Croatia and the euro

Croatia adopted the euro as its currency on 1 January 2023, becoming the 20th member state of the eurozone. A fixed conversion rate was set at 1 € = 7.5345 kn.[1]

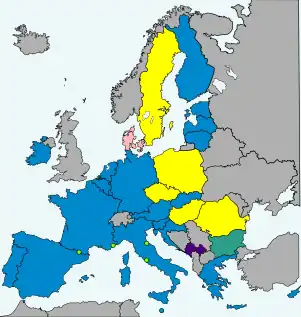

- European Union member states

-

5 not in ERM II, but obliged to join the eurozone on meeting the convergence criteria (Czech Republic, Hungary, Poland, Romania, and Sweden)

- Non–EU member states

Croatia's previous currency, the kuna, used the euro (and prior to that one of the euro's major predecessors, the German mark or Deutsche Mark) as its main reference since its creation in 1994, and a long-held policy of the Croatian National Bank was to keep the kuna's exchange rate with the euro within a relatively stable range.[2]

Croatia's European Union (EU) membership obliged it to introduce the euro once it had fulfilled the euro convergence criteria.[3] Prior to Croatian entry to the EU on 1 July 2013, Boris Vujčić, governor of the Croatian National Bank, stated that he would like the kuna to be replaced by the euro as soon as possible after accession.[4] This had to be at least two years after Croatia joined the European Exchange Rate Mechanism (ERM II), in addition to it meeting other criteria. Croatia joined ERM II on 10 July 2020.[5] Prime Minister Andrej Plenković stated in November 2020 that Croatia intended to adopt the euro on 1 January 2023,[6] and in December 2020 the Croatian government adopted an action plan for euro adoption.[7]

Many small businesses in Croatia had debts denominated in euros before EU accession.[8] Croatians already used the euro for most savings and many informal transactions. Real estate, motor vehicle and accommodation prices were mostly quoted in euros.

On 18 July 2022, the Croatian Mint began producing euro coins with Croatian national motifs.[9][10][11]

Public opinion

- Public support for the euro in Croatia[12]

Convergence status

In its first assessment under the convergence criteria in May 2014, the country satisfied the inflation and interest rate criteria, but did not satisfy the public finances, ERM membership, and legislation compatibility criteria.[13] Subsequent convergence reports published in June 2016, May 2018 and June 2020 came to the same conclusions.

The report published in June 2022 concluded Croatia fulfilled all the criteria for adopting the euro.[14]

| Assessment month | Country | HICP inflation rate[15][nb 1] | Excessive deficit procedure[16] | Exchange rate | Long-term interest rate[17][nb 2] | Compatibility of legislation | ||

|---|---|---|---|---|---|---|---|---|

| Budget deficit to GDP[18] | Debt-to-GDP ratio[19] | ERM II member[20] | Change in rate[21][22][nb 3] | |||||

| 2014 ECB Report[nb 4] | Reference values | Max. 1.7%[nb 5] (as of 30 Apr 2014) |

None open (as of 30 Apr 2014) | Min. 2 years (as of 30 Apr 2014) |

Max. ±15%[nb 6] (for 2013) |

Max. 6.2%[nb 7] (as of 30 Apr 2014) |

Yes[23][24] (as of 30 Apr 2014) | |

| Max. 3.0% (Fiscal year 2013)[25] |

Max. 60% (Fiscal year 2013)[25] | |||||||

| 1.1% | Open | No | -0.8% | 4.8% | No | |||

| 4.9% | 67.1% | |||||||

| 2016 ECB Report[nb 8] | Reference values | Max. 0.7%[nb 9] (as of 30 Apr 2016) |

None open (as of 18 May 2016) | Min. 2 years (as of 18 May 2016) |

Max. ±15%[nb 6] (for 2015) |

Max. 4.0%[nb 10] (as of 30 Apr 2016) |

Yes[26][27] (as of 18 May 2016) | |

| Max. 3.0% (Fiscal year 2015)[28] |

Max. 60% (Fiscal year 2015)[28] | |||||||

| -0.4% | Open | No | 0.3% | 3.7% | No | |||

| 3.2% | 86.7% | |||||||

| 2018 ECB Report[nb 11] | Reference values | Max. 1.9%[nb 12] (as of 31 Mar 2018) |

None open (as of 3 May 2018) | Min. 2 years (as of 3 May 2018) |

Max. ±15%[nb 6] (for 2017) |

Max. 3.2%[nb 13] (as of 31 Mar 2018) |

Yes[29][30] (as of 20 March 2018) | |

| Max. 3.0% (Fiscal year 2017)[31] |

Max. 60% (Fiscal year 2017)[31] | |||||||

| 1.3% | None | No | 0.9% | 2.6% | No | |||

| -0.8% (surplus) | 78.0% | |||||||

| 2020 ECB Report[nb 14] | Reference values | Max. 1.8%[nb 15] (as of 31 Mar 2020) |

None open (as of 7 May 2020) | Min. 2 years (as of 7 May 2020) |

Max. ±15%[nb 6] (for 2019) |

Max. 2.9%[nb 16] (as of 31 Mar 2020) |

Yes[32][33] (as of 24 March 2020) | |

| Max. 3.0% (Fiscal year 2019)[34] |

Max. 60% (Fiscal year 2019)[34] | |||||||

| 0.9% | None | No | 0.0% | 0.9% | No | |||

| -0.4% (surplus) | 73.2% | |||||||

| 2022 ECB Report[nb 17] | Reference values | Max. 4.9%[nb 18] (as of April 2022) |

None open (as of 25 May 2022) | Min. 2 years (as of 25 May 2022) |

Max. ±15%[nb 6] (for 2021) |

Max. 2.6%[nb 18] (as of April 2022) |

Yes[35][36] (as of 25 March 2022) | |

| Max. 3.0% (Fiscal year 2021)[35] |

Max. 60% (Fiscal year 2021)[35] | |||||||

| 4.7% | None | 1 year, 10 months | 0.1% | 0.8% | Yes | |||

| 2.9% | 79.8% (exempt) | |||||||

- Notes

- The rate of increase of the 12-month average HICP over the prior 12-month average must be no more than 1.5% larger than the unweighted arithmetic average of the similar HICP inflation rates in the 3 EU member states with the lowest HICP inflation. If any of these 3 states have a HICP rate significantly below the similarly averaged HICP rate for the eurozone (which according to ECB practice means more than 2% below), and if this low HICP rate has been primarily caused by exceptional circumstances (i.e. severe wage cuts or a strong recession), then such a state is not included in the calculation of the reference value and is replaced by the EU state with the fourth lowest HICP rate.

- The arithmetic average of the annual yield of 10-year government bonds as of the end of the past 12 months must be no more than 2.0% larger than the unweighted arithmetic average of the bond yields in the 3 EU member states with the lowest HICP inflation. If any of these states have bond yields which are significantly larger than the similarly averaged yield for the eurozone (which according to previous ECB reports means more than 2% above) and at the same time does not have complete funding access to financial markets (which is the case for as long as a government receives bailout funds), then such a state is not be included in the calculation of the reference value.

- The change in the annual average exchange rate against the euro.

- Reference values from the ECB convergence report of June 2014.[23]

- Latvia, Portugal and Ireland were the reference states, with Greece, Bulgaria and Cyprus excluded as outliers.[23]

- The maximum allowed change in rate is ± 2.25% for Denmark.

- Latvia, Ireland and Portugal were the reference states.[23]

- Reference values from the ECB convergence report of June 2016.[26]

- Bulgaria, Slovenia and Spain were the reference states, with Cyprus and Romania excluded as outliers.[26]

- Slovenia, Spain and Bulgaria were the reference states.[26]

- Reference values from the ECB convergence report of May 2018.[29]

- Cyprus, Ireland and Finland were the reference states.[29]

- Cyprus, Ireland and Finland were the reference states.[29]

- Reference values from the ECB convergence report of June 2020.[32]

- Portugal, Cyprus, and Italy were the reference states.[32]

- Portugal, Cyprus, and Italy were the reference states.[32]

- Reference values from the Convergence Report of June 2022.[35]

- France, Finland, and Greece were the reference states.[35]

Background

Croatia's EU membership obliged it to join the eurozone once it fulfilled the euro convergence criteria. Prior to Croatian entry to the EU on 1 July 2013, Boris Vujčić, governor of the Croatian National Bank, stated that he would like the kuna to be replaced by the euro as soon as possible after accession.[4] This had to be at least two years after Croatia joined the ERM II (in addition to it meeting other criteria).

The Croatian National Bank had anticipated euro adoption within two or three years of EU entry.[41][42] However, the EU's response to the financial crises in eurozone delayed Croatia's adoption of the euro.[43] The country's own contracting economy also posed a challenge to its meeting of the convergence criteria.[44] While keen on euro adoption, one month before Croatia's EU entry, governor Vujčić stated "...we have no date (to join the single currency) in mind at the moment".[4] The European Central Bank (ECB) was expecting Croatia to be approved for ERM II membership in 2016 at the earliest, with euro adoption in 2019.[45][46]

In April 2015, President Kolinda Grabar-Kitarović stated in a Bloomberg interview that she was "confident that Croatia would introduce the euro by 2020", although the then-Prime Minister Zoran Milanović subsequently refused to commit to such timeline for the euro adoption.[47]

In November 2017, Prime Minister Andrej Plenković said that Croatia aimed to join ERM II by 2020 and to introduce the euro initially by 2025.[48] Jean-Claude Juncker, President of the European Commission, stated in June 2019 that "Croatia is ready to join the ERM-2".[49]

A letter of intent of joining the ERM II mechanism was sent on 5 July 2019 to the ECB, signed by Minister of Finance Zdravko Marić, and the governor of the Croatian National Bank Boris Vujčić.[50][51] The letter marked the first formal step towards the adoption of the euro. Croatia committed to joining the Banking union of the European Union as part of its efforts to join ERM II. On 23 November 2019, European Commissioner Valdis Dombrovskis said that Croatia could join ERM II in the second half of 2020.[52]

Croatia joined ERM II on 10 July 2020.[53] The central rate of the kuna was set at 1 euro = 7.53450 kuna.[5] The earliest allowed date for euro adoption, which requires two years of ERM participation, was then 10 July 2022.

Target date: 1 January 2023

On 11 November 2020, Prime Minister Andrej Plenković stated that Croatia intended to adopt the euro on 1 January 2023.[6][54]

In June 2021, on the occasion of 30 years of independence, Prime Minister Plenković said the government's ambition was to join the eurozone on the target date.[55] In September, speaking at the 11th meeting of the National Council for the Introduction of the Euro as Croatia's official currency, Plenković said Croatia had the full support of the European Commission and the European Central Bank to join the euro area. He restated his confidence Croatia would be ready to enter the euro area from the start of 2023.[56] In September 2021, following the meeting of the Eurogroup in Slovenia, Croatia signed an official agreement (a Memorandum of Understanding) with the European Commission and eurozone member states on practical steps for the actual minting of Croatian euro coins.[57] On 7 December, Croatia and the European Commission signed a Partnership Agreement for the organisation of information and communication campaigns concerning the changeover from the kuna to the euro in Croatia.[58][59]

In November 2021, the Croatian right-wing and eurosceptic party Hrvatski Suverenisti was unable to obtain the required number of signatures to force a referendum to block the planned adoption of the euro.[60]

On 10 December 2021, Finance Minister Marić announced that the bill on introducing the euro currency in Croatia was being drafted and could be outlined in mid-January, with its final adoption expected in April 2022. He further stated, "As of 1 January 2023, we will change over to the euro overnight and then have another two weeks for both currencies in circulation and citizens will be able to continue to pay in kuna but after that payments will be in euro. The dual prices will remain for at least one year".[61]

On 14 December 2021, Prime Minister Andrej Plenković stated that he expected to have a final decision from the EU on Croatia's accession to the Schengen and euro areas in 2022.[62]

In January 2022, Croatian Prime Minister Andrej Plenković announced that from 5 September, prices would be displayed in both kunas and euros in the country, and through the whole of 2023. In 2023, everyone would be able to exchange kunas for euros free of charge in banks, in the Croatian Post offices, and in financial services and payment systems branches.[63]

On 13 May 2022, the Croatian Parliament voted in favour of the proposal to introduce the euro as legal tender.[64][65]

In May 2022, the European Commission completed an assessment of Croatia's progress.[66] The official decision for euro adoption is made by the EU's ECOFIN council and could not occur prior to 10 July 2022, two years after Croatia joined the ERM II.[67][68]

On 1 June 2022, the Commission assessed in its 2022 convergence report that Croatia fulfilled all the criteria for joining the euro area and proposed to the Council that Croatia adopt the euro on 1 January 2023.[14]

On 16 June 2022, the euro area member states recommended that Croatia become the 20th member.[69] Paschal Donohoe, President of the Eurogroup said:

I am very pleased to announce that the Eurogroup agreed today that Croatia fulfils all the necessary conditions to adopt the euro.

On 24 June 2022, the European Council supported the Commission's proposal for Croatia to adopt the euro. "It endorses the Commission's proposal that Croatia adopt the euro on January 1, 2023 and invites the EU's ECOFIN council to adopt swiftly the relevant Commission proposals," the Council added.[70]

On 5 July 2022, the European Parliament approved Croatia's entry in eurozone with 539 votes in favour, 45 against and 48 abstentions. Parliament supported the report of Siegfried Mureșan that Croatia has fulfilled all the criteria for adopting euro on 1 January 2023.[71]

On 12 July 2022, the Council of EU adopted the final three legal acts that were required for Croatia to adopt the euro as legal tender. A fixed exchange rate was set at 1 € = 7.53450 kn.[1]

On 18 July 2022, the Croatian Mint began producing euro coins with Croatian national motifs.[9][10][11]

From 5 September 2022 until 31 December 2023, display of all prices in dual currency is mandatory to prevent unjustified price increases. The public can buy euro starter kits to familiarise themselves with the new currency starting 1 December 2022. These coins were not to be used before 1 January 2023.[11][72]

Payments could be made in both currencies during the first two weeks of January 2023 (with change being given in euro) and after then only in euro. Kuna coins can be exchanged by the Croatian National Bank for three years following the changeover, while it will be possible to exchange kuna notes indefinitely.[73][11][72]

Croatian euro design

While the images of the reverse side of euro coins is common across coins issued by all countries, each country can choose identifying marks for euros it mints.

The national identifying marks on the Croatian euro coins: the Croatian checkerboard, the map of Croatia, a marten, Nikola Tesla and the Glagolitic script, were decided on by the government in 2021.[74][75] A contest was held by the Croatian National Bank for the designs, and was completed in 2022, receiving some negative reaction from Serbia and also being delayed by a licensing issue.[76][77][78][79][80][81] The final set of designs were approved by the Council of the EU in April 2022.[82]

| €0.01 | €0.02 | €0.05 |

|---|---|---|

|

|

|

| Ligature for Glagolitic letters ⰘⰓ HR | ||

| €0.10 | €0.20 | €0.50 |

|

|

|

| Silhouette portrait of Nikola Tesla | ||

| €1.00 | €2.00 | €2 Coin Edge |

|

|

|

| Silhouette design of a marten | Silhouette map of Croatia | |

Mints

2022: Croatian Mint[9][10][11]

Cost of the change from kuna to euro

The Croatian Ministry of Finance estimated the cost of the changeover from the kuna to the euro to be around 2 billion kuna[83] (approximately €266 million). Government analysis indicates that most of the cost would be on the loss of the conversion business by the banking system, which is expected to lead to a rise in other banking fees. There is a possibility of a general price increase for consumers, with a simultaneous general currency conversion risk for most debtors.[84]

References

- "Croatia set to join the euro area on 1 January 2023: Council adopts final required legal acts". Europa. Retrieved 13 July 2022.

- "EFFECTIVENESS OF FOREIGN EXCHANGE INTERVENTION IN CROATIA" (PDF).

- "Joining the euro area". Council of the EU and the European Council. General Secretariat of the Council. Retrieved 24 July 2021.

- THOMSON, AINSLEY (4 June 2013). "Croatia Aims for Speedy Adoption of Euro". The Wall Street Journal. New York. Retrieved 7 September 2013.

- "Communiqué on Croatia" (Press release). European Central Bank. 10 July 2020. Retrieved 11 July 2020.

- "Croatia eyes euro adoption in 2023 -PM". Reuters. 11 November 2020. Retrieved 9 June 2021.

- "Croatia adopts plan for replacing kuna by euro to protect consumer rights". SeeNews. 23 December 2020. Retrieved 9 June 2021.

- Joy, Oliver (21 January 2013). "Did Croatia get lucky on EU membership?". CNN.

- "Početak proizvodnje hrvatskih eurokovanica". croatianmint.hr (in Croatian). Hrvatska kovnica novca. 18 July 2022. Retrieved 2 August 2022.

- "Počela proizvodnja hrvatskih eurokovanica, kao dio eurozone bit ćemo zaštićeniji u nošenju s izazovima". vlada.gov.hr (in Croatian). Government of Croatia. 18 July 2022. Retrieved 2 August 2022.

- "È iniziato il conio delle monete di euro croate". La Voce del Popolo (in Italian). 18 July 2022. Retrieved 2 August 2022.

- "Public Opinion 1999–2022". European Commission. Retrieved 11 July 2022.

- "Convergence Report – 2014" (PDF). European Commission. April 2014. Retrieved 26 February 2014.

- "Croatia and the euro". 1 June 2022. Retrieved 1 June 2022.

- "HICP (2005=100): Monthly data (12-month average rate of annual change)". Eurostat. 16 August 2012. Retrieved 6 September 2012.

- "The corrective arm/ Excessive Deficit Procedure". European Commission. Retrieved 2 June 2018.

- "Long-term interest rate statistics for EU Member States (monthly data for the average of the past year)". Eurostat. Retrieved 18 December 2012.

- "Government deficit/surplus data". Eurostat. 22 April 2013. Retrieved 22 April 2013.

- "General government gross debt (EDP concept), consolidated - annual data". Eurostat. Retrieved 2 June 2018.

- "ERM II – the EU's Exchange Rate Mechanism". European Commission. Retrieved 2 June 2018.

- "Euro/ECU exchange rates - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Former euro area national currencies vs. euro/ECU - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2014. Retrieved 5 July 2014.

- "Convergence Report - 2014" (PDF). European Commission. April 2014. Retrieved 26 September 2014.

- "European economic forecast - spring 2014" (PDF). European Commission. March 2014. Retrieved 5 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2016. Retrieved 7 June 2016.

- "Convergence Report - June 2016" (PDF). European Commission. June 2016. Retrieved 7 June 2016.

- "European economic forecast - spring 2016" (PDF). European Commission. May 2016. Retrieved 7 June 2016.

- "Convergence Report 2018". European Central Bank. 22 May 2018. Retrieved 2 June 2018.

- "Convergence Report - May 2018". European Commission. May 2018. Retrieved 2 June 2018.

- "European economic forecast - spring 2018". European Commission. May 2018. Retrieved 2 June 2018.

- "Convergence Report 2020" (PDF). European Central Bank. 1 June 2020. Retrieved 13 June 2020.

- "Convergence Report - June 2020". European Commission. June 2020. Retrieved 13 June 2020.

- "European economic forecast - spring 2020". European Commission. 6 May 2020. Retrieved 13 June 2020.

- "Convergence Report June 2022" (PDF). European Central Bank. 1 June 2022. Retrieved 1 June 2022.

- "Convergence Report 2022" (PDF). European Commission. 1 June 2022. Retrieved 1 June 2022.

- "Luxembourg Report prepared in accordance with Article 126(3) of the Treaty" (PDF). European Commission. 12 May 2010. Retrieved 18 November 2012.

- "EMI Annual Report 1994" (PDF). European Monetary Institute (EMI). April 1995. Retrieved 22 November 2012.

- "Progress towards convergence - November 1995 (report prepared in accordance with article 7 of the EMI statute)" (PDF). European Monetary Institute (EMI). November 1995. Retrieved 22 November 2012.

- "Bank Governor Determined For Croatia To Adopt Euro Currency ASAP". Croatia Week. Retrieved 7 September 2013.

- "Vujčić: uvođenje eura dvije, tri godine nakon ulaska u EU". Poslovni dnevnik (in Croatian). HINA. 1 July 2006. Retrieved 1 January 2011.

statements made by Boris Vujčić, deputy governor of the Croatian National Bank (now governor (2013)), at the Dubrovnik economic conference, June 2006

- "Croatia ready to join EU in 2013 – official". Reuters.com. 10 June 2011.

- "No Euro for Croatia before 2017". Croatian Times. 31 May 2010.

- "Approaching storm. Report on transformation" (PDF). PricewaterhouseCoopers Poland. Retrieved 7 September 2013.

- "Konferencija HNB-a u Dubrovniku: Hrvatska može uvesti euro najranije 2019" (in Croatian). Croatian National Bank. Archived from the original on 2 February 2014. Retrieved 7 September 2013.

- "Croatia country report" (PDF). rbinternational.com. June 2013. Retrieved 7 September 2013.

- "Deficit to fall below 3 pct of GDP, public debt to stop rising by 2017". Government of the Republic of Croatia. 30 April 2015.

- Ilic, Igor (30 October 2017). "Croatia wants to adopt euro within 7–8 years: prime minister". Reuters. Retrieved 31 October 2017.

- "EU's Juncker backs Croatia joining open-border Schengen zone". Reuters. 7 June 2019. Retrieved 9 June 2019.

- "Statement on Croatia's path towards ERM II participation". Eurogroup. 8 July 2019. Retrieved 14 July 2019.

- "Republika Hrvatska uputila pismo namjere o ulasku u Europski tečajni mehanizam (ERM II)". Croatian National Bank (in Croatian). 5 July 2019. Retrieved 5 July 2019.

- "Croatia Could Enter ERM II in Second Half of 2020". Total Croatia news. 23 November 2019. Retrieved 18 December 2019.

- "Croatia and the euro – Croatia joined the European Union on 1 July 2013 and has been in ERM-II since 10 July 2020". European Commission. 28 June 2021. Retrieved 16 October 2021.

- "Uvođenje eura očekuje se 2023., zna se po kojem tečaju. Vujčić i Marić dali detalje".

- "Four big projects will be completed, reforms will continue in next 3 years". Government of the Republic of Croatia. 28 June 2021. Retrieved 12 July 2021.

- "PM confident Croatia will be ready to join euro area on 1 Jan 2023". Government of the Republic of Croatia. 13 September 2021. Retrieved 22 September 2021.

- "Euro changeover: Agreement with Croatia on practical steps for the start of euro coin production". EU Reporter. 13 September 2021. Retrieved 16 October 2021.

- "Euro changeover: Partnership Agreement with Croatia for the organisation of information and communication campaigns signed". European Commission. 9 December 2021. Retrieved 31 December 2021.

- "Euro changeover: Partnership Agreement with Croatia for the organization of information and communication campaigns signed". EU Reporter. 9 December 2021. Retrieved 31 December 2021.

- "Croatia's eurosceptics fail in bid on referendum to block euro". Reuters. 16 November 2021. Retrieved 3 January 2023.

- "Croatia set to adopt law on euro in April 2022". N1. 10 December 2021. Retrieved 29 January 2022.

- "Plenković: 2022 Essential Because of Accession to Schengen and Euro Area". 14 December 2021.

- "Croatia to display prices in both Kuna and Euro from September 5". Euronews. 18 January 2022. Retrieved 20 January 2022.

- "Croatian Parliament passes law on adoption of euro as legal tender". 13 May 2022.

- "Croatia to introduce euro from January 2023". Raidió Teilifís Éireann. 13 May 2022. Retrieved 16 May 2022.

- "Croatia's Euro Accession on Schedule". Fitch Ratings. 30 May 2022. Retrieved 26 June 2022.

- "Brussels Behind the Scenes: Highway to the eurozone". The Brussels Times. 11 December 2021. Retrieved 31 January 2022.

- "State of play in eurozone enlargement". Euractiv.com. 11 January 2022. Retrieved 12 January 2022.

- "Euro area member states recommend that Croatia become the 20th member of the euro area" (Press release). European Council/Council of the European Union. 16 June 2022. Retrieved 17 June 2022.

- "EU Council supports Commission's proposal for Croatia to adopt euro as of Jan 2023". Seenews. 24 June 2022. Retrieved 24 June 2022.

- "MEPs approve Croatia's entry into the eurozone". European Parliament. 6 July 2022. Retrieved 11 July 2022.

- "Croazia. Preparativi per l'arrivo dell'euro". La Voce del Popolo (in Italian). 21 July 2022. Retrieved 12 August 2022.

- "Gdje će se provoditi zamjena gotovine?". EURO HR (in Croatian). Retrieved 15 August 2022.

- "Plenković otkrio koji hrvatski simboli će biti na eurima: 'Građani su izabrali – Nikolu Teslu!'". Jutarnji list (in Croatian). 21 July 2021. Archived from the original on 21 July 2021. Retrieved 21 July 2021.

- Vladisavljevic, Anja (21 July 2021). "Croatia's Euro to Feature Inventor Tesla, Claimed Also by Serbia". BalkanInsight. Retrieved 22 July 2021.

- "Serbia fumes over Croatia's plan to put Tesla on euro coins". phys.org.

- Brezar, Aleksandar (29 November 2022). "Could a new euro coin help Serbia and Croatia value a shared history?". euronews.

- Đorđević, Nikola (31 July 2021). "Who owns Nikola Tesla?". Emerging Europe.

- "Winning entry for Croatia's first one-euro withdrawn after plagiarism allegations". Reuters. 7 February 2022. Retrieved 7 February 2022.

- "Central Bank to Hold New Competition for Design of €1 Coin With Marten Motif". Total Croatia News. 8 February 2022. Retrieved 12 February 2022.

- "Savjet HNB-a: Odabrano najuspješnije likovno rješenje nacionalne strane Republike Hrvatske na kovanici od 1 eura". HNB (in Croatian). Retrieved 4 May 2022.

- "Decision of the Council on the approval of draft design for the national side of 1 euro circulation coin submitted by Croatia". General Secretariat of the Council. Retrieved 4 May 2022.

- Thomas, Mark (9 March 2022). "Cost of changing from Kuna to Euro will cost Croatia around 2 billion Kuna". The Dubrovnik Times. Retrieved 10 March 2022.

- Marić, Jagoda (20 January 2022). "Najveći trošak uvođenja eura trebale bi imati banke. Preko "noći" će izgubiti 2,26 milijardi kuna". Novi list (in Croatian). Retrieved 11 March 2022.