This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 22 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 25,611 times.

Child support and alimony have different purposes. In particular, child support is awarded because you have an obligation to support your children, regardless of whether they live with you. Most states have a formula they use to calculate how much child support you must pay. Alimony is different. With alimony, the court has wide discretion to decide whether your ex-spouse needs money. Often, alimony is awarded to help your ex-spouse get back on their feet or to maintain their lifestyle if you have been married for a long time. Although child support is typically calculated using a formula, alimony is harder to estimate because it is based on a variety of factors.

Steps

Calculating Child Support

-

1Calculate the non-custodial parent’s income. Child support is money paid to cover a child’s needs. The parent who does not have custody (called the “non-custodial” parent) pays child support to the parent with custody (the “custodial” parent). In order to calculate the amount of child support, you should total up the following sources of income, which you should find listed on the financial affidavit your ex completed:[1]

- wages or salary from all jobs

- self-employed income

- bonuses, profit sharing, severance pay, and deferred compensation

- money from a pension or retirement plan

- estate or trust income

- annuities

- Social Security benefits

- disability or workers’ compensation benefits

- alimony received from a different spouse

-

2Estimate the custodial parent’s income. In some states, only the non-custodial parent’s income may be considered. However, in other states, both parents’ incomes are considered. If you are the custodial parent, then you should calculate your income just as you did the non-custodial parent’s.Advertisement

-

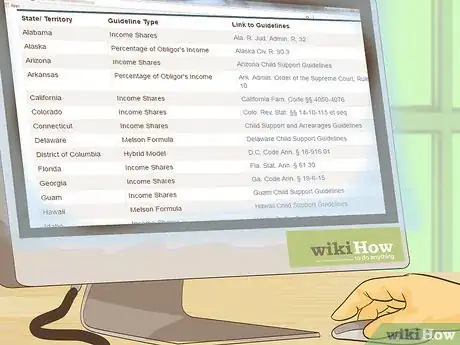

3Find your state’s child support formula. Each state determines child support differently. For this reason, you need to research how your state calculates child support payments. Often, states use a formula, which provides a rough estimate of how much the non-custodial parent will pay.[2]

- In Texas, for example, the formula calls for the non-custodial parent to pay 20% of his or her net income for one child. If there are two children, then the parent must pay 25% of their income. These percentages can be slightly lowered where the non-custodial parent is also supporting other children.

- Texas also bases its calculations on “net income.” This is gross income minus required deductions, such as federal income tax and Social Security and Medicare taxes.[3]

- Find your state’s formula by searching the Internet for “your state” and “child support formula.”

-

4Use an online calculator. There are many calculators online that you can use. Each will ask for certain information and then return an estimate of the amount of child support. You can find calculators in the following places:

- Your state might have a calculator, either at the Attorney General’s website or on a court website.[4] Type “your state” and “child support calculator” to see if one is available.

- Some websites also have calculators.[5] These websites aren’t affiliated with your state government, so the formula they use may not be up-to-date.

-

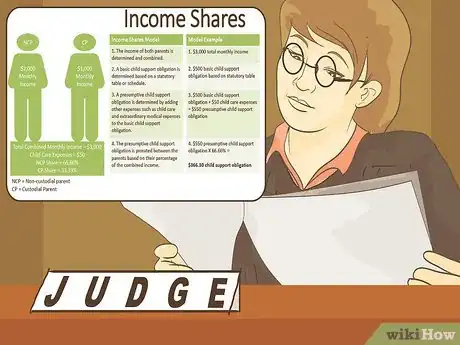

5Identify what other factors a judge considers. In many states, judges have discretion to increase or decrease the amount of child support above or below the guideline amount, depending on the circumstances. Judges will consider the following factors when setting child support:[6]

- The child’s needs. For example, a child who is disabled will have high needs. Also, younger children may have unique certain expenses, such as day care, which older children do not.

- The ability of the non-custodial parent to pay.

- The child’s standard of living before the divorce. If the standard was high, then the court may want to continue this high standard of living by setting the child support at a high amount.

-

6Document your child’s needs. The purpose of child support is to ensure that the child maintains a similar quality of life as she or he had when the parents were living together. For this reason, a judge will take into consideration certain child expenses, such as the following:

- health insurance

- day care

- education expenses

- medical expenses

-

7Understand the duration of child support. Generally, child support lasts until the child reaches the age of majority, which in most states is 18. However, child support can be extended depending on the circumstances:[7]

- Your child is living at home and attending high school. Child support will not end when he or she graduates.

- Your child hasn’t reached age 21. Some states have 21 as a cut-off, not age 18.

- Your child is attending college. In some states, child support might continue to help pay for your child’s college education.

- Your child is disabled and needs lifetime support.

-

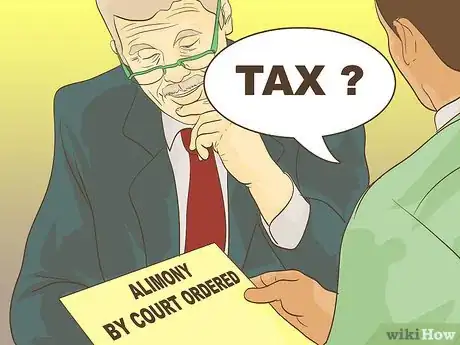

8Don’t forget the tax consequences of child support. You don’t have to pay federal income tax on the child support that you receive. If you pay child support, however, then the amount is not tax-deductible.[8]

- To be exempt from federal taxes, child support needs to be designated as such. It can’t be lumped in with alimony, since alimony is not exempt from federal taxes.

- Contact a qualified tax attorney with questions.

Estimating Alimony Payments

-

1Realize you can come to an agreement. You and your ex-spouse can always agree to a certain amount of alimony. You can also decide whether it will be paid in a lump sum or in monthly payments, as well as the duration of payments.[9] Generally, judges won’t interfere with your agreement.

- You may also decide whether the alimony is “non-modifiable.” This means you can’t change it in the future.

- You can also waive any alimony. For example, one spouse might give up more marital property during the divorce in exchange for not having to pay alimony. However, you can’t waive child support.

-

2Identify why you need alimony. There is a national trend away from granting alimony to a spouse indefinitely. Instead, courts will often award alimony only for a limited amount of time and only for a specific reason. You should identify the reason you are seeking alimony:

- You put your spouse through school or supported their career. If you worked while your spouse got an education or started a business, for example, then you can be compensated for the money spent nurturing your ex-spouse’s career. This is called “reimbursement alimony.”[10]

- You can’t support yourself yet. In some marriages, one person stays home and forfeits a career to raise the children. After a divorce, you need time to get an education and/or find a job. In these situations, you can qualify for “rehabilitative alimony,” which is often temporary. It is also called “transitional support.”[11] It lasts long enough for you to get on your feet.

- You’re disabled. Courts will also award alimony where a spouse has a disability and would have to go on government assistance if no alimony was awarded.

- You’ve been married a certain number of years. Some states still have generous alimony laws and will give you permanent alimony. These states may see alimony as a way for a divorced spouse to maintain his or her standard of living.[12] You should check with a qualified attorney.

-

3Calculate each spouse’s income. Before awarding alimony, a court wants to assess each spouse’s ability to support themselves independently. For this reason, you will have to fill out detailed financial forms (often called “affidavits”). These forms list all sources of income, including the following:[13]

- salary or wages

- bonuses, allowances, commissions, and overtime

- business income, including self-employment income

- unemployment or workers’ compensation

- disability benefits

- retirement, pension, or annuity payments

- interest and dividends

- rental income

- income from trusts, estates, or royalties

-

4Compare each spouse’s income and net worth. If there is a large disparity between the spouses' incomes and net worth, then it is more likely that a court will award alimony.[14] However, alimony laws are continually changing. In the past, a disparity might have been enough to warrant lifetime alimony.

- Today, however, the disparity in income/wealth is just one factor a court considers in some states. The judge may also consider the other factors mentioned in this article.

- For example, the disparity may be great. Nevertheless, the marriage could have been very short. Also, the spouse who makes less could be close to finishing their college degree. In this situation, alimony might be short-term and rehabilitative in nature.[15]

-

5Analyze other factors a court considers. A court will also consider certain factors when calculating the amount and duration of your alimony. Each state has its own set of factors. Only a qualified attorney can properly advise how these factors apply to your situation. Generally, a judge will consider the following:[16]

- How long the marriage lasted. Typically, the longer the marriage, the greater the amount of alimony. In some states, some forms of alimony are available only if the marriage lasted for a certain length of time. In Massachusetts, for example, reimbursement alimony is available only if the marriage lasted five years or less.[17]

- Each spouse’s potential future salary. The court will also analyze the potential salary a spouse could make. For example, if your ex refuses to work, the judge can “impute” a salary based on your ex’s education and work history. This means the judge will calculate alimony assuming your ex-spouse makes a certain amount, whether he or she really does.

- Each spouse’s age. Generally, the older the spouse, the more likely they are to get more alimony. Older people have fewer opportunities to get more education or higher paying jobs. By contrast, younger people might get less alimony because the court assumes they have more time to advance in their careers.

- Who was at fault. About half of all states consider fault when determining alimony. For example, a spouse who was unfaithful might not qualify for alimony.

- Other economic circumstances.

-

6Determine how long you were married. You might think determining the length of your marriage is easy. However, states have different ways of calculating this length of time. For example, your state may consider the following:

- In some states, the marriage ends when one party files a petition for dissolution. However, in other states, the date of separation will mark the end of the marriage.

- Some states will also identify the start date as the day you were married. However, some other states might consider a period of cohabitation before marriage as part of the “marriage.”

-

7Find out if your court uses a formula for temporary alimony. In most courts, you can get alimony during your divorce, annulment, or separation. This is called “temporary alimony.” It is usually easy to calculate according to a formula.

- You can search for your court’s formula by searching for “your state” and “temporary alimony.” New York, for example, provides a calculator for calculating temporary alimony.[18]

-

8Understand the tax consequences of alimony. The spouse who pays alimony can deduct the expenses from his or her tax returns. However, the spouse who receives alimony must report it as taxable income.[19]

- States have their own laws regarding state taxes. You should meet with a tax professional to discuss the tax implications of alimony.

Getting Legal Help

-

1Find an attorney. Because child support and alimony are state-specific, you need to get legal advice from someone familiar with your state’s laws. You should get a referral to a divorce attorney by contacting your local or state bar association.

- Check the attorney’s experience. You can find this information on their website. You will want to meet with someone who handles mostly family law issues.

- Also look to see if the attorney is a family law specialist. Many states award specialist certifications, based upon the attorney’s amount of experience and whether they take continuing legal education classes and pass an exam.

-

2Schedule a consultation. Once you have the name of someone, call them up and ask to schedule a consultation. Check ahead of time how much the attorney charges and how you can pay.[20] Some attorneys offer free or reduced-fee consultations.

- You shouldn’t hesitate to pay a fee. Let the attorney know you have questions you want answered. Often, “free” consultations are little more than meet-and-greets where you don’t get much legal advice.

-

3Compile questions about child support. You should come to the consultation prepared with a list of questions for the lawyer to answer. For example, think about asking any of the following:

- Does it matter how much the custodial parent makes?

- In addition to daycare and health care, what other expenses can I get my ex to pay for?

- Do you think the judge will give me more child support than the amount recommended by the guidelines?

- Does remarriage affect child support?[21] What if my new spouse makes a lot of money?

-

4Draft questions you have about possible alimony. You probably will have many questions about the specifics of alimony in your state. For example, you might want to ask any of the following questions:

- How does the state calculate the length of the marriage?

- Does my state consider “fault” relevant to determining alimony? Can I get alimony if I cheated on my spouse?

- What kind of records or paperwork will I need to seek alimony?[22]

-

5Hire the lawyer to represent you. You can seek alimony or child support on your own. However, if a lot of money is at stake, then you may want to hire the lawyer to represent you. In particular, judges have a lot of discretion when considering alimony, and a skilled lawyer can put your case in the most compelling light.

- If your ex has a lot of money, then you should also consider hiring a lawyer, since the judge might give you more child support than the minimum set by your state’s guidelines.

- Ask the lawyer how much he or she charges for their services.

-

6Find other legal help. You can get help from your state’s Child Support Division if you are seeking child support. Some offices will also help you get alimony, though most won’t help you get only alimony. You can find your local office by searching for the Attorney General’s office in your state. Call and ask.

- Your state’s Child Support Division will probably help you free of charge if you are low-income and receive welfare assistance. However, anyone can use the office. You may have to pay a small fee (such as $25), depending on your circumstances.[23]

References

- ↑ http://family.findlaw.com/child-support/child-support-determining-parents-income.html

- ↑ http://www.nolo.com/legal-encyclopedia/calculating-child-support-faq-29150-2.html

- ↑ http://texaslawhelp.org/resource/answers-to-questions-about-child-support-in-t

- ↑ http://www.in.gov/judiciary/2625.htm

- ↑ http://www.alllaw.com/calculators/childsupport

- ↑ http://www.nolo.com/legal-encyclopedia/calculating-child-support-faq-29150-2.html

- ↑ http://family.findlaw.com/child-support/when-does-child-support-end-.html

- ↑ http://www.nolo.com/legal-encyclopedia/child-support-taxes-30263.html

- ↑ http://www.nolo.com/legal-encyclopedia/alimony-what-you-need-know-30081.html

- ↑ http://www.masslegalhelp.org/children-and-families/divorce/alimony/reimbursement

- ↑ https://www.osbar.org/public/legalinfo/1134_ChildSupportDivorce.htm

- ↑ http://family.findlaw.com/divorce/spousal-support-alimony-basics.html

- ↑ http://www.flcourts.org/core/fileparse.php/293/urlt/902c.pdf

- ↑ http://www.nolo.com/legal-encyclopedia/alimony-what-you-need-know-30081.html

- ↑ http://www.floridabar.org/DIVCOM/JN/JNJournal01.nsf/c0d731e03de9828d852574580042ae7a/303766f6696d39f585256f1f005afe33!OpenDocument&Highlight=0,2003*

- ↑ http://www.attorneys.com/divorce/how-is-alimony-calculated

- ↑ http://www.masslegalhelp.org/children-and-families/divorce/alimony/reimbursement

- ↑ https://www.nycourts.gov/divorce/calculator.pdf

- ↑ http://www.nolo.com/legal-encyclopedia/child-support-taxes-30263.html

- ↑ http://www.calbar.ca.gov/Public/Pamphlets/HiringaLawyer.aspx

- ↑ http://family-law.freeadvice.com/family-law/child_support/71/

- ↑ http://family-law.lawyers.com/spousal-support/alimony-and-spousal-support-theres-no-one-size-fits-all-answer.html

- ↑ https://www.texasattorneygeneral.gov/faq/cs-parents-frequently-asked-questions