This article was co-authored by Priya Malani and by wikiHow staff writer, Megaera Lorenz, PhD. Priya Malani is a Financial Advisor and the Founding Partner of Stash Wealth, a financial planning and investment management firm for HENRYs™ (High Earners, Not Rich Yet). She has over 15 years of wealth management and financial advising experience. Priya's work with Stash Wealth has been featured in Fortune, Wall Street Journal, and CNBC as well as entertainment and lifestyle brands such as the NYPost, Bustle, SiriusXM, and Refinery29. She earned a BA in Economics from Agnes Scott College in 2004.

There are 21 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 565,124 times.

Whether you’re thinking about buying a car, renting a home, or opening up a new credit card, it’s a good idea to know your credit score. That little number can give lenders, landlords, or even potential employers a sense of how safe or risky it might be to do business with you. Buy your score directly from a credit reporting agency or get it for free from your bank or credit card company. To understand where your score comes from and what it means, don’t forget to check your free annual credit report, too.

Steps

Free Credit Scores

-

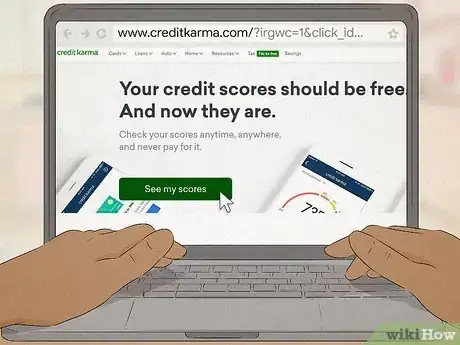

1Visit Credit Karma for free weekly scores. Credit Karma is one of the most popular free credit score services out there.[1] To get your free credit score, visit https://www.creditkarma.com/ and click the “Sign up for free” link in the upper right corner of the page. Follow the prompts and provide the requested information to confirm your identity.

- Once you sign up, you can view your scores from both TransUnion and Equifax, and you’ll get free weekly updates.

- You don’t need to provide a credit card number or make any payments when you sign up. If you sign up for any financial services recommended by Credit Karma, they’ll get a commission from the bank or lender you signed up with.

-

2Try Credit Sesame for personalized financial tips. Credit Sesame is another reputable website that offers free credit scores.[2] To get your free score from TransUnion, plus real-time monitoring of any changes to your score, go to https://www.creditsesame.com/ and click the yellow “Sign Up” button at the top of the page.

- You’ll also get a credit score report card and personal finance advice based on your current score and credit usage.

- While Credit Sesame offers these basic services for free, you can also sign up for a paid membership to get additional benefits, like a monthly credit report from the 3 major credit bureaus.

Advertisement -

3Use Credit.com to get a free biweekly score and report card. Credit.com offers free credit scores from Experian, plus an overview of any factors that might be affecting your credit. You can get your score completely free of charge.[3] To sign up, go to https://www.credit.com/ and click the green “Sign Up” button at the top right of the page.

- Your credit score will be updated twice a week.

- You can also sign up for a paid subscription, called “ExtraCredit,” to get extra benefits such as credit repair services and reports from the major credit bureaus.

-

4Explore other free websites to find one that meets your needs. If you’re not crazy about Credit Karma, Credit Sesame, or Credit.com, there are lots of other options out there. Check out sites like WalletHub, Mint, LendingTree, and Quizzle. Compare the services they offer to figure out which one works best for you, or sign up for more than one service to get the most complete possible picture of your credit for free.

- Read the fine print and be cautious about using sites that ask you to provide your credit card information. You might get stuck with a surprise monthly fee after your free trial ends![4]

- Different sites might use different scoring methods (such as FICO, VantageScore, or some less common scoring system), so read the terms of service carefully or ask a customer service agent if you have questions about how your score was calculated.

-

5Check through your bank or credit card company. If you have a loan or credit card, check your latest statement or log onto your account online. You might find information about how to access your credit score there, or your score might be printed right on your statement.[5]

- Some banks and credit unions may also offer this service, even if you don’t have a loan or credit card with them.[6]

- Your bank might give you your FICO score or your VantageScore. Both scores are created using information from the 3 main credit reporting agencies, but there are slight differences in the way they calculate your score. For instance, your VantageScore is affected by low balance collections (under $100), while FICO excludes them.[7]

- If you’re not sure whether your bank or credit card company offers credit score information, call customer service and ask them.

Paid Options

-

1Buy your score directly through FICO to get the score most lenders see. With so many ways to get your credit score for free, there’s usually no need to shell out any money. However, if it’s really important that you see the exact scores that most lenders are looking at, consider purchasing a score from Fair Isaac Corporation (FICO).[8] Visit https://www.myfico.com/ to buy a copy of your score.[9]

- FICO gets its data from the 3 main credit reporting agencies (CRAs), Transunion, Equifax, and Experian.

- You can request different types of FICO scores depending on your needs. For instance, if you’re trying to get a car loan, ask for a FICO Auto Score 8, 5, or 2. These are the scores that auto lenders are most likely to look at.[10]

-

2Get your VantageScore as well to cover all your bases. Not all lenders use FICO, so you might also want to get your VantageScore. This score is also created with data from the main 3 CRAs, but with slight differences in how the scores are calculated.[11] Buy your VantageScore directly from Experian, or get it for free from services like Credit Karma, CreditCards.com, or CompareCards.[12]

- VantageScore is especially popular among credit card issuers, so you might want to get both your VantageScore and your FICO score if you’re applying for a new credit card.[13]

-

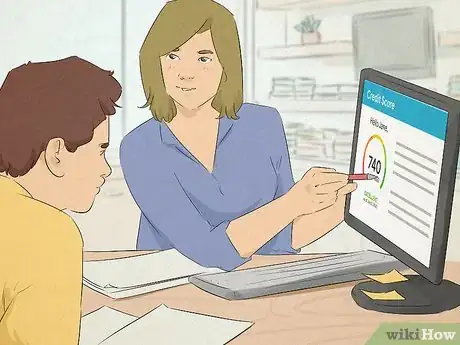

3Work with a non-profit credit counselor to find out your score. Non-profit credit counselors can look up your credit score for you.[14] Plus, they can review your credit report with you and give you advice on how to improve your score. While this is a bit more complicated than many of your other options, it may be a good bet if you’re concerned about your credit or trying to make a major financial decision. If you live in the U.S., look for an approved credit counseling agency in your area using the U.S. Department of Justice directory: https://www.justice.gov/ust/list-credit-counseling-agencies-approved-pursuant-11-usc-111.

- Housing counselors can also help you get your credit score. Use the U.S. Department of Housing and Urban Development Directory to find one in your area: https://apps.hud.gov/offices/hsg/sfh/hcc/hcs.cfm.

- Anyone can get help from a non-profit credit counselor, no matter what your financial situation is. They may offer some services, such as checking your score or giving you basic advice, for free. A reputable counselor should provide free information about the services they offer and any fees they charge.[15]

- Simply getting information from a credit counselor will not hurt your credit score. However, if you sign up for a service such as a debt management plan, your credit might suffer some temporary setbacks since this often involves closing credit accounts.[16]

Understanding Your Score

-

1Check your 3-digit score to determine if your credit is poor, fair, or good. Your credit score is a 3-digit number between 300 and 850. The higher your score, the better your credit. Look at your score and see if it falls into one of the following ranges:[17]

- 300-579: Scores in this range are considered poor. A score in this range might make it very difficult for you to get approved for loans or credit lines.

- 580-699: Scores in this range are fair. You may be able to qualify for loans and lines of credit, but at higher interest rates than you’d get with a better score.

- 670-739: These scores are good. With good credit, you can qualify for a wider variety of loans or lines of credit.

- 740-850: Scores in this range are very good to excellent. With these kinds of scores, you’ll have a good chance of getting approved for most loans, and will probably also qualify for lower interest rates.

-

2Look at a credit snapshot to understand what’s affecting your score. Many websites and services that provide credit scores will also give you a general overview of your finances and how you’re using your credit. If you’re not sure why you got a particular score, take a closer look so that you’ll have a sense of what areas need work.

- For example, a credit snapshot from your bank or credit card company might show that your score has taken a hit because you’re using most of your available credit.[18]

- Other factors that can impact your score include how much unpaid debt you have, how many late bill payments are on your record, and whether you’ve recently opened up any new credit cards.

-

3Compare scores from different companies for a more complete picture. If you’ve gotten scores from more than one source (such as your bank and a free credit score website), you might notice that they aren’t all the same. This is because there are several different scoring methods out there, and different financial institutions get their data from different sources.[19] To get a clearer sense of the numbers potential lenders might be seeing, look at scores from several different sources.

- Whenever you use a credit score reporting service, read the fine print or talk to a specialist about how the scores are calculated. That way, there won’t be any surprises.

Annual Credit Report

-

1Go to AnnualCreditReport.com to order your report. If you need to know more about your credit score, order a free credit report from one or all of the 3 main CRAs. You’re entitled to a free report from each CRA once a year.[20] Instead of tracking down your score with each CRA separately, you can get them all in one place.[21] Go to https://www.annualcreditreport.com and navigate to the “Request yours now!” link.

- You can also explore other information about credit reports, such as how to request a report under special circumstances, by going to the “All about credit reports” tab.

- Because so many people are suffering from financial hardship due to the coronavirus pandemic, all 3 CRAs are currently offering free weekly reports through April 2021.[22]

- Your credit report does not include your credit score! If you need your score, you’ll need to get that separately.

-

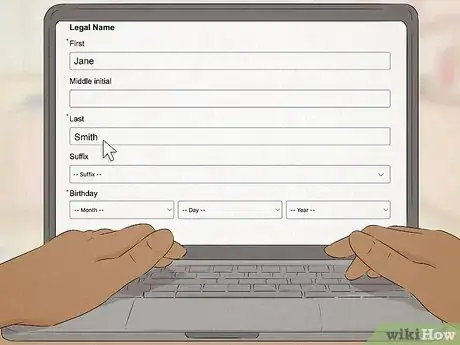

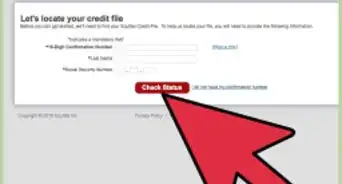

2Fill out a form with your identifying information. To start the process of requesting your credit- report(s), click the red “Request your credit reports” button. You’ll be directed to a short form. Fill out the following information:[23]

- Your full name

- Your birthdate

- Your social security number

- Your current address

- Your previous address, if you have lived at your current address for less than 2 years

-

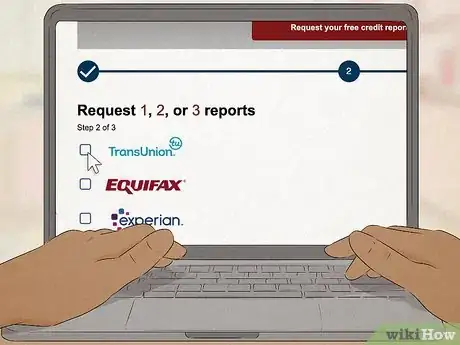

3Choose which report(s) you want to look at. Next, you’ll have an option to select 1, 2, or all 3 of your reports.[24] Check the box next to each report you’d like to view.

- Remember, you can only get each report for free once a year, so you might want to spread them out unless you’re about to make a major purchase (like buying a new car).

-

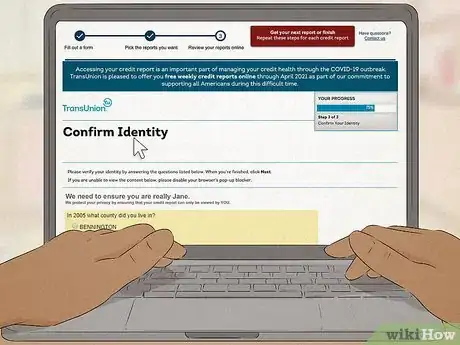

4Answer a few more questions to verify your identity. Before you can see your report, you’ll need to answer some more questions. These will be a little tougher to answer, since they’re meant to protect your identity.[25] Keep your financial records on hand in case you get a question you can’t answer easily from memory.

- For instance, you might get a question about an address where you used to live or the date when you opened a specific financial account.[26]

- The questions are multiple choice, so if you’re having trouble answering, start by eliminating any answers you know are wrong.

- If you can’t answer the questions, contact Annual Credit Report or the individual CRA you’re trying to get a report from. They might ask for documents to help prove your identity.

-

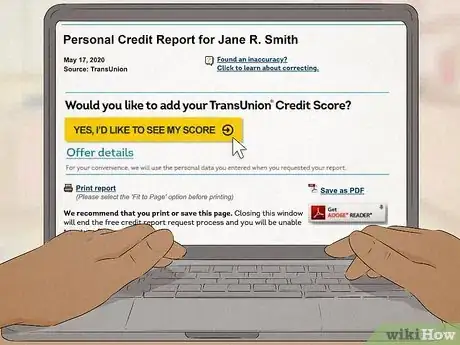

5Review and save your free credit report. Once you answer the security questions, you’ll get your report! Look it over and save a copy to your hard drive. Or, print it out so you have a hard copy for your records.[27]

- The free credit report will not include your credit score, but it will provide information that can help you understand where your score came from.

- If you’ve requested more than one report, you’ll need to repeat the verification process for each separate report.

-

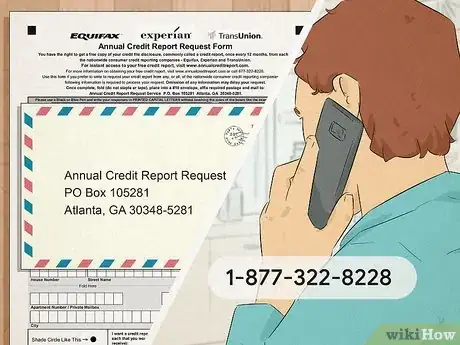

6Call or mail in a form if you don’t want to make a request online. If you’re having trouble with the online form or prefer to get your report another way, you have options. Call 1-877-322-8228 to request your report over the phone. If you need TTY service, call 711 and ask the operator to connect you to 1-800-821-7232.[28]

- You can also fill out a form and mail it to:

- Annual Credit Report Request Service

- PO Box 105281

- Atlanta, GA 30348-5281

- You can also fill out a form and mail it to:

-

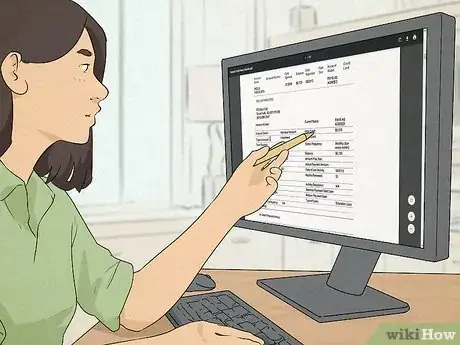

7Review your detailed report to understand what affects your score. To get a sense of where your score is coming from, and how to improve it, take a close look at your credit report. Your report will include a variety of details that help CRAs and lenders determine how good your credit is. These may include:[29]

- Your total current debt

- What types of loans or accounts you have open

- How much of your total credit you’re currently using

- Your payment history, including any late payments

- Any history of bankruptcy, lawsuits, or arrests

-

8Look closely for inaccuracies and errors. Unfortunately, it’s totally possible for errors to show up on your credit report—and those errors can mess up your score! Check your report closely and look for anything that doesn’t seem right.[30]

- For example, maybe you paid off a debt, but it’s still listed as active on your report. Or, there could be accounts listed under your name that don’t actually belong to you.

-

9Report any errors to the CRA and the company that provided the information. If you see a problem, don’t hesitate to report it! If you can get it fixed, it will help boost your score. You’ll need to write a letter disputing the information to the CRA in question, as well as whichever institution submitted the incorrect information to the CRA.[31]

- For example, if your credit card company failed to report that you paid off your card, you’ll need to contact both them and the credit reporting agency that’s showing the problem on your report.

- You can find a sample dispute letter here: https://www.consumer.ftc.gov/articles/0384-sample-letter-disputing-errors-your-credit-report.

- You might also need to provide information to back up your dispute, such as a receipt for a payment that’s not reflected in your credit report.

Warnings

- Be cautious about scams when you’re getting free reports or scores! Always research any company that offers these services, and make sure they’re recommended by sources you can trust, such as the Consumer Financial Protection Bureau.⧼thumbs_response⧽

References

- ↑ https://www.forbes.com/sites/laurengensler/2015/05/13/free-credit-score

- ↑ https://www.pcmag.com/reviews/credit-sesame

- ↑ https://www.forbes.com/sites/laurengensler/2015/05/13/free-credit-score

- ↑ https://www.consumerfinance.gov/ask-cfpb/where-can-i-get-my-credit-score-en-316/

- ↑ https://www.consumerfinance.gov/ask-cfpb/where-can-i-get-my-credit-score-en-316/

- ↑ https://www.experian.com/blogs/ask-experian/checking-your-credit-score-from-a-bank/

- ↑ https://www.experian.com/blogs/ask-experian/the-difference-between-vantage-scores-and-fico-scores/

- ↑ https://www.consumerreports.org/credit-scores-reports/should-you-ever-pay-for-your-credit-score/

- ↑ https://www.consumerfinance.gov/ask-cfpb/what-is-a-fico-score-en-1883/

- ↑ https://www.myfico.com/credit-education/credit-scores/fico-score-versions

- ↑ https://www.experian.com/blogs/ask-experian/the-difference-between-vantage-scores-and-fico-scores/

- ↑ https://your.vantagescore.com/free

- ↑ https://www.vantagescore.com/resource/259/2018-vantagescore-market-study-report

- ↑ https://www.consumerfinance.gov/ask-cfpb/where-can-i-get-my-credit-score-en-316/

- ↑ https://www.consumer.ftc.gov/articles/0153-choosing-credit-counselor

- ↑ https://www.nfcc.org/resources/blog/ask-expert-credit-counseling-affect-credit-score/

- ↑ https://www.experian.com/blogs/ask-experian/infographic-what-are-the-different-scoring-ranges/

- ↑ https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-score-en-315/

- ↑ https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-score-en-315/

- ↑ https://www.usa.gov/credit-reports#item-35087

- ↑ https://www.usa.gov/credit-reports#item-35087

- ↑ https://www.annualcreditreport.com/index.action

- ↑ https://www.annualcreditreport.com/requestReport/requestForm.action

- ↑ https://www.annualcreditreport.com/requestReport/landingPage.action

- ↑ https://www.annualcreditreport.com/requestReport/landingPage.action

- ↑ https://www.experian.com/blogs/ask-experian/having-trouble-answering-the-online-security-questions-what-should-i-do/

- ↑ https://www.annualcreditreport.com/requestReport/landingPage.action

- ↑ https://www.usa.gov/credit-reports#item-35087

- ↑ https://www.usa.gov/credit-reports#item-35087

- ↑ https://www.usa.gov/credit-reports#item-35202

- ↑ https://www.usa.gov/credit-reports#item-35202

- ↑ Priya Malani. Financial Advisor. Expert Interview. 23 March 2020.

About This Article

If you want to check your credit score, visit a free website such as Credit.com or CreditKarma.com to obtain your report. Then, provide the personal information requested by the website so it can access your report. Finally, answer the security questions to confirm your identity before viewing your credit score. Once you've registered, view your credit report. Your score will be between 300 and 850, and will be higher if you have a good credit rating, but lower if it's poor. For tips on how to improve your credit score or how to remove inaccurate information, read on!