This article was co-authored by Nathan Miller and by wikiHow staff writer, Jennifer Mueller, JD. Nathan Miller is an entrepreneur, landlord, and real estate investor. In 2009, he founded Rentec Direct, a cloud-based property management company. Today, Rentec Direct works with over 16,000 landlords and property managers across the United States, helping them manage their rentals efficiently.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 89% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 516,532 times.

Contrary to popular belief, it is possible to buy a home without hiring a real estate agent. While doing so may require more effort on your part, you could also save thousands of dollars. Ideally, you enjoy doing research and are skilled at negotiating, because you'll have to find your house and arrive at a price without the help of an agent. Even if you buy a house without a real estate agent, you'll still need to hire an attorney for the closing.[1]

Steps

Getting Pre-Approved for a Mortgage

-

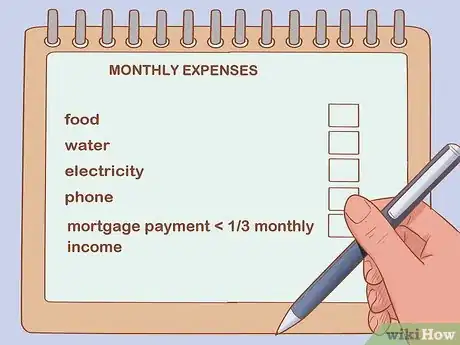

1Total your monthly expenses and debt. If you don't already have a household budget, creating one helps you determine how much of a house you can afford. Since getting a mortgage means taking on significant debt, make sure the debt you already have is manageable.[2]

- Once you've totaled your expenses, calculate how much of a monthly payment you can afford. Generally, your mortgage payment should be less than a third of your monthly income. Ideally, it should be around a quarter of your monthly income.

- While your monthly payment will depend on your interest rate and mortgage term, having a monthly payment in mind helps narrow the range of homes you can buy.

EXPERT TIPNathan Miller is an entrepreneur, landlord, and real estate investor. In 2009, he founded Rentec Direct, a cloud-based property management company. Today, Rentec Direct works with over 16,000 landlords and property managers across the United States, helping them manage their rentals efficiently.Property Management Specialist

Nathan Miller

Nathan Miller

Property Management SpecialistConsider worst case scenarios. Nathan Miller, founder of Rentec Direct, advises: "When you're buying a house, you want to make sure you can afford it if something happens. For example, if it’s a two family income, what if one of those two family members lost their income for up to 6 months? You want to know that if your income goes away, you have enough in savings to make your house payments.

-

2Check your credit score. Pull your credit report from all 3 major credit bureaus: Experian, Equifax, and TransUnion. You are entitled to one free credit report each year by federal law. For the other two, you'll have to pay a nominal fee.[3]

- Use free services, such as Credit Karma or Credit Sesame, to monitor your credit.

- If you see any errors on your credit reports, notify the credit bureaus and get those errors corrected before you start applying for mortgages.

- Your credit score will likely go down considerably in the first year after you buy your home. If your score is in the mid-600s or higher, this shouldn't cause you significant problems.

Advertisement -

3Gather documents to verify your income and debt obligations. When you apply for a mortgage, you'll need at least 3 years of tax returns and 6 months of bank statements. You may also need statements from any investment accounts you have.[4]

- Depending on the lender, you may also need insurance statements or other information. The lender will provide a list of documents you need. Gather documents in anticipation to save some time and get a more accurate offer.

- If you don't have tax returns available, contact the IRS to get copies.

-

4Contact at least 3 mortgage lenders. When looking for a mortgage, compare several offers to make sure you get the best deal. Apply with different types of lenders – large national lenders as well as smaller, regional banks or credit unions.[5]

- If you've had accounts with a bank for at least 5 years, apply with that bank first. Since you already work with them, verification will be easier. You may also get a better rate from a bank you have a relationship with.

- Because shopping around for a mortgage is the responsible thing to do, multiple inquiries typically won't have a negative effect on your credit score.

Finding a House

-

1Identify neighborhoods where you want to live. Real estate values vary widely, even within a city. Figure out areas where you'd like to live, and browse listings in those areas. Use your monthly payment calculations to identify neighborhoods with houses you can afford. If you'r not familiar with the city, look into the reputation of any neighborhood you pick.[6]

- Check information about the neighborhood to make sure it meets your needs. For example, if you will be commuting to work, you might want a neighborhood that is convenient to a major highway or thoroughfare. If you have kids, you would want to evaluate the local schools.

- Depending on the size of the metropolitan area, it might be a good idea to look in several neighborhoods, rather than just one.

-

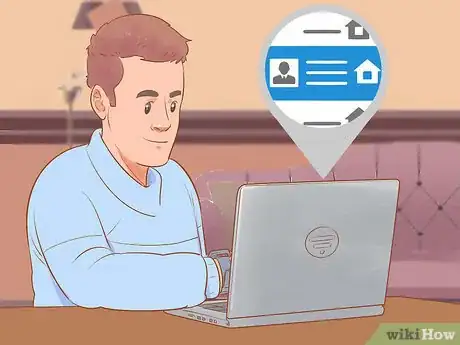

2Check real estate listings online or through social media. It is possible to search for houses by driving through neighborhoods or reading the classifieds in your local paper. However, you'll find the most listings on real estate websites. Online listings allow you to limit your searches based on the neighborhood, listing price, and various characteristics of the property. You may also have the option of searching exclusively for houses that are for-sale-by-owner (FSBO).[7]

- It may be less intimidating to focus on FSBO listings. That way, you would be negotiating with the other owner, not with an experienced real estate agent. However, you don't need to restrict your search solely to FSBO listings.[8]

-

3Compare selling prices of homes in the area. Comparable listings tell you whether the asking price for a home is fair. Research homes of similar size, age, and characteristics in the neighborhoods you're interested in. Determine generally what houses like that are selling for. Focus on listings within the past 6 months.[9]

- When you find a house you're interested in, compare it to other listings in the area. If the asking price is significantly higher, look for differences in the property that would explain it. Go through a similar process if the asking price is significantly lower than other listings.

- Talk to sellers and find out why they're selling their house, and how long it's been on the market. Try to figure out their motivation for setting a particular listing price.

-

4Make an offer on the house you want to buy. Once you find a house that you like, find out if the homeowner has an agent. If so, make your offer and negotiate with the agent. If the house is FSBO, negotiate with the homeowners directly.[10]

- Look at comparable listings in the area to craft your offer. Take any unique features about the property into consideration.

- Negotiation is a process, so your initial offer typically will be less than the maximum you're willing to pay for the property. However, don't make your offer so low that you insult the homeowners.

- Check the applicable laws to make sure you're drawing up the offer correctly. In some states, you'll need to hire an attorney to draw up the formal offer.

-

5Negotiate with the owners of the house. The owners may accept your offer, but typically they'll come back with a counteroffer. Expect a counteroffer if your offer was significantly below their asking price. You may respond to their counteroffer in writing, or arrange to meet in person to discuss the property.[11]

- Provide justifications for your offer, including comparable listings. Be prepared to defend your offer, but also be willing to compromise.

- Negotiations may get heated, particularly if the owners have an emotional attachment to the home. Emotions can cause people believe a property is worth more than it actually is. Be ready to walk away if it appears the owners aren't actually ready to sell their home.

-

6Hire a home inspector to examine the house. Before you close the deal on the house, you need an inspection and an appraisal. The inspector carefully examines the interior and exterior of the house and identify any problems.[12]

- Typically your agent would choose the inspector. Since you don't have an agent, you'll need to do this on your own. You might ask the listing agent if they have any recommendations.

- The buyer's agent usually is present during the inspection. You can ask the listing agent to be there instead, but they may want additional compensation for this. If you've placed an offer on a house that is FSBO, you may need to hire an agent to be present during the inspection. Talk to a real estate attorney or check the applicable laws to find out for sure.

Closing the Sale

-

1Hire an attorney for the closing. Most states require both the buyer and the seller to be represented by an attorney at the closing of any real estate transaction. Even if you aren't required by law to hire an attorney, doing so will save you a lot of time and effort and significantly reduces the risk of an error in the paperwork.[13]

- Although you're hiring them for a transactional purpose, you still want to make sure the attorney you hire has a good reputation and experience handling real estate closings.

- Many real estate attorneys provide a free initial consultation. It's a good idea to talk to 2 or 3 first, so you can make sure you're hiring the attorney who best meets your needs.

-

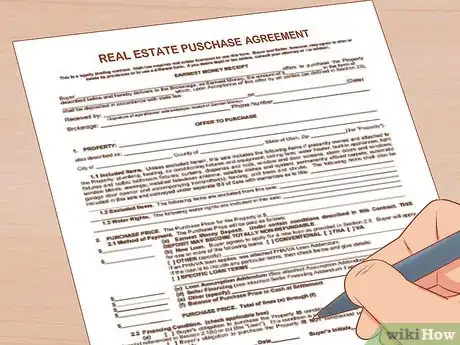

2Sign the purchase agreement and fund escrow. The purchase agreement includes the final terms of the sale, along with an amount of "earnest money" you must deposit to demonstrate that you're serious about buying the property. Once the purchase agreement is signed and the earnest money is deposited, the house will be off the market. The earnest money, or escrow, must be held by a third party – typically a real estate agent or attorney.[14]

- Normally, the listing agent would hold the escrow money until you close on the house. If there isn't a listing agent, either you or the seller should hire another attorney to act as the escrow agent.[15]

-

3Lock in your interest rate with your lender. Your pre-approval may have included a guaranteed rate. Regardless, once you've found the house you want and begun the closing process, finalize the mortgage with your lender.[16]

- Pre-approvals typically are only valid for a limited period of time. If it's been several months since your pre-approval, your lender may require additional paperwork, such as updated bank statements, to finalize your loan.

- Once you've chosen your house, you'll get an exact interest rate as well as an exact figure of how much your monthly mortgage payment will be.

-

4Go over the closing paperwork with your attorney. Your attorney will go through the papers you need to sign to buy the house. Depending on the size and complexity of the deal, there may be hundreds of pages.[17]

- You are responsible for understanding anything you sign. Ask questions if a document is confusing to you.

-

5Do a final walkthrough of the house. During your final walkthrough, make sure nothing has been damaged since you were last in the house. If you and the seller agreed the seller would make repairs after the inspection, make sure those repairs were made.[18]

- In some instances, you may need to bring back the original inspector to verify that the repairs have been made.

-

6Sign the closing paperwork. You and your attorney will meet with the sellers and their attorney to sign all the paperwork and finally close on the house. You may be in the same room, or you may sign the agreements separately.[19]

- This is the last chance you have to ask any questions about the agreement. Make sure you understand it. After everything is signed, you will own the house.

Expert Q&A

Did you know you can get premium answers for this article?

Unlock premium answers by supporting wikiHow

-

QuestionWhen buying a foreclosed home, am I still able to have a mortgage?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage

-

QuestionWhat do I do if I need to sell my home before closing on a new home in order to have enough money to close on the new property?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage

Warnings

- This article covers the process for buying a house without a realtor in the United States. In other countries, the process may be slightly different.⧼thumbs_response⧽

References

- ↑ https://www.redfin.com/blog/2017/02/everything-to-know-about-buying-a-home-without-a-real-estate-agent.html

- ↑ https://www.investopedia.com/articles/real-estate/082816/purchasing-home-without-realtor-what-you-need-know.asp

- ↑ https://www.investopedia.com/articles/real-estate/082816/purchasing-home-without-realtor-what-you-need-know.asp

- ↑ https://www.investopedia.com/articles/real-estate/082816/purchasing-home-without-realtor-what-you-need-know.asp

- ↑ https://www.investopedia.com/articles/real-estate/082816/purchasing-home-without-realtor-what-you-need-know.asp

- ↑ https://www.investopedia.com/articles/real-estate/082816/purchasing-home-without-realtor-what-you-need-know.asp

- ↑ https://www.zillow.com/home-buying-guide/buying-homes-for-sale-by-owner/

- ↑ https://www.redfin.com/blog/2017/02/everything-to-know-about-buying-a-home-without-a-real-estate-agent.html

- ↑ https://www.zillow.com/home-buying-guide/buying-homes-for-sale-by-owner/

- ↑ https://www.redfin.com/blog/2017/02/everything-to-know-about-buying-a-home-without-a-real-estate-agent.html

- ↑ https://www.redfin.com/blog/2017/02/everything-to-know-about-buying-a-home-without-a-real-estate-agent.html

- ↑ https://www.redfin.com/blog/2017/02/everything-to-know-about-buying-a-home-without-a-real-estate-agent.html

- ↑ https://www.zillow.com/home-buying-guide/buying-homes-for-sale-by-owner/

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/10/closing-home-process.asp

- ↑ https://www.zillow.com/home-buying-guide/buying-homes-for-sale-by-owner/

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/10/closing-home-process.asp

- ↑ https://www.redfin.com/blog/2017/02/everything-to-know-about-buying-a-home-without-a-real-estate-agent.html

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/10/closing-home-process.asp

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/10/closing-home-process.asp

About This Article

If you want to buy a house without a realtor, start by applying to get pre-approved for a mortgage with at least 3 different mortgage lenders. Then, choose the neighborhood where you would like to live, and check listings online to see which houses are on the market. Once you visit a house that you like, make an offer to negotiate with the seller or their real estate agent and have an inspection done. Finally, hire an attorney to consult with you about the closing paperwork and lock in and interest rate for your mortgage. For tips on closing the sale smoothly and quickly, read on!