This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 55,836 times.

A limited liability company (LLC) uses an operating agreement to lay out who owns the company as well as how the company will be managed. An LLC operating agreement is roughly the same as corporate bylaws. In order to draft the operating agreement, you should identify the owners and their ownership percentage. You also need to think about who will manage the daily affairs and what powers you will give this person. When you finish drafting an operating agreement, you should show your draft to a lawyer who can identify anything missing. When the agreement is completed, all members should sign it.

Steps

Beginning the Operating Agreement

-

1Meet with your co-owners. You should involve all owners of the LLC in the drafting process. After reading this article, you can get together and hash out the details of the operating agreement. Then you might appoint one person to make a rough draft before circulating it to the other members.

-

2Format your document. To begin drafting, you should open a blank word processing document and set the font to a size and style that is readable. Often, Times New Roman 12 point is acceptable.

- Be sure to use bolded headings so that information is easy to find in your document.[1]

- When you finish, you also might want to set up a table of contents, which will make finding information much easier.

- You can also create a cover page with the title to the document. For example, "Operating Agreement of Sweater Styles, LLC."

Advertisement -

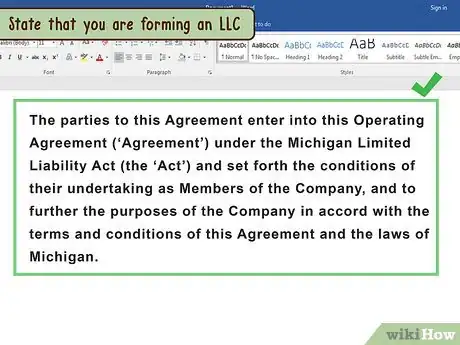

3State that you are forming an LLC. In the first section, you need to form the LLC by stating that the members agree to the terms and conditions as laid out in your operating agreement. You also identify the state whose laws will govern the LLC.

- Sample language could read: “The parties to this Agreement enter into this Operating Agreement (‘Agreement’) under the Michigan Limited Liability Act (the ‘Act’) and set forth the conditions of their undertaking as Members of the Company, and to further the purposes of the Company in accord with the terms and conditions of this Agreement and the laws of Michigan.”[2]

-

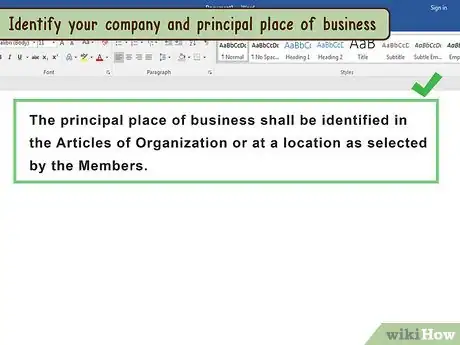

4Identify your company and principal place of business. You always want to identify the name and the location of your principal place of business. Make sure to include information about your registered agent as well.[3]

- If this information was in your Articles of Organization, then you could simply write, “The principal place of business shall be identified in the Articles of Organization or at a location as selected by the Members.”[4]

-

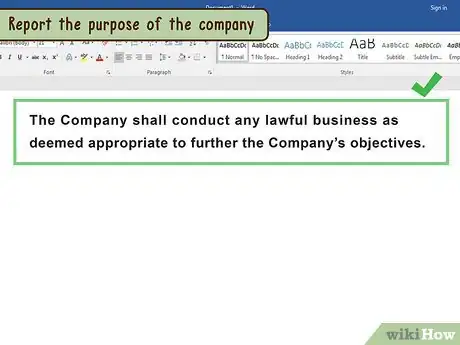

5Report the purpose of the company. You should also explain why the LLC has been formed. For example, you might have been created to manufacture and sell sweaters.

- However, you can also be very general and write, “The Company shall conduct any lawful business as deemed appropriate to further the Company’s objectives.”[5]

-

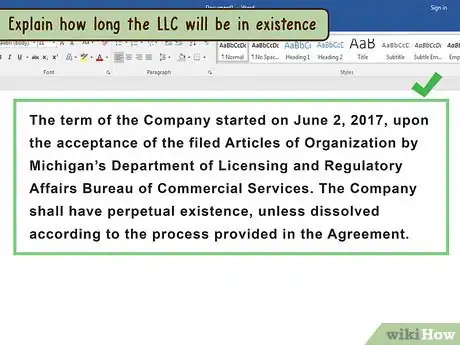

6Explain how long the LLC will be in existence. You can create an LLC for a limited amount of time, or you could create it expecting it to last indefinitely. You should explain the length of the LLC’s term.

- You could write, “The term of the Company started on June 2, 2016, upon the acceptance of the filed Articles of Organization by Michigan’s Department of Licensing and Regulatory Affairs Bureau of Commercial Services. The Company shall have perpetual existence, unless dissolved according to the process provided in the Agreement.”[6]

-

7Provide definitions for key terms. Because the operating agreement is a legal contract, you want to make sure that all key terms are crystal clear. You should define any terms that might be ambiguous or vague and provide a list of definitions.

Identifying the Powers and Rights of Members

-

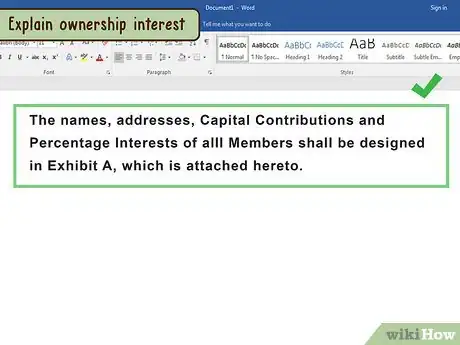

1Explain ownership interest. The owners of an LLC are called “members,” and your operating agreement should provide a breakdown of ownership.[7] This generally means that you must identify each co-owner’s ownership interest, which is typically determined by how much they contributed to the LLC’s startup costs.[8]

- For example, Anne might have contributed 55% to the LLC. Ben contributed 45%. Typically, Anne will have a 55% ownership stake in the company whereas Ben will own 45%. However, you could divide up the ownership interest any way you want.[9]

- You can usually attach an exhibit which identifies each owner by name and lists how much they will contribute to the LLC. You also identify what percent of the LLC they own.[10]

-

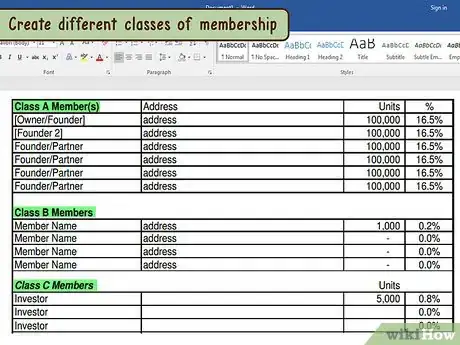

2Create different classes of membership. Just as a corporation can have different classes of stock, an LLC could have different membership interests. However, you are not required to create different memberships, and if your LLC is small you probably don’t want to.

- In larger LLCs, there is a membership that is allowed to vote. Typically, this group is called Membership A.

- There may also be additional memberships which can get a share of the profits but don’t have voting rights. They are often called Memberships B and C.

-

3Refuse to pay interest. Members who contribute capital to the LLC might expect to be paid interest on their contributions. You can state that no interest will be paid (if you want to).

- For example, you could write: “No interest will be paid or due by the Company for any capital contributions, or for any advance made to the Company by a Member.”[11]

-

4Explain if capital can be withdrawn. You can protect the LLC by limiting the ability of members to remove their capital contributions. If you don’t limit them, then members could up and leave, thereby bankrupting the company.

- If you want to limit the withdrawal of capital, then include a provision like the following: “No Member shall have the right to demand the return of their Capital Contribution or the balance of their Capital Account. There is no agreed upon time when the Capital Contribution shall be returned. No Member shall have any right to demand and receive property in the place of cash as a return of their Capital Account.”[12]

-

5Identify how you will admit new members. Your LLC probably will start small, but it could grow rapidly. You may want to admit new members as owners. You should explain how that will happen. Often, new members can be admitted by a vote of the current members.

- A clause could read: “The Company will not admit additional members through issuance of new interest in the Company without unanimous written consent of the current Members.”[13]

-

6Lay out how profits and losses are distributed. The owners should share in the profits or losses of the LLC according to their ownership percentage. If you want to depart from that formula, then you should explain how profits and losses will be divided.

- You could write, “The Company’s net profits or net losses shall be determined annually and shall be allocated to the Members in proportion to each Member’s capital interest in the Company. This allocation may be amended from time to time in accordance with the law.”[14]

-

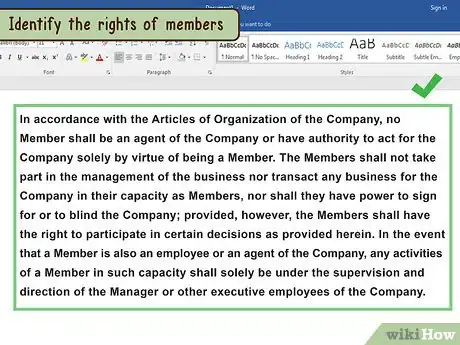

7Identify the rights of members. Members usually have certain rights, such as the ability to vote at meetings and the right to review the books.[15] You should spell out their rights.

- For example, you might want to give members the right to inspect the books only if they provide at least ten days of advance notice. They should also identify why they want to review the books.

-

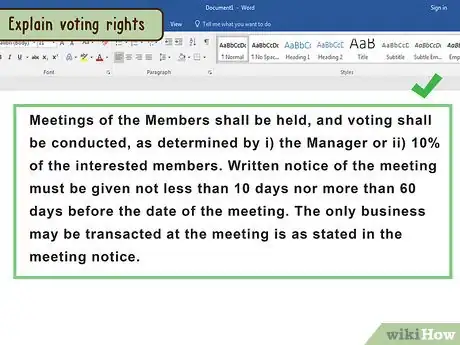

8Explain voting rights. There might be five members of the LLC, all of whom have voting rights. However, you have some options for how you can allocate voting power. Include a provision that explains how voting rights are allocated.[16]

- For example, you could give each member one vote, regardless of their ownership interest.

- Alternately, a member’s vote could be weighted to their proportion of ownership interest. If one member owns 40% of the LLC, then their vote would count more than someone who owns 5% of the LLC.

-

9Describe the process of amending the agreement. You might outgrow your operating agreement, or you may discover it just doesn’t work for your company. In that situation, you need to amend it. You should provide for how to amend the agreement.

- You could require unanimous consent for all changes.

- Alternately, you could require unanimous consent for only some changes, such as changes to compensation, distributions, or the rights of members. You could then require only a majority vote for other changes.[17]

Explaining Who Will Manage the Company

-

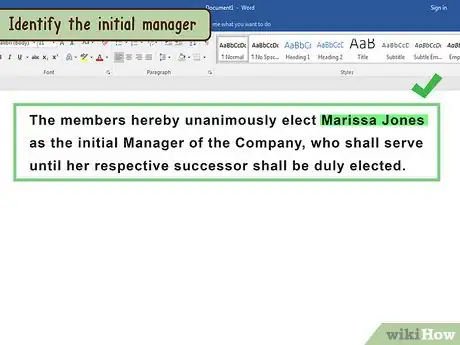

1Identify the initial manager. You should elect an initial manager who can serve at least until your first member meeting. Identify this person and state how long he or she will serve.

- For example, you could write: “The members hereby unanimously elect Marissa Jones as the initial Manager of the Company, who shall serve until her respective successor shall be duly elected.”

-

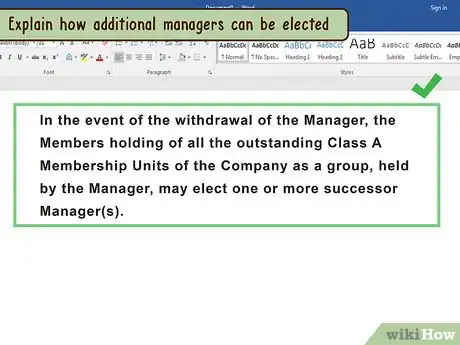

2Explain how additional managers can be elected. You might want to elect more than one manager. Or you could want to elect a new manager every year. You should state the process for electing new managers.

-

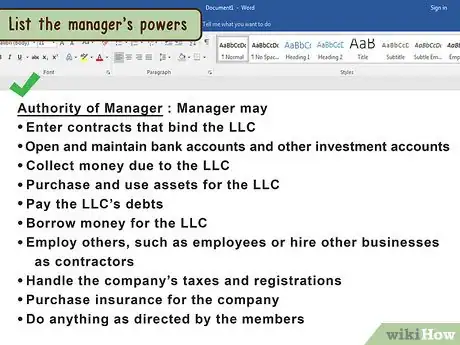

3List the manager’s powers. Your managers will run the day-to-day operations for the LLC. Accordingly, you should list their powers. Try to be detailed. For example, you should think about giving your manager the following powers:

- enter contracts that bind the LLC

- open and maintain bank accounts and other investment accounts

- collect money due to the LLC

- purchase and use assets for the LLC

- pay the LLC’s debts

- borrow money for the LLC

- employ others, such as employees or hire other businesses as contractors

- handle the company’s taxes and registrations

- purchase insurance for the company

- do anything as directed by the members

-

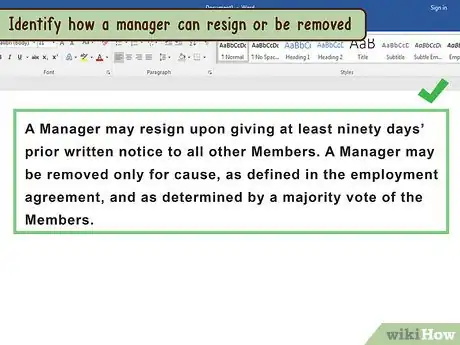

4Identify how a manager can resign or be removed. If someone no longer wants to be a manager, then they should resign. Alternately, the members may need to remove a manager who can no longer do their job. You should include provisions to explain this process.

- For example, you could write, “A Manager may resign upon giving at least ninety days’ prior written notice to all other Members. A Manager may be removed only for cause, as defined in the employment agreement, and as determined by a majority vote of the Members.”[18]

-

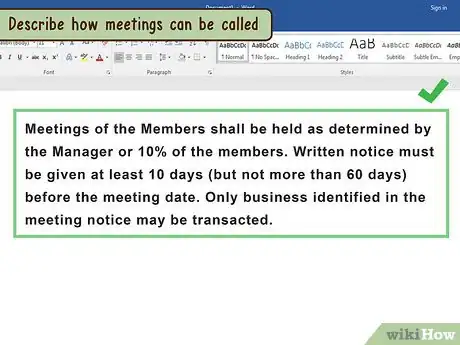

5Describe how meetings can be called. Another important reason to have an operating agreement is to explain how member meetings can be called. Generally, you might want to give the manager the power to call meetings. You also might want to give members the power to call meetings.

- For example, you could write, “Meetings of the Members shall be held as determined by the Manager or 10% of the members. Written notice must be given at least 10 days (but not more than 60 days) before the meeting date. Only business identified in the meeting notice may be transacted.”[19]

-

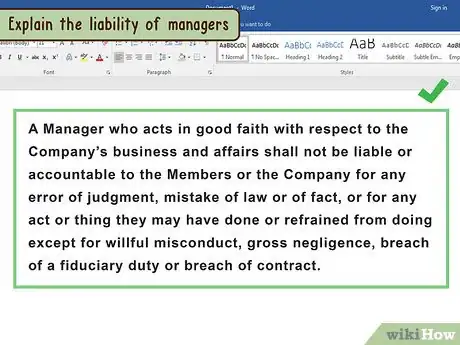

6Explain the liability of managers. One issue you must deal with if you hire a manger is whether they are legally liable for their actions. You can explain this in their employment contract. You can also include a clause in your operating agreement. For example, you might state that managers won’t be legally responsible for “good faith” decisions. This means they will be responsible if they deliberately try to harm the company or are grossly careless.

- You could write, “A Manager who acts in good faith with respect to the Company’s business and affairs shall not be liable or accountable to the Members or the Company for any error of judgment, mistake of law or of fact, or for any act or thing they may have done or refrained from doing except for willful misconduct, gross negligence, breach of a fiduciary duty or breach of contract.”

Describing the Process for Resignation and Dissolution

-

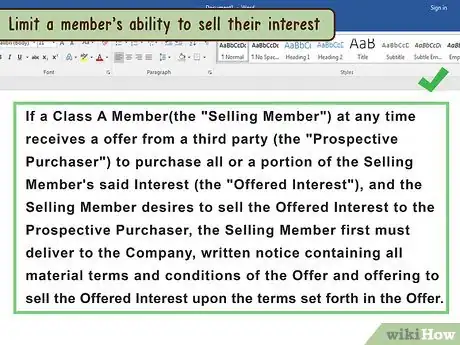

1Limit a member’s ability to sell their interest. Not every member is in it for the long haul. Instead, a member might decide they want to sell their interest in the LLC. You can set out the detailed procedures, or you can limit their ability to sell.[20]

- For example, you might require that they first offer the other members a chance to purchase the interest.

- You might also require that the other members give unanimous consent for a new member to purchase the interest and join as a member with voting rights. If consent is not given, the new member might only have the right to share in the profits.

-

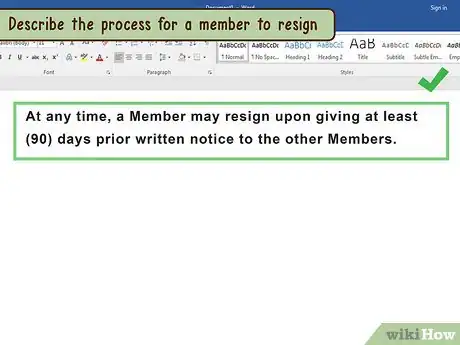

2Describe the process for a member to resign. Generally, you will want a member to give you written notice that they are resigning. You could require that the resigning member provide written notice between 60-90 days in advance.

- Also explain what will happen if a member dies. For example, you could state that the company will value the member’s ownership interest and then buy out the deceased’s interest by paying their heirs.

-

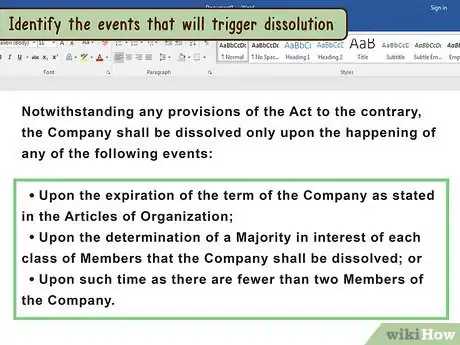

3Explain how to dissolve the LLC. Even if you create an LLC to last indefinitely, you might need to dissolve it. You should identify the events that will trigger dissolution. You might include any of the following:

- the members give unanimous written consent

- a judge dissolves the company

- the law requires dissolution

-

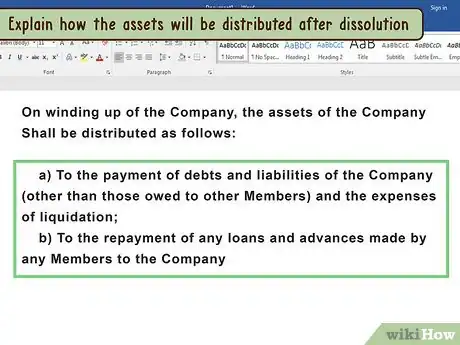

4Explain how the assets will be distributed after dissolution. When the LLC shuts down, you will need to wind up its business and then distribute any assets that remain. You should explain what will get paid off first. The following order is commonly used:

- First, the company’s debts and liabilities are paid, including the expenses of liquidating the business.

- Second, you distribute to members any remaining assets in proportion to their ownership interest.

Including Boilerplate Provisions

-

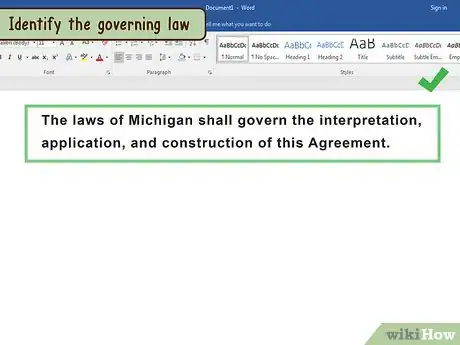

1Identify the governing law. If there is a legal dispute, then you may go to court. The judge must interpret your operating agreement according to the law. However, you can choose which state’s law to apply. Generally, you should choose the law of the state where you have your principal place of business. However, if you have offices in more than one state, then you should pick a state.

- For example, you should write, “The laws of Michigan shall govern the interpretation, application, and construction of this Agreement.”[21]

-

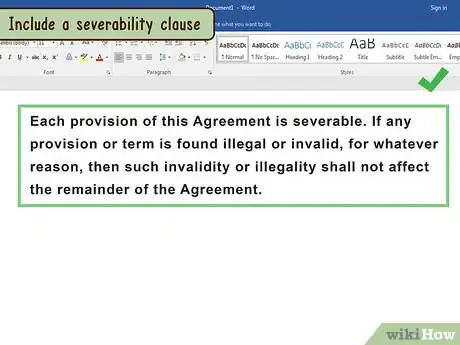

2Include a severability clause. If a judge finds that some provision of the operating agreement is illegal, then the judge could strike down the entire operating agreement. You can prevent that from happening by including a severability clause.

- A sample severability clause could state: “Each provision of this Agreement is severable. If any provision or term is found illegal or invalid, for whatever reason, then such invalidity or illegality shall not affect the remainder of the Agreement.”[22]

-

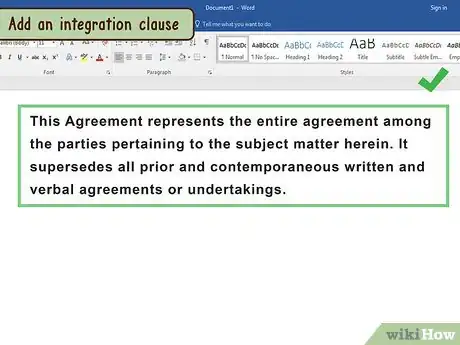

3Add an integration clause. You don’t want a member to claim that there were oral agreements not included in the written operating agreement. Accordingly, you should include an integration clause.

- You can write, “This Agreement represents the entire agreement among the parties pertaining to the subject matter herein. It supersedes all prior and contemporaneous written and verbal agreements or undertakings.”[23]

Finalizing Your Operating Agreement

-

1Circulate your draft to the other owners. You want to make sure you get feedback from all owners before showing a draft to an attorney. Circulate the draft to all owners and give them a deadline for making recommendations. Then incorporate the changes into the draft.

-

2Show the draft to an attorney. This article describes a basic operating agreement suitable to a small LLC. Your needs may vary. For example, if you have a larger LLC, then your operating agreement might need to be much more complicated. Make sure to show your draft to an attorney, who can review it and make suggestions.

- If you don’t have an attorney, then contact your local or state bar association and ask for a referral.

- Call up the lawyer and say you need someone to review an operating agreement you have drafted. Ask how much it will cost for them to read it and discuss it with you.

-

3Discuss tax consequences with an accountant. How you distribute profits and losses has enormous tax consequences which you can only understand by meeting with an accountant.[24] You should schedule a meeting with a certified public accountant or other tax professional to discuss your options.

-

4Have all owners sign the final draft. Type “Certification of Members” at the top of a separate sheet of paper and then add the words “The undersigned agree and certify to the adoption of this Operating Agreement.” Underneath, include signature lines for all members.[25]

-

5Store at your principal place of business. Your state may require that you file a copy of your operating agreement with the state’s Secretary of State office. You should check with them. Always be sure to keep a copy of the operating agreement at your principal place of business.

References

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ https://www.docracy.com/0fd6039euze/multi-member-managed-llc-operating-agreement

- ↑ https://www.docracy.com/0fd6039euze/multi-member-managed-llc-operating-agreement

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ http://smallbusiness.findlaw.com/incorporation-and-legal-structures/making-llc-operating-agreements.html

- ↑ http://articles.bplans.com/guide-crafting-llc-operating-agreement/

- ↑ https://www.nolo.com/legal-encyclopedia/llc-operating-agreement-30232.html

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ https://www.docracy.com/0fd6039euze/multi-member-managed-llc-operating-agreement

- ↑ https://www.docracy.com/0fd6039euze/multi-member-managed-llc-operating-agreement

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ https://www.nolo.com/legal-encyclopedia/llc-operating-agreement-30232.html

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ https://www.docracy.com/0fd6039euze/multi-member-managed-llc-operating-agreement

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ http://csbweb01.uncw.edu/people/eversp/classes/BLA361/BusLawForms/Corporate%20Forms/LLC-Operating-Agreement.a%20law%20firm%20version.pdf

- ↑ https://www.nolo.com/legal-encyclopedia/llc-operating-agreement-30232.html

- ↑ https://www.docracy.com/0fd6039euze/multi-member-managed-llc-operating-agreement