Absa Group

Absa Group Limited (JSE: ABG[1]), commonly known simply as Absa and formerly the Amalgamated Banks of South Africa (ABSA) until 2005 and Barclays Africa Group Limited until 2018, is a multinational banking and financial services conglomerate based in Johannesburg, South Africa and listed on the Johannesburg Stock Exchange. It offers personal and business banking, credit cards, corporate and investment banking, wealth and investment management and bank assurances.[6]

Logo used since 2018 | |

| Formerly |

|

|---|---|

| Type | Public |

| JSE: ABG[1] | |

| Industry | |

| Founded | 1986[2] |

| Headquarters | Johannesburg, South Africa[3] |

Area served | |

Key people |

|

| Products | |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 60,000+ (2020) |

| Subsidiaries | List of subsidiaries |

| Website | www |

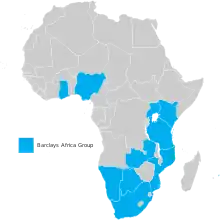

Operating in 10 Sub-Saharan African countries including in-house South Africa such as Botswana, Ghana, Kenya, Mauritius, Mozambique, Seychelles, Tanzania, Uganda and Zambia,[6] the conglomerate maintains representative offices in Namibia and Nigeria[6] and internationals offices in London[7] and New York City.[8] Absa had assets of US$91 billion as of October 2019.[9]

History

Formation of ABSA and Barclays Africa Group Limited (1991–2017)

Absa Group began with the incorporation Amalgamated Banks of South Africa (ABSA) Limited in 1986 from a merger of the United Building Society Holdings South Africa, Allied Bank South Africa, Volkskas Bank Group and certain interests of the Sage Group.[2] In 1992, ABSA acquired the entire shareholding prowess of the Bankorp Group (which included TrustBank, Senbank and Bankfin).[2] In 1997, ABSA changed name of the holding company was changed to ABSA Group Limited and adopted a new corporate identity. It consisted of three main operating divisions, whose brands; "United", "Volkskas", "Allied" and "TrustBank" brands were retired the following year in favor of the ABSA brand.[10]

In May 2005, Barclays of the United Kingdom purchased 56.4% stake in Absa,[11] which was criticized by the then-governor of the South African Reserve Bank, Tito Mboweni, who said he "had yet to see the benefits of Barclays' management of Absa".[12] With the acquisition, ABSA Group Limited was rebranded as Barclays Africa Group Limited.

Snakes incident

In 2004 a disgruntled ABSA client released five[13] puff adders into the bank's head office in Johannesburg following a six year dispute with the bank over the repossession of his car.[14] One person was injured in the incident when their finger was bitten and the client was later convicted under the offense of aggravated assault.[15]

Bank charges (2005-2012)

.jpg.webp)

Finweek Bank Charges Reports from 2008 through 2010[16] found Absa Group Limited to be the most expensive bank in South Africa.[17][18][19] Pay-as-you-transact (PAYT) fees increased 82% from 2005 to 2010.[18] The 2012, Finweek Bank Charges Report ranked Absa's Gold Value Bundle as the cheapest package option amongst the four banks that were compared. The report has also shown Absa's PAYT pricing structure to have reduced by 25% by 2013, leaving it third cheapest in the overall ranking at that time.[20]

In 2013, the group acquired the entire issued share capital of Barclays Africa Limited and issued 129,540,636 Consideration Shares to Barclays Africa Group Holdings Limited (a wholly owned subsidiary of Barclays) thus increasing the shareholding of Barclays plc to 62.3%.[21] The Consideration Shares were listed on the JSE from the commencement of trading on 31 July 2013. The name change from "ABSA Group Limited" to "Barclays Africa Group Limited" was completed in August 2013.[21]

In 2017, the South African Public Protector, Busisiwe Mkhwebane, found that the bailout of R1.125 billion that Absa's predecessor Bankorp Group had received between 1985 and 1992 from the Reserve Bank was illegal, and recommended that Absa be forced to pay back R2.25 billion, the current equivalent of the amount.[22][23] The report was set aside by the Pretoria High Court,[24] finding that "The public protector did not conduct herself in a manner which would be expected from a person occupying the office of the public protector."[25] The court assessed some costs of the case personally against Mkhwebane due to her conduct,[26][27] an order upheld by the Constitutional Court of South Africa in July 2019.[28][29][30]

Absa Group Limited (2018-present)

Barclays Bank Plc in 2018 owned 14.9 percent of Absa Group Limited.[31] In March 2018, Barclays Africa announced the group's name would revert to Absa Group Limited, effective 30 May 2018.[32] The company underwent rebranding in 2018, inclusive of a new logo and slogans.[33]

Absa opened an international office in London in September 2018,[7] then in 2019, opened another international office in New York City.[8] As of October 2019, according to Club of Mozambique, Absa Group Limited had total assets in excess of US$91 billion.[9] ABGL in 2020 was the majority shareholder of 11 banks located in Botswana, Ghana, Kenya, Mauritius, Mozambique, Seychelles, South Africa, Tanzania (two entities), Uganda and Zambia.[6] In March 2022, Sello Moloko was appointed Group Chairman and Arrie Rautenbach was appointed CEO, and its fourth CEO in three years. The company had been without a CEO for eleven months after the abrupt resignation of Daniel Mminele.[4] In August 2022, Barclays Plc sold its remaining stake in Absa, which it had acquired in 2005, selling 7.4 percent of Absa's issued capital for $620 million.[34]

Overview and structure

Absa Group Limited's shares are listed on the JSE Limited stock exchange.[31] In 2020, Absa Bank Kenya and Absa Bank Botswana continue to be listed on their respective stock exchanges.[35]

Major shareholders

Below is the Absa Group's 10 largest shareholders as at 15 January 2019:[36]

| Current Majority shareholders | 15 January 2019 (%) |

|---|---|

| Barclays plc (UK) | 14.88 |

| Public Investment Corporation (SA) | 6.53 |

| Deutsche Securities | 4.28 |

| Old Mutual Asset Managers (SA) | 3.56 |

| BlackRock, Inc. (US, UK) | 3.48 |

| FIL Limited (UK) | 3.18 |

| Prudential Investment (SA) | 3.18 |

| Citigroup Global Markets | 3.01 |

| The Vanguard Group (US, AU) | 3.00 |

| Schroders Plc | 2.92 |

| Others | 51.98 |

| Geographical holding (by owner) | 31 Dec 2018 (%) |

|---|---|

| United Kingdom | 27.27 |

| South Africa | 40.47 |

| United States and Canada | 17.64 |

| Other countries | 14.62 |

Subsidiaries

- Absa Bank Limited (100%)

- Absa Financial Services Limited (100%)

- Absa Bank Botswana (67.8%)

- Absa Bank Ghana (100%)

- Absa Bank Kenya (68.5%)

- Absa Bank Mauritius (100%)

- Absa Bank Mozambique (98.1%)[37]

- Absa Bank Seychelles (99.8%)

- Absa Bank Uganda (100%)

- Absa Bank Zambia (100%)

- National Bank of Commerce Limited (55%)

- Absa Bank Tanzania (100%)

Legal matters

ABSA v. Sweet

Mortgage loans misconduct

In South Africa, banks have to secure consent from the borrower if the bank wishes to securitise the loan, allowing the bank to bundle in the loan with other loans and sell it to new owners.[38][39][40]

In 2014, South African courts made a number of rulings against Absa's mortgage loan division in a number of previous summary judgements against clients who had taken out loans with the bank and who the bank had accused of defaulting on their loans. In August 2014, Absa brought a case against James Grobbelaar and Kevin Jenzen for allegedly defaulting on their home loans. However, Absa was unable to provide proof of the loan agreements, claiming that they had been destroyed in a fire in 2009 and instead presented an unsigned blank loan agreement.[38]

In November 2014, Absa withdrew a similar case it had brought in the North Gauteng High Court against Emmarentia and Monica Liebenberg for allegedly defaulting on loans taken out in 2007, with the bank being unable to provide a copy of the signed documents that the bank claimed to be the loan agreement they were enforcing.[39] The Liebenberg's accused the bank of trying to bully them "into submission, by threatening legal costs and expenses and by pursuing a wrongful summary judgement application knowing full well the massive disputes involved". The Liebenbergs also stated in their affidavit that the bank had inflated the interest rate of the loan and charged additional fees that had never been agreed to and would have been illegal even if they had been written into a signed agreement.[39]

See also

References

- "Absa Group Limited". JSE Limited. 25 July 2018. Retrieved 25 July 2018.

- "ABSA Group". Barclays Group Archives. Barclays PLC. Archived from the original on 5 January 2016. Retrieved 28 December 2015.

- "Contact Us". Absa Group Limited. Retrieved 11 July 2022.

- "Absa Bank appoints Arrie Rautenbach as new CEO, ending leadership vacuum". Business Live. 29 March 2022. Retrieved 29 March 2022.

- "Financial results for the reporting period ended 31 December 2019" (PDF). Absa Group Limited. 20 March 2020. pp. 125–127. Archived from the original (PDF) on 12 April 2020. Retrieved 12 April 2020.

- "Country operations". Absa Group Limited. Retrieved 27 March 2020.

- "Absa opens UK office, hopes to profit from post-Brexit trade in Africa". News24. 13 September 2018. Retrieved 4 February 2021.

- Rumney, Emma; Richardson, Alex (11 November 2019). "South Africa's Absa to open New York office by end of the year". Reuters. Retrieved 16 February 2020.

- Adrian Frey (23 October 2019). "Barclays in Mozambique rebranding as Absa Bank". Maputo: Club of Mozambique. Retrieved 14 November 2019.

- Wright, Chris (1 November 2013). "Better late than never for Barclays-Absa merger". Euromoney. Retrieved 31 August 2017.

- "ABSA Group 2005 Annual Report" (PDF). ABSA Group. 31 March 2005. Retrieved 7 January 2016.

- "Mboweni fires confounding salvo at Barclays". Business Report. 30 March 2007. Archived from the original on 4 November 2012. Retrieved 30 December 2017.

- "Charges altered against Absa snake man". The Mail & Guardian. 18 May 2005. Retrieved 11 March 2023.

- "Absa told: 10 snakes still there". News24. Retrieved 11 March 2023.

- Molwedi, Phomello (19 May 2005). "Snake man is guilty - and it's not over yet". IOL.

- David McKay. "SA's most expensive bank: Absa". Fin24.com. Archived from the original on 19 August 2008. Retrieved 19 August 2008.

- Fin24.com reporter. "SA outraged by bank 'fleecing'". Fin24.com. Archived from the original on 10 September 2009. Retrieved 2009-11-11.

- Fin24.com reporter (27 September 2010). "SA's most expensive bank". Fin24.com. Retrieved 9 February 2011.

- "Afriforum: Standard Bank and Absa is South Africa's most expensive banks". Afriforum. 3 November 2010. Archived from the original on 6 November 2010. Retrieved 9 February 2011.

- "Finweek reports on bank charges. 2012" (PDF). Archived from the original (PDF) on 30 August 2013. Retrieved 4 March 2014.

- "Why Barclays Africa is rebranding back to Absa "with an African identity"". African Business. 2 March 2018. Retrieved 20 January 2022.

- Wet, Athandiwe Saba, Phillip de. "Absa may have to pay back apartheid-era bailout billions". The M&G Online. Retrieved 18 January 2017.

{{cite news}}: CS1 maint: multiple names: authors list (link) - "Don't Let The Politics Get In the Way Of Understanding This Explosive Detail In Mkhwebane's Absa Report". Huffington Post South Africa. Archived from the original on 18 January 2017. Retrieved 18 January 2017.

- Groenewald, Yolandi (16 February 2018). "Public Protector's ABSA bailout report set aside". Mail & Guardian. Johannesburg, South Africa. Archived from the original on 13 June 2018.

- Feltham, Luke; Kekana, Mashadi (13 June 2018). "The case against Mkhwebane". Mail & Guardian. Johannesburg, South Africa.

- Bateman, Barry (28 March 2018). "Mkhwebane loses appeal on costs order in Absa-Bankorp matter". Eye Witness News (EWN). Archived from the original on 28 March 2018.

- Maughan, Karyn (9 July 2018). "Busisiwe Mkhwebane still fighting R900'000 legal bill". Times Live. Johannesburg, South Africa: Tiso Blackstar Group. Archived from the original on 9 July 2018.

- Niselow, Tehillah (22 July 2019). "ConCourt upholds cost order against Mkhwebane, rules she was 'not honest' in Absa investigation". News24.

- "Public protector Busisiwe Mkhwebane must pay up in Reserve Bank/Absa matter". TimesLIVE. Retrieved 29 July 2019.

- Wyk, Pauli Van (22 July 2019). "MKHWEBANE JUDGMENT: Bad faith, dishonest, biased, reprehensible behaviour, not up to standard, falsehoods — the storm that broke over Mkhwebane". Daily Maverick. Retrieved 29 July 2019.

- Nancy Mwape (17 July 2018). "Absa Assures Barclays Customers of Smooth Transition". Zambia Daily Mail. Lusaka. Retrieved 9 November 2019.

- "Proposed Change of Name" (PDF). Barclays Africa Group Limited. 1 March 2018. Archived from the original (PDF) on 8 May 2018. Retrieved 7 May 2018.

- "Here is Absa's brand new look". BusinessTech. 11 July 2018. Retrieved 11 July 2018.

- "Barclays Exits Absa Group in Latest Retreat from Africa". 31 August 2022. Retrieved 26 March 2023 – via www.bloomberg.com.

- Kenneth Mosekiemang (18 February 2020). "Absa Resumes Trading on BSE". Weekend Post Botswana. Gaborone. Retrieved 27 March 2020.

- Absa Group (15 January 2019). "Shareholders". Absa Group Limited. Retrieved 15 January 2019.

- Adrian Frey (23 October 2019). "Barclays in Mozambique rebranding as Absa Bank". Maputo: Club of Mozambique. Retrieved 14 November 2019.

- "Smack down for Absa in Joburg High Court". ACTS. 4 August 2014. Retrieved 2 December 2014.

- "Absa gets snot-klapped in Pretoria High Court by women's army". ACTS. 30 November 2014. Retrieved 2 December 2014.

- "Securitisation: a conspiracy of silence" (PDF). New Economic Rights Alliance. Archived from the original (PDF) on 21 September 2014. Retrieved 2 December 2014.