This article was co-authored by Trent Larsen, CFP® and by wikiHow staff writer, Jennifer Mueller, JD. Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

There are 14 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 15,613 times.

Inflation can make it so that your hard-earned money just doesn't go as far as it used to—but there are ways you can take control of the situation and protect your personal finances. While experts disagree on why it happens and how it works, there's one thing they all agree on: don't panic.[1] X Research source We at wikiHow have collected the most impactful ideas of relatively simple things you can do right now to protect your money and your investments from the worst of inflation.

Steps

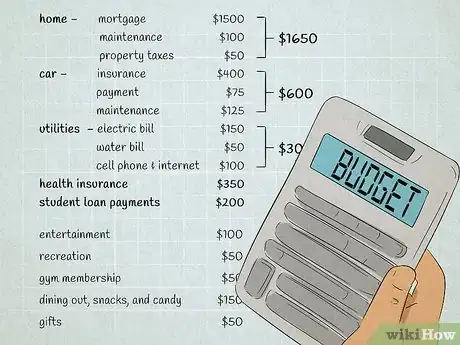

Create a household budget if you don't already have one.

-

A budget helps you keep track of your money and spend less. Start by recording the amount of income your household has each month, then categorize expenses as "necessary" or "discretionary."[2] X Expert Source

Certified Financial Planner Expert Interview. 22 July 2020. Controlling your discretionary expenses is the easiest way to save money during an inflationary period.[3] X Research source- When you have a budget, you can figure out how much money you have to spend for specific categories of expenses, such as entertainment or clothing. From there, you can more easily decide how specifically you're going to spend that money each month.

- Your budget also allows you to find out how you can shuffle things around to add some money to categories where you're going to spend more when inflation hits. For example, you might need to allocate more money to groceries or fuel costs.

Cut spending where you can.

-

Look at last month's expenses to zero in on waste. If your money doesn't go as far, that means you technically have less money to spend each month. Look to cut costs the same way you would if your income decreased or you had an unexpected expenditure that made things tighter than usual.[4] X Expert Source

Certified Financial Planner Expert Interview. 22 July 2020.- For example, you might be subscribing to services that you don't really use or can do without. Canceling those subscriptions is typically fairly easy and the savings add up.

- You might also have duplicate expenses that you can eliminate. For example, if both you and your partner have separate gym memberships, you might be able to save by switching to a single joint or family membership.

- If you own a business, find ways to cut expenses there as well. For example, you might be able to decrease your shipping costs by ordering products in greater quantities.[5] X Research source

Get a roommate to save housing costs.

-

This can lower the amount each of you spends on rent and utilities. If you're single, living with roommates instead of paying the entire rent for a one-bedroom by yourself can help control costs a lot. It might seem trickier if you live with your partner, but it's still doable if you have the space and want to go for it.[6] X Expert Source

Certified Financial Planner Expert Interview. 22 July 2020.- If you own your home, you might consider renting out a spare bedroom to get a little extra cash. You could also look into short-term rentals through a platform such as Airbnb.

Negotiate lower rates for regular bills.

-

Call customer service and ask if you're getting the best rate you can. Companies often have promotions and other offers that they can give you if you ask. If you've been a good customer for several years, you might also be able to leverage your continued loyalty into a better rate.[7] X Research source

- For example, you might say, "I've been with you for 5 years. Is there anything we can do about the amount I'm paying for your service? I noticed your introductory rate is $50 less than what I'm currently paying."

- Explore other options before you call so you know what competitors are charging for the same service. Many companies are willing to match a competitor's rate to keep from losing you as a customer—and if they're not, you can always consider actually switching to the other company.

- If talking to customer service reps on the phone makes you anxious, you might want to sign up with one of the apps, such as Truebill or Copilot, that negotiate for you. They typically charge a percentage of the amount they save you as a fee, but you'll still come out on top and you don't have to spend all that time on the phone.

Hunt for discounts and coupons to save on purchases.

-

Free store loyalty programs and discount apps can help you save. Most coupon apps don't cost anything to use—say goodbye to membership fees—and can save you at least a few bucks off your regular purchases. Some retailers also have their own discount programs, either online or through an app.[8] X Research source

- For example, the Target app has hundreds of offers and coupons available—all you have to do is activate them, then let the cashier scan the code on your phone at checkout.

- While mobile apps are great for brick-and-mortar shopping, browser extensions, such as Honey, can also help you save money on your online purchases.

- Discount apps, such as Groupon, also frequently offer deals on restaurants and entertainment so you can still go out and have a good time.

Stockpile shelf-stable food and household items.

-

Take advantage of sales and promotions to buy in bulk. Shortages and supply chain problems go hand-in-hand with inflation. Protect yourself against these by buying large quantities of food and other things you regularly. If the stores run out, you'll be set.[9] X Trustworthy Source Consumer Reports Nonprofit organization dedicated to consumer advocacy and product testing Go to source

- This doesn't mean that you need to hoard supplies. As long as you have enough to last your household a couple of weeks (or a month at most), you'll be fine. Panic buying causes its own problems and forces other people to do without.

Find alternative ways to earn a little extra cash.

-

Bringing in extra money can offset the effects of inflation. If your grocery bill is up an extra $50 a month, finding a way to earn just $50 a month would offset inflation completely. There are plenty of small side gigs online where you can earn that much working just a few hours a week.[10] X Research source

- For example, you might sign up to take surveys or complete small research tasks.

- If you have a particular skill or area of expertise, you might be able to make a little extra money from that as well. Through platforms such as Fiverr or TaskRabbit, you can do small tasks for other people.

- You can also bring in extra money by having a yard sale or monetizing a hobby, such as selling crafts or baked goods.

- It's not necessarily a great time to start a side hustle that's also going to cost you money. For example, while you could earn a little extra cash driving for a ride-share service, the rising cost of fuel is going to eat away at your profit.

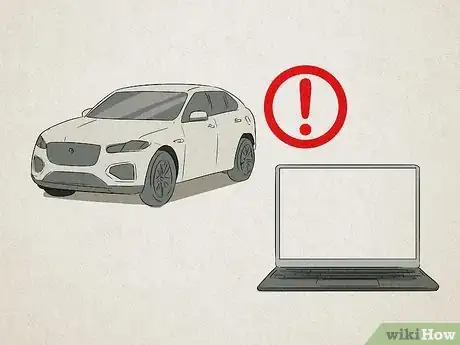

Postpone big-ticket purchases that aren't necessary.

-

Inflation drives up prices and interest rates. Shortages and supply chain issues also increase prices on large purchases. This is particularly true for complex products, such as cars and computers, that are assembled in different places with parts that come from all over the world.[11] X Trustworthy Source Consumer Reports Nonprofit organization dedicated to consumer advocacy and product testing Go to source

- Because interest rates go up when inflation rises, a car loan or credit card payment will end up costing you more. This means you'll end up spending even more if you need to finance your purchase.[12] X Research source

- On the other hand, if there's a big-ticket item you need—an old appliance that needs to be replaced or a car on its last legs—go ahead and do that now. Prices will continue to rise, so you'll ultimately save a little money.

- Shop around so you can get the most bang for your buck. You might be able to find a lightly used or refurbished older model for a fraction of the price of a new one.[13]

X

Expert Source

Certified Financial Planner Expert Interview. 22 July 2020.

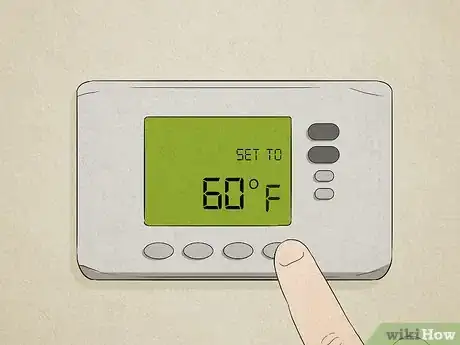

Set your thermostat back to save heating and cooling costs.

-

Just a few degrees can make a big difference in your bill. There's no reason for your home to feel like the tropics when there's snow on the ground outside. If you have a programmable thermostat, you can set the thermostat back even more when no one is going to be at home.[14] X Trustworthy Source U.S. Department of Energy Official site for the U.S. Department of Energy, which provides resources related to energy safety, conservation, and efficiency Go to source

- For example, if you work all day 5 days a week, you could program your thermostat to roll back as much as 7 to 10 °F (−14 to −12 °C) while you're away at work, then automatically return to a more comfortable temperature while you're at home.

Drive more conservatively to use less auto fuel.

-

Your car burns less fuel when you accelerate slowly and evenly. You'll also use less fuel if you drive a little slower than usual. In addition to the way you drive, cutting back on unnecessary car trips also cuts back on your fuel expenses.[15] X Trustworthy Source Consumer Reports Nonprofit organization dedicated to consumer advocacy and product testing Go to source

- For example, instead of running out to do a single errand several times a week, you might make one trip each week and do all your errands at once.

- Shop around when you need to buy fuel as well—the most convenient fuel stations aren't always the cheapest.

Switch to an online bank.

-

Online banks offer higher interest rates and other incentives. Online banks typically don't charge any fees for their bank accounts—this frequently includes ATM and overdraft fees. Other services include the opportunity to get your paycheck a couple of days early.[16] X Research source

- Many online banks offer other budgeting tools that can help you manage your money better—all from the convenience of your smartphone.

- If you're interested in an online bank, shop around and compare them to find the one that seems like it'll best suit your needs. Then open an account and try it out for a little while. You don't necessarily have to switch all of your money over to it right away.

Move your savings to a high-yield account.

-

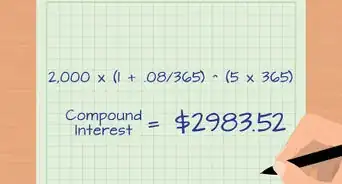

A higher interest rate helps you hold the value of your savings. Shop around online to find the banks that are offering the highest interest rates.[17] X Expert Source

Certified Financial Planner Expert Interview. 22 July 2020. If you move your savings there, the interest might not cancel the effect of inflation but it will put a dent in it.[18] X Research source- For example, many banks and credit unions offer checking accounts that pay at least 3% interest on up to $10,000.

- CD (certificate of deposit) rates are generally pretty low, but you might still be able to find one that's higher than your current savings account. The problem with a CD is that you'll pay fees if you withdraw your money early, so don't use this option for all of your savings.

- Buying savings bonds is another option. You can't redeem them within 12 months of the date they're issued, though, so make sure the money you invest in them is money you won't need for the next year.

Buy a house if you're a renter.

-

While rent goes up with inflation, mortgage payments don't. Often, home and real estate values appreciate at an even higher rate than inflation. This means that, despite inflation, you aren't losing any of the value in your real estate investment.[19] X Research source

- As long as you have a fixed-rate mortgage, your mortgage payment will stay the same year after year—unlike rent, which keeps going up and up every year regardless of inflation. This keeps a big portion of your household expenses under control.[20] X Research source

- If you get in a tight spot, you can also borrow against the equity in your home—something you can't do if you rent.

Raise your prices slightly if you own a business.

-

Research your competitors and increase prices incrementally. You don't want to price yourself out of the market, but you also want to lose as little as possible. What do you do? Small, incremental price increases are barely noticeable and respectful to your customers, who are also feeling the pinch from inflation.[21] X Research source

- Be upfront with your customers about why your prices are going up—they'll appreciate your transparency. You might also recommend ways they can help the community's economy, such as by buying locally and using small businesses instead of large corporations and chains.

- If you don't already have a loyalty program, you might consider starting one. Offering discounts to repeat customers will help offset some of the price increase if people continue to shop with you.[22] X Research source

Buy equities and inflation-protected securities.

-

Rebalance your portfolio to inflation-proof your investments. Treasury inflation-protected securities (TIPS) were specifically created to act as a hedge against inflation. They also pay semiannual fixed interest, although the rate is not as high as other bonds.[23] X Research source

- Discuss your investment goals with your investment advisor. They can help you choose the best investments that will help you control against inflation.

- Equities (stocks in companies) are also a great hedge against inflation. As those companies raise their prices, the stock price will rise as well. Focus on companies that produce goods and services that people always need, like utilities and healthcare.

- Limit your ownership of entertainment and retail companies. As inflation rises, consumers will naturally limit their spending in these categories, which can cause the prices of these stocks to fall.

Invest in gold and commodities sparingly.

-

Commodities and gold typically lose value with inflation. While many people consider gold a traditional hedge against inflation, in reality, it doesn't really work that way. It's fine to have a small portion of your portfolio tied up in gold and commodities, but they definitely shouldn't be the focus.[24] X Research source

- Talk to your investment advisor before investing in gold or commodities or if you already have gold or commodities in your portfolio.

- Commodities that are necessary, such as oil and staple foods, can be good investments during inflation. However, keep in mind that these products can also fall victim to shortages and supply chain issues that typically accompany inflation.[25] X Research source

You Might Also Like

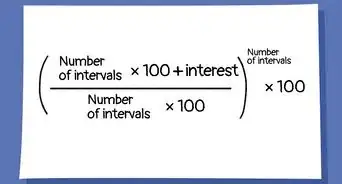

How to Find the Effective Interest Rate

How to Find the Effective Interest Rate

Where Is My Wallet? How to Protect Your Money & Find a Misplaced Wallet

Where Is My Wallet? How to Protect Your Money & Find a Misplaced Wallet

How to Check or Calculate the Value of Savings Bonds

How to Check or Calculate the Value of Savings Bonds

How to Keep Track of Your Money: Personal Finance Tips

How to Keep Track of Your Money: Personal Finance Tips

References

- ↑ https://today.duke.edu/2021/11/inflation-and-omicron-don%E2%80%99t-panic-don%E2%80%99t-hoard-experts-advise

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.aarp.org/money/budgeting-saving/info-2021/how-to-create-a-household-budget.html

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://foodinstitute.com/focus/how-food-businesses-are-fighting-inflation/

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.weforum.org/agenda/2021/08/how-digital-tools-protect-consumers-inflation/

- ↑ https://www.investopedia.com/best-coupon-apps-5181187

- ↑ https://www.consumerreports.org/inflation-prices/how-inflation-is-affecting-consumers-a1015624367/

- ↑ https://www.metrofamilymagazine.com/whats-the-big-deal-with-inflation/

- ↑ https://www.consumerreports.org/inflation-prices/how-inflation-is-affecting-consumers-a1015624367/

- ↑ https://today.duke.edu/2021/11/inflation-and-omicron-don%E2%80%99t-panic-don%E2%80%99t-hoard-experts-advise

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.energy.gov/energysaver/thermostats

- ↑ https://www.consumerreports.org/inflation-prices/how-inflation-is-affecting-consumers-a1015624367/

- ↑ https://www.weforum.org/agenda/2021/08/how-digital-tools-protect-consumers-inflation/

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.cnbc.com/2021/06/28/how-to-find-higher-interest-rates-on-your-money-amid-inflation-worries.html

- ↑ https://theconversation.com/as-inflation-looms-heres-how-real-estate-and-farmland-have-protected-investors-155854

- ↑ https://www.forbes.com/advisor/mortgages/homebuying-can-hedge-against-inflation/

- ↑ https://realeconomy.rsmus.com/four-ways-retailers-and-restaurants-can-manage-current-inflation-and-labor-pressures/

- ↑ https://foodinstitute.com/focus/how-food-businesses-are-fighting-inflation/

- ↑ https://www.journalofaccountancy.com/news/2021/oct/how-investors-can-protect-against-inflation.html

- ↑ https://www.journalofaccountancy.com/news/2021/oct/how-investors-can-protect-against-inflation.html

- ↑ https://today.duke.edu/2021/11/inflation-and-omicron-don%E2%80%99t-panic-don%E2%80%99t-hoard-experts-advise

About This Article