This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 30,373 times.

If you have an LLC, you can transfer real property and personal assets to that LLC to help capitalize your new company and to protect those assets from potential liability. Selling real property or other assets to an LLC is another way to transfer them. The process of transferring property to an LLC is relatively simple, but you must ensure the transfer is recorded properly for it to take effect. Consult an attorney or financial advisor for more complex transfers.

Steps

Transferring Real Property

-

1Get permission from the lender if you have a mortgage. Most mortgage contracts include a clause that gives the mortgage lender the right to demand payment of the loan in full if the property is sold or transferred.[1]

- If you're transferring the property from your name into an LLC that you own, the lender should not have a problem with you doing this. But you need to get permission from them in writing.

-

2Request the correct deed form. You'll need to execute a new deed to transfer the property from your name into the name of your LLC. A warranty deed is more complex and requires you to make specific guarantees about your ownership of the property. A quitclaim deed simply transfers any title you may have in the property.[2]

- If there are other members of your LLC, you may want to ask them which they would prefer. A warranty deed will require a little more work on your part. For example, you may need to do a title search on the property before you can use a warranty deed.

- A quitclaim deed is a quicker and easier, in that you don't have to do any work or research before completing it.

Advertisement -

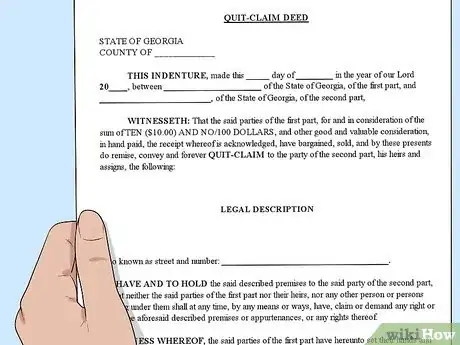

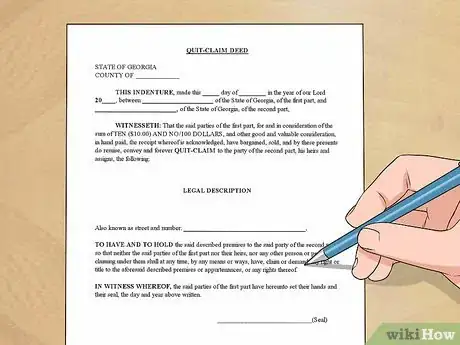

3Fill out your deed form. The new deed officially transfers the property to your LLC. You will list yourself as the grantor and your LLC as the grantee. Make sure you use the registered legal name of your business.[3]

- Check the old deed and make sure you list your name exactly as it's written on the original deed. Otherwise, the transfer could be disputed later on.

-

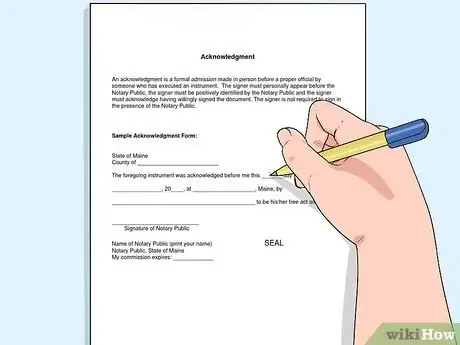

4Sign the deed in the presence of a notary. To make the transfer of real property official, you typically must use a notary public. The notary will verify your identity and then witness your signature.[4]

- In some states you may need additional witnesses apart from the notary. If additional witnesses are required, arrange for them to accompany you to the notary. Typically all signatures must be completed at the same time.

-

5Record the property transfer in your operating agreement. When you transfer real estate to your LLC, you are making a capital contribution to the LLC. The value of that contribution should be reflected in your operating agreement.[5]

- If you don't have a recent appraisal of the property, you may have to get one so that you know the approximate value of the property. You can also use your latest tax assessment.

- Recording the transfer in your operating agreement is especially important if there are other members of your LLC, because your contribution potentially alters the balance of ownership in the company.

Transferring Other Assets

-

1Determine the market value of the property. Any property you transfer to your LLC is considered a capital contribution. The amount of that contribution is the market value of the property you're transferring from your name into the LLC's name.[6]

- Even if you are the sole member of your LLC, the LLC is considered a separate and distinct entity from you and your personal finances. However, you may not need to be as exact about the value if your LLC doesn't have any other members.

-

2Consult a tax advisor. In most cases, simply transferring property to an LLC is a tax-free transaction. All you need to do is adjust your LLC's records accordingly and execute any titles or other ownership documents.[7]

- However, if you started your business as a sole proprietorship and were deducting the property on your taxes, you may have to calculate the carryover basis in the property for the LLC. For example, if you bought a computer for $2,000 and took $1,000 in deductions, the LLC would have a carryover basis of $1,000 regardless of the fair market value of the computer at the time of transfer.

-

3Adjust title documents as needed. If you transfer a piece of property that has a title, such as a car, you'll need to sign the title over to the LLC and execute a new title in the name of the LLC.[8]

- Contact your lender if you're still making payments on the property you want to transfer to your LLC and get their permission. Otherwise, they may act on a clause in the loan agreement and demand payment of the rest of the loan in full.

- You also want to transfer any warranties into the name of the LLC, rather than holding them in your personal name.

- You may be required to have these documents notarized. Look for space for a notary seal on the documents. If you see one, don't sign the transfer document until you are in the presence of a notary, since they will need to witness your signature.

-

4Record the asset transfer in your operating agreement. The fair market value of the property transferred must be noted as a capital contribution in your LLC's operating agreement. If there are other members of your LLC, this could alter the ownership percentages.[9]

- If you filed your operating agreement with your state's Secretary of State, you'll probably need to file the updated agreement as well. Contact the Secretary of State's office if you have any questions about this.

Selling Property to an LLC

-

1Assess the fair market value of the property. Selling property is another way to transfer it to your LLC. The sale must be for a reasonable amount, which means you'll need to know the fair market value of the property.[10]

- In some cases this doesn't require a lot of work. For example, if you're selling a motor vehicle to your LLC, you can simply look up the value using the Kelley Bluebook or a similar reference.

- For other property, such as computers or office equipment, consult a dealer who specializes in that type of property.

-

2Put the sale in writing. Even if you're the only member, your LLC is still considered a separate legal entity from you. While it may seem silly to essentially write a contract with yourself, the written bill of sale is essential to prove it is a fair, arm's length transaction.[11]

- Attach to the sales contract any written appraisal or other assessment of the fair market value of the property.

-

3Document the reason for the sale. If someone sues you, they may argue that you sold your property to the LLC so that it would be protected from any judgement rendered against you. It can help to include a brief description in the sales contract of the reason you're transferring the property to your LLC.[12]

- If you've been sued, or believe you are going to be sued, consult an attorney before transferring property to your LLC.

-

4Consult a tax advisor regarding tax consequences of the sale. If you sell property to your LLC, you may have a capital gain that you need to report on your taxes. A tax advisor will be able to accurately assess your situation and let you know of any tax consequences.[13]

- You can't simply decrease the amount for which you sell the property to eliminate a capital gain. You have to sell the property for a reasonable amount, which typically will be close to fair market value.

-

5Record sales as capital contributions. While you don't need to include sales of real property or other assets in your operating agreement, you still need records of all sales. This typically means making a record of the sale in the bookkeeping ledgers of the LLC.[14]

Warnings

- Transferring property to an LLC is a good way to protect that property if you're sued. However, if you wait to transfer the property until a lawsuit has already been filed against you, the court will disregard the transfer as fraudulent. If you've been served with a lawsuit, talk to an attorney as soon as possible.[15]⧼thumbs_response⧽

References

- ↑ https://www.score.org/blog/how-transfer-assets-your-llc

- ↑ https://www.legalzoom.com/articles/how-do-i-transfer-title-of-a-property-from-a-person-to-an-llc

- ↑ https://www.legalzoom.com/articles/how-do-i-transfer-title-of-a-property-from-a-person-to-an-llc

- ↑ https://www.legalzoom.com/articles/how-do-i-transfer-title-of-a-property-from-a-person-to-an-llc

- ↑ https://www.score.org/blog/how-transfer-assets-your-llc

- ↑ https://www.legalzoom.com/articles/how-to-add-capital-contributions-to-an-llc

- ↑ https://www.allbusiness.com/tax-effects-of-transferring-assets-to-an-llc-3878627-1.html

- ↑ https://www.score.org/blog/how-transfer-assets-your-llc

- ↑ https://www.score.org/blog/how-transfer-assets-your-llc

- ↑ https://www.score.org/blog/how-transfer-assets-your-llc

- ↑ https://www.allbusiness.com/tax-effects-of-transferring-assets-to-an-llc-3878627-1.html

- ↑ https://www.score.org/blog/how-transfer-assets-your-llc

- ↑ https://www.allbusiness.com/tax-effects-of-transferring-assets-to-an-llc-3878627-1.html

- ↑ https://www.score.org/blog/how-transfer-assets-your-llc

- ↑ https://www.marketwatch.com/story/let-an-llc-be-a-key-in-protecting-your-assets-2015-12-02