This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 53,347 times.

Learn more...

New Jersey requires municipalities to hold tax sales of delinquent property taxes at least once a year. Many people look at the purchase of tax liens as an investment opportunity. You pay the taxes owed, and in exchange you get the right to charge interest on the amount owed by the property owner. If they fail to pay their delinquent taxes within 2 years, you can foreclose on the property and take it over.[1]

Steps

Registering as a Bidder

-

1Check municipality registration requirements. While each municipality is required to have at least one tax sale each year, some have more than one. Check the website of the tax collector for the municipalities where you're interested in buying property. They will list the deadlines and requirements for registering as a bidder.

- At a minimum, you must be at least 18 years old and a citizen or legal resident of the United States.

- If there is an upcoming sale, you may be able to look at the property list so you can determine your interest in that municipality. You can also look at the results of previous sales.

-

2Comply with additional requirements for special tax sales. Under New Jersey's Abandoned Properties Rehabilitation Act, municipalities can hold special tax sales that include abandoned properties in distressed communities. The goal is to revitalize these communities.[2]

- Municipalities may have additional requirements for bidders at special tax sales. For example, you may have to demonstrate that you have experience and qualifications to rehabilitate a distressed property.

- Bidders at special tax sales often are nonprofit organizations or community organizations dedicating to rebuilding distressed communities.

Advertisement -

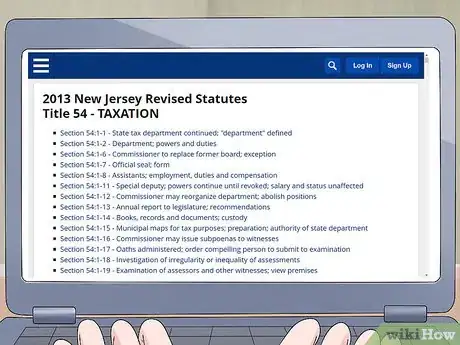

3Read Title 54 of the New Jersey Statutes. As a bidder, it is your responsibility to understand your responsibilities as a tax certificate holder. The law lays out specific obligations for tax certificate holders. If you don't meet these legal obligations, you could lose your investment and any right to the property.[3]

- Sales take place online. You can take a training class that covers how to use the software, but it does not cover statutory requirements. It still might be helpful if you are unfamiliar and don't consider yourself to be particularly tech savvy. Call the customer service center at (877) 361-7325 for more information about how to register for the training.[4]

-

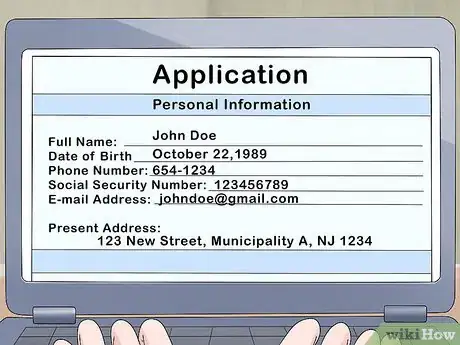

4Complete your application. Since the sales take place online, the application is also online. Follow the link on the tax sale website of each municipality. If you want to register for tax sales at several municipalities, you'll have to complete a separate application for each one.

- Double-check your information before you submit it. In the event you win a bid, the municipality will use the information you provided to fill out your tax certificates.

-

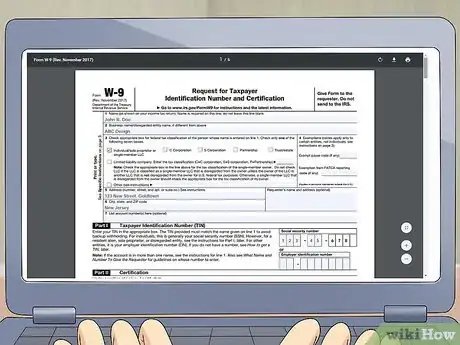

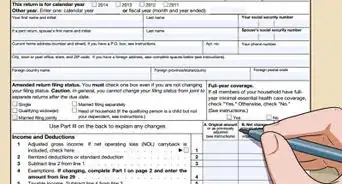

5Submit a W-9. Since you will potentially be earning interest if you purchase any tax certificates, you must submit a W-9 so that income can be reported to the IRS. You are responsible for reporting any interest earned on your own income tax returns.

- You can fill out the W-9 online when you complete the application to register as a bidder.

Buying Tax Liens

-

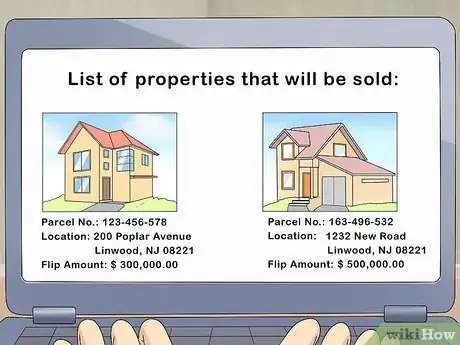

1Study the published list of available properties. A few weeks before the tax sale, the municipality will post a list of properties that will be sold. The sale itself will follow the order the properties are listed on the published list, although some properties may be removed from the list by the time of the sale.[5]

- The main reason a property would be removed from the list would be that the property owners have paid their delinquent taxes.

- Use the list to plan your strategy for the sale and decide which properties you're interested in bidding on.

-

2Pay your initial deposit. A day or two before the sale at the latest, you must submit a deposit of at least 10 percent of the amount you plan to bid at the tax sale. Since the price of the properties is already fixed, simply mark the properties you plan to bid on and deposit 10 percent of the total. This total doesn't need to include premiums.[6]

- The initial deposit can only be paid online using ACH transfer from a US bank account.

-

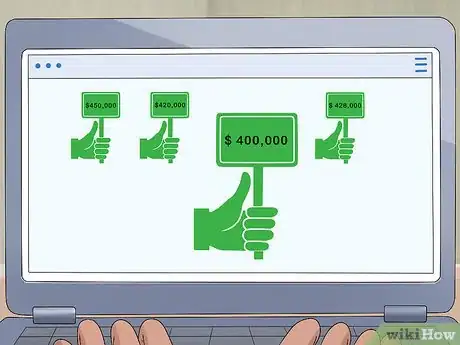

3Bid down the lien. The price of each listing is already fixed. By law, you must pay the total taxes, penalties, and interest owed for each property. When you bid for properties, you are bidding on the interest you will receive while you hold the tax lien.[7]

- Bidding starts at the statutory maximum rate of 18 percent and goes down. The person with the lowest bid wins the property.

-

4Offer a premium if the lien is bid down to zero. If the interest rate is bid down to zero and there are several people still interested in the property, you can win the tax lien by bidding a dollar amount you are willing to pay in excess of the taxes, penalties, and interest already owed on the property.[8]

- The bidder offering the highest premium is awarded the tax lien on the property.

-

5Pay taxes and interest on winning bids. All taxes, penalties, and interest owed must be paid immediately after the conclusion of the tax sale. Different municipalities have their own rules regarding the timing and method of payments.[9]

- When you make your payments, you will be issued certificates for the tax liens you've purchased. Your certificates may be ready immediately, or you may have to wait a few days before you can pick them up. You'll be notified when they're ready.

-

6Record your certificate. Take your certificate to the Deed Room of the County Clerk's office within 90 days after the close of the sale. The clerk will record your certificate to protect your interest in the lien you've purchased.[10]

- If you don't record your certificate within 90 days, the certificate may be revoked and you would lose any right to recover the taxes, penalties, and interest you paid on the property.

Foreclosing on the Property

-

1File a complaint in Superior Court. For tax certificates bought at regular tax sales, you must wait for 2 years before you can foreclose on the property. This redemption period gives the property owners a chance to retain their ownership interest by paying all taxes, penalties, and interest due.[11]

- You have a legal obligation to file a complaint for foreclosure within 6 months after the redemption period expires.

- If you bought a tax certificate on abandoned property at a special tax sale, you don't have to wait 2 years for the property owners to redeem the property. You can file a complaint for foreclosure immediately after the tax sale.

-

2Serve notice to anyone with an ownership interest. Tax foreclosure eliminates all property interests in the property. Accordingly, the property owners must be notified of the foreclosure, as well as any other lien holders, such as mortgage companies.[12]

- You are only responsible for serving individuals or entities that you can find by looking at the property records. Use the last known address or contact information available.

- Use the exact language, format, and procedure specified in the statute to provide notice. If the court determines your notice was insufficient, you may lose your right to ownership of the property.

-

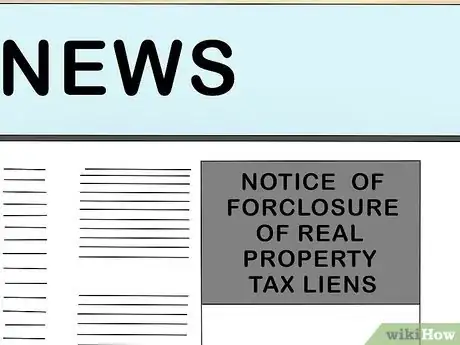

3Publish notice in the newspaper. You must run a legal advertisement in a newspaper circulating in the municipality where the property is located for several weeks before the foreclosure hearing is scheduled.[13]

- To be sufficient as notice, this ad must include the properties involved, their owners of record, and the amounts due.

- Tax certificates on abandoned property purchased at a special tax sale have an expedited notice procedure that only requires a single advertisement in any newspaper circulating in that municipality.

-

4Attend the court hearing. The court will hold a hearing to determine whether you have met all your obligations as a lien holder. If you have, and if the property owners still have not paid the taxes, interest, and penalties due, the judge will order the property foreclosed upon.[14]

- The property owner retains the right to redeem the property by paying the total amount of taxes, interest, and penalties due up until the moment the judge signs the order of foreclosure.

-

5Take possession of the property. Once foreclosure is perfected, a new deed will be issued in your name. You are now the owner of the property and have all the rights that come with that, including the right to sell the property.[15]

- If you purchased the property at a special tax sale, you may not be able to sell the property outright. Municipalities have guidelines on the rehabilitation and reuse of abandoned property sold at special tax sales.[16]

Warnings

- Buying tax liens is not a passive investment strategy. It requires active management to meet the legal requirements so you can earn interest or eventually foreclose on the property. Research carefully and make sure you understand the process and potential for gains and losses before you begin.[17]⧼thumbs_response⧽

References

- ↑ http://www.nj.gov/dca/divisions/dlgs/programs/tax_collector_docs/elements_of_tax_sales_nj.pdf

- ↑ http://www.hcdnnj.org/tax-foreclosure-and-tax-sales

- ↑ https://trenton.newjerseytaxsale.com/index.cfm?folder=showDocument&documentName=FAQ

- ↑ https://trenton.newjerseytaxsale.com/index.cfm?folder=showDocument&documentName=training

- ↑ https://trenton.newjerseytaxsale.com/index.cfm?folder=showDocument&documentName=biddingRules

- ↑ https://trenton.newjerseytaxsale.com/index.cfm?folder=showDocument&documentName=biddingRules

- ↑ http://www.hcdnnj.org/tax-foreclosure-and-tax-sales

- ↑ http://www.hcdnnj.org/tax-foreclosure-and-tax-sales

- ↑ http://www.nj.gov/dca/divisions/dlgs/programs/tax_collector_docs/elements_of_tax_sales_nj.pdf

- ↑ http://www.nj.gov/dca/divisions/dlgs/programs/tax_collector_docs/elements_of_tax_sales_nj.pdf

- ↑ http://www.hcdnnj.org/tax-foreclosure-and-tax-sales

- ↑ http://www.hcdnnj.org/tax-foreclosure-and-tax-sales

- ↑ http://www.hcdnnj.org/tax-foreclosure-and-tax-sales

- ↑ http://www.hcdnnj.org/tax-foreclosure-and-tax-sales

- ↑ http://www.nj.gov/dca/divisions/dlgs/programs/tax_collector_docs/elements_of_tax_sales_nj.pdf

- ↑ http://www.hcdnnj.org/tax-foreclosure-and-tax-sales

- ↑ http://www.nj.gov/dca/divisions/dlgs/programs/tax_collector_docs/elements_of_tax_sales_nj.pdf