wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 13 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 59,935 times.

Learn more...

When you decide to start a business, you have many decisions to make. Arguably the most important decision you will make is which form of a business entity to establish. There are many entities to choose from and each will have its own advantages and disadvantages. Evaluate each option from a tax standpoint and assess any legal liability considerations when determining which will best fit your business.

Steps

Creating a Sole Proprietorship

The Sole Proprietorship is a very common business structure because it is the easiest to form and to create. A sole proprietor is an individual that owns an unincorporated business by himself. All of the profits and losses of the sole proprietorship are treated as the income or losses of the individual owner for tax purposes, and must be reported on the owner’s income tax return. Since the sole proprietorship is an unincorporated business, there is no corporate tax.

From a legal standpoint, the sole proprietorship does not exist as a separate entity from the owner of the business, whereas other business structures (such as corporations) exist as separate legal entities. The main area of concern with regard to a sole proprietorship is with liability. With a sole proprietorship, if someone wishes to file a lawsuit against the business, they are essentially suing the business owner, and the business owner will be personally liable for the lawsuit.[1] In contrast, with a corporation, if someone wishes to sue the corporation, that person is suing only the corporation, and generally the shareholders will not be personally liable for the lawsuit.

-

1Consider writing a business plan. A business plan details how your business will run. While this step is not required to operate a sole proprietorship, it will help you to plan your business.

-

2File for a “Doing Business As” (DBA) Certificate.[2] If you wish to conduct business under a name that is not your own, you must obtain a certificate to do so. You may file for a DBA at your local county clerk’s office building by filling out a form and paying a fee. If you are doing business under your given name (not giving your business a separate name) you do not need a DBA.Advertisement

-

3Begin conducting business. As a sole proprietor, your business does not technically exist from a legal standpoint, and therefore you need not file any paperwork to get it started.

-

4Report your business profits and losses on your personal tax return.

Creating a Limited Liability Company (“LLC”)

An LLC is an unincorporated business, but has more protections (hence the limited liability) than the sole proprietorship. To create an LLC, a business owner must file documents and pay fees in the state where it wishes to form. Note that not every state has the LLC as an available business structure.

As with the sole proprietorship, the profits and losses of the business pass through to the members of the LLC, thus avoiding corporate taxes. Each member of the LLC will report the income and losses of the LLC on their individual tax return and be taxed at their individual tax rate.

According to the federal government, the LLC does not exist separately from the individual members. For liability purposes, however, individual members of the LLC will generally not be personally liable for a lawsuit against the LLC.[3] This is the main advantage over the sole proprietorship.

-

1Consider writing a business plan.

-

2File organizational documents with your state. Not all states offer the LLC as a business entity, so be sure to check with your state’s Department of State before deciding on this structure.[4] Then determine which documents you will be required to file. Generally the documents include Articles of Organization and some states may also require you to publish notice of your business formation in local newspapers. You will also likely have to pay a fee.

-

3Draft and adopt an Operating Agreement. An operating agreement is generally an internal document that is not filed with the state, however you may be required to have one by your state. Even if not required, it is a good idea to draft an operating agreement because it details exactly how your business will run, from the type of business you decide to operate to handling payroll and who will receive what share of profits and losses.

-

4Operate your business.

-

5Report your business profits and losses on your personal tax return.

Creating a Corporation

A corporation is an incorporated business where shareholders put money and/or property into the business in exchange for shares of the corporation’s stock. A corporation is often a large business with several different shareholders. Forming a corporation requires filing documents with the state and the federal government. A disadvantage of a corporation is that this business structure requires the owners to comply with many state- and federally-mandated corporate formalities.

For tax purposes, the corporation is taxed twice: once at the corporate level and again at the individual level. This double taxation is often viewed as the main disadvantage of the corporate business structure.[5] The federal government recognizes a corporation as a separate legal entity, which can be an advantage of the corporation business structure.

For legal liability purposes, the corporation structure enjoys the benefits of being a separate legal entity, and thus the shareholders of the corporation are generally not liable for lawsuits against the corporation.[6]

-

1Choose a name for your corporation. States generally place restrictions on the words that may or may not be used in the name of a corporation. Generally the name must include the word ‘incorporated’ or ‘inc.’ or some other indicia that the business is a corporation.

-

2Determine who will be the initial directors of the corporation. The initial board of directors is composed of those individuals in charge of getting the corporation up and running. They will authorize the issuance of stock and pick officers of the corporation, two of the most important decisions the corporation will make.

-

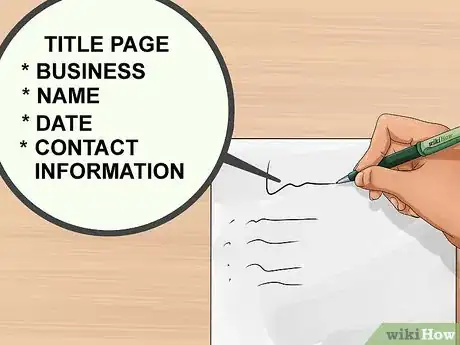

3File incorporation documents with your state. These are usually called articles of incorporation and are generally accompanied by a filing fee. Your state’s secretary of state or department of state office will likely have an approved form that you may fill out or you may draft your own. Articles of incorporation generally include the name of the corporation, its address, and the name and contact information for a person to whom members of the public can contact regarding that corporation.

-

4Draft corporate bylaws. These are analogous to the operating agreement that an LLC operates under. Corporate bylaws will include additional information such as how shares of stock will be voted, how directors are chosen, etc. Usually you may use a template for the bylaws or draft your own.

-

5Hold an initial board meeting and adopt the bylaws. At this meeting the initial board of directors will adopt the bylaws, elect officers, authorize the issuance of stock, and determine how to handle certain financial or tax issues such as the corporation’s fiscal year.

-

6Issue shares of stock. In order to officially be a corporation you must issue stock, as this formalizes the division of the ownership of the business.

Creating a Subchapter S Corporation

The S Corporation is a tax election that an existing corporation makes. Essentially, it avoids the double taxation of regular corporations by electing to have the taxes pass through the corporation to the shareholders.[7] Each shareholder will report the S corporation’s profits and losses on their own individual tax return. The S Corporation has a number of restrictions on the type of business the corporation can engage in, the number of shareholders, and the type of stock issues.

The S Corporation enjoys the same legal liability status of other corporations.

-

1Form a corporation. Since a Subchapter S Corporation is a tax election that a corporation makes, the first step to creating an S Corporation is to create a corporation. Follow the steps outlined above.

-

2File Form 2553 with the IRS. The form is available on the IRS website.

-

3Approve the S Corporation tax election at the initial board meeting. There must be unanimous consent by the board in order to make the S Corporation tax election.

References

- ↑ https://www.entrepreneur.com/article/77798

- ↑ https://www.businessexpress.ny.gov/app/answers/cms/a_id/3050/kw/sole%20proprietor

- ↑ http://www.businessdictionary.com/article/39/what-is-a-limited-liability-company-llc/

- ↑ https://www.entrepreneur.com/article/200516

- ↑ https://www.accountingtools.com/articles/corporation-advantages-and-disadvantages.html

- ↑ https://startupnation.com/start-your-business/plan-your-business/benefits-of-forming-a-corporation/

- ↑ https://startupnation.com/start-your-business/plan-your-business/benefits-of-forming-a-corporation/