This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 46,855 times.

Learn more...

A regular C corporation is taxed twice—one tax at the corporate level on the corporation’s net income, and then a second tax when profits are distributed to shareholders. You can avoid this double taxation by electing to become an S corporation. File articles of incorporation with your state to get your corporation off the ground. Then fill out the appropriate IRS form to elect to become an S corporation.[1]

Steps

Forming a Corporation

-

1Pick your corporate name. Your name must be unique. It can’t be the same or too similar to a name currently used in your state.[2] Your Secretary of State’s website should have a database you can use to search. Find out whether the name is available.

- Consider reserving the name if it is available. Typically, you will complete a form and file it with your Secretary of state. You typically need to pay a fee, and the reservation is good for a limited amount of time.

- Also check whether the name has been trademarked. You can search the federal trademark database at https://www.uspto.gov/trademarks-application-process/search-trademark-database. You shouldn’t use the name if someone has trademarked it.

-

2Fill out articles of incorporation. You incorporate by filing articles of incorporation with your state.[3] Check with your Secretary of State’s office, which should have “fill in the blank” forms. Generally, you’ll need to include the following information:

- Your corporation’s name.

- The address for your principal place of business.

- The name and contact information for your registered agent. This person will receive legal papers in case your corporation gets sued.

- The name of at least one director.

Advertisement -

3Submit your articles of incorporation. Depending on your state, you might be able to fill out and submit your articles online. In other states, you have the option of completing paper articles and submitting the through the mail.

- You’ll need to pay a fee to file. If you file online, you can usually pay with a debit or credit card.

-

4Draft bylaws. Your bylaws are the operating manual for the corporation. You won’t need to file them with your state. However, you should draft them and keep them at your principal office. Bylaws typically contain the following information:[4]

- Your corporation’s identifying information, such as name, address, and principal place of business.

- The number of directors and corporate officers.

- Your procedure for calling and holding director or shareholder meetings.

- A description of how corporate records will be kept, including who can inspect them.

- A conflict of interest statement. This policy will prohibit how directors, officers, and managers personally benefit from the corporation’s dealings.

- The process for amending your bylaws and articles of incorporation.

-

5Obtain other permits. Depending on the business, you might need other licenses to operate. Each state is different. Contact your county government and possibly consult with an attorney.

- Your nearest Small Business Development Center (SBDC) can help you identify what licenses or permits you need. Find your nearest SBDC at http://americassbdc.org/home/find-your-sbdc/.

-

6Get an EIN. Your Employer Identification Number will be your corporation’s tax ID. You’ll need this number when you open a business bank account and report employee income tax. You can request it online at https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online.

-

7Convene a board of directors. At their first meeting, they should adopt the bylaws and select corporate officers. You might also need to elect other directors at the meeting.

- Your directors should authorize stock certificates for all shareholders. Note the names of shareholders in your corporate records book.[5]

- Your board should also approve applying for S corporation status. Make sure all directors review the requirements of an S corporation before voting.

-

8Register with your state and local taxing authority. Find out what taxes you need to pay. For example, if you sell goods or services directly to the public, you must collect and remit sales or use tax. You’ll need a registration number from your state.

Meeting Qualifications for an S Corp

-

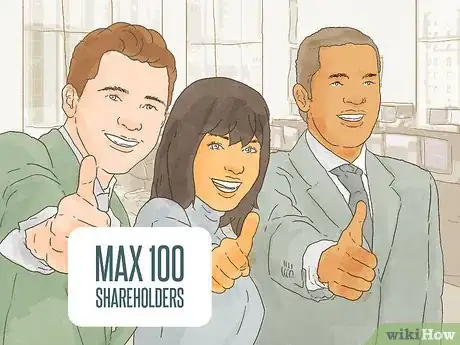

1Have 100 or fewer shareholders. Large corporations can’t become S corporations. You must have no more than 100 shareholders in order to qualify.[6]

- You can also have only one class of stock. Voting rights don’t need to be identical, but all stock should confer the same rights to distribution and liquidation proceeds.[7]

-

2Make sure you have only allowable shareholders. Partnerships, corporations, and non-resident aliens cannot be shareholders in your business. However, individuals, estates, and certain trusts may own stock in the company.[8]

-

3Satisfy other requirements. Confirm that your business will satisfy the following, otherwise you can’t form an S corporation:[9]

- You must be a domestic corporation.

- You can’t be an ineligible corporation. Certain corporations, such as financial institutions, insurance companies, and domestic international sales corporations don’t qualify.

-

4Consult with an attorney if you have questions. You might not know if becoming an S corporation is right for you, or you might not know if you meet the requirements. Only a qualified attorney can listen to your situation and offer tailored advice.

- Obtain a referral by contacting your nearest bar association.

Electing to Become an S Corporation

-

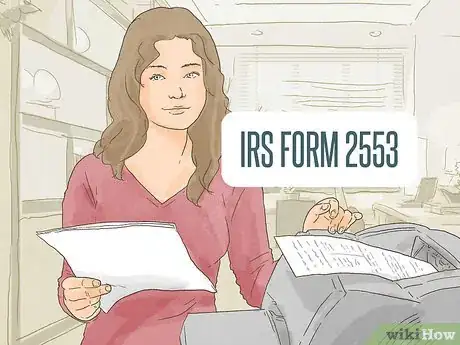

1Complete IRS Form 2553. You must complete and submit this form in order to become an S corporation. The form is available at the IRS website: https://www.irs.gov/businesses/small-businesses-self-employed/s-corporations. Also download instructions from the same website.

- You should either print neatly or type your information directly into the PDF. Provide all requested information.

- This form must also be signed by all shareholders.[10]

- Read the instructions to find out where to submit the form. The mailing address will depend on where your corporation is located. Make a copy for your records before submitting.

-

2Submit on time. You must submit your form no later than two months and 15 days from the start of your tax year. If you miss this deadline, then the S corporation status won’t take effect until the next tax year.[11]

- For example, your tax year might run from January 1, 2018 to December 31, 2018. If you want S corporation status for 2018, you must submit before March 15, 2018.

-

3Receive your notification. You will be notified if your election has been accepted. Generally, it will take about 60 days to hear back. If you don’t hear anything within two months, you should follow up and call 1-800-829-4933.[12]

- Once approved, your S certification stays in effect until you revoke it or until the IRS cancels it.

References

- ↑ https://www.legalzoom.com/knowledge/corporation/faq

- ↑ http://www.nolo.com/legal-encyclopedia/form-corporation-how-to-incorporate-30030.html

- ↑ http://www.nolo.com/legal-encyclopedia/form-corporation-how-to-incorporate-30030.html

- ↑ http://smallbusiness.findlaw.com/incorporation-and-legal-structures/writing-corporate-bylaws.html

- ↑ http://www.nolo.com/legal-encyclopedia/form-corporation-how-to-incorporate-30030-2.html

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/s-corporations

- ↑ https://www.irs.gov/instructions/i2553/ch01.html

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/s-corporations

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/s-corporations