Chapter 2

Accounting Information and the Accounting Cycle

By Boundless

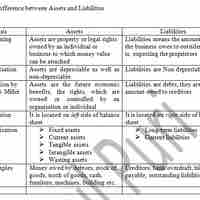

Important terminology in accounting includes cash vs. accrual basis, assets, liabilities, and equity.

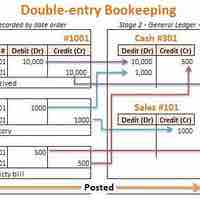

Credit and debit are the two fundamental aspects of every financial transaction in the double-entry bookkeeping system.

To ensure that a company is "in balance," its assets must always equal its liabilities plus its owners' equity.

Preparing financial statements requires preparing an adjusted trial balance, translating that into financial reports, and having those reports audited.

Transactions include sales, purchases, receipts, and payments made by an individual or organization.

The accounting cycle is performed during the accounting period, to analyze, record, classify, summarize, and report financial information.

All business transactions must be recorded to the proper journal by double-entry book keeping.

Items are entered into the general journal or the special journals via journal entries, also called journalizing.

Posting is recording in the ledger accounts the information contained in the journal.

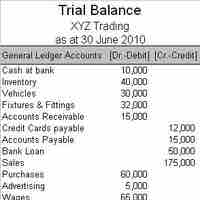

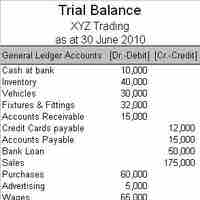

A trial balance is run during the accounting cycle to test whether the debits equal the credits.

Adjusting entries are journal entries made at the end of an accounting period that allocate income and expenses to their proper period.

Preparing financial statements requires preparing an adjusted trial balance, translating it into financial reports, and auditing them.

Transferring information from temporary accounts to permanent accounts is referred to as closing the books.

A post-closing trial balance is a trial balance taken after the closing entries have been posted.

Adjusting entries often disrupts routine transactions, so they are simply reversed on the first day of the new period.