This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 552,893 times.

While many employees are paid on an hourly or salaried basis, commissioned employees are paid based on the value of goods and services that they sell. Commission-based payment is common in certain positions—sales in particular—where bringing in money is an important part of the job. To calculate commission, you need to understand what system your business uses and any additional factors that may affect your total commission earnings.

Steps

Calculating the Commission

-

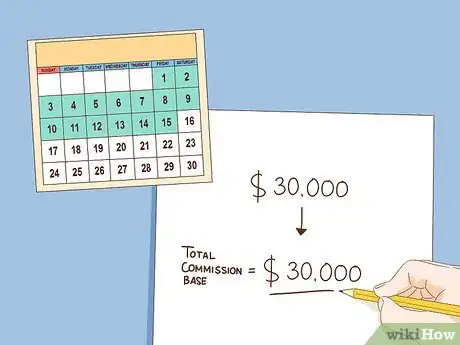

1Determine the commission period. Commission payments are usually made on a monthly or biweekly basis. For example, if you’re paid every 2 weeks, your commission period might be January 1 to January 15. That means that you’re only paid for sales made during January 1 to January 15.

- Typically, your commission will be paid based on whatever sales you made in the preceding commission period. For example, if you made several sales in January, you may not receive your commission until February.[1]

- Depending on how the business operates, there may be other factors that delay your commission. For example, some companies will not pay you your commission until after they receive full payment from the customer for the sale or service.[2]

-

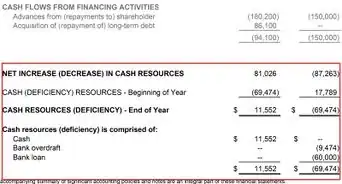

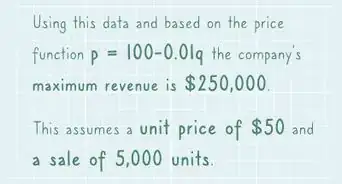

2Calculate the total commission base you made during the period. For example, if you’re paid based on the purchase price of products sold, and you sold $30,000 worth of products from January 1 to January 15, your total commission base for that period is $30,000.[3]

- If you’re paid a different commission rate for different products, calculate the total commission base by-product. For example, if you sold an equal amount of 2 products but they have different commission rates, note that you sold $15,000 of Product A and $15,000 of Product B.

Did you know? Companies take a variety of approaches to setting commission bases. For example, your commission might also be based on the gross margin or net profit of the product or service you’re offering.

Advertisement -

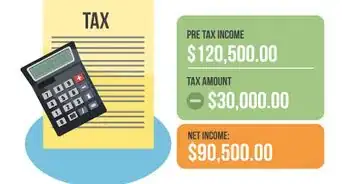

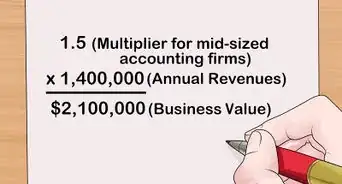

3Multiply your commission rate by your commission base. To calculate your commission for a specific period, multiply the appropriate commission rate by the base for that period. For example, if you made $30,000 worth of sales from January 1 to January 15 and your commission rate is 5%, multiply 30,000 by .05 to find your commission payment amount of $1,500.[4]

- In some cases, you may need to calculate the original sale amount based on your commission. Assuming your commission is a straightforward percentage of the commission base, you can figure this out by dividing the amount of your commission by commission rate (e.g., $1,500/.05 = $30,000).

-

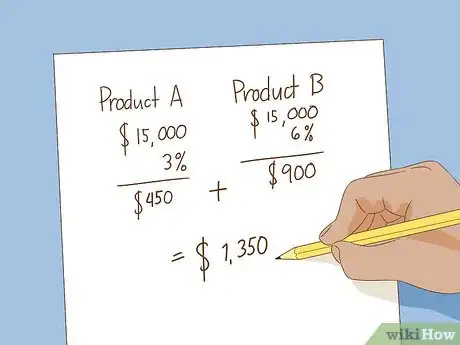

4Take variable commission rates into account. Some commission rates vary based on which products or services you’re selling.[5] If you’re paid different rates for different products, multiply each commission base by the corresponding commission rate and add the resulting figures.

- For example, say you sold $15,000 of Product A at a 3% commission rate and $15,000 of Product B at a 6% commission rate. Your commission payment for Product A is $450, your commission payment for Product B is $900, and your total commission payment is $1,350.

-

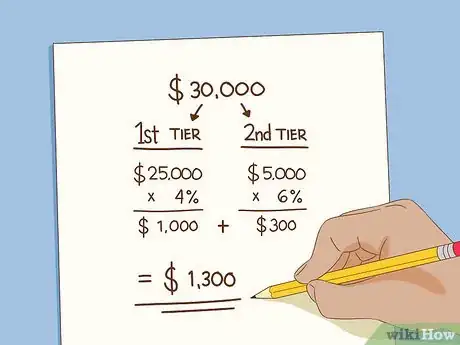

5Allow for tiered commission rates. If commission rates vary based on amount of product sold, multiply each commission base by the commission rate for that tier and add the resulting figures. For example, say you sold $30,000 and you’re paid a rate of 4% on the first $25,000 and 6% on the remainder. Your commission payment is $1,200 for the first tier, $300 for the second tier, and your total commission payment is $1,500.

- In other cases, the override rate may apply retroactively to your entire commission base for the period. For example, if your rate goes up from 4% to 5% if you make more than $30,000 in sales, the 5% rate may apply to your entire commission base for the period if you exceed your quota.[6]

Making Adjustments as Necessary

-

1Take split commissions into account. Split commissions are when more than one salesperson is involved in a sale and they share the commission. Alternatively, a regional sales manager may receive part of the commission of the salespeople in their region.[7]

Did you know? Split commissions are common in real estate transactions. Real estate brokers frequently split their commissions with 1 or more agents involved in the sale of a property.[8]

-

2Assess any additional bonus structures or related incentives. In addition to a straight percentage, a commission structure also can include any number of more complicated incentives for a salesperson or other commission-earning individual.

- For example, if you know that your commissions were the top-scoring numbers for a department or team, you may be eligible for top-performance bonuses.

-

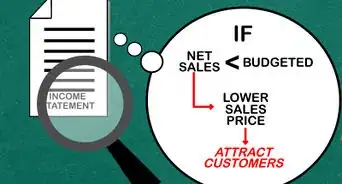

3Be prepared to lose commissions based on returns. Depending on your commission plan, your company may subtract money from your commission if merchandise or services you sold are returned or refunded. You may also lose commission money if payment for your services can’t be collected for some other reason (e.g., if the customer booked a service and then canceled it).[9]

- For example, if you sold $30,000 worth of merchandise during your commission period, but customers return $600 worth of that merchandise, $600 may be subtracted from your commission base.

Understanding Your Commission Plan

-

1Find out what your commission is based on. Typically, commissions are paid based on the purchase price of goods and services that you sold. However, some companies use different commission bases, like the item’s net profit or the item’s cost to the company.[10]

- Ask if there are any products or services excluded from the commission plan. A company may pay you a commission for selling certain products and services but not others.

-

2Determine the commission rate that your company pays. The commission payment rate could be, for example, 5% of the selling price of all goods sold. Alternatively, your company might offer a flat commission rate (for example, $25 for every sale you make).[11]

- The company may set different commission rates for different types of products. For example, it may pay 6% commission on a product that’s hard to sell and only 4% commission on a product that’s easy to sell.

-

3Learn about any other nuances in your commission plan. For example, in some plans, your commission rate changes after you sell a certain amount of product or if you reach a specific quarterly goal. This is called an override.[12]

- In a tier-based commission system, for example, your commission rate might increase to 7% after you sell $50,000 worth of product.

- Some commission plans may involve splitting the commission if you make a sale or complete a project jointly with another employee.

Tip: Some commission plans offer an advance at the start of every commission period, and then the amount of the advance is subtracted from your commission at the end of the period. This is called “draw against commission."[13]

Expert Q&A

Did you know you can get premium answers for this article?

Unlock premium answers by supporting wikiHow

-

QuestionHow do you calculate real estate commission?

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Financial Accountant

References

- ↑ https://www.accountingtools.com/articles/how-to-calculate-a-commission.html

- ↑ https://www.forentrepreneurs.com/commissions/

- ↑ https://www.accountingtools.com/articles/how-to-calculate-a-commission.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-calculate-a-commission.html

- ↑ https://www.accountingtools.com/articles/how-to-calculate-a-commission.html

- ↑ https://www.accountingtools.com/articles/how-to-calculate-a-commission.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-calculate-a-commission.html

- ↑ https://www.investopedia.com/articles/personal-finance/080714/how-do-real-estate-agents-get-paid.asp

- ↑ https://www.accountingtools.com/articles/how-to-calculate-a-commission.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-calculate-a-commission.html

- ↑ https://www.accountingtools.com/articles/how-to-calculate-a-commission.html

- ↑ https://www.accountingtools.com/articles/how-to-calculate-a-commission.html

- ↑ https://www.businessinsider.com/death-to-the-salesman-by-draw-against-commission-7-pay-packages-explained-2011-4

About This Article

To calculate commission, start by determining what your commission is based on and what commission rate your company pays. Next, multiply your commission rate by your commission base for a selected time period to calculate your commission payment. Don't forget to factor in split commissions, bonuses, and incentives if your company offers them! To learn how to calculate commission when you're dealing with different commission rates, read on!

-Step-04.webp)