This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 23 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 30,751 times.

Various forms of public assistance are available for people struggling to meet basic needs. Assistance comes in many forms, from federal and state government programs to private charities and organizations. To get necessary assistance, you will need to gather proof of your financial stress, such as proof of income, assets, and expenses. Then you need to locate sources of help. Necessary food or medical care could be only a phone call away. The amount and types of benefits available may depend on your state. Different states have different methods of dispensing federal benefits, and may have additional state benefits available. Contact your local department of social services or other public assistance office and speak to a counselor there to find out exactly what benefits are available to you.

Steps

Proving Your Need

-

1Identify your needs. Public assistance programs exist to assist with food, housing, medical care, and heat. Also, general cash assistance is available for people with children or for people who are disabled. Identify your current needs.

-

2Gather financial information. Before applying for a grant, be sure to document your financial situation, to show that you are truly needy. Gather income tax forms, pay stubs, and social security payment information. Whenever applying to a program, you should also have bank statements and information about the current value of life insurance, retirement accounts, and stocks or bonds.

- Always keep the originals and send copies. If you send the original and it is lost, you will then have to get original copies again.

- Also be sure to have proper personal identification documentation, such as a driver’s license or ID card, as well as your Social Security number.

Advertisement -

3Document any disability. Some funds are given for specific disabilities or other qualifying characteristic. Have copies of your medical records made and safely secure them along with your financial information.

-

4Compile a list of expenses. In addition to showing that your income is low, you should document your expenses. Standard expenses include housing costs (rent or mortgage payment) as well as utility bills (electric, heat, water, etc.)

- Also keep records of health care expenses (hospital bills, payments for subscription medicines) as well as money spent on health insurance premiums.

-

5Document any disaster. If you are seeking relief from a disaster, such as a hurricane, tornado, or house fire, document the destruction to your home.

- Taking pictures or video is best. At the least, go through each room and list everything that has been destroyed.[1]

- Save receipts when you buy anything that replaces something that has been destroyed.

Getting Food Assistance

-

1Apply for SNAP food stamps. The Supplemental Nutrition Assistance Program is a federal program, commonly referred to as “food stamps.”[2] The program is administered by your state or local agency.[3]

- Contact your state Department of Human Services for information on how to apply as well as for a detailed list of eligibility requirements. Typically, you will need your monthly gross income to fall below a guideline maximum.

- When determining eligibility, states will also consider your expenses, as well as the number of people living and eating together.

- For detailed information on requirements and income thresholds, visit wikiHow’s How to Apply for Food Stamps in the US.

- States often have a SNAP Eligibility Calculator to use. You input information on household income and assets, as well as household expenses. As an example, Illinois’s calculator is here.

-

2Get emergency food assistance. The Emergency Food Assistance Program (TEFAP) provides supplement food assistance in the form of groceries and meals.[4] The food is principally distributed to local food banks, some of whom then pass the food along to soup kitchens and hunger relief centers.[5]

- For a partial listing of food pantries by state, visit this website and click on your state. You can then call the food pantry or stop in if you have questions.

-

3Use the Commodity Supplemental Food Program. The United States Department of Agriculture offers food items to vulnerable populations: seniors over age 60, infants, and children under 6 years of age. Also mothers up to 1 year after giving birth are eligible.[6]

- Over 500,000 people receive food from this program, which is provided at no cost.[7]

- Food items include cheese and dairy products, canned fruits and vegetables, canned fish and other meats, breakfast cereals, fruit juices, and rice and macaroni.[8]

- Qualifying criteria vary by state. You should contact your state social services or Department of Human Services for more information.

Obtaining Housing Assistance

-

1Look into assistance from HUD. The U.S. Department of Housing and Urban Development (HUD) runs federal programs and helps building owners offer apartments at a reduced rent. To search for a low-rent apartment, visit this website and search by state.

- HUD also runs a voucher program through local public housing agencies called Section 8. With a Section 8 voucher, you can find your own housing and then use the voucher to partially subsidize the cost of rent.[9] You should visit this web portal and click on your state.

- Section 8 eligibility depends on income and family size. Generally, a family may not have an income that exceeds 50% of the median income for the county or metropolitan area where the recipient chooses to live.[10]

-

2Find a state or local agency. On the HUD webpage is a list of states (here). Click on your state and find any state agencies that provide rental or mortgage payment assistance.

- Cities may also offer programs. Chicago, for example, offers an emergency rental assistance program for those who are suffering financial hardship because of job loss, fire, or illness.[11]

-

3Find private assistance. Many private charities offer assistance with rent. You can search for them on the web, or look in your Yellow Pages to see if an office is nearby.

- Salvation Army. The Salvation Army offers money paid to landlords, utility bill assistance, food, clothing, emergency housing, spiritual counseling, and many other services. They are also a good "place to start” whenever a need for help arises. Their toll free contact number is 1-800-728-7825.

- United Way. They offer many of the same types of assistance programs that are listed above. They also have a national network of community assistance and other emergency services agencies. You can call their help number at 2-1-1.[12]

- Check if there is any local assistance as well. In a browser, type your town and “housing assistance.” Or visit your county courthouse clerk’s office and look at the community board. They are a great resource for providing you information on local and statewide assistance programs of all types.

Receiving Help with Utilities

-

1Look into LIHEAP. The Low Income Home Energy Assistance Program is a block grant made to the states.[13] Applicants then apply to their state for assistance in paying for the heat in their homes. The state agency will disburse funds to either the utility or to the applicant directly.[14]

- Generally, you must have an income less than 150% of the federal poverty level to be eligible.[15] Currently, those limits are $ 17,655 for an individual, and $23,895 for a family of 2.[16]

- To find out where to apply, type “LIHEAP” and your city into a web browser. You can also visit this webpage and click on your state.

-

2Visit your state HUD website. These websites often contain links to various state programs that will help with utility bills.

-

3Contact the Salvation Army. The Salvation Army partners with different organizations to provide assistance programs in various states. They may also be aware of other organizations that provide utility assistance.

- For example, the Salvation Army operates a “Heat Share” program, which uses privately-raised funds to help low income families with assistance paying heating or cooling bills.This program is available in Kansas, Minnesota, Nebraska, Missouri, and South Dakota.

-

4Check the back of your utility bills. In most states, utility providers are required by law to list on every bill contact information for local assistance groups, watchdog organizations to police unfair practices, and other helpful topics as they relate to that specific company and service.

- Call the number provided or visit any website listed.

Getting Medical Services

-

1Sign up for Medicaid. Medicaid is a healthcare program for individuals and families with low incomes which is jointly funded by the federal and state governments. Qualifications vary by state. In many states, those with incomes below 138% of the federal poverty line are eligible.[17] In other states, eligibility is much more restricted and reserved for pregnant women, people with disabilities, and some low-income families.[18]

- To check if you qualify for Medicaid, you should contact your state’s Department of Human Services.

-

2Register for disability benefits. The federal Social Security Administration pays benefits to adults and children suffering from a long-term disability. The law states that the disability must be one that prevents you from working for a year or that will result in death.

- For information on how to register, see wikiHow’s How to Get Social Security Disability.

-

3Check your phone book for "Free Clinic." Every state and most counties should have free medical clinics. Most offer medical, dental, and legal services at little to no cost to their patients and/or customers. They also have good local contacts for additional assistance programs.

Applying for Cash Assistance

-

1Look into TANF (Temporary Assistance for Needy Families). TANF is a federal program that helps pregnant women and families with at least one dependent child access cash and benefits.

- A person who gets TANF may also receive medical assistance and SNAP benefits.

- Applicants must have a monthly income below a certain threshold set by the state. In 28 states and the District of Columbia, for example, a mother of 2 children cannot make more than $795 a month.[19]

- There are also limitations on the amount of assets you can own. About half of all states require that an applicant have assets valued at no more than $2,000.[20]

- For more information about the eligibility requirements of your state, contact your local Department of Human Services office.

-

2Apply for Supplemental Security Income (SSI). SSI is a federal program that makes payments to those who have low income and few resources and who are 65 or older, blind, or disabled.[21] It provides cash to meet basic housing, food, and clothing needs.[22]

- To be eligible, you must have a low income and few resources. The income limit is $733 a month for an individual and $1,100 a month for a couple.[23] Generally, you may qualify if you have resources under $2,000 (if an individual) or $3,000 (as a couple).[24]

- If your income and resources are near these limits, you should contact SSI. The agency uses complicated rules to exclude some income and assets from their calculations, so you may still qualify even if you think you are over the limit.

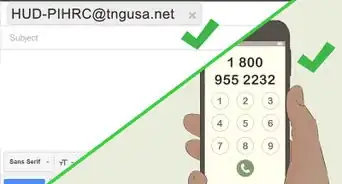

- To apply, call 1-800-772-1213 and make an appointment. You cannot apply for SSI online.[25]

-

3Ask about state programs. Contact your state Department of Human Services and ask if there are programs that provide cash assistance.

Filing for Unemployment Benefits

-

1Determine if you are eligible for benefits. Unemployment benefits are cash benefits to eligible workers made possible through a joint program between state and federal governments.[26]

- Generally speaking, the unemployment insurance program provides you with temporary financial assistance if you became unemployed through no fault of your own.[27] For example, if you were fired because you violated your employer's attendance policy by coming into work an hour late three days in a row, you would not be eligible for unemployment benefits.

- The federal government provides minimum guidelines for unemployment insurance benefits. However, each state may set additional eligibility requirements and amounts of benefits available, as well as how long you may continue to receive benefits and what you must do to remain eligible.[28]

-

2Contact your state's unemployment insurance program. You should contact the appropriate office in your state as soon as possible after you lose your job.

- Find out if you must apply in person or if you can apply online, through the mail, or over the phone.

- You also should find out the specific requirements for eligibility in your state and what documents you will need to prove your eligibility.[29]

-

3Gather necessary information. Before you go to apply for unemployment benefits, make sure you have all documents and other information you will need to fill out the application.

- You must have proof of where you worked and how much money you made, as well as the reason you lost your job. Generally you must be able to prove that you lost your job through no fault of your own. Your employer typically will provide you a form indicating that you are eligible for unemployment benefits.[30]

- You will be asked for certain information, such as the dates you were employed and the address and phone number of your former employer. If you don't know this information off the top of your head, you should find it out and write it down before you start filling out your application.[31]

-

4File your claim. Once you have all the documents and information you will need to complete your application, you're ready to fill out your application and file your claim for unemployment benefits.

- Answer all questions on the application as completely and accurately as possible. The information on your application will be used to determine how much money you will receive, and for how long.[32]

-

5Wait to receive benefits. Generally, you will have to wait two to three weeks to receive your first check for unemployment benefits. Some states also have imposed a minimum one-week waiting period.[33]

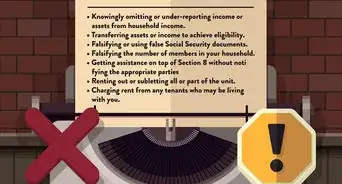

Warnings

- Be honest when filling out forms, communicating issues, etc. You will be immediately disqualified and become ineligible for future help if you are not honest.⧼thumbs_response⧽

References

- ↑ http://budgeting.thenest.com/document-property-insurance-reasons-26430.html

- ↑ http://www.needhelppayingbills.com/html/public_assistance.html

- ↑ https://www.needhelppayingbills.com/html/snap_food_stamps.html

- ↑ https://www.needhelppayingbills.com/html/emergency_food_assistance_prog.html

- ↑ https://www.needhelppayingbills.com/html/emergency_food_assistance_prog.html

- ↑ http://www.needhelppayingbills.com/html/public_assistance.html

- ↑ http://www.needhelppayingbills.com/html/commodity_supplemental_food___.html

- ↑ http://www.needhelppayingbills.com/html/commodity_supplemental_food___.html

- ↑ http://portal.hud.gov/hudportal/HUD?src=/topics/housing_choice_voucher_program_section_8

- ↑ http://portal.hud.gov/hudportal/HUD?src=/topics/housing_choice_voucher_program_section_8

- ↑ http://www.cityofchicago.org/city/en/depts/fss/provdrs/serv/svcs/how_to_find_rentalassistanceinchicago.html

- ↑ http://www.unitedway.org/contact-us/faqs

- ↑ http://www.acf.hhs.gov/programs/ocs/resource/professional-frequently-asked-questions

- ↑ https://www2.illinois.gov/dceo/communityservices/utilitybillassistance/pages/faqs.aspx

- ↑ http://www.acf.hhs.gov/programs/ocs/resource/liheap-eligibility-criteria

- ↑ http://www.benefits.gov/benefits/benefit-details/623

- ↑ http://kff.org/medicaid/fact-sheet/where-are-states-today-medicaid-and-chip/

- ↑ https://www.healthcare.gov/medicaid-chip/getting-medicaid-chip/

- ↑ https://www.fas.org/sgp/crs/misc/R43634.pdf

- ↑ https://www.fas.org/sgp/crs/misc/R43634.pdf

- ↑ http://www.socialsecurity.gov/pubs/EN-05-11000.pdf

- ↑ http://www.ssa.gov/ssi/

- ↑ http://www.nolo.com/legal-encyclopedia/income-asset-limits-ssi-disability-eligibility.html

- ↑ http://www.socialsecurity.gov/pubs/EN-05-11000.pdf

- ↑ http://www.ssa.gov/ssi/text-apply-ussi.htm

- ↑ http://www.careeronestop.org/ReEmployment/UnemploymentBenefits/what-is-unemployment-insurance.aspx

- ↑ http://www.careeronestop.org/ReEmployment/UnemploymentBenefits/what-is-unemployment-insurance.aspx

- ↑ http://www.careeronestop.org/ReEmployment/UnemploymentBenefits/what-is-unemployment-insurance.aspx

- ↑ http://www.careeronestop.org/ReEmployment/UnemploymentBenefits/how-do-i-apply.aspx

- ↑ http://www.careeronestop.org/ReEmployment/UnemploymentBenefits/how-do-i-apply.aspx

- ↑ http://www.careeronestop.org/ReEmployment/UnemploymentBenefits/how-do-i-apply.aspx

- ↑ http://www.careeronestop.org/ReEmployment/UnemploymentBenefits/how-do-i-apply.aspx

- ↑ http://www.careeronestop.org/ReEmployment/UnemploymentBenefits/how-do-i-apply.aspx