This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 106,487 times.

Setting the right rent for your investment property involves more than simply trying to make a profit. Tenants have so many choices when it comes to rental properties, so you have to make yours stand out. This means setting the right rental price that attracts high-quality tenants and reflects the positive attributes of your property. With a little research, math and market know-how, you can determine the appropriate rental price for your investment property.

Steps

Using Your Home’s Value

-

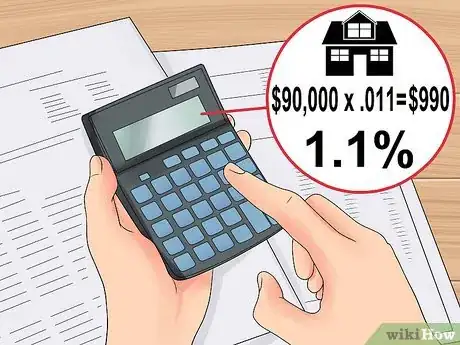

1Calculate 1.1 percent of the value of your property. This will result in the monthly amount you should charge renters. Professional investors use this percentage as a rule of thumb for determining the rental price of a unit.

- For example, if you are renting out an apartment in your home and your home is worth $90,000, use the equation $90,000 x .011 = $990. This would be the monthly amount you could charge renters for the unit.

-

2Understand the limitations of using this calculation. While it might be a good place to start, this flat calculation fails to take into account other factors that add to or detract from the rental value of a property. Also, if the home is in a high-income neighborhood, the percentage calculation might result in a rental price that is too high.

- Other considerations, such as location, nearby amenities, design features and layout, also affect how much rent you can charge.

- Try the same calculation using a range between 1.0% to 1.3%, based upon rent rates and availability of similar rental properties in the area.

Advertisement -

3Consider the market. If the property is located in a hot market with fierce competition from other rental properties, this formula may make the rent too high to compete with other properties. In this case, you should survey the current market by comparing your unit to other comparable rental properties to find the ideal cost.

Researching Comparable Units

-

1Research rental prices for units similar to yours. Find out how much rent others are charging for comparable units. Look on sites like Craigslist, Zillow and Trulia. Drive around the neighborhood to find rental properties that are not listed on these sites.

- Look for units that match yours in square footage, number of bedrooms and bathrooms, age, amenities and location.

- Make a list of properties that are similar to yours and write down how much rent the owners are charging and the occupancy rate. Assess whether you can ask the same, more or less rent than these properties based on the location, amenities and size of yours.

- Keep in mind that the advertised rental price of a property might be too high. If, for example, you find a property similar to yours that has been vacant for a long time, the rental price the owners are asking might be too high. Take this into consideration when setting the rental price for your unit.

-

2Contact property managers to determine a rental price. If you plan to hire a property management company to oversee your property, they should have a good idea of what rent you can charge. Otherwise, you can contact local property managers and ask them about rental prices in your area to get a sense of what you should be charging.[1]

- Setting the right rent is part of a property manager’s responsibilities. Property managers understand the local market and know the rental values of comparable properties in the area.

-

3Work with an agent. Rental agents, property managers, and some real estate agents who deal with rentals have a keen understanding of the local rental market. They are familiar with all of the other rental properties in the area. This makes them qualified to assess the positives and negatives of your rental property and set the appropriate rental price. Since they do showings, they also know what tenants like and don’t like. An agent will know what tenants will be willing to pay for the location, size and amenities of your property.[2]

- Most real estate agents do not deal with rentals, although some might. For this reason, you might want to contact a property management company or rental agent in your area, as these tend to specialize in rental units exclusively.[3]

-

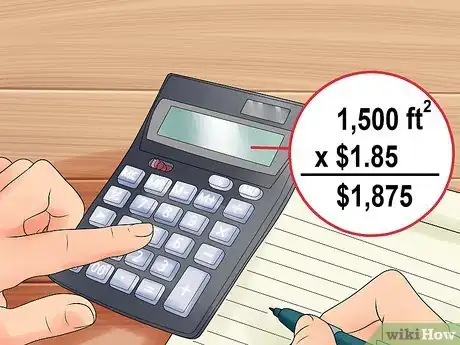

4Calculate rental price per square foot. If you cannot find other similarly-sized rental units in your area, determine the rental price per square foot of unit that is similar in other ways. Apply the rental price per square foot to your unit to set the rental price.

- To calculate the rental price per square foot, divide the rental price by the total square footage of the unit.

- For example, suppose you have a three-bedroom, 1,500 square-foot unit available. A nearby two-bedroom, 1,000 square-foot unit is renting for $1,250 per month. Calculate the rental price per square foot of the nearby unit with the equation $1,250 / 1,000 square feet = $1.25 per square foot.

- Apply the rental price per square foot to set the rental price for your unit. Multiply 1,500 square feet x $1.25 = $1,875. Based on the rental price per square foot, you can ask $1,875 for your unit.

- Note that smaller properties generally rent for more per foot than larger properties.

Understanding Factors that Impact Rental Value

-

1Consider the location. Location is the key factor that commands higher rent. People are generally willing to do without certain amenities if the property is in a convenient and popular location.[4]

- If the property is near schools, it may be more valuable to families with children.

- Students may be willing to pay more for rental units within walking distance to local colleges.

- Renters also tend to be willing to pay more for units near public transportation.

-

2Consider available amenities. Renters are willing to pay more for certain conveniences and comforts. For example, rental properties go for higher rent in planned developments with attractive facilities. Desirable features can make one property command a higher rent than a comparable property without them.[5]

- Pools and tennis courts make rental units more attractive and can increase their rental value. In fact, any outdoor space, such as a balcony or deck, makes a unit more attractive to renters.

- Renters also are willing to pay for readily available or covered parking, especially in urban areas. Renters prefer off-street parking, but nearby on-street parking can also appeal to renters.

- Renters want convenient laundry facilities. If laundry facilities are in the building, or preferably in the unit, the renters will be willing to pay more.

-

3Consider the desirability of your unit. The size and layout of the unit affects the rental value. Also, quality tenants are willing to pay top dollar for contemporary design elements. In addition, high-end finishes and appliances command higher rents.[6]

- The square footage affects the rental value. If a renter sees a 700 square foot one-bedroom apartment and a 1,000 square foot one-bedroom apartment, she will likely be more attracted to the larger one and be willing to pay more.

- The floor level is important to renters. You can charge more for units on higher floors than for ground-level units, especially if there is an elevator. However, if the property is a walk-up, you may need to charge less rent for the higher floors because tenants will be less willing to climb the stairs.

- A washer and dryer in the unit appeals to most renters. Tenants will be willing to pay for the convenience and privacy of having their own washer and dryer that they don’t have to share with their neighbors. If you don’t want to purchase a washer and dryer, at least think about installing washer dryer hookups so tenants can bring their own appliances.

- Most tenants expect air conditioning, especially in areas with hot and humid weather conditions. Renters will be willing to pay more for central air conditioning than a property with window units.

- Offer free wireless internet. Renters expect the convenience of wireless internet, and quality tenants will be attracted to properties that offer this service.

- The layout of the unit affects the rental value. Renters love an open floor plan. A unit with an open floor plan looks bigger and will command a higher rent than one without it.

- Renters are willing to pay for hardwood floors. If you can boast that your property has hardwood floors, you will be ahead of the competition.

- Tenants need lots of storage space. They will be willing to pay higher rent for a property with extra closets, especially walk-in closets.

-

4Adjust rental prices based on the market. For example, when the economy is bad, the demand for rental properties increases because people don’t want to purchase homes. This means that you can charge more for your rental properties. Conversely, when demand for rental properties declines, you must charge less to continue to attract tenants.[7]

- Also, if you rent seasonally, the rental price you can charge will increase during the peak season. It will decrease during the off season.

- Think about the type of lease you can offer (month-to-month, a fixed end date, fixed number of months, option to purchase, etc.) and what type of impact this might have on who is willing to rent.

- You can charge more for short term leases than long term leases. For example, you can charge $1000 month to month or $900 a month if the tenant signs a lease for a year. Generally, it is acceptable to change the lease based on the terms of the contract, so long as all applicants are quoted the same terms and prices.

- There is a limit on how much you can charge for a deposit. If your deposit is too high, you may have trouble attracting renters.

- When determining the deposit, consider the risk factor of the applicant. Factors to consider include credit score, former rental history, income, and any criminal history. For example, an applicant with a good credit score should receive a lower deposit than one with a poor credit score.

Deciding to Raise the Rent

-

1Decide if you should raise the rent for occupied units. Raising the rent for occupied units requires similar considerations as setting the rent for vacant units. Consider the current rental market in your area. Also, think about whether or not you want to risk losing valuable tenants.[8]

- Compare your rental rates with others for similar properties in the area. If your rent is lower than others, judge whether you offer enough amenities to justify raising the rent. Decide whether you want to raise rent across the board or just for specific units.

- Think about your long-term, valuable tenants. It’s hard to put a price on reliable tenants who treat your property like their own. Decide if you would be willing to lose those tenants if they don’t want to pay the increased rent, and if so, whether you’d be willing to exclude any of them from a rental increase.

- If you have multiple units, you may want to only increase the rent on certain units at any one time. Stagger the rent increases over time, so that you do not risk losing all of your tenants at the same time.

-

2Check your state laws. In the US, states have laws regarding how rent increases are to be determined and communicated to the tenant. These laws may state how many days notice is needed before you can increase the rent. You should also be aware if rent control is instituted in your area. You should read the Landlord Tenant Act for your state.

- Commercial leases often have different regulations than residential ones do.

- If you're uncertain about the laws in your state, check with an attorney, preferably one who specializes in real estate or in landlord-tenant law.

-

3Justify your reasons for raising the rent. Explain to tenants the reasoning behind the higher rent. If higher property taxes or operating costs warrant the increase, make sure tenants understand this. Make them aware of any added value they can expect because of the increase. For example, perhaps you are hiring a better janitorial service. Or, maybe you are planning some capital improvements.[9]

-

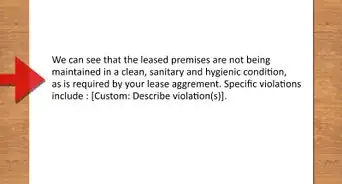

4Communicate with tenants about the rent. Build a plan for increasing rents into your leases so tenants know when to expect them. Provide tenants with written notification of planned increases in the rent. Adhere to the notification guidelines specified in the lease so tenants receive sufficient advance notice. Use clear and concise language, and be professional by sending a typed letter on company letterhead.[10]

References

- ↑ http://www.nolo.com/legal-encyclopedia/landlord-hire-property-management-company-29885.html

- ↑ http://articles.latimes.com/2014/feb/23/business/la-fi-lew-20140223

- ↑ http://www.allpropertymanagement.com/resources/hiring-a-property-manager/property-manager-or-rental-agent-a27.html

- ↑ http://landlords.about.com/od/Marketing/a/Amenities-Tenants-Look-For-In-A-Property.htm

- ↑ http://www.rentprep.com/property-maintenance/top-rental-property-amenities-2015/

- ↑ http://www.rentprep.com/property-maintenance/top-rental-property-amenities-2015/

- ↑ http://www.wsj.com/articles/SB10001424052748703940904575395100318041736

- ↑ http://www.appfolio.com/blog/2013/05/the-abcs-of-raising-rents-and-keeping-tenants/

- ↑ http://www.appfolio.com/blog/2013/05/the-abcs-of-raising-rents-and-keeping-tenants/