This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 1,429,043 times.

Gross profit is a way to compare the cost of the goods your company sells and the income derived from those goods. All you need for the gross profit formula is your total revenue, and the cost of goods sold (COGS). You can use your gross profit margin to quickly and meaningfully compare your company to your competitors, the industry as a whole, or even your own past performance. Our how-to guide breaks it down for you, including examples.

Steps

Calculating Gross Profit Margin

-

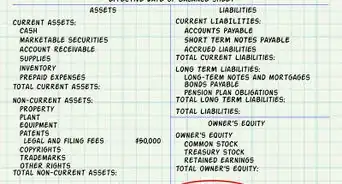

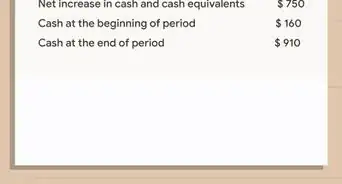

1Look up Net Sales and Cost of Goods Sold. The company's income statement lists both values.

-

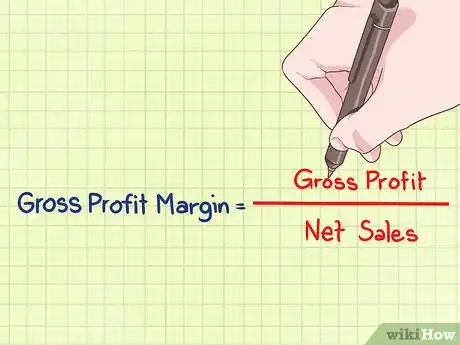

2Gross Profit Margin = (Net Sales - Cost of Goods Sold) ÷ Net Sales.Advertisement

-

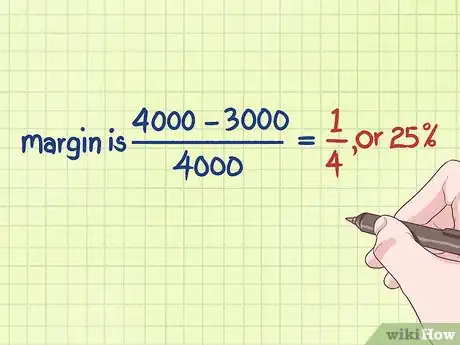

3Example. A company makes $4,000 selling goods that cost $3,000 to produce. Its gross profit margin is , or 25%.

Understanding the Terms

-

1Understand Gross Profit Margin. The Gross Profit Margin (GPM) is the percentage of revenue a company has left over after paying direct costs of producing goods.[1] All other expenditures (including shareholder dividends) must come out of this percentage. This makes the GPM a good indicator of profitability.

-

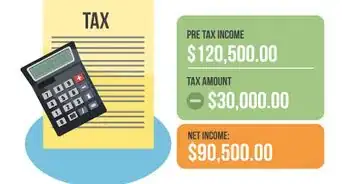

2Define Net Sales. A company's net sales equal its total sales minus returns, allowances for damaged merchandise, and discounts.[2] This is a more accurate measure of incoming money than total sales alone.

-

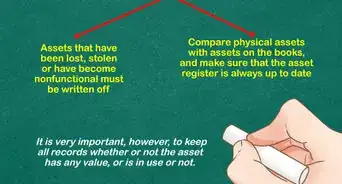

3Measure Costs of Goods Sold. Abbreviated COGS, this figure includes the cost of materials, labor, and other expenses directly related to the production of goods or services.[3] It does not include costs of distribution, labor that does not go into goods production, or other indirect costs.

-

4Avoid confusing Gross Profit with GPM. The Gross Profit equals the Net Sales minus the Cost of Goods Sold. This is expressed in dollars or other units of currency. The formula above converts Gross Profit to GPM, a percentage, for easy comparison with other companies.

-

5Understand why these figures are important. Investors look at Gross Profit Margin to see how efficiently a company can use its resources. If one company has a GPM of 10% and a second company has a GPM of 20%, the second company is making twice as much money per dollar spent on goods. Assuming other costs are roughly equal between the two companies, the second company is probably the better investment opportunity.

- It's best to compare companies in the same sector. Some goods and services have a lower average profit margin than others.

Expert Q&A

-

QuestionHow do I calculate the profit, expressed as a percentage, that the vendor makes when selling a 180 airtime voucher?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor Subtract the cost of the voucher from the price received from its sale. the difference is gross profit. To calculate the Gross Profit Margin percentage, divide the price received for the sale by the gross profit and convert the decimals into a percentage. For example, 0.01 equals 1%, 0.1 equals 10 percent, and 1.0 equals 100 percent.

Subtract the cost of the voucher from the price received from its sale. the difference is gross profit. To calculate the Gross Profit Margin percentage, divide the price received for the sale by the gross profit and convert the decimals into a percentage. For example, 0.01 equals 1%, 0.1 equals 10 percent, and 1.0 equals 100 percent. -

QuestionHow do I calculate the gross as a percentage if I have the GP in dollars and the net sales in dollars?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor Net Sales is Gross Sales less returns, discounts, and allowances for damaged or missing goods. Calculate Gross Sales by adding back those amounts if known to Net Sales, then divide your Gross Profit by Gross Sales. This will provide the answers in decimals that can be converted into a percentage.

Net Sales is Gross Sales less returns, discounts, and allowances for damaged or missing goods. Calculate Gross Sales by adding back those amounts if known to Net Sales, then divide your Gross Profit by Gross Sales. This will provide the answers in decimals that can be converted into a percentage.

References

About This Article

To calculate gross profit margin, start by subtracting the cost of goods sold from the net sales. Then, divide the difference by the net sales to find the gross profit margin. If you're not sure what the net sales and cost of goods sold are, you can look them up on the company's income statement. For more tips from our Financial co-author, like how to interpret gross profit margin, scroll down!