This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 15 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 174,024 times.

Employers give bonuses to employees for various reasons. Perhaps it's a one-time reward for a job well done. Or it may be a payment made at regular intervals, based on company performance. Whatever the reason, bonuses are considered supplemental income by the IRS. As such, they are subject to special tax withholding rules.[1] Your employer has options, both as to the method of paying your bonus and how to calculate withholding. Which options are chosen can have an impact on how much of your bonus money you'll actually take home.

Steps

Determining How Your Bonus Will Be Paid

-

1Contact your payroll or accounting department to see what method they use to pay bonuses. Find out if your bonus will be a separate payment, or if it will be lumped together with your regular paycheck. Don't make the mistake of thinking “money is money, so how I get it doesn't really matter." There could be a big tax difference between your employer including your bonus with your regular wages in a single payment, or giving you a separate check.[2]

- For example, a one-time bonus of $5,000 added to your paycheck of, say, $35,000 could throw you into a different tax bracket, making the amount of income tax you owe higher since your total income is higher. A single person in the US who makes $35,000 a year is currently in the 12% tax bracket, but an income of $40,000 a year (which the bonus would take you to) would kick you up to the 22% bracket.[3]

-

2Learn how your employer calculates withholding tax on bonuses. Basically, under IRS rules, companies have 3 options in calculating taxes on bonuses. The first 2 listed immediately below apply where the bonus is paid to you separately from your regular pay. The third is applicable when the employer gives you your bonus and regular pay in one payment. (Again, payroll or accounting should have the answer for you.)

- Option 1 - The “percentage” method. This is where a flat rate is applied to your bonus amount. A "flat tax" of 22% on bonuses is stipulated per IRS Publication 15.

- Option 2 - The “aggregate” method. Here, the employer combines your regular income and your bonus, but uses a formula to calculate the tax on each separately.

- Option 3 - The “single payment” method. Your bonus and regular wages are combined, taxed together, and paid together.[4]

Advertisement -

3Find out if your employer offers the option of letting you choose the payment and/or tax calculation method. In a large company, this may not be possible, since the business probably wants consistency in how bonuses are paid out. But a small employer may not be concerned with the payment method or tax calculation method used. This could work to your advantage once you determine the possible tax consequences of how your employer pays, and calculates the tax on, your bonus.

Calculating Federal Tax Withholding

-

1Calculate your tax using the percentage method (option 1). Under this method, your employer applies a flat tax rate of 22% to the bonus amount. That amount is then withheld from your bonus for federal taxes. For example, let's assume you had a bonus of $5000. Your employer would withhold a straight $1100 (22%) from this amount. This is separate and apart from your regular paycheck, which would remain the same as usual.[5]

-

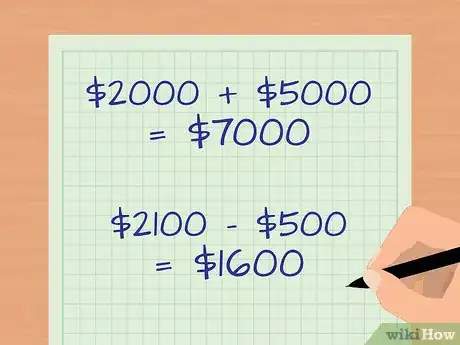

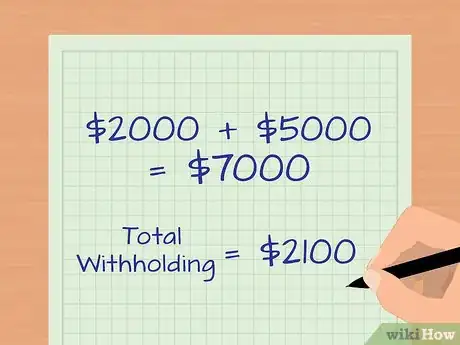

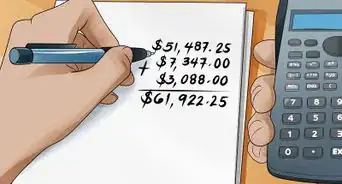

2Compute the tax using the aggregate method (option 2). Here your employer adds the amount of your bonus to the amount of your most recent regular paycheck. Let's say that your regular gross paycheck is $2000, and your bonus is $5000, for a combined total of $7000. Let's also assume that the normal withholding from your regular pay is $500. In computing the tax on your bonus, the employer would:

- Determine the withholding amount (based on IRS withholding tables) for the $7000 total. For our example, we'll use a figure of $2100 as the total withholding amount on the $7000.

- Subtract the $500 normally withheld from your paycheck from the $2100 (total tax due on the $7k). The remaining $1600 will be deducted from your bonus check.[6]

-

3Apply the single payment method (option 3). Like the aggregate method, in this scenario, the employer lumps your regular pay and bonus together. Going back to our example, this would amount to $7000. The company then uses the standard IRS withholding tables to calculate the tax based on this combined figure. Again using our example, this results in a withholding amount of $2100.[7]

- However, the employer doesn't give you your regular paycheck plus a separate bonus check. Rather, you get one paycheck for the $7000 less the total withholding of $2100.

-

4Remember to factor in Social Security, Medicare, and state withholding. Bonuses, as supplemental income, are subject to Social Security and Medicare withholding. Additionally, your state may have its own tax rate for supplemental income. You'll have to take these into account in figuring out the total tax on your bonus. Supplemental tax rates, on a state-by-state basis, can be found here.

-

5Use a tax calculator to figure out which option is best for you. Many financial sites offer free tax calculators. Using this tool can facilitate determining the tax liability that would be incurred under the 3 tax calculation options relating to bonuses.

Reducing Your Tax Liability

-

1Speak with your employer about which tax payment method and calculation method to use. If your employer gives you the option of choosing the tax payment and/or calculation method, ask to have your bonus paid using the method that you calculated puts the most money in your pocket.

-

2Ask your employer to defer your bonus until the beginning of the new year. Many times employers like to pay holiday bonuses in December, because they're able to write them off if they close their yearly books on December 31st. If you feel it would be more beneficial to you to have your bonus paid in the following year, see if there's any leeway in the company's policy. This would be ideal if you expect to have more deductions the next year, such as if you're buying a house.[8]

- Deferring doesn't always reduce your tax liability. In most cases, it's just moving from one tax period to the next. If next year's income and taxes will not be lower, there's usually no advantage to deferring.

-

3Use your bonus money for additional retirement plan contributions. This is another good way to reduce the tax liability resulting from a bonus. You could do this through your 401(k) or 403(b) at work. If you don't have an employer plan, you could make a traditional IRA contribution.[9]

- Note that there are income limitations for deducting traditional IRA contributions.

-

4Pre-pay your mortgage and property taxes. If you have a mortgage, consider making your January mortgage payment, and paying your next property tax bill, in December. This will give you additional deductions for the current tax year.[10]

- This is only helpful if you itemize your deductions rather than taking the standard deduction. #*Note that there is now a limit on state and local tax deductions of $10,000. If you have already paid $10,000 in total state and local income taxes plus property taxes, it would not make sense to pre-pay your property taxes.

-

5Consider other means of reducing tax liability. The steps listed above are only a few of the ways your tax liability can be diminished. Some others you might want to consider are:

- Make “green” home improvements. Residential energy-efficient home improvements (like solar water heaters and solar panels) may provide you with a tax credit of up to 30% of the cost of the improvements. [11]

- Earn tax-free income. Some income or benefits may not be subject to income tax, thus lowering your tax liability. Consider investing in tax-exempt bonds [12] or opening a health savings account.[13] Tax-free income sources may still trigger alternative minimum tax in some cases, so it's smart to consult with a tax accountant for advice.[14]

- Look into a child-care reimbursement account. If your employer offers one, use it. You'll be paying your child-care bills—but with pre-tax dollars. Let's say you have $5000 in child care expenses per year. You'd probably have to earn about $7500 to net that $5000, because of the taxes on that income. With a child-care reimbursement account, you avoid both income and Social Security taxes.[15]

- See other wikiHow articles, including Save Money on Taxes and Pay Less in Taxes, for more tips.

Expert Q&A

-

QuestionAre you required to hold out for a 401(k) on a bonus check?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant Whether or not your employer will withhold 401(k) contributions from your bonus is based on the rules laid out in your employer's 401(k) plan document.

Whether or not your employer will withhold 401(k) contributions from your bonus is based on the rules laid out in your employer's 401(k) plan document. -

QuestionIf we code supplemental wages as bonus or severance, do we have to tax at a bonus rate?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant If you code supplemental wages separately from regular wages, you are not required to withhold tax at the supplement wage rate of 22%; however you do need to use one of the methods described in the article above. You can also find an explanation of these methods in the IRS Publication 15 (Circular E), in the Supplement Wage section of the publication.

If you code supplemental wages separately from regular wages, you are not required to withhold tax at the supplement wage rate of 22%; however you do need to use one of the methods described in the article above. You can also find an explanation of these methods in the IRS Publication 15 (Circular E), in the Supplement Wage section of the publication.

Warnings

- With the aggregate and single-payment methods of tax calculation for bonuses, you may be taxed at a higher rate than usually applies to you, because the tax is being calculated on your normal pay plus your bonus. Depending on the size of your bonus, this may bump you up to a higher bracket in the IRS withholding tables. The good news, relatively speaking, is that if this leads to an overpayment of your taxes for the year, you'll be entitled to a refund when you file your tax return.[18]⧼thumbs_response⧽

References

- ↑ http://finance.zacks.com/percentage-income-tax-deducted-bonus-checks-2960.html

- ↑ http://www.businessinsider.com/why-bonus-taxed-high-2014-12

- ↑ http://taxfoundation.org/article/2015-tax-brackets

- ↑ http://www.consumerismcommentary.com/federal-taxes-on-bonus-pay/

- ↑ http://www.consumerismcommentary.com/federal-taxes-on-bonus-pay/#sthash.wIxXMw4w.dpuf

- ↑ http://www.consumerismcommentary.com/federal-taxes-on-bonus-pay/#sthash.wIxXMw4w.dpuf

- ↑ http://www.consumerismcommentary.com/federal-taxes-on-bonus-pay/#sthash.wIxXMw4w.dpuf

- ↑ http://www.businessinsider.com/why-bonus-taxed-high-2014-12

- ↑ http://www.huffingtonpost.com/lisa-lewis/due-for-a-holiday-bonus-h_b_4299110.html

- ↑ http://www.huffingtonpost.com/lisa-lewis/due-for-a-holiday-bonus-h_b_4299110.html

- ↑ http://www.huffingtonpost.com/lisa-lewis/due-for-a-holiday-bonus-h_b_4299110.html

- ↑ https://www.wellsfargoadvisors.com/financial-services/investment-products/investing-in-bonds/types-of-bonds.htm

- ↑ http://money.usnews.com/money/blogs/my-money/2014/03/14/10-ways-to-lower-your-tax-bill

- ↑ http://www.investopedia.com/terms/t/tax-preference-item.asp

- ↑ http://www.kiplinger.com/article/taxes/T055-C000-S001-71-ways-to-cut-your-tax-bill.html

- ↑ http://www.consumerismcommentary.com/federal-taxes-on-bonus-pay/

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/General-Tax-Tips/What-is-the-Federal-Supplemental-Tax-Rate-/INF19305.html

- ↑ http://blog.turbotax.intuit.com/income-and-investments/bonus-time-how-bonuses-are-taxed-and-treated-by-the-irs-8003/