wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 19 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 178,626 times.

Learn more...

Equifax, one of the three major credit reporting agencies, provides contact information on all of its free annual credit reports. However, it is also easy to contact Equifax without requesting a report. Equifax responds to questions, comments, and requests online, over the phone, and even via physical mail, so there's always a way to get in touch when you need to.

Steps

Getting a Credit Report

-

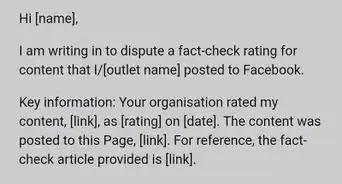

1Visit annualcreditreport.com to get your free yearly report online. Did you know that you are guaranteed one free credit report each year? Under the Federal FACT (Fair and Accurate Credit Transactions) Act, every U.S. consumer is entitled to one free credit report every year from each of the "big three" credit reporting agencies (including Equifax). To request your free report, click here to visit annualcreditreport.com, then:

- Click the "Request your free credit reports" button.

- Click the "Request your credit reports" button on the next page.

- Fill out the form with the requested information, pressing "Next" at the end of each page to proceed.

- Follow the prompts to request your reports. Note that, with this method, you can get a report from Equifax, Experian, TransUnion, or all three agencies.[1]

-

2Call 1-877-322-8228 to request a credit report via phone.[2] If you don't have an internet connection or prefer not to use one, using your phone is the second-quickest option. Follow the automatic prompts you hear to complete and submit your request. You'll need to supply some important personal and financial information to complete the request — see the "What You'll Need" section below for more information.

- As with the online method, you can request reports from any combination of the three agencies when ordering over the phone.

Advertisement -

3Mail in the request form. If you'd prefer to receive your credit reports by mail, use the official request form provided by the Federal Trade Commission (FTC). The form is (available via the FTC website). Use the "print" option to print out the form (you'll need access to a printer), then fill out the required information.

- When you're done, fold the form (don't tape or staple it), seal it in a #10 envelope, and address the envelope to:

- Annual Credit Report Request Service

- P.O. Box 105281

- Atlanta, GA 30348-528

- Be sure to check the bubbles at the bottom of the form for the agencies that you'd like to receive a report from.

- When you're done, fold the form (don't tape or staple it), seal it in a #10 envelope, and address the envelope to:

-

4Don't contact Equifax directly for credit reports. Equifax (as well as Experian and TransUnion, the other major credit agencies) do not handle requests for credit reports directly. If you contact the customer service department as Equifax or one of the other agencies to get your free credit report, you will be directed to use one of the methods above.

- Note that all three of the methods above allow you to request reports from one, two, or all three agencies, so you don't have to worry about using up all of your free reports at once if you don't want to.

-

5Don't fall prey to imposter websites. If you decide to request your free credit reports online, make sure you only use annualcreditreport.com. This is the only site that is officially verified and approved by the FTC.[3] Other, unauthorized credit reporting sites may not be truly free — they may, for instance, require you to sign up for a free trial service that will automatically start charging you if you don't specifically cancel it. Some malicious sites may even be blatant attempts to gather your personal information.

- This means that it's a bad idea to use search engines queries like "free credit reports." Many of the results you'll get from these searches will be websites deliberately designed to imitate the "real" free credit report website.

What You'll Need to Request a Credit Report

-

1Be prepared to provide basic personal information. All of the methods for requesting your credit report above will require you to provide basic information about yourself. This includes, but may not be limited to, your:

- Legal name

- Birth date

- Current address

- You'll also need the address of your previous residence if you have moved within the last two years.[4]

-

2Have your Social Security number handy. The major piece of private information that is requested when you request a credit report is your Social Security number (SSN). This number is unique for every U.S. citizen and is used for a wide variety of important financial tasks.

- If you don't know your SSN and can't locate your card, you should contact your local SS office to ask for a replacement. You may also call 1-800-772-121 or visit ssa.gov. You will probably be required to prove your citizenship with a birth certificate or passport.

- Note that, when requesting your credit report(s), you will have the option to have only the last four digits of your Social Security number disclosed on the report you receive.

-

3Be ready to supply a limited amount of private financial information. You may or may not be required to provide additional information about your finances to get a credit report. The precise information you will be asked for can vary from agency to agency because the different agencies use different information to put together your report. Being aware of this beforehand allows you to gather the documents you'll need to answer these questions. Things you may be asked about include:

- Mortgage payments

- Student loans

- Car loans

- Credit card payments

Customer Support for Personal Accounts

-

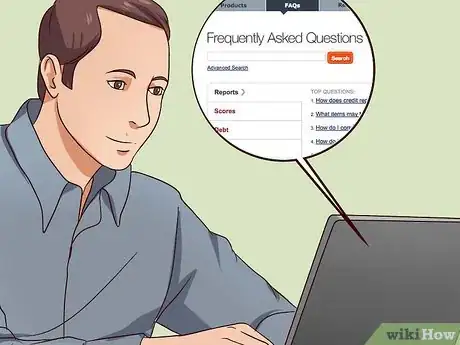

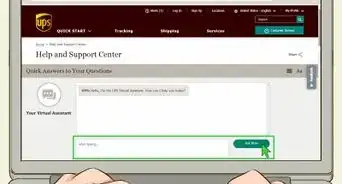

1Use the FAQ to answer common questions. Many of the most common customer service requests at Equifax can actually be answered via the official FAQ (frequently-asked questions) page. For personal customers, this is available here. At this page, you will find answers to many important questions, like:[5]

- "How does credit reporting work?"

- "How do I correct or dispute inaccuracies on my credit file?"

- "How do I get a free copy of my credit file?"

- ...and more.

-

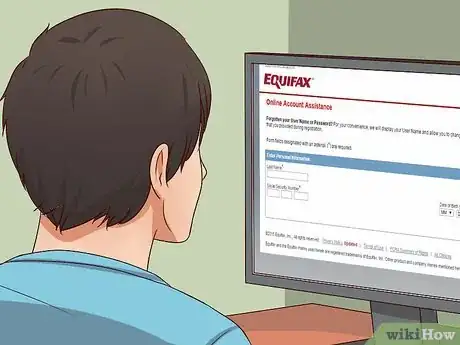

2Visit Online Account Assistance for log-in help. If you have forgotten your username or password, you can get them back here.

- You will need to verify basic personal information as well as your SSN to get your log-in information back.

-

3Use online resources for common tasks. You can request many important functions for your account via Equifax's online infrastructure. See below for specific links:

-

4Contact Equifax via phone. Equifax operates numerous different help lines for various requests and issues. See below for more information:

- Dial 1-866-640-2273 for general customer service inquiries.

- Dial 1-888-766-0008 to place a fraud alert.

- Call 1-800-685-1111 to order special reports via telephone. This number will connect you to the Equifax automated ordering system. Note that this number should not be used to request the free annual credit report you are entitled to as a consumer. Use the number in the section above instead.

- To dispute part of your credit report, check the report itself for the correct contact number. You'll be asked to provide the confirmation number from your Equifax credit report.

-

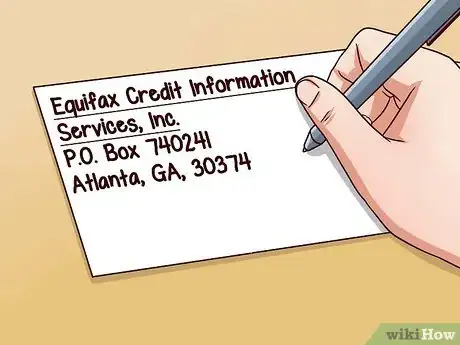

5Use P.O. Box 740241, Atlanta, GA, 30374 for snail mail. If time is not a factor, Equifax will gladly respond to most inquiries by mail. Please include copies of any supporting documentation needed for your request and allow plenty of time to a receive a response.

- For best results, address your letter to "Equifax Credit Information Services, Inc." like this:

- Equifax Credit Information Services, Inc.

- P.O. Box 740241

- Atlanta, GA, 30374

- For best results, address your letter to "Equifax Credit Information Services, Inc." like this:

Customer Support for Business Accounts

-

1Visit the business FAQ page for answers to commonly-asked questions. Before taking the time to contact Equifax, you may want to check whether your question is already addressed online. The Equifax Business Customer Support FAQ (frequently-asked questions) page has links to many common customer service issues, including:

- How do I update my company information via fax? (Use 770-740-5223)

- How do I cancel my account? (Use this form)

- How do I confirm my account balance? (Call 800-685-5000)

- ...and much more.

-

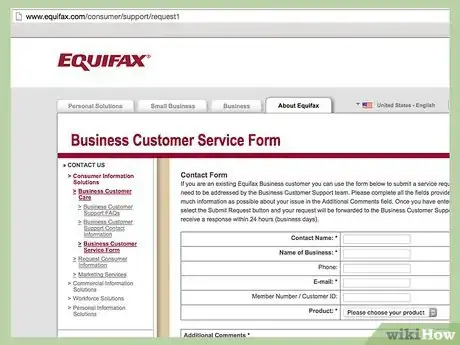

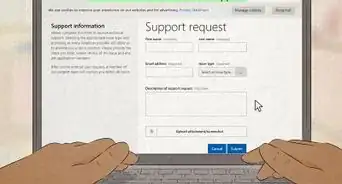

2Submit a web-based "Service Request" form. If you're having trouble with your Equifax business account, a good way to get in touch with customer service is to use submit a service request via the official contact form. Supply the requested information, then describe your problem in the "Additional Comments" box.

- You should receive a response within one business day.

-

3Contact Equifax Business Support via e-mail. Equifax has different e-mail addresses for different types of customer service requests. See below for more information:

-

1

- If you need support specifically for eID Verifier, InterConnect, Decision Power or eID Compare, send an e-mail to ETSupport@equifax.com.

- If you need support for Prospect Select, Equifax List Select, ReadiScreen, TPA Lite or MarketReveal, send an e-mail to emshelpdesk@equifax.com.

-

2Contact Equifax Business Support via phone. Again, different types of requests require you to call different numbers. See below for more information:

- To inquire about becoming an Equifax business customer, dial 1-888-202-4025.

- If you're already a business customer, contact Equifax business customer support at 1-800-685-5000.

- If you need support for Market Reveal or TPA Lite, you can also dial 1-800-865-5000.

- To contact support for InterConnect, eID Verifier, eID Compare and Decision Power, dial 1-877-420-7345.

- Finally, to get information about Equifax Mortgage services, call 1-866-746-3780.

Community Q&A

-

QuestionHow do I know if my credit info was involved in the Equifax security breach?

Community AnswerContact them as soon as you can. It is their legal obligation to tell you if your information has been involved.

Community AnswerContact them as soon as you can. It is their legal obligation to tell you if your information has been involved. -

QuestionHow can I submit to Equifax, Transunion, and Experian a satisfaction of judgment, in order to correct my credit report?

Community AnswerThe lender should have already done so. If not, you would need to file a dispute, and provide written and verified evidence that the judgement was satisfied.

Community AnswerThe lender should have already done so. If not, you would need to file a dispute, and provide written and verified evidence that the judgement was satisfied. -

QuestionEquifax lists my credit as poor, yet Chase just doubled my credit line. I am well within bounds of good usage, what can I do to get them to correct this?

Community AnswerEquifax is a credit reporting agency, when you get things like "usage reports" and "credit scores," even if they are from Equifax, they are subjective. Most banks use either FICO or an internal scoring algorithm to judge credit worthiness. That's why Equifax might tell you your score is 720, but another company might say 710. Take all of these "recommendations" with a grain of salt, it is indeed important to keep your credit utilization low, but there is no magic number that will increase your credit worthiness. Also, remember that it takes up to 60+ days for credit reports to update, so if you just got a credit limit increase, it may not be reflected on your credit report yet.

Community AnswerEquifax is a credit reporting agency, when you get things like "usage reports" and "credit scores," even if they are from Equifax, they are subjective. Most banks use either FICO or an internal scoring algorithm to judge credit worthiness. That's why Equifax might tell you your score is 720, but another company might say 710. Take all of these "recommendations" with a grain of salt, it is indeed important to keep your credit utilization low, but there is no magic number that will increase your credit worthiness. Also, remember that it takes up to 60+ days for credit reports to update, so if you just got a credit limit increase, it may not be reflected on your credit report yet.

References

- ↑ https://www.annualcreditreport.com/requestReport/landingPage.action;jsessionid=AsSER5QYJt0eBhfxGQSs2PF8NjGclf-YuICAGIko

- ↑ https://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ https://www.annualcreditreport.com/index.action

- ↑ http://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ https://help.equifax.com/

About This Article

If you need to contact Equifax, go to annualcreditreport.com and fill out the form to request your free annual credit report from Equifax. Alternatively, request your credit report by phone at 1-877-322-8228. If you have a general customer service inquiry, call Equifax at 1-866-640-2273. Whether you have a personal or business account, you can also use online resources on the Equifax website to contact the company if you want to put a security freeze on your online account or cancel your account. For tips on how to avoid fake websites when requesting a credit report, read on!

-Step-3-Version-2.webp)