BACKGROUND

By the summer of 1940, the victories of Nazi Germany against Poland, Denmark, Norway, Belgium, the Netherlands, and France brought urgency to possible United States involvement in World War II. Of principal concern were issues surrounding war financing. Many of President Franklin D. Roosevelt's advisers favored a system of tax increases and enforced savings program, as advocated by British economist John Maynard Keynes. In theory, this would permit increased spending while decreasing the risk of inflation. Secretary of the Treasury Henry Morgenthau, Jr., however, preferred a voluntary loan system and began planning a national defense bond program in the fall of 1940. The intent was to unite the attractiveness of the baby bonds that had been implemented in the interwar period with the patriotic element of the Liberty Bonds from the first World War. Bonds became the main source of war financing, covering what economic historians estimate to be between 50% and 60% of war costs.

THE BOND SYSTEM

Morgenthau sought the aid of Peter Odegard, a political scientist specializing in propaganda, to draw up the goals for the bond program. On the advice of Odegard, the Treasury began marketing the previously successful baby bonds as "defense bonds." Three new series of bond notes, Series E, F, and G, would be introduced, of which Series E would be targeted at individuals as "defense bonds." Like the baby bonds, they were sold for as little as $18.75 and matured in 10 years, at which time the United States government paid the bondholder $25. Larger denominations of between $50 and $1000 were also made available, all of which, unlike the Liberty Bonds of the first World War, were non-negotiable bonds. For those that found it difficult to purchase an entire bond at once, 10 cent savings stamps could be purchased and collected in Treasury-approved stamp albums until the recipient had accumulated enough stamps for a bond purchase. The name of the bonds was eventually changed to war bonds after the Japanese attack on Pearl Harbor on December 7, 1941, which resulted in the United States entering the war.

The War Finance Committee was placed in charge of supervising the sale of all bonds, and the War Advertising Council promoted voluntary compliance with bond buying. Popular contemporary art was used to help promote the bonds such as the Warner Brothers theatrical cartoon, "Any Bonds Today?" The government appealed to the public through popular culture. Norman Rockwell's painting series, The Four Freedoms, toured in a war bond effort that raised $132 million. Bond rallies were held throughout the country with celebrities, usually Hollywood film stars, to enhance the bond advertising effectiveness. The Music Publishers Protective Association encouraged its members to include patriotic messages on the front of their sheet music like "Buy U.S. Bonds and Stamps." Over the course of the war, 85 million Americans purchased bonds totaling approximately $185.7 billion.

SERIES E OR "DEFENSE BONDS'

The United States government marketed series E U.S. Savings Bonds as war bonds from 1941 to 1980. The first Series E bond was sold to Roosevelt by Morgenthau on May 1, 1941. These were marketed first as "defense bonds", then later as "war bonds." Although Series E bonds are usually associated with the war bond drives of World War II, they continued to be sold until June 1980.

THE COST OF THE WAR

The budgetary expenses for the years 1941–1945 amounted to some $317 billion, of which $281 billion was directly related to the war effort; expenditures climbed from $9.6 billion in fiscal 1940 to nearly $100 billion in 1945. Of these outlays some 45 percent was covered by taxes and other non-borrowing sources. The deficit had to be covered by selling bonds. The Treasury sold $185.7 billion of securities (over $2.1 trillion in 2016) to finance the war. The public debt rose from $50 billion in 1940 to $260 billion in 1945.

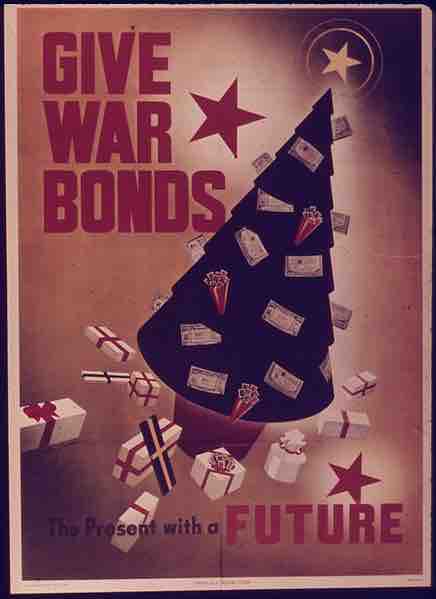

"Give War Bonds," Office for Emergency Management, 1941-45

A propaganda poster encouraging Americans to purchase war bonds from the Office for Emergency Management.