This article was co-authored by Cassandra Lenfert, CPA, CFP® and by wikiHow staff writer, Jennifer Mueller, JD. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 2,440,817 times.

Every individual and business in the US has a unique tax ID number—this is how the IRS identifies each taxpayer. But what happens if you can't find one that you need? Ultimately, it depends on whether the number you're looking for is your own or someone else's. There are plenty of official documents where you can find the number you need if you just know where to look. Read on to find out where to look to get the individual TIN (Tax ID Number), SSN (Social Security Number), or business EIN (Employer Identification Number) that you need.

Things You Should Know

- Find a business EIN on business tax records, bank records, or licenses issued by the state or local government.

- Ask independent contractors or employers for their individual TIN so you can complete their hiring and tax paperwork.

- Look on your most recent W-2 or 1099 to find your employer's EIN.

- Call the IRS at 800-829-4933 if you've misplaced your own business's EIN and can't locate it on any of your business records.

Steps

Finding a Third Party's TIN

-

1Check any invoices from the business or individual. Most commercial invoice forms include a space for the TIN of the seller or shipper. If you've recently purchased any goods or services and still have a copy of the invoice, that's a good place to look for the TIN.[1]

- Businesses that are frequent subjects of tax deductions typically include their EIN in their letterhead. For example, childcare services usually put their EIN on their invoices and often also on their letterhead.

- If you've made a donation to a nonprofit organization and need their EIN to claim a deduction on your taxes, look at the receipt for your donation—the EIN will usually be listed there.

-

2Look under "legal information" on the company's website. Nonprofit organizations, in particular, tend to post their EIN on their website so you can find it easily. It might even be on the footer at the bottom of the page so it appears on every page of the website—that makes it super-easy to find.[2]

- For-profit businesses that are frequent subjects of tax deductions, such as childcare services or office services, also usually publish their EINs on their websites so you can access this information easily when you need it.

Advertisement -

3Call the business or individual and ask. If you need an EIN for a business, it's typically to claim a tax deduction. They're usually pretty understanding about this—just call and speak to someone in accounting. For individuals, if you're hiring someone to do work for you as an independent contractor, they're typically not going to have any problem giving you their TIN for that purpose.[3]

- For example, if you're employing a babysitter and need their TIN for tax purposes, you could give them a 1099 and have them fill out their information.

-

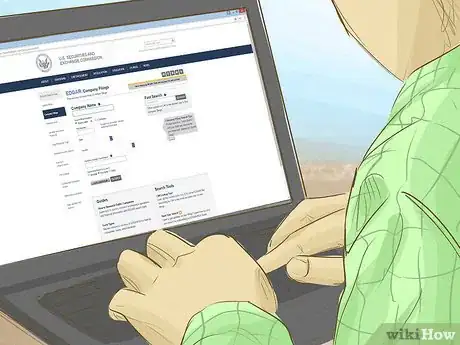

4Use an online database for publicly-traded companies or nonprofits. If you need the EIN of a corporation, check out EDGAR—the public database of filings corporations are required to make with the SEC (Securities and Exchange Commission). These filings are all public records—just put in the name of the corporation and click through the results until you find what you're looking for. The corporation's EIN will be on 8-K, 10K, and 10-Q reports.[4]

- Try state filings as well. Check the website of the attorney general of any state where the business operates.[5]

Finding Your Individual TIN

-

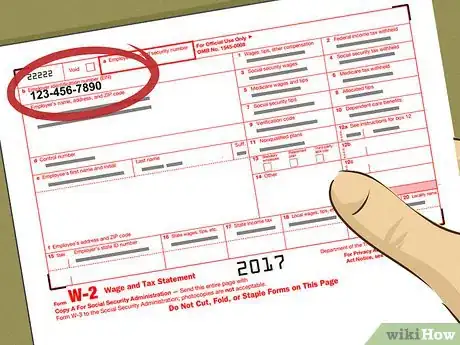

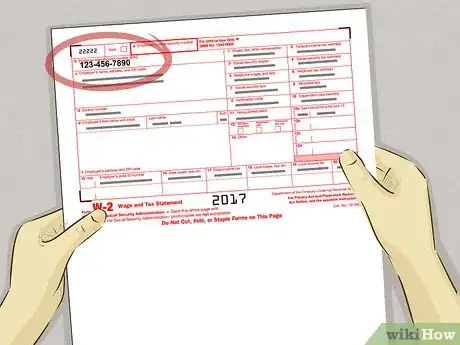

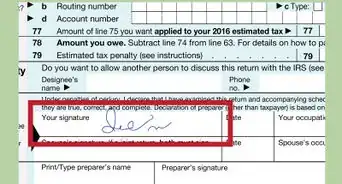

1Look at Box "a" on your W-2 form if you're employed. This required form includes your Social Security number. If you have a Social Security number, that number is also your federal tax ID number (TIN). If you don't have a Social Security number but you're employed, you have a TIN issued by the IRS.[6]

- If you're an independent contractor, look in the box labeled "Recipient's TIN" on Form 1099.[7]

-

2Ask for a copy of your W-2 from a previous employer. The IRS requires employers to keep these documents on file for at least 4 years after you leave the company. Call and speak to someone in accounting, payroll, or human resources. They'll help you get the paperwork you need.[8]

-

3Request a replacement Social Security card. If you've lost your Social Security card, start your application online. Then, go to your local Social Security office with original documents to verify your identity. Your replacement card will soon be in the mail.[9]

- Often, you don't need the card itself—you just need to know the number. But if you don't have your Social Security number memorized, having the card will save you a lot of hassle.

-

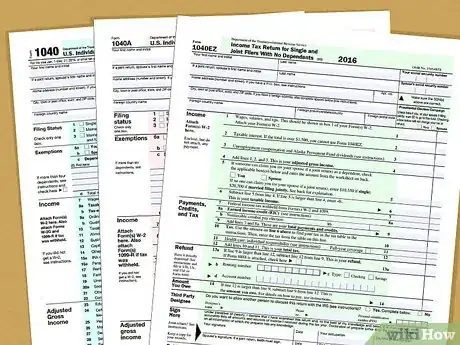

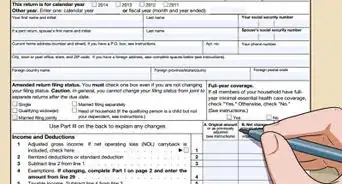

4Look on the top right-hand corner of an old tax return. Your tax returns always have your Social Security number or other TIN on them. Search your records for paper copies of old tax returns. If you filed your taxes online, you can get copies from the company you originally used to file your taxes—just log on to your account and follow the prompts to access past returns.[10]

Finding Your Employer's EIN

-

1Check Box "b" on your most recent W-2. This box is near the top-left corner of the form. As long as your employer hasn't changed their ownership or corporate structure since the W-2 was created, that number is still your employer's EIN.[11]

-

2Call your employer's payroll or human resources department. These departments typically have your employer's EIN at hand and can rattle it off for you pretty quickly. It's not private information like a Social Security number, so they shouldn't have any trouble giving it to you—even if you've recently left the company.[12]

-

3Look up SEC filings if your employer is a publicly traded corporation. Search for the name of your employer on EDGAR to pull up the SEC filings. Scroll through, looking specifically for an 8-K, 10-K, or 10-Q report—you'll find the EIN there.[13]

- If you don't find anything through the SEC, try state filings in the state where you live. Even if your employer doesn't have to file any documents with the SEC, they might have to file documents at the state level.[14]

Finding Your Business's EIN

-

1Look at your business's tax records. Your EIN appears on any tax return or other official correspondence between your business and the IRS or your state's taxation and revenue department. If your business is new, look for the automatic notice the IRS sent when it issued your EIN.[15]

- Check both digital and physical records, especially if you've been filing a lot of tax returns and documentation electronically.

-

2Check with your bank. If you have a business bank account for your business, stop by a local branch and ask for your business's EIN. Bring personal identification with you so you can verify that you're entitled to this information. You might also be able to get it online or over the phone.[16]

-

3Look on your local or state government licenses. Typically, you at least need a business license to operate a business in a specific location. That license might have your EIN listed on it. If it doesn't, call the state or local department that issued the license—they'll have your EIN on file.[17]

-

4Call the IRS business and specialty tax line. Call 800-829-4933 Monday through Friday between 7 a.m. and 7 p.m. in your local US time zone. If you've misplaced your EIN, operators can search the database and give you the number you need.[18]

- Be prepared to provide your name, Social Security number, and position in the company. The operator needs to verify that you're entitled to the information before they give it to you.

-

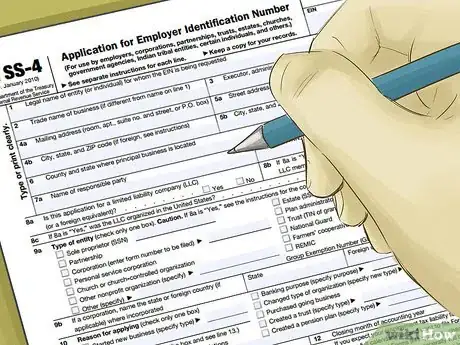

5Apply for a new EIN after a change in your business structure. Your EIN lasts for the lifetime of your business. At the same time, the IRS interprets some changes as ending the old business and creating a new one, which means you need a new EIN.[19]

- For example, if you originally organized your business as an LLC, then later incorporated it, you would need a new EIN for the corporation.

References

- ↑ https://www.fedex.com/content/dam/fedex/us-united-states/services/CommercialInvoice.pdf

- ↑ https://causeinspiredmedia.com/google-ads/importance-nonprofits-ein/

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-self-employed-or-employee

- ↑ https://www.sec.gov/edgar/search-and-access

- ↑ https://www.sos.la.gov/BusinessServices/SearchForLouisianaBusinessFilings/Pages/default.aspx

- ↑ https://www.irs.gov/pub/irs-pdf/fw2.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/employment-tax-recordkeeping

- ↑ https://faq.ssa.gov/en-US/Topic/article/KA-02017

- ↑ https://www.irs.gov/pub/irs-pdf/f1040.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw2.pdf

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/employment-tax-recordkeeping

- ↑ https://www.sec.gov/edgar/search-and-access

- ↑ https://www.sos.la.gov/BusinessServices/SearchForLouisianaBusinessFilings/Pages/default.aspx

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/employment-tax-recordkeeping

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/lost-or-misplaced-your-ein

- ↑ https://azdor.gov/business

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/lost-or-misplaced-your-ein

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/how-to-apply-for-an-ein

About This Article

If you need to find the federal tax ID number for your employer, also called their Employer Identification Number or EIN, check your W-2 form under section “b.” If you haven’t gotten a W-2 yet, call your employer’s payroll division instead. If you are trying to find the tax ID number for a third-party, such as a child-care facility or a non-profit organization, check any invoices or other paperwork you have received from them. If the information isn’t listed in your records, check the company’s website or call the business directly and ask for the EIN. If you need to find the tax ID number for your own business, keep reading the article!