This article was co-authored by Jill Newman, CPA. Jill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

This article has been viewed 422,874 times.

Your company’s sales represent amounts you are paid for selling a product or service. However, you may not receive full payment from the invoices you send to customers. Your total sales (gross sales) may be reduced by sales returns, allowances and discounts. You make these adjustments to calculate net sales. Businesses do not immediately receive all of their sales in cash.

Steps

Foundational Basics

-

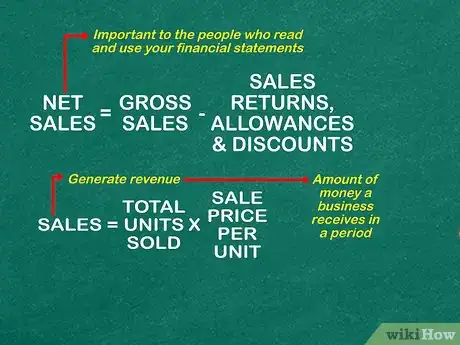

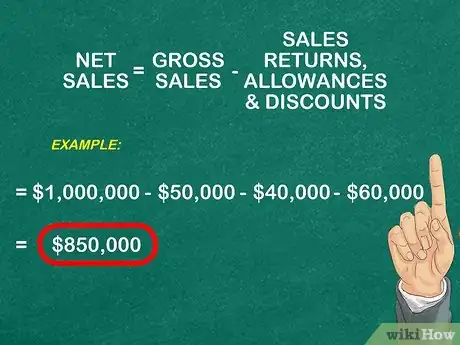

1Review the net sales formula. Sales represents the total units you sold, multiplied by the sale price per unit. The formula for net sales is (Gross sales) less (Sales returns, allowances and discounts). Net sales is important to the people who read and use your financial statements. Your gross sales are total sales before any adjustments.

- The net sales total is the most precise figure for the sales that your firm generates.

- Sales generate revenue. Revenue is defined as the amount of money a business receives in a period. Most of the revenue generated by a business is from selling a product or service.[1]

- Your company can also generate revenue from non-sales activities, such as selling a building or a piece of machinery.

-

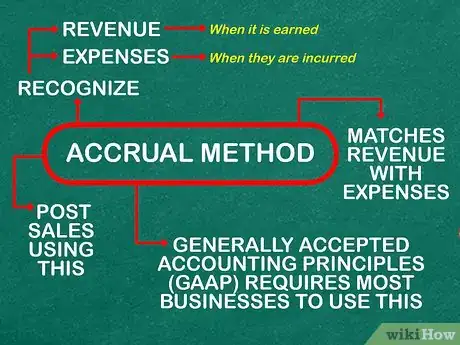

2Use the accrual method of accounting for your sales. The accrual method recognizes revenue when it is earned and expenses when they are incurred. Since sales generate revenue, you should post sales using the accrual method. [2]

- You can recognize revenue from sales when you send an invoice to the client, or when you physically deliver the product. Every company has a policy for recognizing sales revenue.

- This accounting method matches revenue with expenses. It is a better indicator of company profit than the cash method of accounting. The cash method recognizes revenue when cash is received. Expenses are posted when cash is paid.

- Only publicly traded companies are required to use the Generally Accepted Accounting Principles (GAAP) accrual method of accounting. Many smaller, private companies prefer the simplicity of the cash method.

Advertisement -

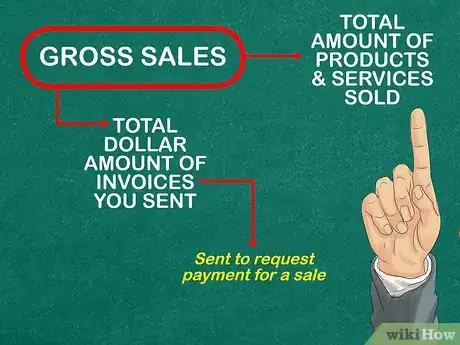

3Compute gross sales. Gross sales is the total amount of products and services sold during a period of time. You can think of gross sales as the total dollar amount of invoices that you sent to clients. Invoices are sent to request payment for a sale.[3]

Deductions

-

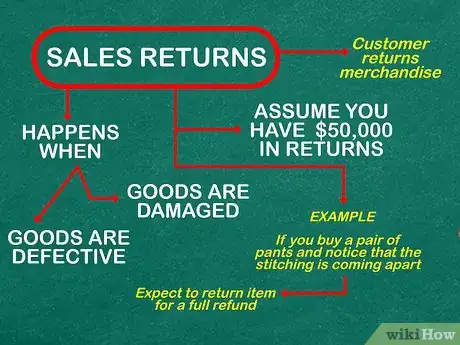

1Subtract sales returns. A sales return occurs when a customer returns merchandise to you. Typically, a sales return happens when the goods are defective or damaged. If you buy a pair of pants and notice that the stitching is coming apart, for example, you would expect to return the item for a full refund. Assume you have $50,000 in returns.[4]

-

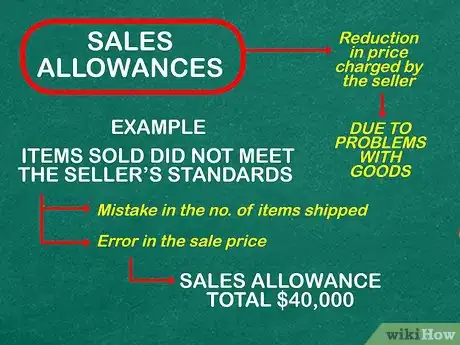

2Account for sales allowances. A sales allowance is a reduction in price charged by the seller. The reduction could be due to a problem with the goods sold. For example, the quality of the items sold did not meet the seller’s standards. If there is a mistake in the number of items shipped, or an error in the sale price, the seller may post a sales allowance. Say that sales allowances total $40,000.[5]

-

3Post a sales discount. A sales discount is a reduction in the sale price, in exchange for an early payment from the buyer. In this case, the seller would prefer to collect cash early, even the cash received is less that the amount billed to the customer. Offering sales discounts can improve the company’s cash flow. Assume that sales discounts total $60,000.[6]

Final Calculations

-

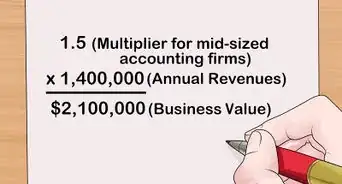

1Calculate net sales. Assume that your gross sales total $1,000,000. You have $50,000 in sales returns, $40,000 in sales allowances and $60,000 in sales discounts. Your net sales would be ($1,000,000 - $50,000 - $40,000 - $60,000 = $850,000).

-

2Record net sales in the general ledger. Typically, a company records gross sales, followed by discounts and deductions, followed by net sales.

-

3Generate income statements. On a regular basis, the company should generate income statements from the records in the general ledger. These present revenue, expenses, and the difference between them: net income or profit. Net sales should be added to other revenue when generating the income statement.

-

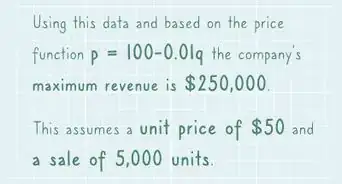

4Analyze the income statement to make business decisions. You can compare the results in income statement to the amounts you budgeted for the period. This analysis can help you make informed business decisions to improve your company. If net sales were lower than budgeted, you may consider lowering your sales price to attract more customers.

Expert Q&A

-

QuestionHow do you calculate net profit given cost and discount?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

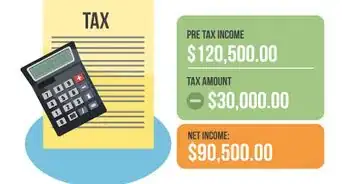

Financial Advisor "Net Profit" is the same thing as "Net Income." You would calculate net sales and then deduct all expenses, including cost and discount, to arrive at the net profit amount.

"Net Profit" is the same thing as "Net Income." You would calculate net sales and then deduct all expenses, including cost and discount, to arrive at the net profit amount. -

QuestionIn case of vat, what amount of vat is net sales, and what amount is gross sales?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Financial Advisor A value-added tax (VAT) is a type of consumption tax that is placed on a product whenever value is added at a stage of production and at final sale. VAT is most often used in the European Union. The amount of VAT that the user pays is the cost of the product, less any of the costs of materials used in the product that have already been taxed. http://www.investopedia.com/terms/v/valueaddedtax.asp#ixzz4ZlqyW01J

A value-added tax (VAT) is a type of consumption tax that is placed on a product whenever value is added at a stage of production and at final sale. VAT is most often used in the European Union. The amount of VAT that the user pays is the cost of the product, less any of the costs of materials used in the product that have already been taxed. http://www.investopedia.com/terms/v/valueaddedtax.asp#ixzz4ZlqyW01J

References

- ↑ http://www.investopedia.com/terms/r/revenue.asp

- ↑ http://www.accountingcoach.com/terms/A/accrual-basis-of-accounting

- ↑ http://www.investinganswers.com/financial-dictionary/businesses-corporations/net-sales-2615

- ↑ http://www.businessdictionary.com/definition/sales-return.html

- ↑ http://www.accountingtools.com/definition-sales-allowance

- ↑ http://www.accountingcoach.com/terms/S/sales-discounts

About This Article

To calculate your net sales, start by figuring out your gross sales, which will be the total of all invoices you've submitted to clients in the relevant period. Then, deduct sales returns, which occur when products are returned by the buyer, and sales allowances, such as a price reduction due to poor quality. If you offered any sales discounts, subtract them as well. Finish by recording the figure you have after these deductions as your net sales. Finally, use your net sales to create an income statement that includes other revenues. To learn how to use the accrual and cash methods of accounting for calculating sales, keep reading!

-Step-04.webp)