This article was co-authored by Trent Larsen, CFP®. Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

There are 14 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 91% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 230,401 times.

Being financially stable means you’re spending less money than you earn, which can be a daunting task. Though becoming financially stable requires patience and diligence, if you work on saving your money, paying down debt, and controlling your spending over six months, you can be well on your way to financial stability.

Steps

Living within Your Means

-

1Create a budget. According to CFP Trent Larsen, the key to making a budget "is figuring out what you're actually spending your money on." It can be scary to total up all of your monthly expenses and to evaluate your total debt. But if your goal is to manage your monthly expenses so that you can become financially stable, then creating a realistic budget is an important first step. Larsen stresses that "it's important to understand what you're spending money on so you don't live beyond your means."

- Make a list of all of your bills, including your mortgage or rent, transportation, groceries, child support. Include debt payments, such as student loans, credit cards and car payment.

- Figure out your total monthly income. Include all income that you can use to pay your bills each month. This would include your paychecks, dividends from stocks, child support payments, gifts and inheritances and deferred compensation from a settlement or retirement plan.[1]

- If you are paid hourly, track your salary for a few weeks and calculate the average. This will give you an average monthly income figure you can use when creating your budget.

- Subtract your expenses from your income. This will tell you whether or not you are overspending. If you are spending more than you earn, then your need to prioritize your expenses.

- Make a plan to significantly reduce your spending.[2] Reducing how much you spend will leave you with more money at the end of the month that you can use to get out of debt or to build an emergency fund.

-

2Save on transportation expenses. According to AAA, the annual cost to own and operate a car is over $8,000 per year.[3] Gas, maintenance, car payments and insurance contribute to this figure. Put some of this money back in your pocket by selling your car and using public transportation. If you really need a car to get somewhere, use a rideshare service like Uber. If you don’t want to sell your vehicle, reduce how often you drive it by carpooling.Advertisement

-

3Lower your utility bills. The average household spends approximately $2,200 per year on utilities. Most of this is on heating and cooling.[4] Find ways to improve the energy efficiency of your home to reduce utility costs. Replace incandescent light bulbs with more efficient compact fluorescent light bulbs (CFL) or light-emitting diodes (LED) bulbs. Install a programmable thermostat to reduce heating and cooling use when nobody is at home. Unplug all of your devices when you’re not using them. Air seal your home, and lower the temperature on your hot water heater.

-

4Reduce spending on entertainment. CFP Trent Larsen stresses the importance of understanding "the items that you can cut back on." Thankfully, it’s easy to cut entertainment costs without negatively impacting your lifestyle. Larsen comments that "cable TV is a common cost that people like to cut from their budgets." Replace these forms of entertainment with less expensive ones, such as running or biking in the park, borrowing books and movies from the library, and attending community cultural events. You can also cancel newspaper and magazine subscriptions and read those items at the library. Eliminate other paid services such as Hulu, Amazon Prime, or Netflix.

- Practice intentional spending. Add in a budget for the entertainment or fun things that really bring you joy. For instance, you might opt to go out for an expensive dinner once a month with friends because you enjoy it, but then you decide not to travel or subscribe to magazines.[5]

-

5Save money on food. CFP Trent Larsen explains that "it may not be possible to go out to restaurants or bars every night of the week." With this in mind, make a meal plan and cook your meals at home. This will keep you from getting take out for dinner. Also, you can pack leftovers for lunch the next day instead of buying lunch at work. Use coupons and buy generic instead of name brands. Purchase non-perishable items in bulk for a lower unit price. Start your own garden to give yourself a steady supply of fresh vegetables.

-

6Cut your insurance bills. If you are healthy and don’t require frequent doctor visits, change your health insurance to a high-deductible plan. Shop around for better rates on homeowners and auto insurance. Sometimes bundling these two can save you money. Consider purchasing term life insurance. It is a less expensive option than whole life or universal life insurance.

-

7Build a buffer in your checking account. Save up a cushion of money of that remains untouched in your checking account. The amount should be $500 to $800, or equal one to two weeks of your income. It’s there to cover you in case of an unexpected expense. This way, you won’t get charged overdraft fees or have to use your credit card.[6]

- For example, suppose your rent payment gets debited to your account one or two days before your paycheck is deposited. Having that buffer means that your account won’t end up overdrawn, and you won’t be charged any overdraft or returned check fees.

- You should have this buffer even if you are in credit card debt. Keep the size of your buffer only as big as necessary. Channel all of you other extra income to paying down the debt.

- It can be hard to save up that buffer if you are living paycheck to paycheck. But you can do it if you cut down your expenses or find a way to earn a little extra money on the side.

-

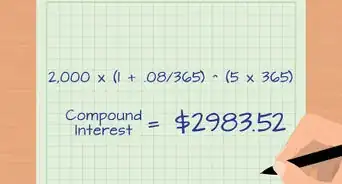

8Start an emergency fund. This is different from a buffer in your checking account. An emergency fund is a separate account that holds anywhere from three to nine months’ worth of income. You need this in case of a major emergency, like an illness or injury, loss of your job or a major home or car repair. Your emergency fund should be kept in a separate savings account where it earns interest.[7] [8]

- Keep your emergency account separate from your checking account so that you’re not tempted to use it.

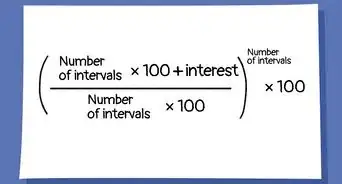

- Compare interest rates at different banks. Your local bank may offer as low as .25 percent interest on a savings account. Online savings accounts offer much higher interest rates because they don’t have to pay the overhead expenses of maintaining a physical location.[9]

Getting Rid of Bad Debt

-

1Understand what bad debt is. Bad debt includes credit cards, personal loans, car loans or any other loan on which you pay an interest rate of more than 6.5 percent.[10] This is the kind of debt that you run up by spending more than you earn. Once you save up a buffer in your checking account, you next priority should be to reduce bad debt.[11]

- Plan to pay off debts with the highest interest rates first.[12]

- Another option is to pay off the debts with the smallest balances first. This way you achieve goals of paying things off sooner.

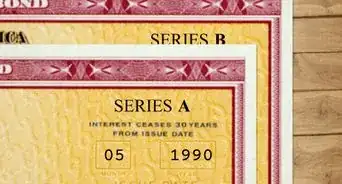

- Student loans typically have low interest rates of below 6 percent. Unless the interest rates on your student loans are higher than 6 percent, there is no need to pay down this debt sooner. Continue making the minimum payments, and divert your other income into paying down higher-interest debt or into investments with a larger rate of return.[13]

- Be aware that there are ways to get student loans forgiven. Certain jobs, such as those in education and public service, and programs like AmeriCorps, may allow you to have some or all of your loans forgiven. You must meet specific criteria to qualify for loan forgiveness.

- Your mortgage, if you have one, is not considered bad debt.

-

2Calculate your total bad debt. Examine the statements for all of your credit cards, personal loans, auto loans. Total up the unpaid balances on everything. This is the total amount of debt you owe.[14]

- For example, suppose you have a credit card with a $5,000 balance, a personal loan with a $7,000 balance and a car loan with a $15,000 balance. Your total bad debt is $27,000.

-

3Determine your debt to income ratio. Divide your total debt by your total gross annual income. This gives you an idea of how far into debt you have fallen. A debt to income ratio of more than 35 percent means you really need to focus on paying down your debt.[15]

- For example, suppose you have $27,000 in debt and you earn $48,000 per year. Your debt to income ratio is 56 percent ($27,000/ $48,000 = 56.25).

-

4Change your lifestyle. Focus on changing the behaviors that got you into debt in the first place. Recognize that accumulating too much debt means that you are living beyond your means.[16] Even if you got into debt because of a job loss or an illness, you need to examine your spending habits and change your behavior. Creating a budget and reducing your expenses will help you to stop spending more than you earn.[17]

-

5Transfer high-interest balances. If you have a credit score of 700 or above, you may quality for a new credit card that offers a zero percent balance transfer to new customers. This would allow you to transfer some debt off of a high-interest credit card. The zero percent interest period typically lasts 12 months. So during this time period, all the money you pay on the credit card each month goes towards paying down your balance.

-

6Consider peer-to-peer lending. If you have too much debt to qualify for a new credit card, look into getting a debt consolidation loan from a peer-to-peer lending network. Since there is no bank involved, you may be able to get a low interest rate. If you qualify, they may give you a personal loan with a fixed interest rate for three to five years.[18]

- Examples of peer-to-peer lending networks include Prosper and Lending Club.

-

7Look into credit counseling or debt management. If your credit isn’t good enough to qualify for a new credit card or personal loan, then you may need to ask for some help. Credit counseling is working with a professional who can help you make a plan to get out of debt. Debt management is working with a third party who negotiates with your creditors to get you lower interest rates or payment amounts so you can pay down your debt.

- Contact the National Foundation for Credit Counseling. They have reputable credit counselors who can help you make a plan to get out of debt.

- Avoid debt management scams. Many disreputable companies will try to charge you expensive fees or make promises they can’t keep. Never work with a company that charges upfront fees. Research debt management companies with the Better Business Bureau (BBB). Read the contract carefully so you fully understand how the company works.[19]

Earning More Income

-

1Supplement your income. Cutting expenses and changing your lifestyle may leave you with enough money to pay more towards your debt. However, you may need to increase your income in order to earn enough to get yourself out of debt. Many people stay in debt because their debt payments are so high that they don’t have enough money to cover their living expenses, so they continue to use their credit cards. Earning more money can help you to break your dependence on credit cards and focus on getting out of debt.[20]

-

2Freelance in your spare time. Use the skills you have acquired in your professional life to earn some extra money on the side. If you’re good at writing, have a flair for design or have an artistic talent, you can earn money by providing services with these skills. If you are replicating work you do in your professional life, be careful not to compete with your employer. Check to see if you signed a non-compete agreement, which prevents you from working in the same industry in direct competition with your employer.[21]

- Freelance writing jobs include writing blog posts and generating content for content websites. Content sites pay around $.03 per word, which would be $3 for 100 words. Writing guest blog posts might earn you up to $50 per post.

- If you have solid experience as a graphic artist, you could earn up to $100 per hour designing advertisements, website home pages, book covers, brochures or corporate reports. Create a website that states that you are available for hire and links to samples of your work and customer testimonials.

- If you have a digital SLR camera and can use photo editing software, you can earn money taking portraits, as a wedding photographer or by selling stock photos. Family and portrait photographers earn up to $100 per session. Wedding photographers can charge several thousand dollars. Stock photography pays between $.15 and $.50 per picture.

-

3Create and sell arts and crafts. If you are artistic or crafty, you can sell your wares. Start your own website or sell your products on a site like Etsy. Ask local merchants to sell your products. Rent a table at a local craft fair or flea market.

- Make jewelry from conventional or unique materials. Remember to include the cost of materials and the time spent on the items when determining the price.

- Create holiday crafts for Easter, Christmas, Halloween and Valentine’s Day.

-

4Sell your expertise. If you are really good at something or have expertise with an activity or hobby, create a digital product to share your knowledge. Writing e-books or creating online courses are good sources of passive income. That means that once you create the product and put it up for sale, it continues to generate income for you even after you have stopped actively working on it.

- If you already have a blog, put your posts together into an e-book that you can sell on a platform like Amazon’s Kindle Direct Publishing.

- Create an online course on sites like Udemy or Pathwright. Courses can be sold for up to $50 or more, depending on the topic. According to Forbes, the average instructor earns about $7,000 per course.[22]

-

5Teach or tutor. If you are a teacher or you have a skill in something like a foreign language or a musical instrument, take on a few students to tutor. Find students through word of mouth or by advertising in the newspaper or on Craigslist. Give lessons in person, or connect with students online through platforms like AceYourCollegeClasses.com. Private tutors can earn at least $30 per hour or more if they have advanced degrees. Music teachers can charge $25 to $30 for a 30 minute lesson. Teaching in an adult education center pays approximately $20 per hour.

Expert Q&A

-

QuestionIs 20k a good emergency fund?

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Certified Financial Planner Possibly! A good emergency fund should cover 3-6 months worth of expenses. So, if $20,000 covers at least 3 months of your expenses, you should be good to go.

Possibly! A good emergency fund should cover 3-6 months worth of expenses. So, if $20,000 covers at least 3 months of your expenses, you should be good to go. -

QuestionDo I need emergency savings?

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Certified Financial Planner Definitely! Emergency savings can be really helpful if you go through a rough patch, like losing your job. Your emergency savings can help cover expenses in the short-term until you find something else.

Definitely! Emergency savings can be really helpful if you go through a rough patch, like losing your job. Your emergency savings can help cover expenses in the short-term until you find something else.

References

- ↑ http://www.forbes.com/sites/kellyphillipserb/2012/04/09/33-perfectly-legal-tax-free-sources-of-income-and-benefits/

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ http://newsroom.aaa.com/2015/04/annual-cost-operate-vehicle-falls-8698-finds-aaa/

- ↑ http://www.energystar.gov/index.cfm?c=products.pr_where_money

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ http://www.moneyunder30.com/bank-account-buffer

- ↑ http://www.moneyunder30.com/bank-account-buffer

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ http://www.moneyunder30.com/high-yield-savings-accounts-compared

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ http://www.moneyunder30.com/six-and-a-half-steps-to-financial-stability

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ http://www.moneyunder30.com/emergency-fund-or-student-loans

- ↑ http://www.moneyunder30.com/big-fat-guide-get-out-of-debt-on-your-own

- ↑ http://www.moneyunder30.com/big-fat-guide-get-out-of-debt-on-your-own

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ http://www.moneyunder30.com/big-fat-guide-get-out-of-debt-on-your-own

- ↑ http://www.moneyunder30.com/big-fat-guide-get-out-of-debt-on-your-own

- ↑ http://www.goodfinancialcents.com/debt-settlement-scams/

- ↑ http://www.moneyunder30.com/big-fat-guide-get-out-of-debt-on-your-own

- ↑ http://thewritelife.com/quit-job-to-freelance-legal/

- ↑ http://www.forbes.com/sites/dorieclark/2014/08/06/how-to-create-a-money-making-online-course/

About This Article

The first step to becoming financially stable is to sit down and create a budget that covers how much you’ll spend on housing, utilities, entertainment, insurance, and food. Look for areas where you may be able to lower your spending by switching insurance, using coupons for groceries, or spending less on entertainment. Open a separate account and start adding to it so you have an emergency fund to prepare for any unexpected expenses. For more advice from our Financial review on how to pay off your debt and maximize your income, read on!