toronto. April 12, 2019. Retrieved August 14, 2019.

- Walsh, Marieke (April 18, 2019). "NDP says Ford carbon tax stickers break federal election laws". iPolitics. Retrieved August 14, 2019.

- "'Climate change will cost us more': Ontario Green Party releases rival gas station sticker". Global News. May 2, 2019. Retrieved August 14, 2019.

- "Ontario court rules Doug Ford's gas-pump stickers attacking carbon-pricing are 'unconstitutional'". Toronto Star. September 4, 2020. Retrieved September 24, 2020.

- "Government of Northwest Territories Carbon Tax". Government of Northwest Territories. Government of Northwest Territories. Retrieved December 18, 2020.

- Leach, Andrew (December 23, 2018). "The federal output-based carbon pricing system works because it's not an exemption". Archived from the original on January 1, 2019. Retrieved December 25, 2018.

- Jones, Robert (October 30, 2018). "NB Power to dodge major carbon taxes after Ottawa proposes looser rules on coal plants". CBC News. Archived from the original on November 29, 2018. Retrieved December 25, 2018.