Criminal Assets Bureau

The Criminal Assets Bureau (CAB) (Irish: An Biúró um Shócmhainní Coiriúla) is a law enforcement agency in Ireland. The CAB was established with powers to focus on the illegally acquired assets of criminals involved in serious crime. The aims of the CAB are to identify the criminally acquired assets of persons and to take the appropriate action to deny such people these assets. This action is taken particularly through the application of the Proceeds of Crime Act 1996.[2] The CAB was established as a body corporate with perpetual succession in 1996[3] and is founded on the multi-agency concept, drawing together law enforcement officers, tax officials, social welfare officials as well as other specialist officers including legal officers, forensic analysts and financial analysts.[4] This multi-agency concept is regarded by some as the model for other European jurisdictions.[5][6][7][8]

| Criminal Assets Bureau | |

|---|---|

| |

| Agency overview | |

| Formed | 15 October, 1996 |

| Employees | 91 (total)

|

| Annual budget | €8.832 million[1] |

| Jurisdictional structure | |

| National agency (Operations jurisdiction) | IE |

| Operations jurisdiction | IE |

| |

| Map of Criminal Assets Bureau's jurisdiction | |

| Size | 70,273 km2 |

| Population | 4,784 million (2017) |

| Legal jurisdiction | Ireland |

| Constituting instrument | |

| General nature | |

| Operational structure | |

| Headquarters | Harcourt Square, Harcourt Street, Dublin 2 |

| Elected officer responsible | |

| Agency executives |

|

| Notables | |

| Award |

|

| Data as of Annual Report 2021 | |

The CAB is not a division of the Garda Síochána (police)[9][10] but rather an independent body corporate although it has many of the powers normally given to the Gardaí.[11] The Chief Bureau Officer is drawn from a member of the Garda Síochána holding the rank of Chief Superintendent and is appointed by the Garda Commissioner. The remaining staff of the CAB are appointed by the Minister for Justice.[12] CAB members retain their original powers as if they were working within their separate entities and have direct access to information and databases that their original organisations are allowed by law. [13] This ability to share information was described by the Garda Síochána Inspectorate in its Crime Investigation Report of October 2014 as "a good model that could be replicated outside of CAB".[14]

The CAB reports annually to the Minister through the Commissioner of the Garda Síochána and this report is laid before the Houses of the Oireachtas.[15] The Minister for Justice, in publishing the 2011 CAB Annual Report, stated: "The work of the bureau is one of the key law enforcement responses to tackling crime and the Government is very much committed to further strengthening the powers of the bureau through forthcoming legislative proposals."[16] In publishing the Bureau's 2012 report the Minister for Justice set out: "The Annual Report provides an insight into the workings of the Bureau and highlights the advantage of adopting a multi-agency and multi-disciplinary approach to the targeting of illicit assets. The Bureau is an essential component in the State’s law enforcement response to serious and organised crime and the Government is fully committed to further strengthening its powers through future legislative reform."[17]

The Minister for Justice set out that Ireland, through the work of the Bureau, has established itself as a jurisdiction that is responding to that challenge and the work of the Bureau is internationally recognised as a best practice approach to tackling criminality and the illicit monies it generates.[18]

The CAB has been effective against organised criminals, especially those involved in the importation and distribution of drugs. It has also been used against corrupt public officials and terrorists.[19][20]

Legislative framework

The Law Reform Commission provides consolidated legislation relating to the Bureau, namely:

- Criminal Assets Bureau Act 1996 (updated to 28 May 2019)

- Proceeds of Crime Act 1996 (updated to 30 July 2018)

The Proceeds of Crime Acts were amended further by the Proceeds of Crime (Amendment) Act 2016. The Proceeds of Crime (Amendment) Act 2016 is designed to facilitate the seizure of property which is suspected to be the proceeds of crime by expanding the powers of the Criminal Assets Bureau to seize those proceeds. This act amends the Proceeds of Crime Act 1996 in two key respects. First, it allows the Criminal Assets Bureau to seize property which it suspects to be the proceeds of crime for up to 21 days. Second, it reduces the threshold value of property which can be pursued by the Criminal Assets Bureau from €13,000 to €5,000.[21]

Objectives

The statutory objectives of the CAB are –

- the identification of the assets of persons which derive, or are suspected to derive, directly or indirectly from criminal conduct;

- the taking of appropriate action under the law to deprive or to deny those persons of such assets or the benefit of such assets, and

- the pursuit of any necessary investigation or other preparatory work in relation to relevant proceedings.[22]

The emergence of CAB signalled a more focused approach on targeting the financial proceeds of crime than previously existed.[23]

Overview

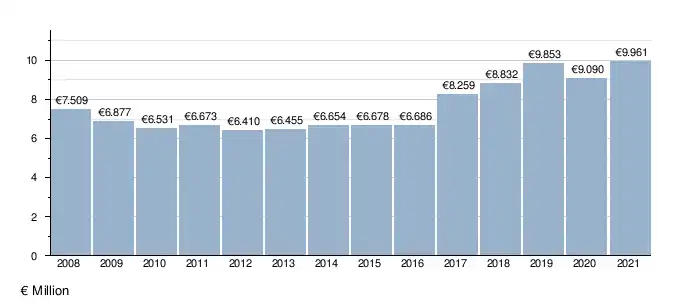

The CAB collected €89 million in taxes in its first ten years of existence and it also engaged in initiatives to curtail international criminality.[24] The CAB has a staff of 91, including members of Garda Síochána, Revenue Commissioners, (both customs and taxes officers), and civil servants from the Department of Social Protection and the Department of Justice.[25] Its annual budget for 2011 was €6.673 million, of which 86% is salary cost.[26] This was reduced to €6.410 million in 2012, but has increased to 8.832m Euro in 2018.

Budget

The budget of the Bureau over the period 2008 to 2021 was as follows:

Officers and staff

Officers and staff of the CAB (with the exception of members of the Garda Síochána and the Bureau Legal Officer) are protected with statutory anonymity.[27] This anonymity, whilst causing some concerns, has been recognised an important practical issue for all countries when faced with action against people who may be involved in violent crime and extortion and recognises that although police and customs officers are usually trained to deal with such threats and to expect them, revenue and social security officials do not reasonably expect to have to deal with such risks when they take a job.[28]

A number of people have been convicted for threatening CAB officers:

- Christopher Pratt was sentenced in 2013 to three years in prison for threatening to "take the head off" a CAB officer.[29]

- Paschal Kelly was sentenced in 2015 to four-and-a-half years in prison for threatening a CAB officer, tax evasion and serious driving offences, and more recently in February 2019 was sentenced to 18 years in prison following a conviction for a "tiger kidnapping".[30]

Fachtna Murphy was the first Chief Bureau Officer and Barry Galvin[31] was the first Bureau Legal Officer.[32] The current Chief Bureau Officer is Detective Chief Superintendent Michael Gubbins[33] (who succeeded Pat Clavin[34]) and the current Bureau Legal Officer is Kevin McMeel. The former Bureau Legal Officer was Declan O'Reilly.[35][36] The Bureau Legal Officer is appointed following a recruitment campaign run by the Public Appointments Service.[37]

Background

The Criminal Assets Bureau was established on 15 October 1996 by the then Minister for Justice, Nora Owen TD.[38] The CAB was established to deal with increasing levels of serious organised crime in Ireland, most notable being the murders of crime reporter Veronica Guerin and Detective Garda Jerry McCabe.[39][40][41]

The CAB was set up by the Oireachtas as a body corporate primarily for the purpose of ensuring that persons should not benefit from any assets acquired by them from any criminal activity. It was given power to take all necessary actions in relation to seizing and securing assets derived from criminal activity, certain powers to ensure that the proceeds of such activity are subject to tax, and also in relation to the Social Welfare Acts. However, as the High Court has noted, it is not a prosecuting body nor a police authority but rather it is an investigating authority which, having investigated and used its powers of investigation, then applies to the High Court for assistance in enforcing its functions.[42]

Proceeds of crime

A novel or radical aspect[43] of the CAB was the use of civil forfeiture to freeze and seize the proceeds of criminal conduct under the Proceeds of Crime Act, 1996. Ireland was one of the first countries to introduce civil forfeiture.[44] Civil forfeiture involved a recognition on the part of the State that conventional methods of tackling organised crime were ineffective.[45] Whilst the CAB was perhaps intended to confiscate the assets of drug dealers and those involved in organised crime its powers can extend to all assets that are the result of criminal activity.[46] Even though the CAB focuses on serious and organised crime, it has increasingly moved against low- and medium-level offenders who may present as poor role models within their communities, albeit that these cases often cost more to bring than they return financially.[47] The CAB has been distinguished from other agencies who tackle serious organised crime in Ireland in that those agencies may be typified as being reactive whereas the CAB is proactive; a fact which may be considered as representing a significant development in crime control.[48] Whilst novel to Ireland, the concept of forfeiture in the absence of a criminal conviction has a long ancestry, with roots in ancient Rome and evidence of its lineage in the Old Testament. It has long been an important feature of the jurisprudence of the US and has recently been adopted in other common law jurisdictions, including the UK and the Cayman Islands, in their proceeds of crime legislation.[49]

In 2005, the CAB's powers were amended by Part 3 of the Proceeds of Crime (Amendment) Act 2005.[50] The purpose of this Act was to make further provision in relation to the recovery and disposal of proceeds of crime. This involved amending four different acts as follows:

- the Proceeds of Crime Act 1996,

- the Criminal Assets Bureau Act 1996,

- the Criminal Justice Act 1994, and

- the Prevention of Corruption (Amendment) Act 2001.

The Act was intended to substantially bolster the powers of the CAB in the continuing battle to target the proceeds of all types of crime and will extend those powers to the proceeds of white-collar crime and corruption. The substantial provisions of the Act extended the proceeds of crime legislation to cover foreign criminality and corrupt enrichment. In addition, there were a number of technical provisions relating to court procedures, search powers and evidence.[51]

Under the Proceeds of Crime Act 1996 and 2005, if the CAB can satisfy the High Court on the balance of probabilities that specified property is the proceeds of crime, the court will make an interim order over the property preventing anybody from dealing with it. This order stays in place for 21 days, following which an application is made for an interlocutory hearing, on notice to any person who has an interest in that property. If it appears to the court that such property is the proceeds of crime, despite anything said by any respondent, an interlocutory order is put in place for a period of seven years. In the course of that time any person who can satisfy the court that the property is not the proceeds of crime can move to have the order lifted. If no such order has been granted during those seven years, the CAB can seek a disposal order effectively extinguishing anybody's rights to the properties and transferring it to the central exchequer.[52] In April 2014, Deputy Eamonn Maloney sponsored a private members Bill to amend the Proceeds of Crime Acts.[53] Section 1 of the Bill seeks to reduce the seven-year period to two years. This Bill was listed before the Dáil on Friday 8 May 2015[54] and is viewed as a move by the Government to toughen the laws on confiscating criminals' assets and similarly is expected to yield a multimillion-euro windfall for the taxpayer.[55] As the Bill is a Private Members' Bill, its referral to Select Committee on Justice, Defence and Equality was required pursuant to the Standing Orders 82A and 118.[56]

In July 2016, the statutory threshold of €13,000 as set out under the Proceeds of Crime Act, 1996 was reduced to €5,000.[57] This was done to facilitate the Bureau in targeting mid-level proceeds of crime.[58]

This Irish model, including the Irish legislation, the innovative multi-agency Criminal Assets Bureau approach, as well as judicial dicta, has played a central role in the expansion of the non-conviction based approach across the common law world.[59]

Constitutional and human rights debate

Some have suggested that, for example, a bridal gift from a perpetual tax evader to his daughter might now find itself on the responding end of an order from the CAB.[60] The limits of the legislation are uncertain and accordingly, the Proceeds of Crime Act 1996 and 2005 has been subject to academic review. Writing in 2014, one academic concluded:

"The Proceeds of Crime Act was hastily rushed through parliament in the summer of 1996 in the wake of significant concerns surrounding organized crime and little thought was given to its implications, and likely effectiveness, of this legislation... Ireland will continue to be driven by this sense of populist punitiveness whereby harsh regimes are introduced for no other reason than that they are appealing."[61]

Others conclude that civil forfeiture and recovery is a potent crime fighting device:

"Civil recovery is a particularly useful device where the offender is unavailable for prosecution or where it is difficult to obtain sufficient evidence to obtain a conviction against him, primarily because of the reluctance of witnesses to testify. Hence, it is an important tool for dealingwith crime bosses who are usually divorced from the day-to-day activities of their enterprise and thus insulated from detection and prosecution."[49]

Civil forfeiture holds with the view that it is not enough to prosecute the perpetrator but recognises the importance of also combatting the driving forces behind the criminal act.[62]

The Supreme Court,[63] however, in reviewing the Proceeds of Crime Act 1996 concluded:

... as has been pointed out, repeatedly, a person directly or indirectly in possession of the proceeds of crime can have no constitutional grievance if deprived of their use. The Proceeds of Crime Acts 1996–2005 are identified as being legislation "to enable the High Court, as respects the proceeds of crime, to make orders for the preservation and, where appropriate, the disposal of property concerned and to provide for related matters". There is a strong public policy dimension to this legislation. That policy is to ensure that persons do not benefit from assets which were obtained with the proceeds of crime irrespective of whether the person benefiting actually knew how such property was obtained with the proceeds of crime but subject to whether or not such person may have been a bona fide purchaser for value, where different considerations may arise. The Act provides for fair procedures to be observed. It cannot be seen as arbitrary. It is designed to achieve a desirable social objective and be proportionate. It cannot be said to impinge on a right to private property, as the property was acquired unlawfully. One of the facts to be borne in mind is the extent to which, as a result of the commission of crime, persons may directly or indirectly benefit in a way not open to other members of the community, such as living without the requirements of payments of tax, mortgage repayments or rent. These activities are profoundly anti-social and contrary to the common good. The interference with the rights of private property embodied in Article 40.3.2 and Article 43 of the Constitution and Article 8 of the European Convention on Human Rights are, therefore, proportionate and in accordance with law.

— MacMenamin J.

Similar legislation in England and Wales has also withstood constitutional scrutiny in its highest courts.[64] In 2014, the Supreme Court of India addressed the issue of whether forfeiture of property violated Article 20 of the Constitution of India. In deciding that forfeiture did not violate the constitution, the Indian Supreme Court[65][66] cited with approval the Irish High Court decision in Gilligan v Criminal Assets Bureau.[67] It noted that non-conviction based asset forfeiture model was also to be found in various countries: United States of America, Italy, Ireland, South Africa, UK, Australia and certain provinces of Canada. Similar civil forfeiture legislation was found to be constitutional compliant in Bulgaria.[68]

Ad Hoc Legal Aid

The Department of Justice operated the CAB Ad Hoc Legal Aid Scheme until 2014.[69] However, from 1 January 2014 the remit for the administration of the Scheme transferred to the Legal Aid Board.[70] The scheme is applicable to persons who are respondents and/or defendants in any court proceedings brought by, or in the name of, the CAB or its Chief Bureau Officer or any member of the CAB, including court proceedings under the Proceeds of Crime Act 1996, Revenue Acts or Social Welfare Acts.

The scheme also includes:

- social welfare appeals made to the Circuit Court under Section 34 of the Social Welfare Act 1997;

- tax appeals made to the Circuit Court under the Taxes Acts where the CAB or its Chief Bureau Officer or any member of the CAB is the respondent and/or defendant; and

- applications made by the Director of Public Prosecutions under Section 39 of the Criminal Justice Act 1994

The Ad Hoc Legal Aid Scheme provides that the grant of legal aid, including the level of legal representation and/or witness expenses allowed, is a matter for the court with the appropriate jurisdiction to deal with the specific case. The calculation of fees which apply to counsel representing the legally aided person is made in accordance with the mechanism which is in operation under the Criminal Justice (Legal Aid) Act 1962 and the Regulations made under that Act.

The CAB Ad Hoc Legal Aid Scheme cost €334,000 in 2009, up 18% from the previous year's figure of €283,000. It cost €257,000 in 2010.[71]

In October 2014, the Department of Public Expenditure and Reform suggested that the State could cut its criminal legal aid bill by using the Criminal Assets Bureau to carry out a "more thorough" analysis of defendants' ability to pay.[72]

Outcomes

From the Bureau's establishment in October 1996 up to end of 2011 the Bureau successfully froze over €70m worth of criminals' assets. It also collected €137m of the €200m demanded in unpaid taxes, interest and penalties. CAB also made social welfare savings of almost €6m and recovered over €2m in fraudulently claimed welfare.[55] According to the Annual Report for 2017, the total amount of funds restrained was in excess of €4.8 million. However, one case currently under investigation accounts for approximately €3.5 million. Tax recovered by the Bureau during 2017 amounted to €2.374m from fifty one individuals / entities and as a result of actions by Social Welfare Bureau Officers, a total sum of €319,720.31 was returned to the Exchequer in 2017.[73]

International cooperation

The statutory functions of the Criminal Assets Bureau include the taking of all necessary actions for the purpose of the freezing and confiscation of assets suspected of deriving from criminal activity and that such actions include, where appropriate, subject to any international agreement, cooperation with any police force or any authority outside Ireland which has functions related to the recovery of proceeds of crime.[74][75][76]

CAB represents Ireland at the Camden Assets Recovery Interagency Network (CARIN), a group which aims to improve informal cross-border and inter-agency cooperation within the European Union and elsewhere. CAB currently sits on the CARIN steering group. The CAB held the presidency of CARIN in 2005 and again in 2013.[77]

EU Council Decision 2007/845/JHA obliges Member States to set up or designate national Asset Recovery Offices (AROs) as national central contact points which facilitate, through enhanced cooperation, the fastest possible EU-wide tracing of assets derived from crime. This Decision was designed to complete the CARIN by providing a legal basis for the exchange of information between Asset Recovery Offices of all the Member States.[78] The Decision allows the AROs to exchange information and best practices, both upon request and spontaneously, regardless of their status (administrative, law enforcement or judicial authority). It requests AROs to exchange information under the conditions laid down in Framework Decision 2006/960/JHA2 ("the Swedish Initiative") and in compliance with the applicable data protection provisions. Ireland designated the Criminal Assets Bureau as its ARO.[79][80]

In 2008 a Cross Border Fuel Fraud Enforcement Group was established by the Northern Ireland Security Minister, Paul Goggins, and operates under the auspices of the Organised Crime Task Force.[81] On this group, which is chaired by HM Revenue and Customs, sits the Police Service of Northern Ireland (PSNI), Serious Organised Crime Agency (SOCA), the Northern Ireland Environment Agency together with the CAB, the Revenue Commissioners and the Garda Síochána.[82][83] The Criminal Assets Bureau is also represented on the Joint Agency Task Force, which was created under the "Fresh Start Agreement" to identify strategic priorities for combatting cross-border organised crime and to oversee operational co-ordination.[84]

The CAB is a member partner of Organised Crime Portfolio (OCP) (HOME/2011/ISEC/AG/FINEC/400000222) which is funded by EU Commission, DG Home Affairs and is carried out by an international consortium coordinated by Transcrime – Università Cattolica del Sacro Cuore (Milan, Italy). The aims of the project are to study the investments of organised crime in European Union Member States, analyse the infiltration of organised crime groups and assess the impact on legitimate markets.[85]

See also

References

- "CAB Annual Report 2015" (PDF). Department of Justice. Archived (PDF) from the original on 29 October 2016. Retrieved 28 October 2016.

- "Country legal profiles". European Monitoring Centre for Drugs and Drug Addiction. Archived from the original on 27 January 2013. Retrieved 27 April 2013.

- Criminal Assets Bureau Act 1996, s. 3: Establishment of Bureau (No. 31 of 1996, s. 3). Enacted on 11 October 1996. Act of the Oireachtas. Retrieved from Irish Statute Book.

- Criminal Assets Bureau Act 1996, s. 9: Staff of Bureau (No. 31 of 1996, s. 9). Enacted on 11 October 1996. Act of the Oireachtas. Retrieved from Irish Statute Book.

- Dr. Oliver Lajić (2012). "Uporedni pregled sistema za istraživanje i oduzimanje imovine stečene kriminalom" [Comparative review of the investigation and confiscation of criminal assets] (PDF). Zbornik Radova Pravnog Fakulteta, Novi Sad (in Serbian). Proceedings of the Faculty of Law in Novi Sad – Centre for Evaluation in Education and Science. 46 (2): 207–222. doi:10.5937/zrpfns46-2419. Archived (PDF) from the original on 3 December 2013. Retrieved 24 March 2013.

- Mitchell, Gay (2012). "Asset Confiscation as an Instrument to Deprive Criminal Organisations of the Proceeds of their Activities" (PDF). Special Committee on Organised Crime, Corruption and Money Laundering – (CRIM) 2012–2013. Archived (PDF) from the original on 21 December 2013. Retrieved 21 March 2013.

- Cormac O’Keeffe (16 October 2009). "European Criminal Assets Bureau based on CAB". Irish Examiner. Archived from the original on 28 October 2013. Retrieved 24 March 2013.

- "Minister Shatter publishes the Criminal Assets Bureau Annual Report for the year ending 31 December, 2011" (Press release). Dublin: Department of Justice. 26 April 2013. Archived from the original on 2 May 2013. Retrieved 26 April 2013.

The Bureau is a very well developed model for the confiscation of proceeds of crime. This is recognised not only in this jurisdiction but also at international level where the experience of the Bureau is much valued. I have therefore taken steps at EU level to encourage my European colleagues to study the Bureau model and to consider this model in the further development of the EU confiscation framework allowing for mutual recognition of confiscation orders.

- Murphy v. Flood [1999] IEHC 9 at para. 16 (1 July 1999) (Ireland)

- Barbara Vettori (2006). Tough on Criminal Wealth: Exploring the Practice of Proceeds from Crime Confiscation in the EU. Springer. p. 73. ISBN 978-1-4020-4129-7. Retrieved 11 May 2013.

- King, Colin (June 2010). The Confiscation of Criminal Assets: Tackling Organised Crime Through a 'Middleground' System of Justice (PDF) (PhD). University of Limerick. p. 115. Archived (PDF) from the original on 4 April 2019. Retrieved 25 March 2013.

- McKenna, Felix; Egan, Kate (2009). "Chapter 3: Ireland: a multi-disciplinary approach to proceeds of crime". In Young, Simon (ed.). Civil Forfeiture of Criminal Assets – Legal Measure for Targeting the Proceeds of Crime. Edward Elgar Publishing Ltd. pp. 52–91. ISBN 9781847208262.

- Jensson, Arnar (2011). Crime should not pay: Iceland and the International Developments of Criminal Assets Recovery (PDF) (M.A.). University of Iceland (School of Social Sciences). Archived from the original (PDF) on 13 November 2014. Retrieved 23 March 2013.

- Garda Síochána Inspectorate (October 2014). Crime Investigation Report (Report). p. 8. Archived from the original on 13 November 2014. Retrieved 13 November 2014.

The Inspectorate believes that the sharing of information by these agencies is a good model that could be replicated outside of CAB.

- "Criminal Assets Bureau (CAB)". International Association of Anti-Corruption Authorities. Archived from the original on 12 February 2013. Retrieved 21 March 2013.

{{cite web}}: CS1 maint: unfit URL (link) - Judith Crosbie (26 April 2013). "State recoups €6.5m through Cab investigations". The Irish Times. Archived from the original on 30 April 2013. Retrieved 26 April 2013.

- "Minister Shatter publishes the Criminal Assets Bureau Annual Report for the year ending 31 December 2012" (Press release). Dublin. MerionStreet.ie. 9 April 2014. Archived from the original on 13 April 2014. Retrieved 10 April 2014.

- "Minister Fitzgerald publishes the Criminal Assets Bureau Annual Report for 2013" (Press release). Dublin. Department of Justice. 8 October 2014. Archived from the original on 13 October 2014. Retrieved 8 October 2014.

- "CAB to lead anti-terrorism efforts here". The Irish Times. 28 September 2001. Archived from the original on 4 March 2016. Retrieved 22 June 2015.

- Paul O'Mahony (2002). Criminal justice in Ireland. Institute of Public Administration. p. 9. ISBN 978-1-902448-71-8. Archived from the original on 3 January 2014. Retrieved 11 May 2013.

- Hooper, Megan; Barton, Séan (28 October 2016). "Anti-corruption & Bribery in Ireland". lexology.com. Archived from the original on 28 October 2016. Retrieved 28 October 2016.

- Criminal Assets Bureau Act 1996, s. 4: Objectives of Bureau (No. 31 of 1996, s. 4). Enacted on 11 October 1996. Act of the Oireachtas. Retrieved from Irish Statute Book.

- 'The Governance of Crime and Security in Ireland (PDF) (Report). UCD. Archived (PDF) from the original on 8 March 2014. Retrieved 22 March 2013.

- "'Untouchables' of CAB make our criminals pay up to the tune of €16m". Irish Independent. 26 August 2006. Archived from the original on 3 March 2016.

- 'Criminal Assets Bureau Annual Report 2010' (PDF) (Report). Archived (PDF) from the original on 12 February 2019. Retrieved 11 February 2019.

- Criminal Assets Bureau (29 June 2011). Criminal Assets Bureau Annual Report 2011 (PDF) (Report). Department of Justice. Archived from the original (PDF) on 13 April 2014. Retrieved 27 April 2013.

- Criminal Assets Bureau Act 1996, s. 9: Anonymity (No. 31 of 1996, s. 9). Enacted on 11 October 1996. Act of the Oireachtas. Retrieved from Irish Statute Book.

- Combating Organised Crime: Best-Practice Surveys of the Council of Europe. Council of Europe. 2004. p. 69. ISBN 978-92-871-5476-7. Archived from the original on 4 July 2014. Retrieved 11 May 2013.

- Magee, Jessica (29 January 2013). "Man is jailed for threat to 'take head off' detective". Irish Independent. Archived from the original on 4 April 2015. Retrieved 23 March 2015.

- "Gang member jailed for 18 years over tiger kidnapping". The Irish Times. Retrieved 29 August 2023.

- "'Ireland's Eliot Ness'". The Lawyer. 26 April 1999. Archived from the original on 13 April 2014. Retrieved 21 March 2013.

- "The Men from the Bureau". Irish Independent. 17 April 1999. Archived from the original on 13 April 2014. Retrieved 21 March 2013.

- David Hurley (7 May 2020). "Limerick man appointed as head of the Criminal Assets Bureau". Limerick Leader. Retrieved 29 July 2022.

- Tom Brady (27 July 2016). "Garda chief reshuffles her senior team". Irish Independent. Archived from the original on 11 August 2016. Retrieved 10 August 2016.

- "Extra-Mural Course in White-Collar Crime". Trinity College Dublin. Archived from the original on 4 April 2013. Retrieved 22 March 2013.

- "Confiscation and Recovery of Criminal Assets" (PDF). Irish Centre for European Law. Archived from the original (PDF) on 13 April 2014. Retrieved 28 April 2013.

- Public Appointments Service: Annual Report 2012. Public Appointments Service. Archived from the original on 13 April 2014. Retrieved 10 April 2014.

- Criminal Assets Bureau Act 1996 (Establishment Day) Order 1996 (No. 310 of 1996). Enacted on 15 October 1996. Act of the Oireachtas. Retrieved from Irish Statute Book.

- Hunt, Patrick. Criminal Assets Bureau and Taxation Matters. Taxation Conference of the Bar of Ireland. The Bar Council of Ireland.

- "Amanda meets ... former politician Nora Owen". Sunday World. Archived from the original on 11 April 2013. Retrieved 21 March 2013.

- Simser, Jeffrey (2008). "Perspectives on Civil Forfeiture" (PDF). University of Hong Kong. Archived (PDF) from the original on 24 April 2014. Retrieved 23 March 2013.

{{cite journal}}: Cite journal requires|journal=(help) - Murphy v. Flood [1999] IEHC 9 (1 July 1999) (Ireland)

- King, Colin (June 2010). The Confiscation of Criminal Assets: Tackling Organised Crime Through a 'Middleground' System of Justice (PDF) (PhD). University of Limerick. p. 21. Archived (PDF) from the original on 4 April 2019. Retrieved 25 March 2013.

- Grigorov, Grigor; Kuzmanova, Nikoleta; Zarkov, Krum; Galabov, Antoniy. Forfeiture of Illegal Assets: Challenges and perspectives of the Bulgarian approach (PDF). Transparency International - Bulgaria. p. 7. ISBN 978-954-2999-07-2. Archived from the original (PDF) on 11 August 2014. Retrieved 25 July 2014.

- Campbell, Liz (2008). "The Culture of Control in Ireland: Theorising Recent Developments in Criminal Justice". Web Journal of Current Legal Issues. 1: 12. Archived from the original on 11 March 2013. Retrieved 23 March 2013.

- O'Mahoney, Paul (2002). Criminal Justice in Ireland. Institute of Public Administration. p. 173. ISBN 1902448715.

- RAND Europe – Final Report Prepared for the European Commission Directorate-General Home Affairs (DG HOME) (DRR-5380-EC) (29 May 2012). Study for an impact assessment on a proposal for a new legal framework on the confiscation and recovery of criminal assets (PDF) (Report). European Commission Directorate-General Home Affairs (DG HOME. Archived from the original (PDF) on 16 July 2014.

- King, Colin (June 2010). The Confiscation of Criminal Assets: Tackling Organised Crime Through a 'Middleground' System of Justice (PDF) (PhD). University of Limerick. p. 139. Archived (PDF) from the original on 4 April 2019. Retrieved 25 March 2013.

- Ali, Shazeeda (2014). "The civil law: a potent crime-fighting device". Journal of Money Laundering Control. Emerald Group Publishing Limited. 17 (1): 4–16. doi:10.1108/JMLC-11-2013-0042. Archived from the original on 15 July 2014. Retrieved 13 July 2014.

- Proceeds of Crime (Amendment) Act 2005 (No. 1 of 2005). Enacted on 12 February 2005. Act of the Oireachtas. Retrieved from Irish Statute Book.

- "No. 1 of 2005 – Proceeds of Crime (Amendment) Act 2005". Archived from the original on 22 February 2011.

- Cassidy, Francis H (2009). "Targeting the Proceeds of Crime: An Irish Perspective" (PDF). In Greenberg, Theodore S.; Samuel, Linda M.; Grant, Wingate; et al. (eds.). Stolen Asset Recovery: A Good Practices Guide for Non-Conviction Based Asset Forfeiture. The International Bank for Reconstruction and Development / The World Bank. pp. 153–16210. doi:10.1596/978-0-8213-7890-8. ISBN 978-0-8213-7890-8. Archived (PDF) from the original on 10 May 2013. Retrieved 28 April 2013.

- "Proceeds of Crime (Amendment) Bill 2014 [PMB]". oireachtas.ie/viewdoc.asp?DocID=25915&&CatID=59. 15 April 2014. Archived from the original on 28 July 2014. Retrieved 25 July 2014.

- "This Week in the Houses of the Oireachtas 4 - 8 May 2015". oireachtas.ie. Houses of the Oireachtas. 6 May 2015. Archived from the original on 18 May 2015. Retrieved 7 May 2015.

- Downing, John (6 May 2015). "New law will let CAB sell off top criminals' assets in just two years". The Herald. Archived from the original on 18 May 2015. Retrieved 7 May 2015.

- "Proceeds of Crime (Amendment) Bill 2014): Second Stage [Private Members] (Continued)". oireachtas.ie. 8 May 2015. Archived from the original on 19 May 2015. Retrieved 8 May 2015.

- Proceeds of Crime (Amendment) Act 1996, s. 4 (No. 8 of 2016, s. 4). Enacted on 27 July 2016. Act of the Oireachtas. Retrieved from Irish Statute Book.

- "Tánaiste brings new bill on CAB property seizures to Dáil". UTV Ireland. 14 July 2016. Archived from the original on 20 August 2016. Retrieved 10 August 2016.

- King, Colin (February 2014). "Chapter 1: Emerging Issues in the Regulation of Criminal and Terrorist Assets" (PDF). In King, Colin; Clive, Walker (eds.). Dirty Assets: Emerging Issues in the Regulation of Criminal and Terrorist Assets. Ashgate. ISBN 978-1-4724-0786-3.

- S. N. M. Young (1 January 2009). Civil Forfeiture of Criminal Property: Legal Measures for Targeting the Proceeds of Crime. Edward Elgar Publishing. p. 354. ISBN 978-1-84844-621-2. Archived from the original on 19 October 2014. Retrieved 11 May 2013.

- King, Colin (February 2014). "Chapter 7: 'Hitting Back' at Organized Crime: The Adoption of Civil Forfeiture in Ireland". In King, Colin; Clive, Walker (eds.). Dirty Assets: Emerging Issues in the Regulation of Criminal and Terrorist Assets. Ashgate. ISBN 978-1-4724-0786-3.

- Korsell, Lars; Hansen, Helén Örnemark (2014). "Kapitel 1 - Vad är tillgångsinriktad brottsbekämpning?" (PDF). Gå på pengarna - Antologi om tillgångsinriktad brottsbekämpning (in Swedish). Vol. 2014. Brå. ISBN 978-91-87335-25-9. Archived (PDF) from the original on 15 July 2014. Retrieved 14 July 2014.

- CAB v. Kelly & anor [2012] IESC S64 at para. 32 (29 November 2012), Supreme Court (Ireland)

- King, Colin (2014). "Civil Forfeiture and Article 6 of theECHR: Due Process Implications forEngland and Wales and Ireland". Journal of Money Laundering Control. Legal Studies. 34 (2): 371–394. doi:10.1111/lest.12018. S2CID 143242769. Archived from the original on 25 September 2021. Retrieved 14 July 2014.

- Biswanath Bhattacharya -v- Union of India & Ors, 2014 STPL(Web) 40 SC (Supreme Court of India 2014-01-21).

- "Biswanath Bhattacharya vs Union Of India & Ors on 21 January, 2014". Judgment Information System. Archived from the original on 23 September 2016. Retrieved 16 September 2016.

- Murphy v. M. (G.) [2001] IESC 82 at para. 124 (18 October 2001) (Ireland)

- Grigorov, Grigor; Kuzmanova, Nikoleta; Zarkov, Krum; Galabov, Antoniy. Forfeiture of Illegal Assets: Challenges and perspectives of the Bulgarian approach (PDF). Transparency International - Bulgaria. p. 9. ISBN 978-954-2999-07-2. Archived from the original (PDF) on 11 August 2014. Retrieved 25 July 2014.

- "Criminal Assets Bureau (CAB) Ad Hoc Legal Aid Scheme". Department of Justice. Archived from the original on 26 January 2013. Retrieved 27 April 2013.

- "Criminal Assets Bureau Ad-hoc Legal Aid Scheme". Legal Aid Board. Archived from the original on 13 April 2014. Retrieved 10 April 2014.

- International Legal Aid Group (2011). National Report – Ireland – ILAG Conference, Helsinki (PDF) (Report). p. 7. Archived (PDF) from the original on 10 December 2013. Retrieved 27 April 2013.

- Mac Cormaic, Ruadhán (25 October 2015). "Criminal Assets Bureau could be used to cut legal aid bills, department suggests". The Irish Times. 13 November 2014. Archived from the original on 4 March 2016. Retrieved 20 February 2020.

{{cite news}}: CS1 maint: location (link) - "Criminal Assets Bureau: Annual Report 2017" (PDF). Archived (PDF) from the original on 12 February 2019. Retrieved 11 February 2019.

- Criminal Assets Bureau Act 1996, s. 5: Functions of Bureau (No. 31 of 1996, s. 5). Enacted on 11 October 1996. Act of the Oireachtas. Retrieved from Irish Statute Book.

- Kennedy, Anthony (2006). "Designing a civil forfeiture system: an issues list for policymakers and legislators" (PDF). Journal of Financial Crime. Emerald Group Publishing Limited. 13 (2): 132–146. doi:10.1108/13590790610660863. Archived (PDF) from the original on 12 August 2014. Retrieved 23 March 2013.

- Kennedy, Anthony (2007). "Winning the information wars: Collecting, sharing and analysing information in asset recovery investigations". Journal of Financial Crime. Emerald Group Publishing Limited. 14 (4): 372–404. doi:10.1108/13590790710828136. Retrieved 23 March 2013.

- "CARIN – Camden Assets Recovery Interagency Network (Criminal Assets Bureau)". eu2013.ie. Archived from the original on 4 March 2016. Retrieved 21 March 2013.

- 'COUNCIL DECISION 2007/845/JHA of 6 December 2007 concerning cooperation between Asset Recovery Offices of the Member States in the field of tracing and identification of proceeds from, or other property related to, crime' (Report). Archived from the original on 19 December 2013. Retrieved 2 April 2013.

- 'COM(2011) 176 final – Report from the Commission to the European Parliament and to the Council based on Article 8 of the Council Decision 2007/845/JHA of 6 December 2007 concerning cooperation between Asset Recovery Offices of the Member States in the field of tracing and identification of proceeds from, or other property related to, crime' (PDF) (Report).

- Council Decision 2007/845/JHA of 6 December 2007 concerning cooperation between asset recovery offices of the Member States in the field of tracing and identification of proceeds from, or other property related to, crime – notification (PDF) (Report). 22 January 2009.

- "Cross-border group to tackle fuel fraud". RTÉ News. RTÉ. 19 June 2008. Archived from the original on 21 February 2014. Retrieved 7 April 2013.

- House of Commons – Northern Ireland Affairs Committee. Fuel laundering and smuggling in Northern Ireland (Third Report of Session 2010 -12) (Report). p. 17.

- "New cross-border group to tackle fuel fraudsters". Breaking News. 19 June 2008. Archived from the original on 22 February 2014. Retrieved 7 April 2013.

- "The Fresh Start Agreement - Department of Foreign Affairs and Trade". Archived from the original on 22 February 2019. Retrieved 22 February 2019.

- "Organised Crime Portfolio". Archived from the original on 23 November 2013. Retrieved 27 April 2013.

External links – Annual Reports

- CAB Annual Report 2003

- CAB Annual Report 2004

- CAB Annual Report 2005

- CAB Annual Report 2006

- CAB Annual Report 2007

- CAB Annual Report 2008

- CAB Annual Report 2009

- CAB Annual Report 2010

- CAB Annual Report 2011

- CAB Annual Report 2012

- CAB Annual Report 2013

- CAB Annual Report 2014

- CAB Annual Report 2015

- CAB Annual Report 2016

- CAB Annual Report 2017

- CAB Annual Report 2018

- CAB Annual Report 2019

- CAB Annual Report 2020

- CAB Annual Report 2021